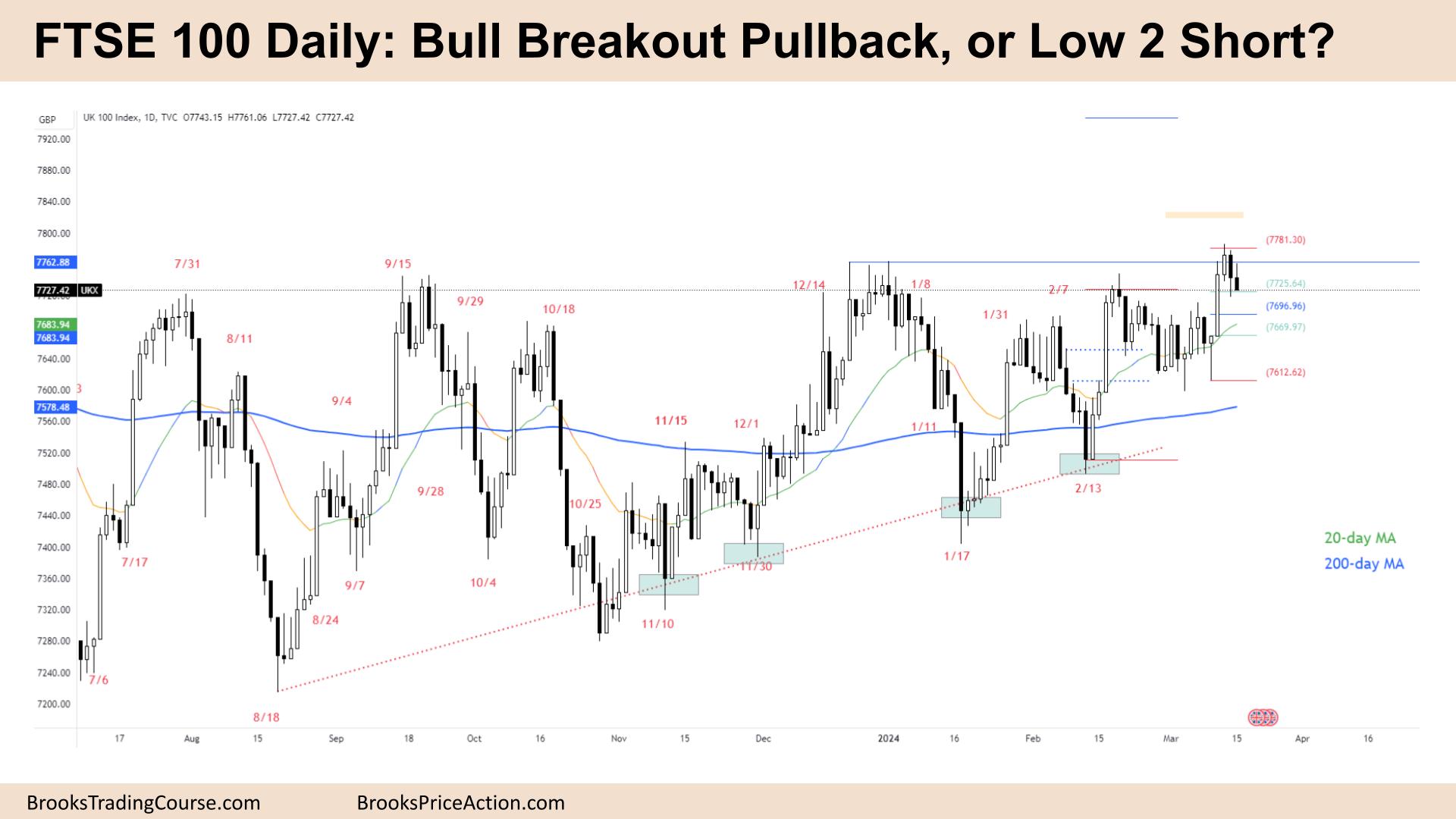

Market Overview: FTSE 100 Futures

FTSE 100 futures moved larger final week when the Excessive 2 was triggered. It appears like a bull breakout of BOM in a broad bull channel. Sloping up MA and large bull bars over the MA are good indicators for consumers on the MA and decrease. MM targets up are round 8000. Towards the bull case is the attainable failed breakout of a TR and a bear flag. Why can’t bulls get far above the prior highs? There may be nothing to promote but on this timeframe, so lengthy or flat.

FTSE 100 Futures

The Weekly FTSE chart

- The FTSE 100 futures moved larger with a bull bar with tails above and under when the Excessive 2 triggered.

- We’re beginning to shut above the MA once more, and we’re above the 200 and the 20 MA, so we are going to probably be at all times in lengthy.

- Anticipate sideways to up subsequent week.

- The Excessive 2 triggered in a bull atmosphere so we must always anticipate consumers under as properly.

- The bears had two probabilities to show it down. They’d three consecutive good bear bars however dangerous follow-through.

- Bears shorting above prior highs can be involved that we broke above.

- Some restrict order bears will promote once more above the three bear bars, but it surely was probably a scalp solely.

- Bulls right here anticipate a breakout and measured-move up, so may have purchased final week for a 2:1 up.

- Can subsequent week do something to encourage merchants to quick? Not on the lows or on the MA, so the one promote is above. Meaning we’re probably going larger.

- The bears would possibly create an inside bar right here, however I wouldn’t promote it.

- They would wish two superb bear bars, a attainable wedge high and a better excessive double high. However they’ve accomplished that 3 occasions already up to now 6 months.

- Anticipate consumers right down to the MA and under final week. Bear scalpers quick right here will probably exit there.

- What’s subsequent week is an enormous bear bar closing on its low. I can’t rule out any risk, so that might be a probable fade bar. And solely a reputable quick if it acquired follow-through.

- In bull tendencies, Excessive 2s are forgiving to merchants. After they fail, they usually create robust MM down, which permits merchants to get well.

The Day by day FTSE chart

- The FTSE 100 futures moved decrease on Friday, with a bear inside bar closing on its low.

- The each day chart has been in a broad bull pattern and has began to maneuver away from the 200 MA.

- The bulls now have three robust bull spikes, consecutive bull bars, and a closing far above the MA. So, it’s the early levels of a bull breakout in a better time-frame.

- However in a buying and selling vary it usually appears most bullish on the high and most bearish on the backside. Merchants are higher off shopping for close to the MA and scaling into their positions.

- The bulls lastly acquired a stronger larger excessive, which implies probably consumers under and on the MA.

- You possibly can see the tail on the bars for the bear, then an inside bar. The bulls may be upset and anticipate yet one more bar down.

- However now we have damaged out of one other bull flag. A bull flag breakout pullback is considered one of Al’s finest trades and a dependable lengthy setup.

- Measured transfer targets of the vary could possibly be about 8000.

- However anticipate deep pullbacks to enter your first place.

- Something to quick right here? Bears may argue a wedge high however with out a set off but.

- My downside with the quick argument is the 6 larger lows on this chart. So extra like every robust transfer down hits a trendline and finds scale in bulls.

- HH MTR? Stretching the that means just a little however nonetheless attainable if there’s good follow-through. I believe any bears would wait to enter their full place after a decrease excessive, a head and shoulders high, reasonably than now.

- We’re probably at all times in lengthy, so merchants needs to be lengthy or flat.

- Anticipate sideways to up subsequent week.

Market evaluation experiences archive

You possibly can entry all weekend experiences on the Market Analysis web page.