Market Overview: DAX 40 Futures

DAX futures went sideways final week with an inside-outside-inside sample (ioi.) The bulls see a last flag earlier than yet another leg up. The bears see a parabolic wedge, a decent channel up on the prime of an increasing triangle. No good indicators in 5 bars is TR value motion, so we could be in breakout mode once more and head again to the MA. The bulls need a Excessive 2, however we already examined the very best bull shut, so a tough purchase to take now.

DAX 40 Futures

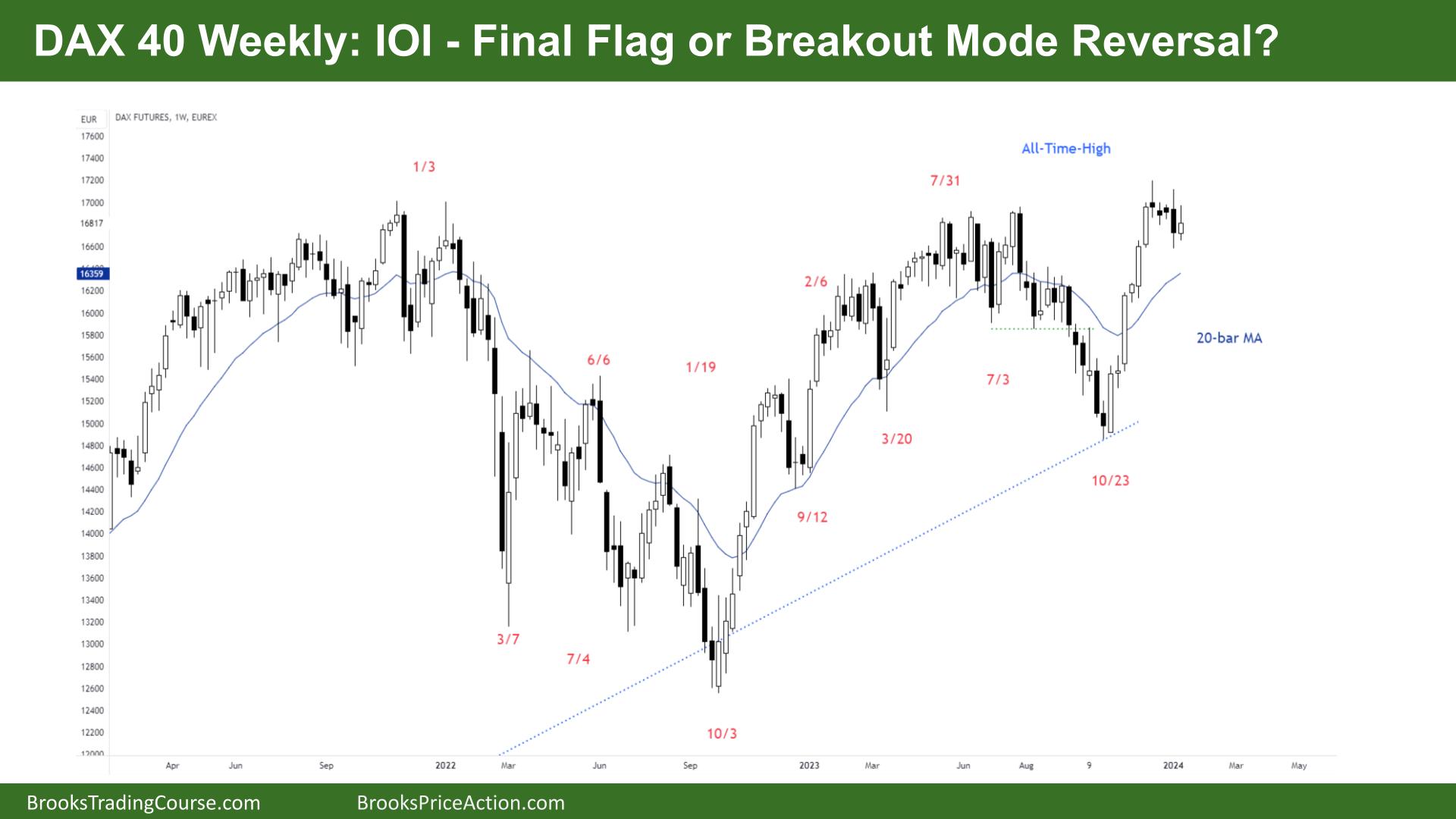

The Weekly DAX chart

- The DAX 40 futures went sideways in an ioi (Inside-outside-Inside) sample final week.

- IOI is a breakout mode sample, and the context after a robust bull transfer could possibly be a last flag. That will imply yet another leg up.

- The bulls needed a pullback to purchase decrease for one more transfer up. However now, 4 bear bars is now not trending behaviour. This might imply the primary reversal up shall be minor.

- The bears needed to promote above the steep bear leg. They noticed a buying and selling vary and triggered a second promote sign. They see a Low 2 promote now however too many tails for promote under.

- At all times in bulls might have exited under one of many indicators. Most took income on the highs after a purchase climax.

- The bulls that purchased the highs in all probability took a smaller place and can look so as to add on after two legs down. We could not have began the second leg but.

- The bears might have offered underneath and above the bear bars. However it’s nonetheless a decrease chance commerce.

- Breakout-mode-type patterns this distant from the MA typically return to the common value.

- Inside bar, so a weak purchase sign, however context is sweet for extra up. The issue is the place do you place your cease?

- Extra sellers could be above that bar, betting on a superb risk-to-rewards setup to the MA.

- Higher to be brief or flat. If you happen to’re lengthy, it’s higher to commerce a small measurement and add on on the MA or one other good bull bar.

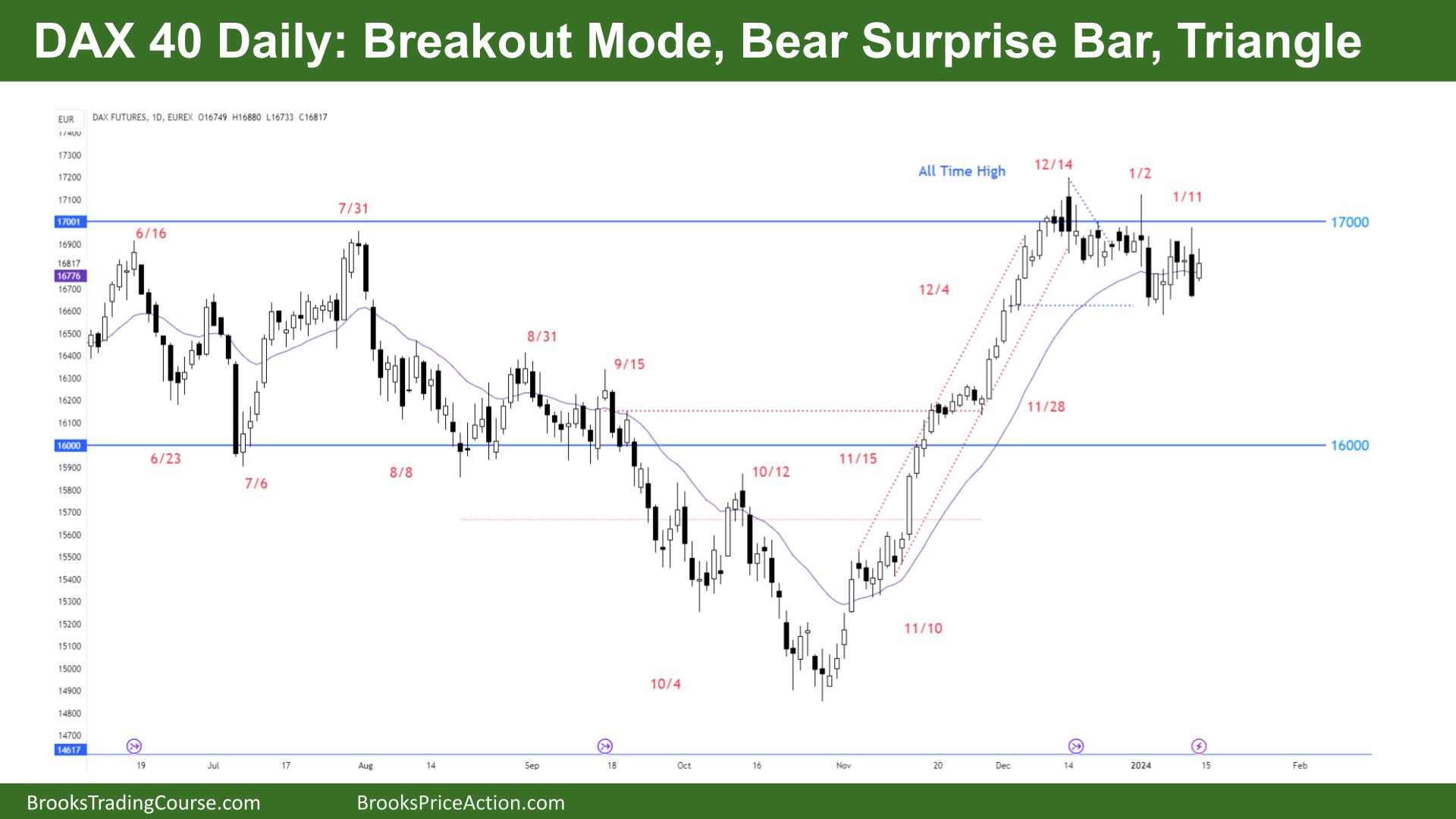

The Day by day DAX chart

- The DAX 40 futures hugged the MA on Friday with a bull inside bar after an enormous bear exterior down bar: a bear shock.

- The follow-through from the bear shock was unhealthy, so buying and selling vary value motion.

- Merchants could be questioning if there ought to be a second leg after that.

- The bulls see a decent bull channel, and we examined the small doji from December. So it’s a double backside and a buying and selling vary. The bulls need a good purchase sign.

- The bears see an infinite pullback to the MA, about 3 legs and sideways. it’s tight so some ways to rely it.

- Is it a wedge backside? With 8 bars on the MA, it’s in all probability simpler to contemplate it a TTR and breakout mode.

- Bulls need a good bull bar with FT above the MA.

- Bears need one other bull bar to fail and get consecutive bear bars under the MA.

- Each side are prone to get upset on this buying and selling vary.

- I believe we’ll return up and check 17000 once more. in all probability sellers above and consumers not far under.

- Most merchants ought to be flat. Some bears shall be swinging down, however you’ve got had two failed breakouts now, so it could be higher to exit and promote greater.

- Count on sideways to up subsequent week.

Market evaluation reviews archive

You may entry all weekend reviews on the Market Analysis web page.