Market Overview: Bitcoin

Bitcoin is buying and selling above the numerous psychological degree of fifty,000 Huge Spherical Quantity (BRN) for the primary time since 2021. Inspecting the weekly chart, we observe a constant uptrend in value motion, nonetheless, as Bitcoin continues its ascent, questions come up concerning the sustainability of this Bull Development. Will the present bullish momentum persist, propelling Bitcoin to additional highs? Or are we getting ready to a transition right into a Trading Vary, signaling a possible interval of consolidation?

Bitcoin

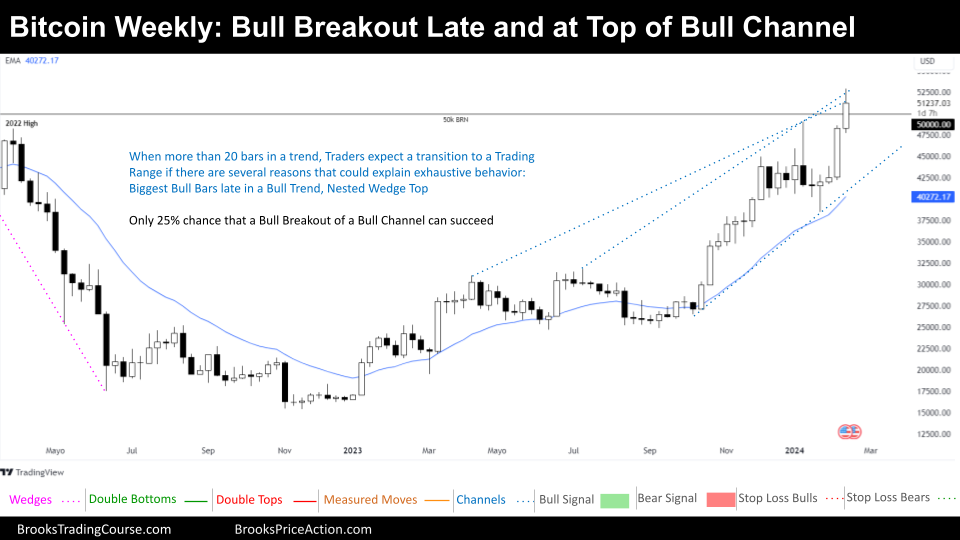

The Weekly chart of Bitcoin

This week witnessed Bitcoin’s value persevering with its strong ascent, notably surpassing the numerous milestone of fifty,000. Over the previous two weeks, the value exhibited an explosive upward motion, culminating in its present place on the higher development line of a Bull Channel. Inside the market cycle, Bitcoin is firmly entrenched in a Bull Channel, signaling sustained upward momentum.

Nevertheless, as Bitcoin extends its Bull Development, merchants are vigilant for indicators of a possible transition right into a Trading Vary. Usually, after roughly 20 bars in a Bull Development, merchants start scrutinizing for indications of exhaustion within the prevailing development. The latest value motion, characterised by a late-stage bull breakout and the formation of a Nested Wedge Prime sample, suggests potential exhaustion within the Bull Development.

Anticipating a shift in market cycle, many Bulls using the Bull Development could decide to promote their positions, and lift the remaining positions with cease losses probably positioned under the January Low. Ought to Bitcoin certainly enter a Trading Vary cycle, the preliminary goal could be the January Low.

Whereas some Bears could seize the chance to promote at this week’s shut, inserting cease losses above the excessive of the week entails appreciable threat, significantly if the week concludes above its midpoint. Bears planning to place their cease loss a Measured Transfer up away from the Bull Breakout, don’t plan their cease loss to ever get hit and can take into account exiting if the value motion proves they’re mistaken.

The gap from the 20-week Exponential Transferring Common and the presence of a number of exhaustion alerts deter Bulls from contemplating excessive entries.

In conclusion, regardless of Bitcoin’s ongoing Bull Development, warning prevails amidst mounting indicators of potential exhaustion. Bulls are inclined to await decrease entry factors, assessing the energy of Bears earlier than committing additional. As uncertainty looms, rational decision-making trumps emotion-driven impulses just like the Worry Of Lacking Out.

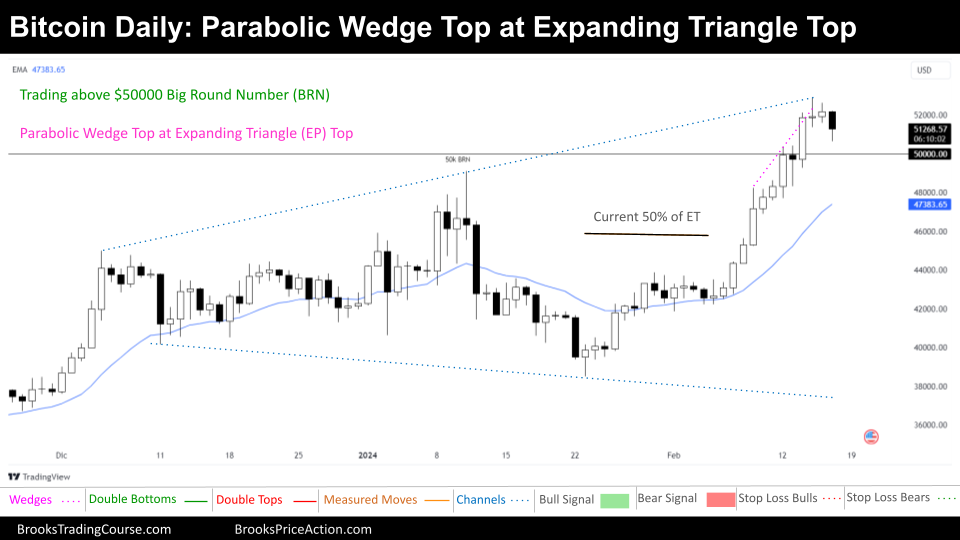

The Day by day chart of Bitcoin

The latest value motion signifies a check of the higher boundary of an Increasing Triangle Sample, which is a Trading Vary Sample. Whereas the present market cycle seems to resemble a Tight Bull Channel within the brief time period, a broader perspective reveals traits extra aligned with a bull leg inside a Broad Bull Channel.

In a state of affairs indicative of a Broad Bull Channel, merchants could take into account shopping for above prior highs, albeit with warning, as they do provided that they’ll scale in at decrease ranges to handle the chance related to deep pullbacks and potential transitions into Trading Vary patterns.

Merchants working inside a Broad Bull Channel typically search alternatives to purchase at a 50% pullback or upon witnessing a reversal from such a degree. Alternatively, shopping for across the backside third of a Trading Vary, as prompt by the Increasing Triangle Sample, can also be a viable technique. Promoting above prior highs presents a possibility for bears to scalp income, they solely do if they’re able to scale in at increased ranges.

There’s uncertainty concerning whether or not the present market cycle is a Broad Bull Channel, or if that is simply the beginning of a Spike and Channel Bull Development. We have no idea even when the Bull Spike section has concluded, prompting a cautious method. For bears, anticipating a Bull Climax would possibly result in untimely actions. It’s important to train persistence and look ahead to All the time In Brief.

In conclusion, the evaluation of this chart signifies a number of key observations. Firstly, the present value motion locations us on the higher boundary of an Increasing Triangle sample, suggesting a possible reversal zone.

Secondly, the continued bullish breakout may also symbolize a bull leg inside a Broad Bull Channel. This means that whereas the fast development could also be bullish, merchants ought to stay aware of potential pullbacks and transitions into buying and selling vary patterns.

Lastly, there’s a chance that the present market development may align with a Spike and Channel Bull Development state of affairs. Nevertheless, this consequence is taken into account much less probably in comparison with the opposite situations mentioned. Nonetheless, it stays a believable state of affairs that merchants ought to monitor and adapt their methods accordingly.

Your insights and views are invaluable to fostering the Brooks Price Motion neighborhood of merchants and analysts. Please don’t have any hesitation to share your ideas within the feedback part under and interact with fellow contributors. Moreover, when you discovered our evaluation insightful and useful, share them together with your community! Collectively, we are able to proceed to study, develop, and navigate the complexities of the market extra successfully. Your participation and help are tremendously appreciated!

Josep Capo

Market evaluation experiences archive

You’ll be able to entry all of the weekend experiences on the Market Analysis web page.