Market Overview: Bitcoin

The Bitcoin weekly chart exhibits a late-stage bull breakout, which raises issues a few potential pattern shift, both to sideways buying and selling or a reversal. Bears may quick right here, whereas bulls are cautious.

The each day chart motion paints a special image. Caught in a bull channel with out a clear At all times In sign, short-term choppiness is anticipated. Bulls can search for “high 2” or “high 3” setups throughout the channel, whereas bears ought to watch for affirmation of a reversal sample earlier than getting into quick positions. Dive deeper into the report for a complete breakdown!

Bitcoin

The costs depicted on our charts are sourced from Coinbase’s Trade Spot Price. It’s essential to notice that the spot worth of Bitcoin is repeatedly in movement; buying and selling exercise by no means ceases. Which means market fluctuations and worth adjustments happen across the clock, reflecting the dynamic nature of cryptocurrency buying and selling.

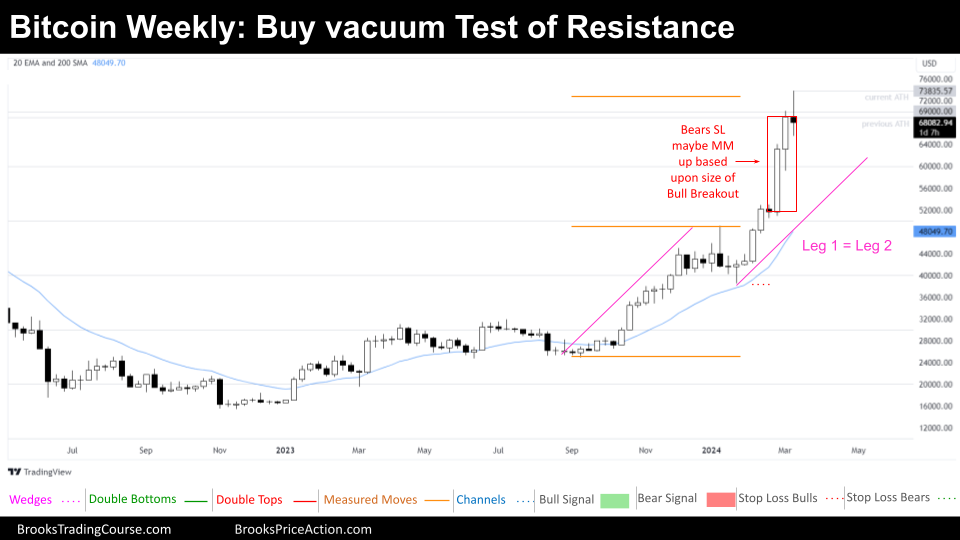

The Weekly chart of Bitcoin

The general pattern leans bullish as a result of there’s an At all times in Lengthy market contained inside a bull breakout market cycle. Nonetheless, the timing of this breakout raises eyebrows.

Such late-stage bull breakouts (20 or extra bars right into a bull pattern) are purchase vacuum assessments of resistance. The late bull breakout may propel Bitcoin larger and create a stronger bull pattern, nevertheless, a shift available in the market cycle is extra probably. This shift may very well be a buying and selling vary, or a reversal.

Keep in mind that each turning level in a bull pattern, whether or not a reversal or a take a look at of power, occurs at resistance.

Aggressive bears can quick the shut of a weak bull follow-through week, like the present one. Their Cease Loss is predicated upon the peak of the bull breakout (see chart), and their goal is the low of the bull breakout (many will simply take a $3000 to $5000 “scalp”). Different Bears will wait to promote beneath a reversal down. Conservative bears will watch for bull weak spot, and can watch for a Decrease Excessive Main Pattern Reversal sample earlier than getting into a brief place.

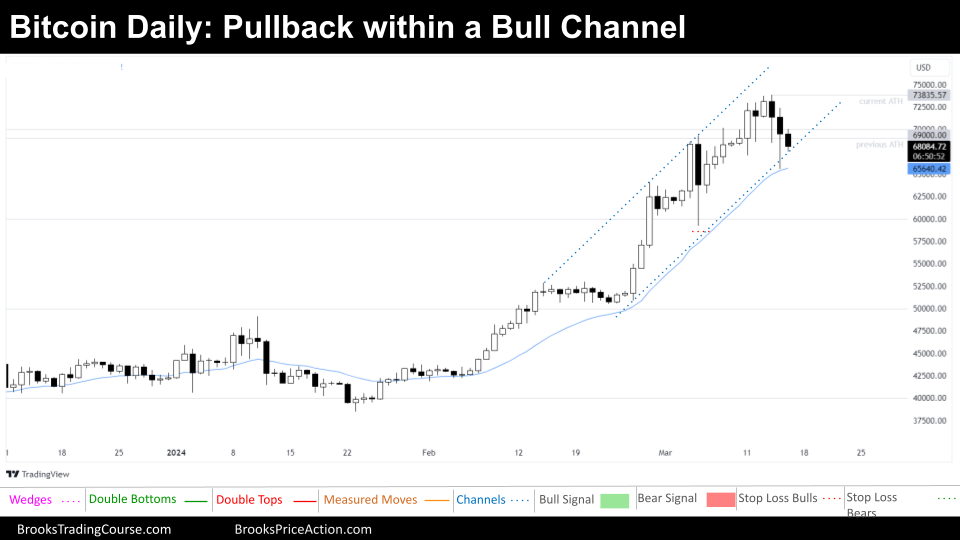

The Day by day chart of Bitcoin

We’re at present in a bull channel, however both At all times in Lengthy or At all times in Quick market are absent. This means short-term sideways buying and selling is extra probably than a robust directional transfer.

For bulls, a pullback throughout the bull channel presents a possible shopping for alternative. Anticipating continued upward momentum contradicts the upper timeframe evaluation. Nonetheless, merchants ought to commerce what they see, and bulls ought to preserve their concentrate on setups. They are going to look to commerce a “high 2” or a “high 3” setup, specifically if these have a big bullish candle physique and the market just isn’t At all times in Quick when that circumstances are met. These bull setups are traded as scalps; nonetheless, a dealer could go away a small portion of the commerce working, making an attempt to catch one other swing up throughout the bull pattern.

Bears, alternatively, ought to train warning. They want affirmation of a reversal sample earlier than getting into quick positions. A reversal sample can appear to be a decent buying and selling vary, a double prime, or a head and shoulders prime. Ready for an At all times in Quick after the reversal sample affirmation is good for bearish performs.

If the market transitions right into a broader Trading Vary, bulls will purchase on the backside third and bears will promote on the higher third.

What are your ideas? Share your ideas within the feedback beneath and let’s get a dialogue going! We respect any insights you might have concerning the worth motion framework. Keep in mind, a number of the most beneficial contributions come from you, so don’t hesitate to share your data!

Market evaluation reviews archive

You possibly can entry all of the weekend reviews on the Market Analysis web page.