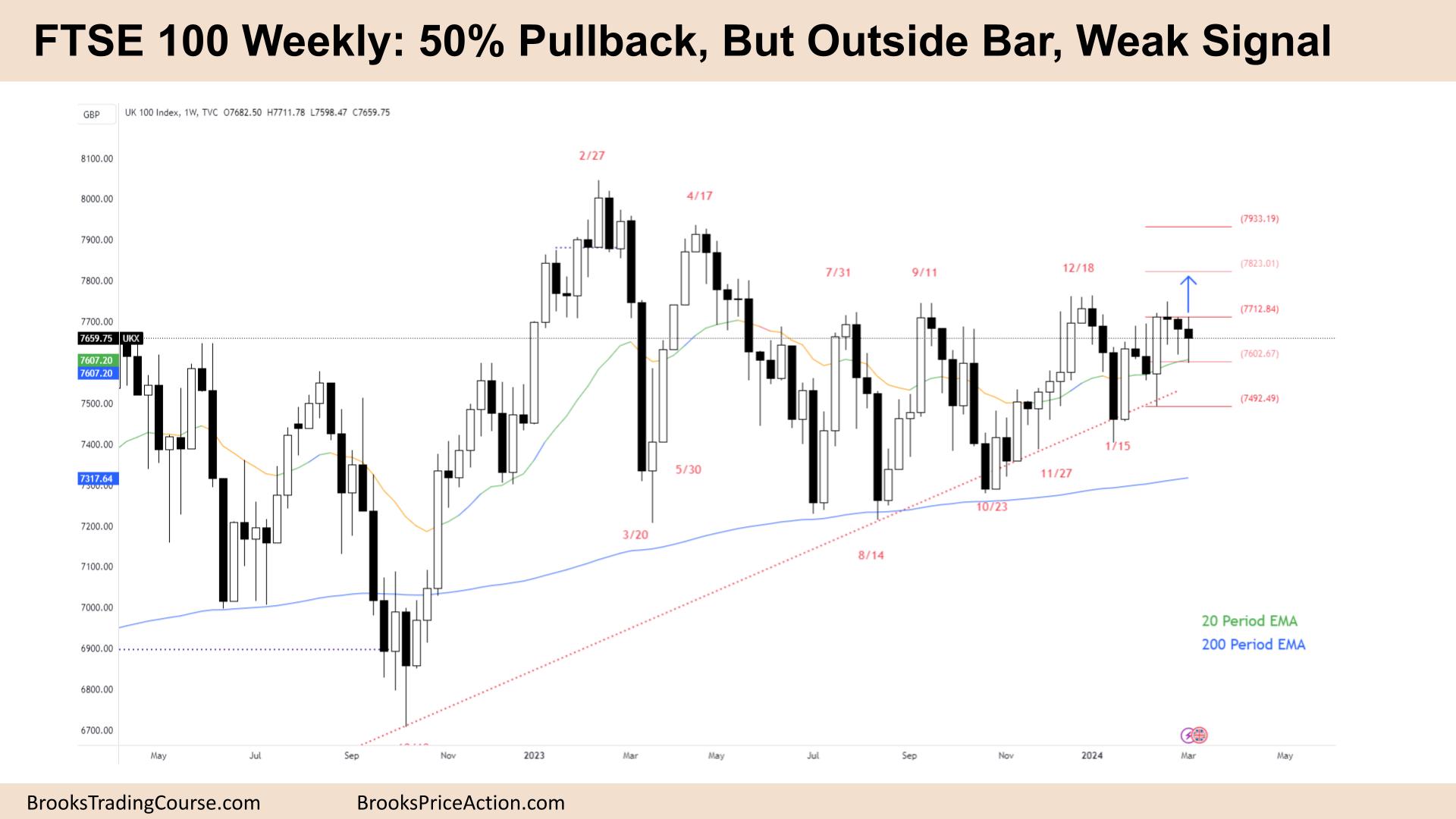

Market Overview: FTSE 100 Futures

FTSE 100 futures went sideways final week with a 50% pullback to the MA. Its beginning to resume the broad bull channel, so it’s higher to be trying to purchase pullbacks and across the MA. It has been doing this for a while whereas nonetheless in breakout mode. Bears can nonetheless fade the highest of this buying and selling vary, however in some unspecified time in the future will get caught. At present, they’re earning profits promoting good bull bars, so they are going to preserve doing it!

FTSE 100 Futures

The Weekly FTSE chart

- The FTSE 100 futures dropped barely final week, triggered by a bear doji, a 50% pullback from the MA.

- This week was an out of doors bar with an even bigger bear breakout

- It’s the third consecutive bear doji, so breakout mode on a smaller timeframe.

- The bulls see a broad bull channel, breakout mode (BOM), and massive bull bars closing on their highs above the MA. So, there’s a 60% probability we are going to go up.

- The bears see a number of double-top bear flags, however they’re increased excessive double tops (HHDTs.) However they need to squeeze their definition barely. They haven’t been making decrease lows.

- It’s extra more likely to be a buying and selling vary above the 200 MA, so development resumption up continues to be extra possible.

- It’s a doji bar, so a weak sign bar for stop-entry merchants. It’s possible the restrict order buying and selling, with sellers above and consumers under.

- The bears have been capable of promote above swing factors. In buying and selling ranges the bvears promote highs and scale in increased. They are going to proceed to take action as a result of they’re earning profits doing this till it fails a couple of occasions.

- Bulls need consecutive good bull bars. A bull, breakout.

- The bears need a good failure. Sturdy bear bars right here will consider they’re low in a buying and selling vary, and it’s unlikely that extra swing sellers can be discovered. They should persuade bulls to purchase excessive in order that they lure themselves.

- The bulls lack urgency right here, however they nonetheless purchased the 50% pullback. The chart exhibits a goal of two:1 above.

- It’s higher to be lengthy or flat. Most merchants needs to be flat in BOM.

- However at all times in lengthy from the context since October, and AIL value motion from November perhaps?

- Count on sideways to up subsequent week.

The Each day FTSE chart

- The FTSE 100 futures went sideways to down final week and on Friday with a bear bar closing close to its low with a small tail under touching the MA.

- it follows three consecutive bull bars, two closed above the MA, so a breakout pullback.

- The bulls see a powerful bull spike in February to a brand new 3-monthly excessive, but decrease than the 12 months’s open. They see a breakout for a second leg, however bears see a triangle – decrease highs.

- The bears see a small double-top bear flag, however they’ve issues at and above the MA.

- If you wish to promote, you don’t need to promote simply above the MA, and also you don’t need to promote after three bull bars.

- However when you’re bullish, why are the three bull bars small and overlapping with many tails?

- Trading vary value motion. Merchants are nonetheless BLSHS on this timeframe. Sturdy bull bars reverse down, and robust bear bars reverse up.

- The most effective place for merchants to enter are at extremes when it’s most tough to take action.

- Measured transfer targets are above as marked on the chart. I don’t have any bear MM targets as a result of we’re above the 200 proper now they usually gained’t make sense.

- Higher to be lengthy or flat.

- Most likely nonetheless at all times in lengthy, the bears by no means obtained 2 good bear bars closing on lows and shutting under the MA. However okay to be flat and ready for a greater sign bar.

- Count on sideways to up subsequent week.

Market evaluation studies archive

You may entry all weekend studies on the Market Analysis web page.