Fast Take

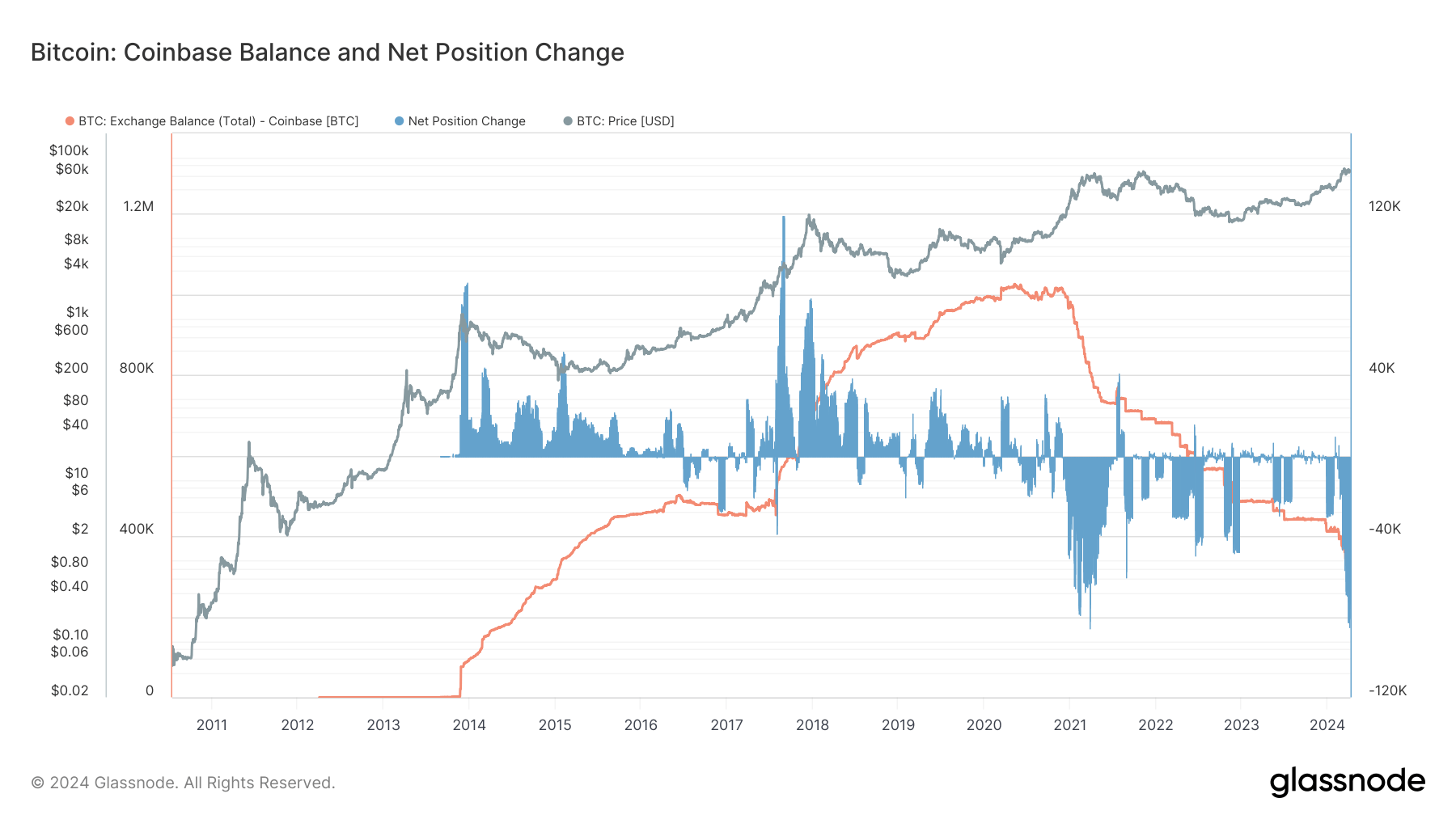

Glassnode information reveals a considerable lower in Bitcoin (BTC) holdings on the Coinbase change. During the last 30 days, a notable 85,000 BTC have been withdrawn from the platform, marking the second-largest internet outflow on file for a 30-day interval. This mirrors an analogous prevalence in March 2021, when 86,000 BTC left Coinbase.

The change’s Bitcoin steadiness has proven a constant decline since March 2020. In December 2020, Coinbase possessed roughly 1 million BTC, however by July 2021, this determine had dwindled to only 730,000 BTC – a discount of 270,000 BTC amidst the value surge from $10,000 to $60,000.

Extra just lately, this downward pattern has accelerated. Following the launch of the inaugural Bitcoin ETFs in January 2024, Coinbase held 411,000 BTC. Presently, this determine has plummeted to 294,000 BTC, indicating a decline of roughly 120,000 cash in a mere two months, coinciding with a value hovering round $72,000. These tendencies counsel each retail and institutional traders are swiftly withdrawing their Bitcoin holdings from the change.

Over the last two months, CryptoSlate has documented a number of vital withdrawals from Coinbase, with the most recent being roughly $1.1 billion.

The put up Coinbase Bitcoin holdings plummet by 85,000 BTC in 30 days, second biggest on record appeared first on CryptoSlate.