Whereas the previous can’t assure future outcomes, it stays our most dependable useful resource for understanding market conduct. Previously, I outlined how Monte Carlo simulations can be utilized to estimate these possibilities. However relying solely on one methodology is limiting. Diversifying the methods we calculate possibilities provides robustness to the evaluation.

On this article, I’ll delve deeply into three extra strategies for calculating possibilities: Hidden Markov Fashions (HMM), seasonality-based possibilities, and implied possibilities derived from choices costs. Every methodology has distinct benefits and enhances the Monte Carlo strategy, offering a complete framework for assessing Credit score Put Spreads.

1. Hidden Markov Fashions (HMM): Unveiling Hidden Market Dynamics

Hidden Markov Fashions (HMM) are a classy machine studying method designed to investigate time-series information. They function on the idea that noticed information (e.g., ticker costs) are generated by an underlying set of “hidden states” that can not be immediately noticed. These states signify distinct market situations, resembling bullish tendencies, bearish tendencies, or intervals of low volatility.

How HMM Works

-

Defining Observations and States:

- The noticed information on this context are the historic closing costs of the ticker.

-

The hidden states are summary situations influencing worth actions. For instance:

- State 1 (Bullish): Greater possibilities of upward worth actions.

- State 2 (Bearish): Greater possibilities of downward worth actions.

-

State 3 (Impartial): Restricted worth motion or consolidation.

-

Coaching the Mannequin:

- The HMM is educated on historic worth information to be taught the transition possibilities between states and the chance of observing particular worth modifications inside every state.

-

For instance, the mannequin would possibly be taught {that a} bullish state is prone to transition to a impartial state 30% of the time, and stay bullish 70% of the time.

-

Making Predictions:

- As soon as educated, the HMM can estimate the present state of the market and use this data to foretell future worth actions.

-

It calculates the likelihood of the ticker being above a selected threshold on a given date by analyzing doubtless state transitions and their related worth modifications.

Benefits of HMM in Choices Trading

- Sample Recognition: HMM excels at figuring out non-linear patterns in worth actions, which are sometimes missed by easier fashions.

- Dynamic Evaluation: Not like static fashions, HMM adapts to altering market situations by incorporating state transitions.

- Chance Estimation: For a Credit score Put Unfold, HMM offers a probabilistic measure of whether or not the underlying will stay above the brief strike primarily based on historic market conduct.

By capturing hidden dynamics, HMM gives a extra nuanced view of market possibilities, making it a helpful software for assessing threat and reward in Credit score Put Spreads.

2. Seasonality-Based mostly Possibilities: Unlocking Historic Patterns

Seasonality refers to recurring patterns in worth actions influenced by elements resembling financial cycles, investor conduct, or exterior occasions. In choices buying and selling, seasonality-based possibilities quantify how typically a ticker’s worth has exceeded a sure share of its present worth over a selected time horizon.

How one can Calculate Seasonality-Based mostly Possibilities

-

Outline the Threshold:

-

The edge is expressed as a share relative to the present worth (e.g., -2%, +0%, +2%). This normalization ensures the likelihood calculation is impartial of absolutely the worth degree.

-

The edge is expressed as a share relative to the present worth (e.g., -2%, +0%, +2%). This normalization ensures the likelihood calculation is impartial of absolutely the worth degree.

-

Analyze Historic Knowledge:

- For a given holding interval (e.g., 30 days), calculate the share change in worth for every historic commentary.

-

Instance: If the present worth is $100, and the brink is +2%, rely how typically the worth exceeded $102 after 30 days within the historic information.

-

Combination the Outcomes:

- Divide the variety of instances the brink was exceeded by the full variety of observations to calculate the likelihood.

-

Instance: If the worth exceeded the brink in 70 out of 100 situations, the likelihood is 70%.

Purposes in Credit score Put Spreads

Seasonality-based possibilities reply the query: “In similar conditions, how often has this ticker remained above the breakeven?” This strategy is especially helpful for ETFs, which frequently exhibit extra predictable patterns than particular person shares. For instance, sure sectors would possibly carry out higher throughout particular instances of the yr, offering a further layer of perception.

Limitations to Contemplate

- Seasonality possibilities rely fully on historic information and assume that previous patterns will persist. Whereas that is typically true for ETFs, it could be much less dependable for particular person shares or in periods of market disruption.

3. Implied Possibilities from Choices Costs: Extracting Market Sentiment

Choices costs are extra than simply numbers; they encapsulate the collective beliefs of market contributors about future worth actions. By analyzing the costs of places and calls throughout numerous strikes for a given expiration date, we are able to derive the implied possibilities of the ticker being in particular worth ranges.

Steps to Calculate Implied Possibilities

-

Gather Choices Knowledge:

- Receive the bid-ask costs for places and calls at completely different strike costs for the specified expiration date.

-

Calculate Implied Volatility:

- Use the choices costs to derive the implied volatility (IV) for every strike. IV displays the market’s expectations of future worth volatility.

-

Estimate Possibilities:

- For every strike, calculate the likelihood of the ticker being at or above that degree through the use of IV and the Black-Scholes mannequin (or related strategies).

-

The possibilities are then aggregated to assemble a distribution of anticipated costs at expiration.

Why Implied Possibilities Matter

- Market Consensus: Implied possibilities mirror what the market “thinks” in regards to the future, providing a forward-looking perspective.

-

Dynamic Changes: Not like historic strategies, implied possibilities adapt in real-time to modifications in market sentiment, resembling information occasions or macroeconomic information.

Software to Credit score Put Spreads

For a Credit score Put Unfold, implied possibilities can reply questions resembling: “What is the market-implied likelihood that the ticker will remain above the short strike?” This perception helps merchants align their methods with prevailing market sentiment.

Conclusion

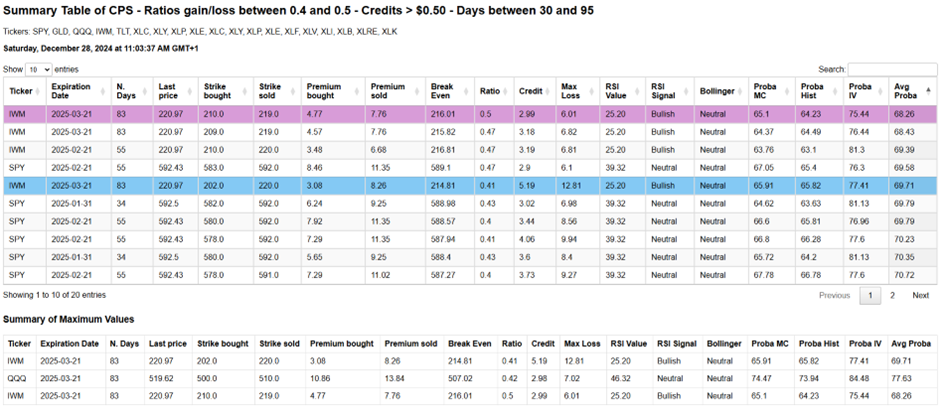

By integrating these three strategies—Hidden Markov Fashions, seasonality-based possibilities, and implied possibilities from choices costs—into my current Monte Carlo framework, I’ve developed a sturdy system for evaluating Credit score Put Spreads. This strategy permits a complete evaluation of Out-of-the-Cash (OTM) Credit score Put Spreads amongst a selection of ETFs, filtering for:

- Achieve/loss ratios inside particular thresholds,

- Expiration dates inside an outlined vary,

-

A minimal credit score of $0.50.

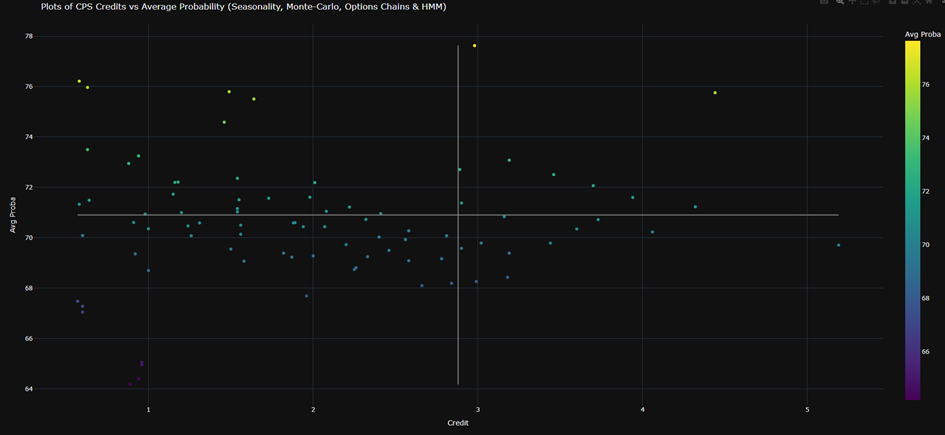

The result’s what I prefer to name a “stellar map” of chosen spreads:

accompanied by a abstract desk:

These instruments present readability and actionable insights, serving to merchants establish the perfect trades—these providing the very best likelihood of success whereas maximizing potential returns relative to threat.

Wanting forward, the following step will contain calculating the anticipated worth ($EV) of those trades, combining possibilities and potential outcomes to additional refine the choice course of.

The final word purpose stays the identical: to stack the chances in our favor—not by predicting actual costs, however by estimating possibilities with precision and rigor.

Keep tuned as I proceed refining these strategies and increasing their functions!