They get a foul identify due to their short-term nature, however at their core, they’re simply choices with a shorter lifespan. All the identical rules of choices apply to them, so if you will get previous the stigma related to them, there are many buying and selling alternatives current. As Euan Sinclair as soon as mentioned about this topic, “the house cat and tiger have more similarities than differences.”

And by the best way, for these associating weekly options with gambling, you need to know that almost all main monetary establishments these days are vital gamers in weeklies. Simply ask Roni Israelov, the previous supervisor of choices methods at AQR, who advised the FT, “If I have monthly options, I get 12 independent bets per year. If I have weekly, I get 52 bets per year. Daily gives me 252. If you’re generating trading strategies, the ability to have more ‘at bats’ and more diversification by taking more independent trades can be useful.”

Elevated Capital Turnover

Suppose you are a mechanical choices dealer who routinely sells choices in 45-60 DTE expirations with excessive implied volatilities. Take your income at 50% of max revenue. And you would maintain your common commerce for a couple of weeks earlier than reaching your required revenue degree.

If we take the identical assumptions however with shorter, 10-15 day expirations, you will be holding your common commerce for just some days.

You are turning over your capital a number of occasions faster, and assuming you possibly can choose trades with the same anticipated worth, you are capable of generate increased returns, growing your pattern measurement and, in idea, reducing the variance of your portfolio.

I am simplifying in a giant manner. Brief-dated choices have completely different properties within the type of market dynamics and Greeks that’ll have an effect on this equation significantly.

Nonetheless, the idea is that getting extra “at-bats,” to make use of Israelov’s phrase from the intro of this piece, is usually higher, assuming you possibly can maintain the remainder of the variables comparatively fixed.

Volatility is Extra… Risky in Weekly Choices (“Vol-of-Vol”)

As a precept, shorter-dated (i.e., weekly choices) have much less vega than longer-dated choices. To notice, vega is an possibility’s sensitivity to modifications in implied volatility. Identical to delta, theta, and gamma, the results of an possibility’s vega are easy to calculate. For every one-point improve in implied volatility, the choice value ought to change by its vega.

As an illustration, let’s take an SPX name possibility value $10.00 with an implied volatility of 18 and a vega of .20. Ought to the implied volatility of the possibilities improve to 19, the choice’s value would improve to $10.20. This works in each instructions.

As a result of short-dated choices usually have low vega, many merchants mistakenly assume that weekly choices are comparatively unaffected by vega, i.e., the chance of implied volatility growing or reducing.

However that will be incorrect. Whereas short-dated choices have low vega on the face, the implied volatility on short-dated prospects is rather more unstable. In different phrases, volatility is extra… unstable.

The results of short-term volatility dampen with time. With out referencing precise numbers, take into consideration the distinction in how the worth of a 1-year LEAP and a 1-day weekly possibility would reply to a ten% change within the underlying value. Certain, each values are affected, however with an entire yr till expiration, that 10% one-day change is sort of a blip on the radar so far as the place the underlying will likely be a yr out.

So short-term implied volatility must account not just for these “black swan” sort dangers but additionally for business-as-usual, which is realized volatility being under implied.

The sellers of those choices aren’t naive and must be compensated for taking up this wide selection of dangers, in order that they demand a better variance premium.

So this property of short-dated choices can each assist and hurt you, relying on which aspect of the commerce you’re on and what sort of dangers you favor to take.

Volatility is Typically Too Excessive (Or Low)

Within the earlier part, we mentioned how the implied volatility on short-dated choices is extra unstable than the IVs on longer-dated choices. It’s because, with so little time to expiration, a slight short-term aberration like order movement or a chunk of reports can dramatically have an effect on the place the underlying trades are at expiration. With extra time to expiration, these elements type themselves and volatility tends to stay nearer to a longer-term common

With volatility being extra unstable in these choices, you possibly can typically determine durations during which the market overreacts and also you deem volatility too excessive or low, permitting you to swoop in and make a great commerce shortly.

Theta Decay is Totally different in Weekly Choices

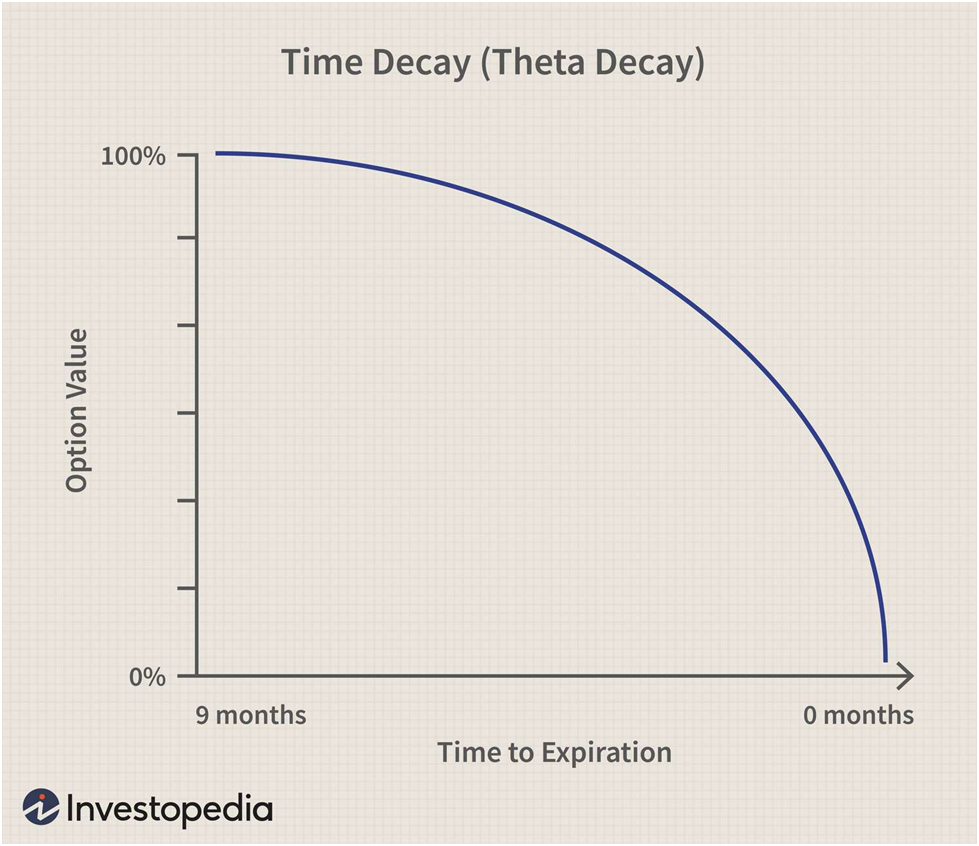

Longer-dated choices profit from considerably constructive theta, giving a dealer who sells longer-dated choices a constructive carry from theta decay. All through the lifetime of the choice, theta decay happens at a non-linear charge. This is a chart for an intuitive sense:

One of the frequent arguments in favor of longer-dated choices, particularly within the vary of 30-45 days to expiration, is that these choices not solely have a lot theta, however they’re proper on the candy spot the place the speed of theta decay begins to speed up. Certainly a robust argument.

And proponents of this philosophy are proper. Absolutely the degree of theta for longer-dated choices is certainly increased. The theta decay per day as a share of the choice value is far increased in shorter-dated choices.

Let’s evaluate the identical strike in two completely different expirations. A $SPY .30 delta name expiring in 5 days is buying and selling for $1.21 with a theta of -0.21, representing a -17% charge of decay every day, whereas a .32 delta name expiring in 37 days is buying and selling for $4.10 with a theta of -0.11, which is a -2.61% charge of every day decay. After all, the speed of theta decay will speed up within the longer-dated possibility as expiration nears.

So you’ve got two choices, each of that are inherently appropriate. You’ll be able to go together with the longer-dated possibility on the “sweet spot” of the theta decay curve and experience it for a couple of weeks, or you possibly can churn and burn weekly choices, turning your capital over and shifting on from trades in a short time.

Weekly Choices Have Very Excessive Gamma

If you happen to recall, gamma is the speed of change of delta. The upper the gamma, the extra dramatically a tick within the underlying will have an effect on the delta. As a rule, the nearer choices get to expiration, the higher their gamma is, particularly for near-the-money choices.

However why is that this? As expiration nears, choices that are not within the cash expire nugatory. This makes the worth of near-the-money choices extremely suspect and topic to huge value swings, which is the intuitive definition of gamma.

There’s an elevated uncertainty as to which choices will expire nugatory, so every tick within the underlying creates extra vital swings within the delta as you get nearer to expiration.

It is a present and a curse. If you happen to’re on the appropriate aspect of the market, you see vital positive factors shortly, however getting caught on the opposite aspect means your fortune shortly wanes.

Backside Line

Weekly choices to month-to-month choices as day buying and selling are swing buying and selling. Fortunes are received and misplaced extra quickly in weekly choices, they usually favor the bolder, faster-acting dealer over the analytical “dot the i’s and cross the t’s” sort of dealer.

Loads of profitable merchants commerce weekly choices, people who commerce longer-dated choices, and many who commerce each. Choices buying and selling could be very a lot about trade-offs, and mentioned trade-offs typically come all the way down to temperament or private desire.

One positive factor is that when you commerce weekly choices, it’s important to turn into rather more lively as a dealer, which is a value in itself.

Associated articles: