Fast Take

Bitcoin’s long-term holders (LTHs), those that have held for greater than 155 days, have historically been perceived because the ‘smarter money’ on account of their expertise weathering Bitcoin volatility. Key to their technique is shopping for Bitcoin throughout value slumps and offloading throughout market euphoria.

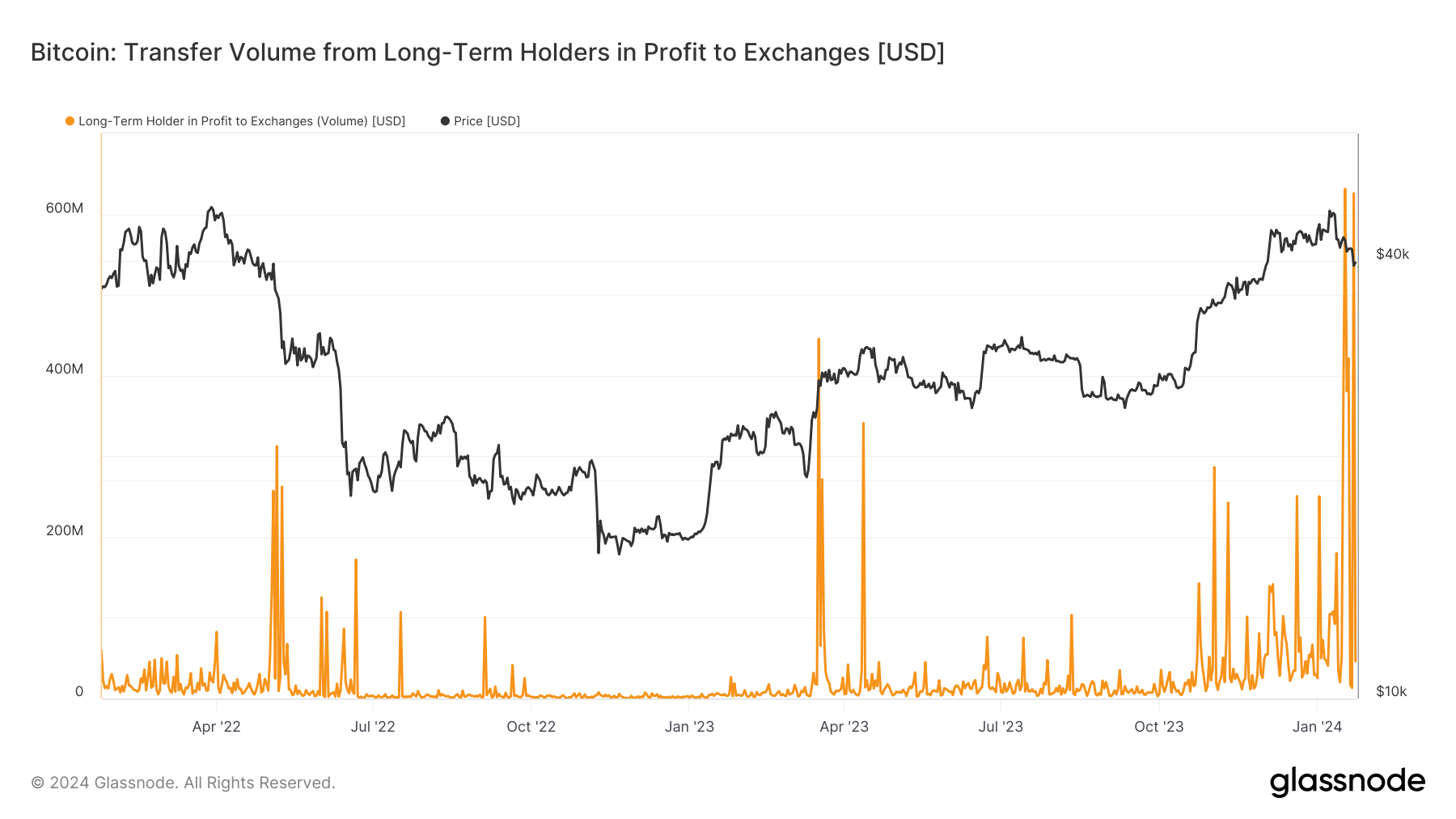

Nevertheless, noticed current developments trace at a shift. Information evaluation signifies that LTHs initiated a sell-off, and this pattern has endured. Notably, on Jan. 22, roughly $625 million in revenue was transferred to exchanges, drawing parallels to the exercise on Jan. 17.

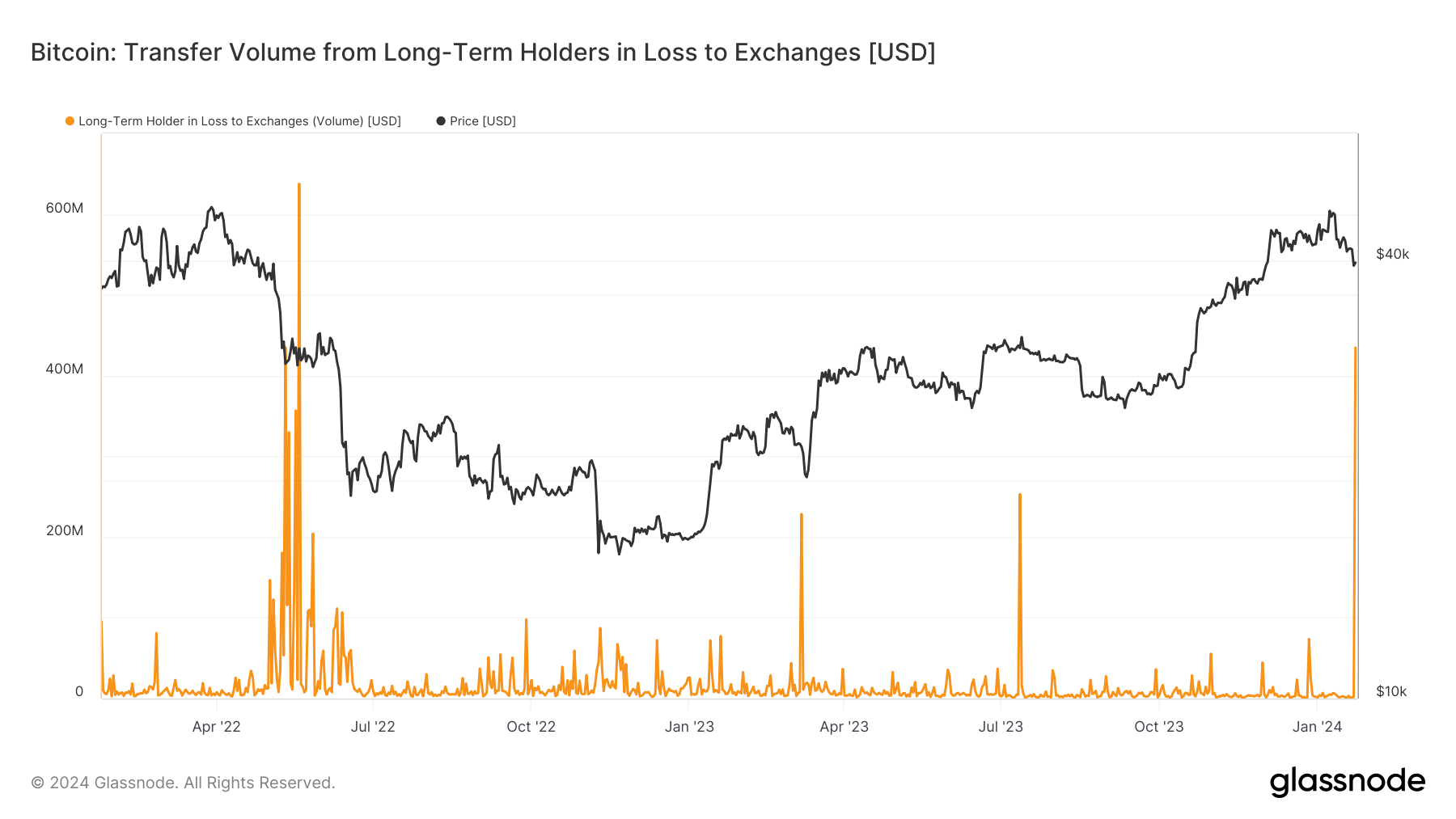

The information developments started to boost eyebrows on Jan. 23, when LTHs transferred cash to exchanges, incurring a considerable lack of roughly $430 million on account of Bitcoin falling beneath $39,000. This case ominously mirrors the pre-Luna collapse capitulation witnessed in Might 2022. Again then, a virtually equivalent quantity was despatched to exchanges at a loss, adopted by a extra extreme lack of over $600 million only a week later, proper earlier than Bitcoin’s worth shockingly plummeted beneath $20,000.

The repetition of such losses might level in the direction of growing proof of capitulation amongst Bitcoin’s long-term stakeholders.

The submit Long-term Bitcoin holders’ recent sell-off raises ghosts of past capitulations appeared first on CryptoSlate.