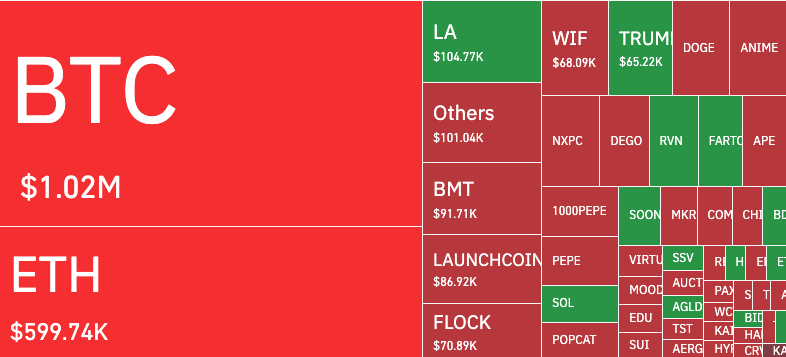

The cryptocurrency market confronted a pointy downturn in early buying and selling hours at present, with Bitcoin (BTC) retreating towards the $101,000 stage and dragging the broader digital asset sector into the pink. On the coronary heart of the sell-off lies a mix of political controversy, macroeconomic uncertainty, and a wave of liquidations throughout leveraged positions.

In response to information from CoinGlass, over $308 million in crypto lengthy positions had been liquidated inside the previous 24 hours, marking one of many steepest liquidation occasions since April.

Bitcoin accounted for roughly $91 million of that determine, adopted by Ethereum (ETH) with about $78 million in liquidations.

Supply: CoinGlass

Trump vs. Musk Provides Gas to the Hearth

Market sentiment took a blow following an surprising disagreement between former U.S. President Donald Trump and Tesla CEO Elon Musk. Throughout a marketing campaign cease in Phoenix, Trump criticized Musk for allegedly backing out of earlier political commitments. The tech mogul swiftly responded on X, calling Trump “unreliable and self-serving.”

Whereas the spat may appear superficial on the floor, analysts consider the confrontation may complicate the political dynamics surrounding crypto regulation.

Each Trump and Musk have held important sway over crypto markets in recent times, and any perceived instability of their relationship provides to uncertainty for buyers.

“Markets dislike uncertainty, and a Trump-Musk rift, especially as both may influence future crypto policy – adds noise that investors are trying to price in,” mentioned Adam Cochran, a associate at Cinneamhain Ventures, in a publish on X.

Weak Macro Backdrop and Greenback Power

Including to the bearish tone is renewed macroeconomic strain. Friday’s stronger-than-expected U.S. jobs information reignited considerations that the Federal Reserve could maintain rates of interest increased for longer. The U.S. Greenback Index (DXY) climbed to a one-month excessive, signaling a transfer away from threat property comparable to crypto.

“Stronger dollar, weaker BTC – this inverse correlation is playing out as expected,” famous Noelle Acheson, creator of the “Crypto Is Macro Now” publication. “We also have Treasury yields climbing, which reduces the appeal of speculative assets.”

Supply: TradingView

Merchants are actually bracing for subsequent week’s Client Price Index (CPI) launch and the Federal Open Market Committee (FOMC) assembly, which may additional decide the short-term trajectory of digital property.

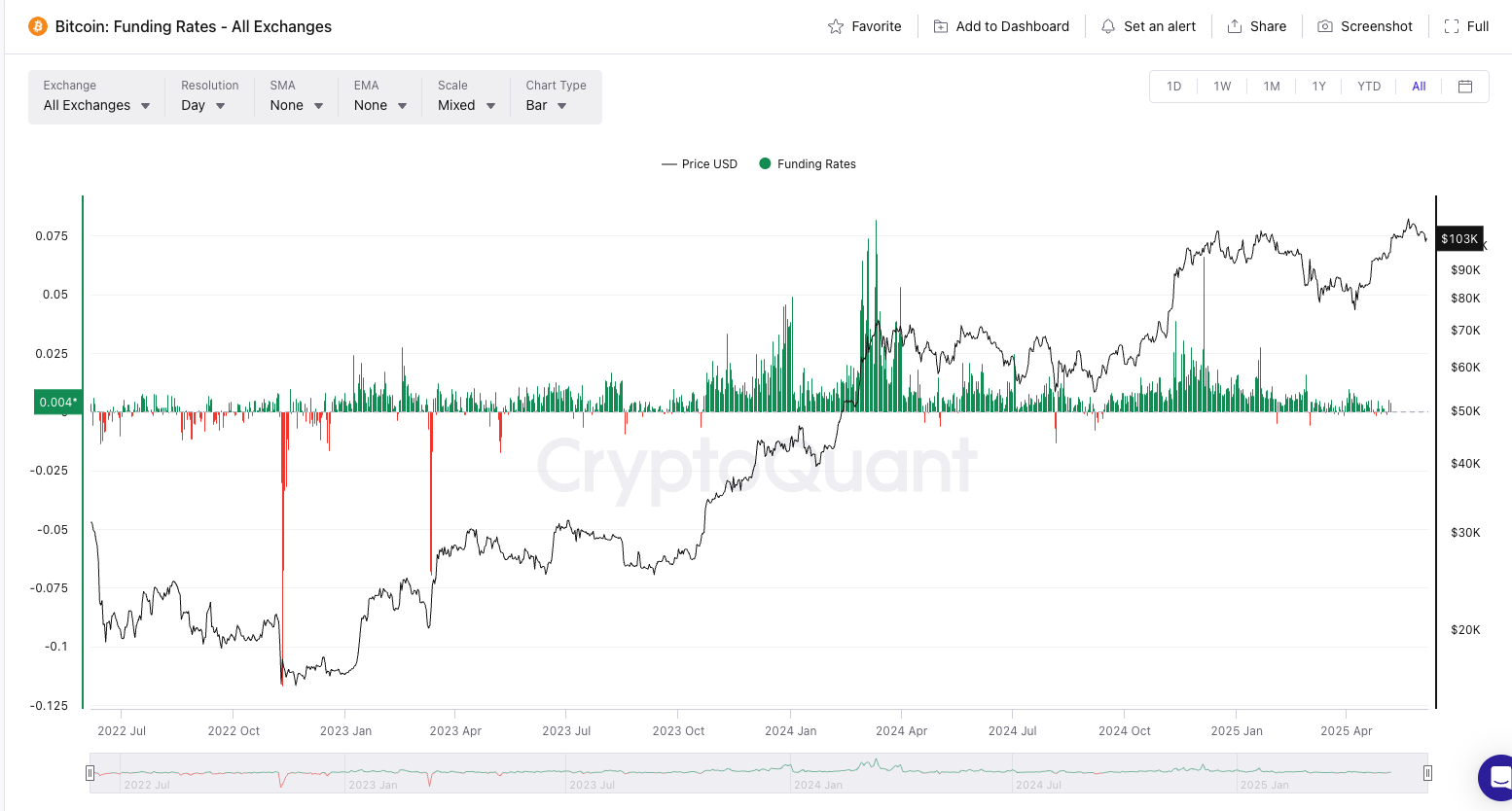

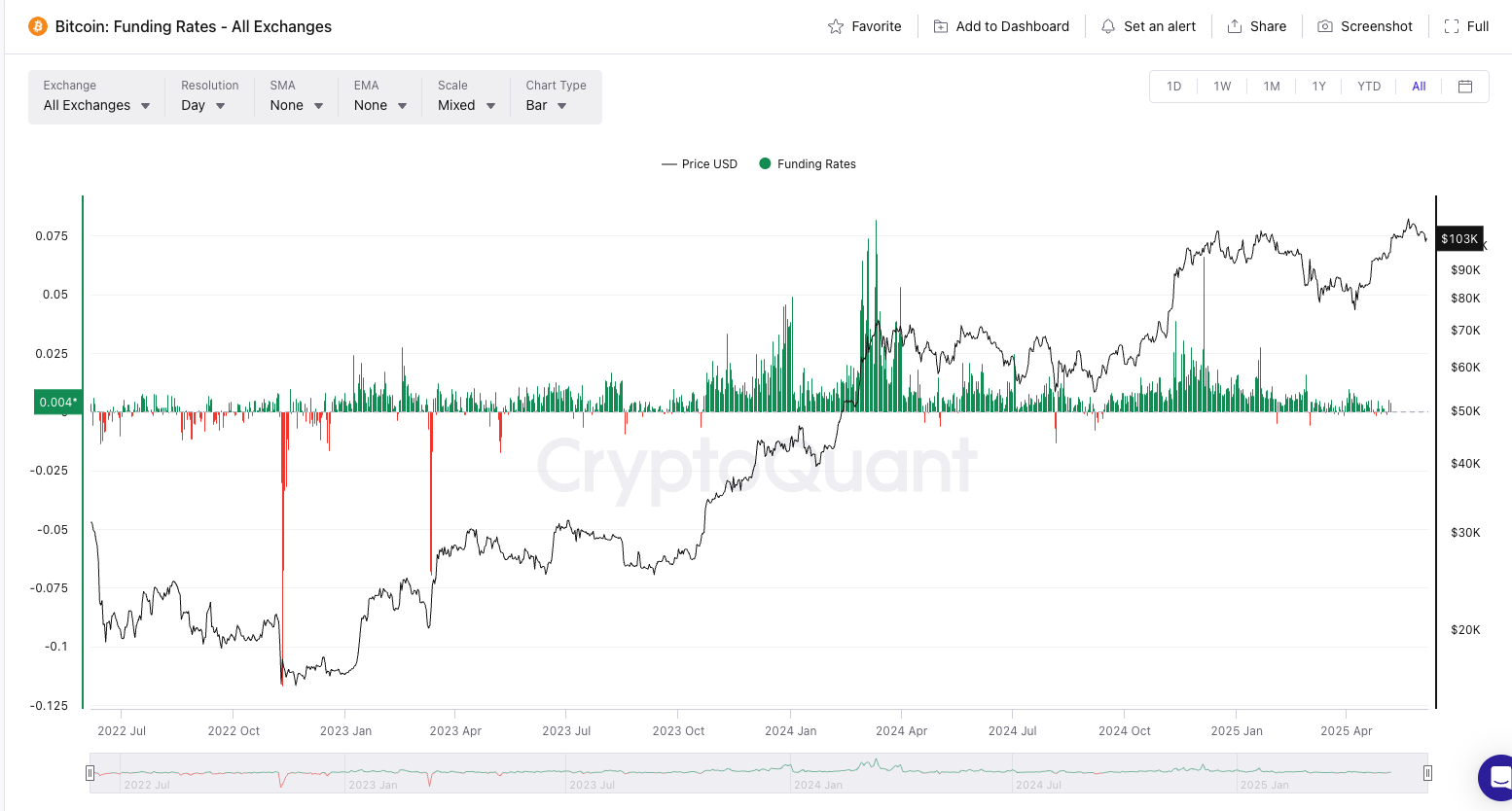

Bitcoin’s downturn additionally uncovered the fragility of overleveraged markets. Funding charges on perpetual futures had hovered at abnormally excessive ranges prior to now week, indicating that bullish merchants had been paying important premiums to take care of lengthy positions.

As value dipped beneath crucial assist ranges, cascading liquidations triggered extra promote strain. A surge in pressured unwinding of positions, notably in altcoins comparable to Solana (SOL), Dogecoin (DOGE), and PEPE, all of which noticed double-digit declines.

“When funding rates stay elevated and sentiment becomes euphoric, even minor shocks can cause outsized volatility,” defined James Lavish, managing associate on the Bitcoin Alternative Fund.

Regardless of at present’s drawdown, some market contributors view the correction as wholesome within the context of the broader bull cycle.

“It’s a shakeout, not a breakdown,” mentioned Ki Younger Ju, CEO of CryptoQuant. “We still see strong on-chain accumulation and no signs of exchange inflows from long-term holders.”

Supply: CryptoQuant

Others are urging warning as volatility is predicted to stay excessive by way of mid-June. Merchants see $104,000 as assist; breaking it could push BTC towards $100,000–$98,000, analysts say.

BTC Market Replace

Technical analysts have highlighted the $101,700 stage as a crucial assist zone for Bitcoin. Earlier at present, BTC closed an 8-hour candle decisively beneath this threshold – a sign of a possible shift right into a deeper corrective section.

Following yesterday’s sharp decline, Bitcoin could try a short-term restoration towards the $103,000–$103,500 vary. Nonetheless, such a rebound may function a setup for renewed promoting strain, focusing on the following main assist zones at $98,295, $96,250, and $93,350.

In the meantime, Bitcoin dominance (BTC.D) continues climbing and is approaching resistance close to the 65% stage – traditionally some extent of warning for altcoin buyers. Broader market indices additionally present indicators of structural weakening.

The TOTAL crypto market cap has damaged beneath a key stage at $3.22 trillion. Analysts counsel a possible backtest of this stage earlier than additional draw back towards $3.0 trillion and $2.86 trillion.

Equally, TOTAL2 – excluding Bitcoin, has dropped beneath its crucial assist at $1.16 trillion. A short retest may very well be adopted by declines towards $1.07 trillion, $1.04 trillion, and even $1.00 trillion. TOTAL3, which excludes each BTC and ETH, is heading towards an important assist stage round $794.23 billion.

Whereas some bounce may happen right here, analysts warn it could provide solely temporary aid and warning in opposition to getting into lengthy positions within the present setting.

Conclusion

The crypto market’s sharp pullback at present underscores the fragility of sentiment in an overleveraged setting, the place a mixture of political theatrics, macroeconomic stressors, and cascading liquidations can quickly unravel bullish momentum. The Trump-Musk conflict, whereas seemingly peripheral, has amplified investor unease at a time when regulatory and political narratives stay pivotal to market path.

In the meantime, a stronger greenback and rising Treasury yields proceed to sap threat urge for food. Technically, Bitcoin’s break beneath the $101,700 assist alerts potential for deeper corrections, with key zones round $98,000 now in focus.

Learn extra: Trading with Free Crypto Signals in Evening Trader Channel

| CoinFN