Market Overview: Crude Oil Futures

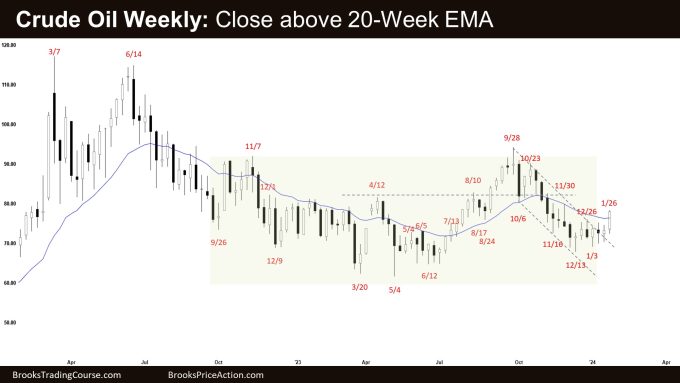

The weekly chart fashioned a Crude Oil sturdy bull bar closing above the 20-week EMA. The bulls have to get a follow-through bull bar to extend the percentages of the bull leg starting. The bears see the present transfer merely as a two-legged pullback and wish the 20-week EMA and the bear development line to behave as resistance, forming a double prime bear flag with the December 26 excessive being the primary leg.

Crude oil futures

The Weekly crude oil chart

- This week’s candlestick on the weekly Crude Oil chart was a giant bull bar closing close to its excessive.

- Final week, we stated that Crude Oil should still be within the sideways to up minor pullback section. Merchants will see if the bulls can create sustained follow-through shopping for or will the market stall across the 20-week EMA space.

- The bulls managed to create good follow-through shopping for closing above the 20-week EMA.

- They see the selloff to the December 13 low merely as a bear leg inside a buying and selling vary.

- They need a reversal from the next low main development reversal (Dec 13), a wedge bull flag (Oct 6, Nov 16, and Dec 13) and a small double backside (Dec 13 and Jan 3).

- Since this week closed above the 20-week EMA, the bulls might want to create follow-through shopping for to extend the percentages of the bull leg starting.

- The bears bought a robust transfer down buying and selling far under the 20-week EMA in a decent bear channel and consisting of three pushes due to this fact a wedge (Oct 6, Nov 16, and Dec 13).

- They see the present transfer merely as a two-legged pullback and wish the 20-week EMA and the bear development line to behave as resistance, forming a double prime bear flag with the December 26 excessive being the primary leg.

- They need one other leg right down to retest the prior leg low (Dec 13) and the buying and selling vary low (Might low).

- Since this week’s candlestick is a bull bar closing close to its excessive, it’s a purchase sign bar for subsequent week.

- For now, Crude Oil should still be within the sideways to up minor pullback section.

- Merchants will see if the bulls can create follow-through shopping for or will the market stall across the 20-week EMA space.

- Crude Oil is at present in a 77-week buying and selling vary. Merchants will BLSH (Purchase Low, Promote Excessive) till there’s a breakout with sustained follow-through shopping for/promoting from both path.

- The market is buying and selling within the decrease third of the buying and selling vary which is the purchase zone of buying and selling vary merchants.

- The bulls have to do extra to point out that they’re now again in management by creating just a few consecutive bull bars.

The Each day crude oil chart

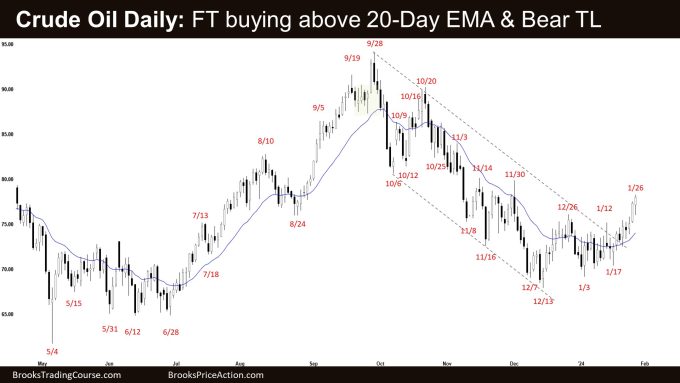

- Crude Oil traded sideways to up for the week. Thursday broke above the December 26 excessive with follow-through shopping for on Friday.

- Final week, we stated that the market should still be within the minor pullback (sideways to up) section. If it stays weak and sideways, we’ll seemingly see extra promoting strain return quickly.

- The bulls handle to create a stronger leg up this week buying and selling far above the 20-day EMA and the bear development line. They bought what they wished.

- They see the transfer right down to December 13 merely as a bear leg inside a buying and selling vary.

- They need a reversal from a wedge sample (Oct 6, Nov 16, and Dec 13) and the next low main development reversal (Dec 13).

- They hope to get a retest of the September excessive.

- If the market trades decrease, they need a reversal from the next low and the 20-day EMA to behave as help adopted by one other leg up finishing a wedge sample with the primary two legs being December 26 and January 26.

- The bear bought 3 pushes down, forming a wedge sample (Oct 6, Nov 16, and Dec 13).

- They need a retest of the December low after the present pullback.

- They see the present pullback as forming a double prime bear flag (Dec 26 and Jan 26).

- For now, odds barely favor the market to nonetheless be within the minor pullback (sideways to up) section.

- Merchants will see if the bulls can create sustained follow-through promoting.

- If the bulls can get a collection of consecutive bull bars closing close to their highs, buying and selling far above the 20-day EMA and the bear development line, it could possibly swing the percentages in favor of the bull leg starting. This stays true.

- Crude Oil stays in a 77-week buying and selling vary. Merchants will BLSH (Purchase Low, Promote Excessive) in buying and selling ranges till there’s a breakout with sustained follow-through shopping for/promoting.

- Most breakouts from a buying and selling vary fail 80% of the time. Odds barely favor the buying and selling vary to proceed.

Market evaluation reviews archive

You may entry all weekend reviews on the Market Analysis web page.