Market Overview: DAX 40 Futures

DAX futures moved larger with a follow-through bull bar, so consecutive bull bars above 18000. We had an overshoot on the measured transfer and now have 3 legs in a decent channel, so we would begin to go sideways right here quickly. Bulls will possible purchase the primary reversal try and with a lot room to the transferring common, the very best the bears can get is a buying and selling vary.

DAX 40 Futures

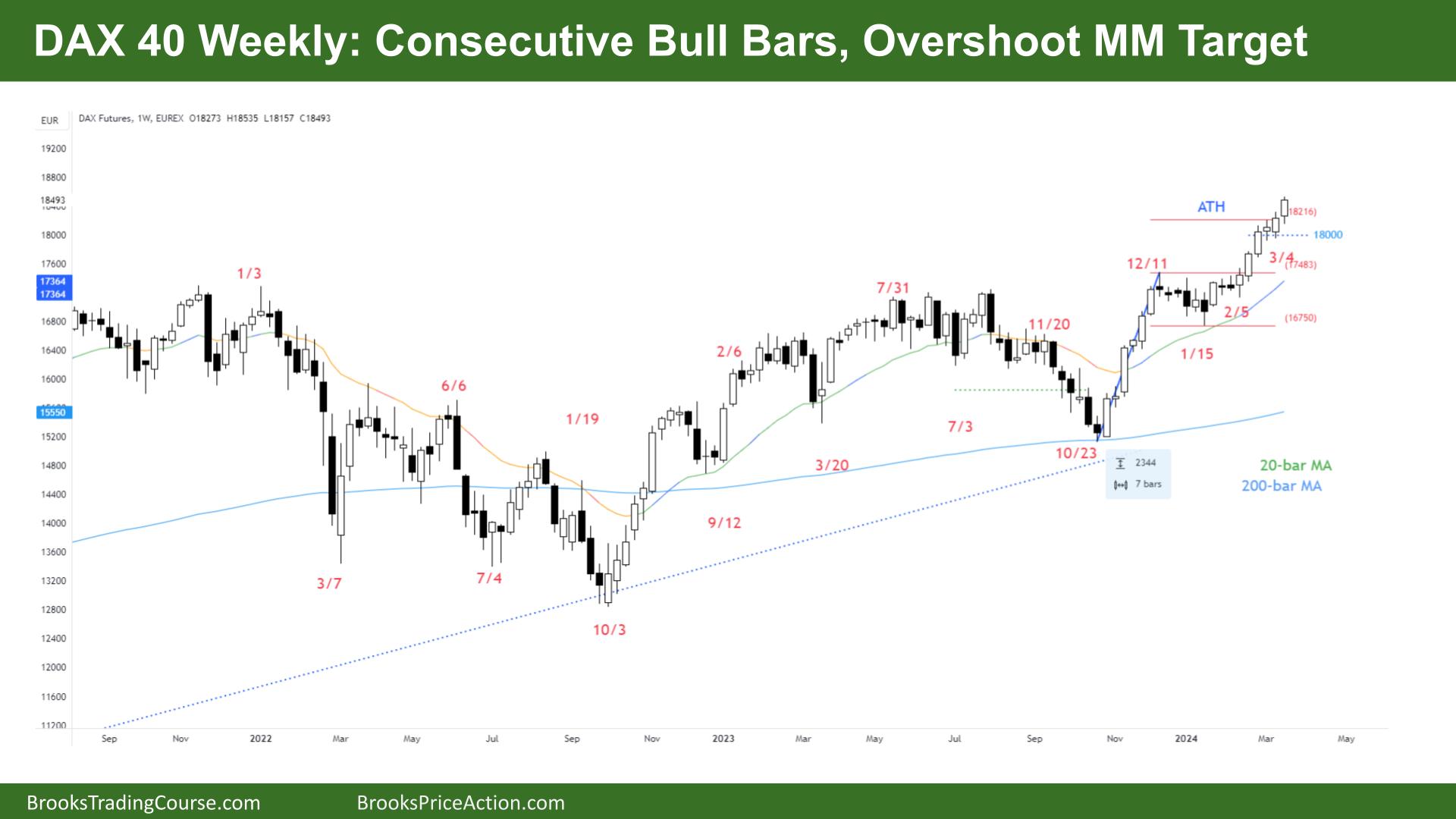

The Weekly DAX chart

- The DAX 40 futures rose final week with consecutive bull bars previous 18000.

- Final week was a powerful bull bar closing close to its excessive, so it’s purchase the shut.

- Additionally it is the sixth bull bar in a decent bull microchannel. Microchannels have a better price of pulling again previous 6 bars, so we would begin to go sideways subsequent week.

- It was a measured transfer overshoot, so some bears will scale in to get again there. However that is in all probability not the chart to do it on!

- The transferring common is sloped up, and we’re capturing away from it. Meaning acceleration.

- The bears tried to reverse at 18000 but it surely was too robust. Open gaps so going larger.

- Acceleration late in a pattern is an indication that profit-taking ought to occur quickly, so maybe sideways to 1 extra bar up.

- You’ll be able to see the shortage of bear bars within the buying and selling vary beneath the place we’re. Nothing to promote for the bears, so higher to be lengthy or flat.

- We’re all the time in lengthy.

- The bulls don’t must get out, both. The primary bar to go beneath the low of a previous bar after consecutive bull bars in a microchannel is prone to be purchased, so bulls will purchase and scale in decrease.

- It’s beginning to get climactic. Look again to December. When the bulls acquired 6 bars, we went sideways, so we would do this once more.

- Bears can argue a parabolic wedge high, with three pushes: January, February, and now March. So merchants count on two legs sideways to down after which, in a number of months, one other leg up? That may then be three bigger legs.

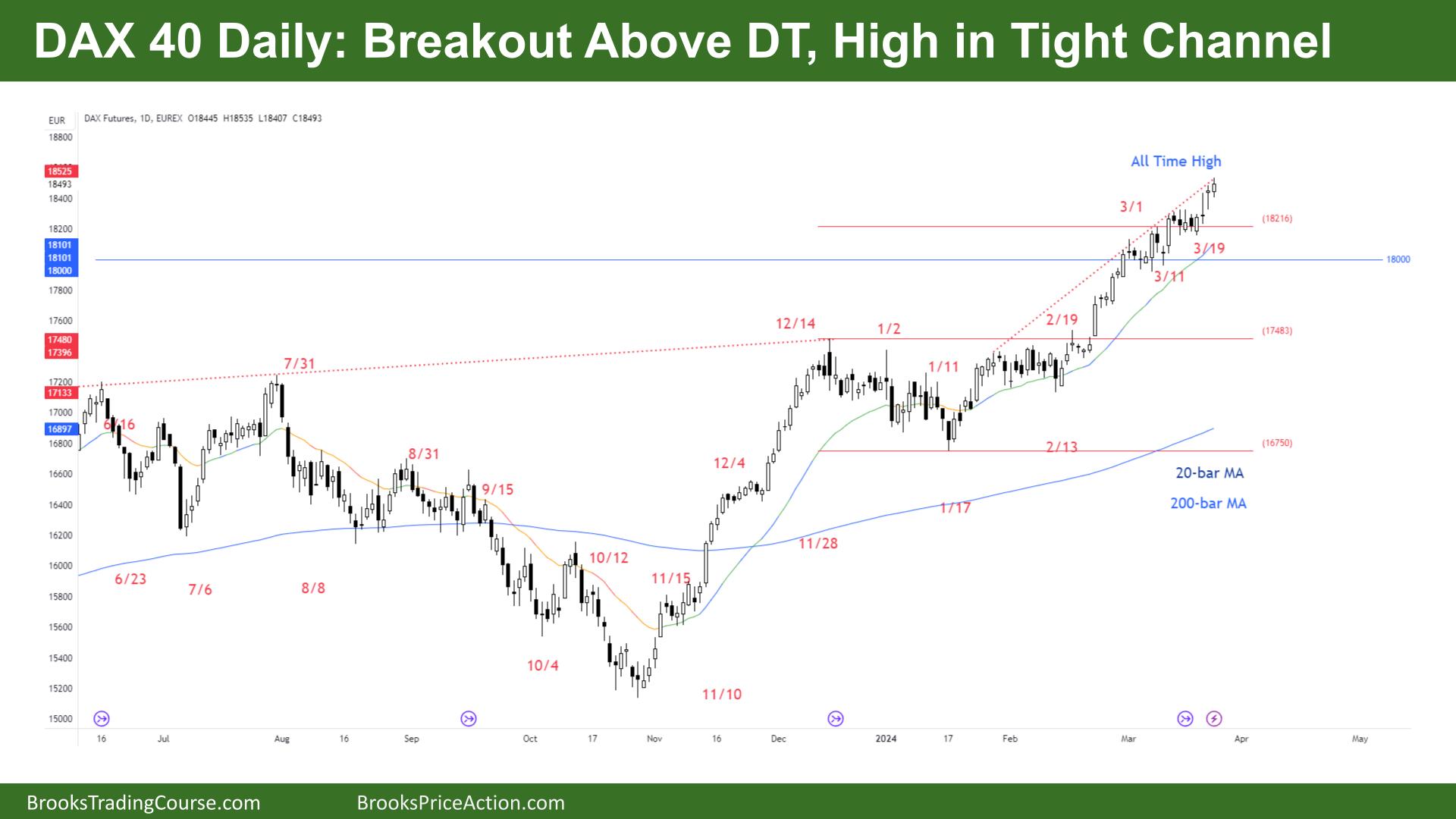

The Every day DAX chart

- The DAX 40 futures went larger with a bull doji, excessive in a decent bull channel.

- Three dojis in a row, so we’ll in all probability convert right into a buying and selling vary within the subsequent 10 bars.

- The market went proper previous the buying and selling vary measured transfer goal, so there is perhaps one other bigger goal which is extra vital. Maybe on the month-to-month chart.

- I believe we’ll come again to 18000. We’ve a wedge high in a decent channel, so maybe we’ll kind a buying and selling vary, and 18000 would be the backside.

- However nothing to promote for the bears.

- The bulls see open gaps above 18000, so so long as measuring gaps are there, restrict order bears are shedding cash.

- Bears would possibly argue a wedge high, however the place was the nice each day promote sign? We’re hugging the highest of the channel, so some bulls would possibly take earnings. Others will search for the channel to leap one other vary.

- Most merchants ought to be lengthy or flat. At all times in lengthy so subsequent week ought to be sideways to up.

- However its a late leg so is perhaps higher to attend for a few legs sideways to down earlier than shopping for once more.

- Above each transferring averages and a big airpocket above the 20 MA. So the primary reversal down is prone to be minor.

- Friday didn’t shut above Thursday so indicators of the buying and selling vary are beginning to seem. If bulls will not be shopping for above yesterday’s excessive, then they need to purchase beneath it.

- So bears will likely be extra aggressive above bars, or promote a distance above it.

Market evaluation reviews archive

You’ll be able to entry all weekend reviews on the Market Analysis web page.