Market Overview: DAX 40 Futures

DAX futures moved decrease final week in a bull flag with a bear doji. Sideways worth motion after an enormous transfer up. Price had a tough time getting by 17000 final time. The bulls desire a good double backside right here to maneuver greater. It’s nonetheless above the 200, so most bear strikes must be pullbacks on the month-to-month chart. Anticipate extra consumers on the MA for a check of the excessive. The bears wish to disappoint them and escape beneath.

DAX 40 Futures

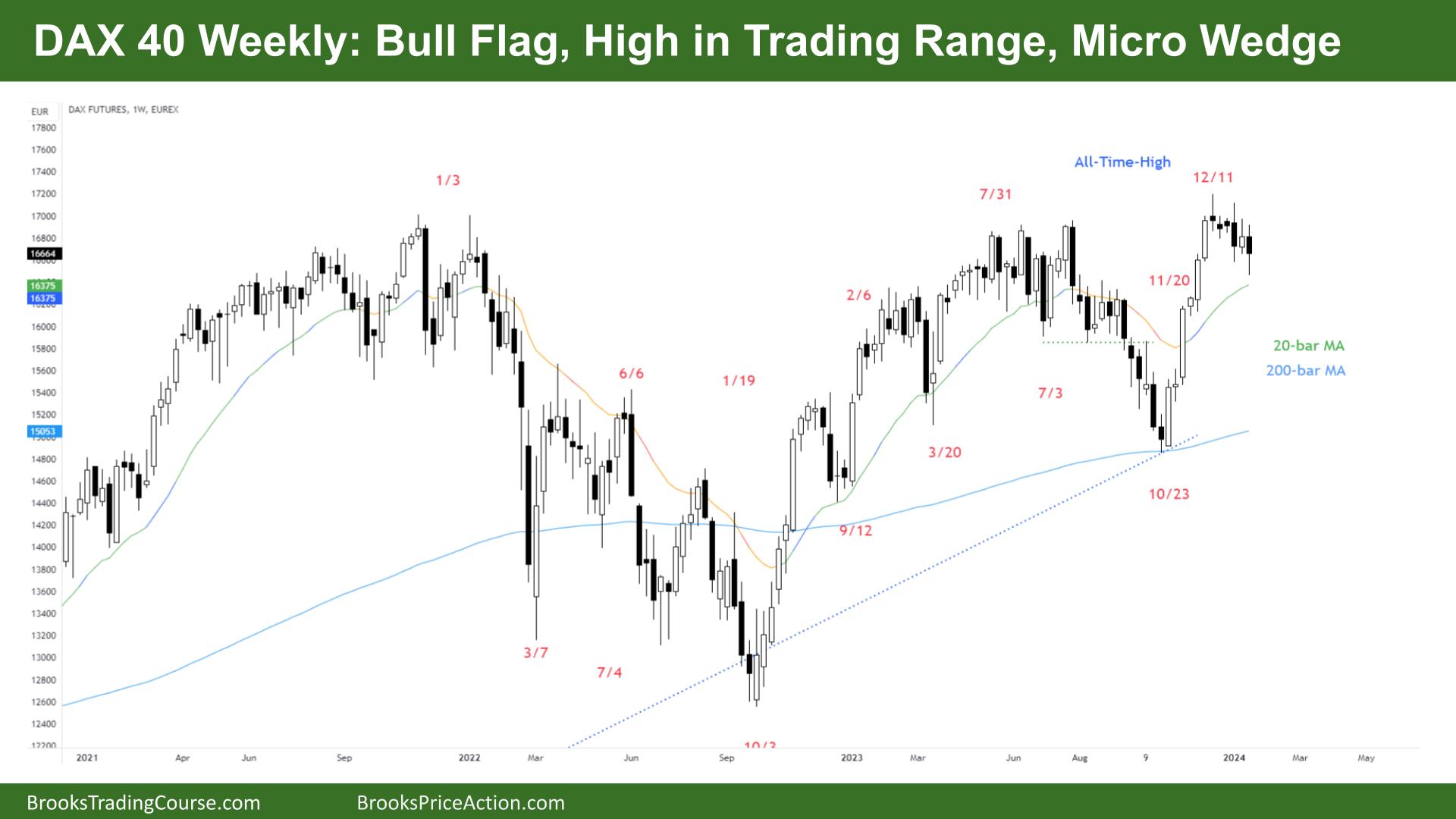

The Weekly DAX chart

- The DAX 40 futures went decrease final week in a bull flag with a bear doji.

- Tails above and beneath, so sideways, have been anticipated after such a robust transfer up.

- The bulls see a decent bull breakout, a parabolic wedge prime. Most merchants wished two legs sideways to down, maybe again to the shifting common.

- It’s three pushes down on a LTF, a micro wedge sample.

- It’s a Low 2 presently, so a purchase above can be a Excessive 2 purchase. However the bear doji is a weak sign bar. Most bulls will anticipate a superb sign bar.

- Restrict order bulls have been scaling in and can doubtless achieve this all the best way to the MA.

- The bears see a double prime, a check of a wedge prime. An increasing triangle – some ways to see it. The issue is the all-time excessive.

- Now that the bulls have a brand new excessive, the bears should work to make sure they will create a decrease excessive. Most HH DT are adopted by LHDT.

- The bears see it as a significant pattern reversal – break trendline, new excessive and now reversal – however the sign bars are usually not nice. The transfer up was so sturdy merchants will anticipate a second piece to it.

- All the time in lengthy, however okay for these bulls to have exited beneath these bear bars and wait for one more purchase sign.

- Different merchants are ready for it to get again to the highest, the promote climax from September. We raced previous and trapped bears there. We must always allow them to out.

- Anticipate sideways to down subsequent week.

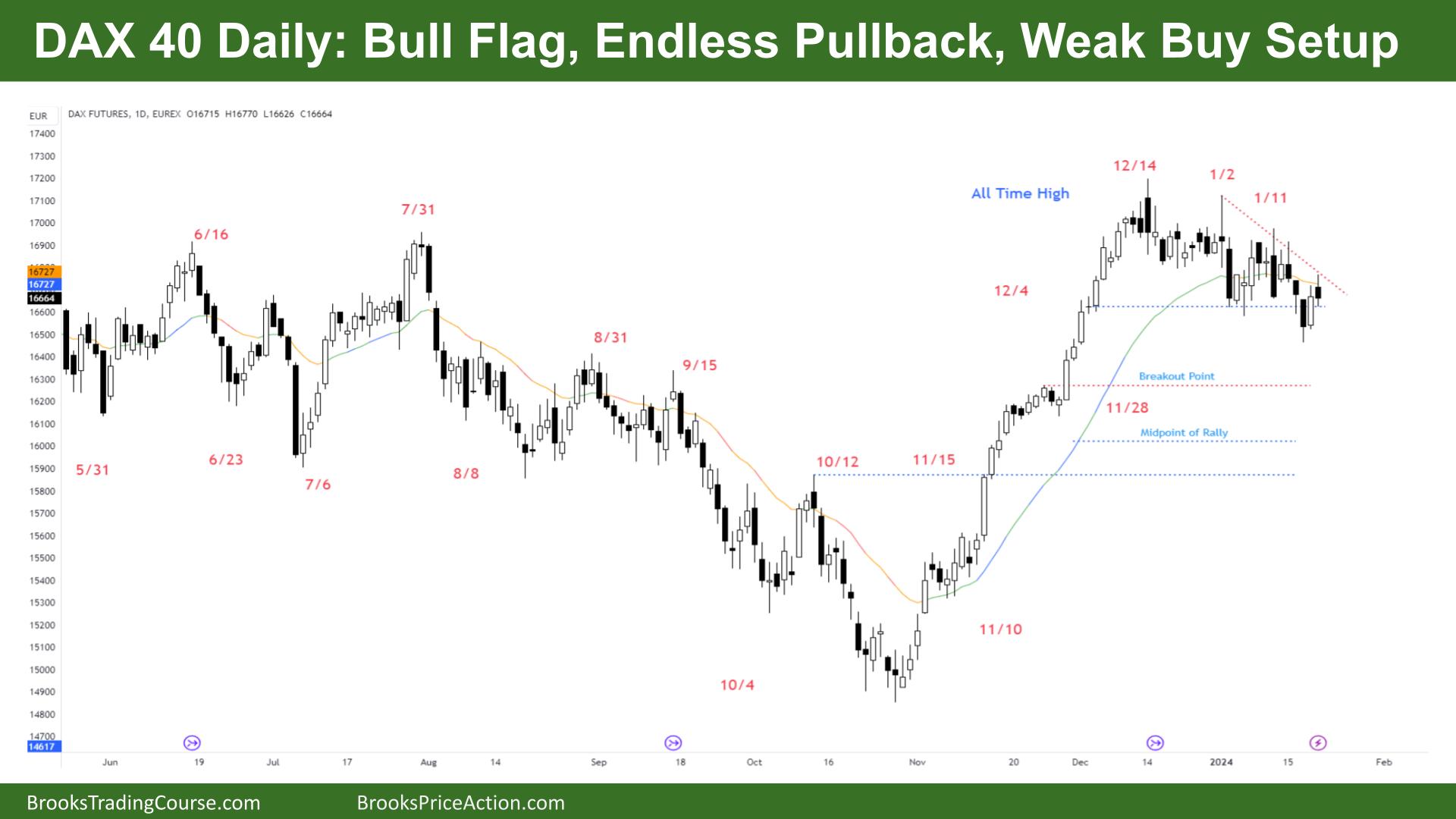

The Each day DAX chart

- The DAX 40 futures went sideways beneath the 20-bar shifting common on Friday.

- Bulls see an enormous bull spike, and we’re pulling again in a bull flag. However the bears see a bear channel gaining momentum beneath the MA.

- The bulls see a wedge bull flag setup, triggering the purchase sign. However it’s a unhealthy location beneath the MA, so it’s harmful. It might fall rapidly.

- The bears see a breakout beneath a double backside, however they know the very best they will get is a buying and selling vary, so they’re nonetheless scalping and taking fast earnings.

- The upper timeframe is probably going to provide the bulls what they need.

- Some bears are hoping to get again to shut the breakout level hole beneath. They wish to get to the midpoint of the entire rally finally. However the bulls ought to get an opportunity to create a double prime first.

- Some bears can say it’s at all times in brief beneath the MA. That could be a change of character, and now they’ve a superb promote sign for Monday.

- However there aren’t any open gaps, so the bulls are holding it as a buying and selling vary for now. They want the next excessive to get it again to sideways.

- A couple of weeks in the past, we mentioned this doji can be a check goal. A nasty purchase sign that led to an enormous breakout.

- Bears who light that bar wished to get again to it.

- The vary is tight, and bars are overlapping, so cease order merchants must be cautious – scaling in is probably going required.

Market evaluation experiences archive

You’ll be able to entry all weekend experiences on the Market Analysis web page.