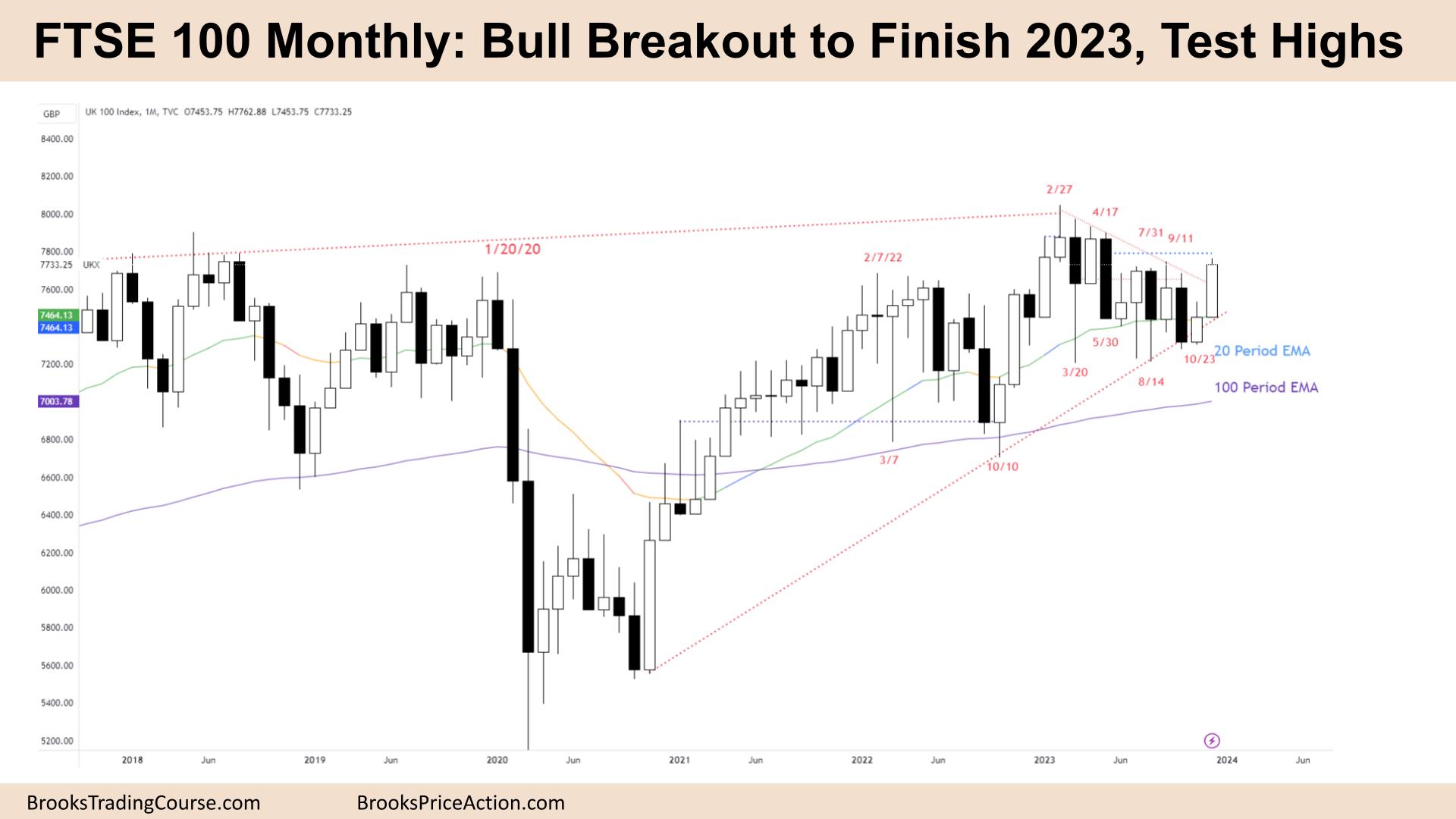

Market Overview: FTSE 100 Futures

FTSE 100 futures moved increased final month with a bull breakout of a wedge bull flag to complete 2023. Bulls needed an affordable purchase sign, however final month wasn’t it. Small bull bar closing beneath the MA – nevertheless it labored anyway. We’d must go sideways for bears to get out and different bulls to affix in. The ache commerce might be if it shoots increased as bears exit.

FTSE 100 Futures

The Month-to-month FTSE chart

- The FTSE 100 futures was a bull development bar, a bull breakout to complete 2023.

- The bar closed close to its excessive and much above the prior bull bar. So, there’s an open breakout hole.

- The bulls see a Excessive 2 or Excessive 3, breaking out of a bull flag off a HTF trendline.

- The bulls desire a pullback to maintain the hole open or continuation subsequent month to check the very best bull shut.

- The bears see a HH DT, a part of a doable head and shoulders high. They see a buying and selling vary and this can be a pullback to create LH DT.

- Extra seemingly we go increased, contemplating we’re above each transferring averages.

- Bears will in all probability promote above Might’s candle – a robust bear bar.

- Most merchants ought to search for a swing commerce. Consecutive bull bars above the transferring common is an effective selection.

- Extra seemingly, they’ll get no less than 1:1 and, worst-case, scalp out at breakeven.

- Swings are 40% more likely to go 2:1. Which means 60% probability it doesn’t. The bears see a buying and selling vary and can look to fade this bull breakout, however want a promote sign in the appropriate place beforehand.

- The place for bears to scale in is simply above 8000. So we may transfer up shortly to there.

- Now we have been in a triangle for a lot of months. The primary breakout usually fails, and we return and take a look at it. Some merchants will look to commerce the weekly as a substitute for higher steering.

- It was complicated as a result of the prior month closed below the MA, so this follow-through is a shock. We’d pull again to draw extra bulls.

- It’s seemingly at all times in lengthy; it’s higher to be lengthy or flat. Count on sideways to up subsequent month.

The Weekly FTSE chart

- The FTSE 100 futures was a small bull inside-bar final week.

- It’s the fifth consecutive bull bar, so a good channel and merchants will count on a second leg sideways to up.

- The bar closed below the excessive of the prior bar. This normally occurs on the fringe of a channel, the place bulls take income at new highs and like to attend to purchase decrease.

- The bulls see a breakout above a double high and are in search of a measured move-up. That may take us to round 8000 and a brand new ATH.

- The bulls desire a pullback into the vary of the bar to draw new patrons. They need a bear reversal bar to be weak, fail, and get their second leg up.

- The bears see the buying and selling vary as a double high or a triple high. It has been in breakout mode (BOM) for a lot of months, and most breakouts fail. They are going to be fast to get out if their fading doesn’t work.

- Some bear scalpers already scalped. That was the large tail two weeks in the past. However the follow-through has been stunning, in order that they watch for bear reversal bar to do it once more.

- It’s a 5-bar bull microchannel, and merchants will count on patrons beneath the final two bull bars. The second final one is close to the MA, which is probably going a greater place to get in if you’re ready for a pullback.

- It’s at all times in lengthy; it’s higher to be lengthy or flat. Count on sideways to up subsequent week.

Market evaluation stories archive

You possibly can entry all weekend stories on the Market Analysis web page.