What are actual world belongings? Actual world belongings (RWAs) are worldly possessions resembling shares, treasury payments, artworks, and actual property properties that exist exterior the digital enviornment. Within the context of decentralized finance (DeFi), RWAs consult with digital tokens that signify these bodily, monetary, and intangible belongings on a blockchain. Touted as a transformative software of blockchain know-how, RWA tokens are steadily gaining traction worldwide.

On this article, we will stroll you thru the assorted features of actual world belongings – their significance, how they work, advantages, high RWA cash cum credit score protocols, and position in DeFi.

What are Actual World Property (RWAs)?

Actual world belongings (RWAs) are tokenized variations of intangible (e.g., mental property), monetary (e.g., financial institution deposits), and tangible belongings (e.g., industrial gear) that maintain financial worth within the non-digital sphere.

Every RWA digital token represents an asset partly or in full. They’re ruled by smart contracts, self-executing strains of code programmed to automate compliance checks, transactions, escrow accounts, possession transfers, and many others.

Actual World Property as Non-Fungible Tokens (NFTs)

Actual world belongings (RWAs) can be represented as NFTs, distinctive crypto tokens reflecting the possession of a digital or bodily asset. Most tokenized belongings that exist as NFTs embody arts, collectibles, memorabilia, sports activities, land parcels, and gaming objects.

Since customers can embed detailed metadata and distinct identifiers in NFTs, they’re extra appropriate for RWAs that derive worth from uniqueness.

If you wish to seize particular attributes resembling colour, dimension, historical past, authenticity, provenance, or situation of belongings, it’s essential to mint them as NFTs reasonably than multi-tokens, which look the identical.

Why Are Actual World Asset Tokens Essential?

Actual world belongings (RWAs) bridge the hole between decentralized and conventional finance, enhancing liquidity, stability, scalability, accessibility, and diversification within the blockchain ecosystem.

Moreover, RWAs have lowered entry obstacles and eradicated geographic hurdles. Whereas earlier than, you wanted to put aside a significant slice of your funds to enter the DeFi market, now you can begin buying and selling or creating wealth with a couple of {dollars} from anyplace on the planet.

Most significantly, tokenization helps customers convey off-chain belongings on-chain and faucet their funding yield within the DeFi area. It has additionally fostered fractional possession of indivisible conventional belongings like actual property and specialised equipment.

How Actual World Asset Tokenization Works?

Tokenization is the method of harnessing blockchain know-how to convert actual world belongings into crypto tokens. It fosters inclusion by democratizing entry to a number of lessons of intangible and tangible belongings.

The right way to Tokenize Actual World Property

- Asset choice: Consider the RWA’s suitability for asset tokenization primarily based on numerous parameters like market demand, long-term worth proposition, and fractional possession potential.

- Token specs: Decide the token’s sort (fungible, semi-fungible, or non-fungible), customary (ERC-20, ERC-1155, or ERC-721), and different primary features.

- Blockchain desire: Choose a public or personal blockchain community for tokenizing tangible, intangible, and monetary belongings.

- Authorized compliance: Adhere to worldwide and native legal guidelines, tax insurance policies, and industry-specific norms relevant in your jurisdiction.

- Asset standards: Use developer or visible toolkits to outline asset standards resembling whole provide, divisibility, title, account tackle, uniform useful resource locator (URL), and metadata hash.

- Offchain hyperlinks: Many tokenized belongings require reliable oracles to get high-quality actual world knowledge. Validate the belongings backing RWA tokens and the chosen blockchain’s capability to keep up digital belongings, utilizing proof-of-reserves (PoR) verification companies.

- Token issuance: Create and deploy good contracts to mint the token.

- Integration: Combine actual world asset tokens with cloud-based platforms or functions that monitor the worth actions of the underlying asset in actual time.

- Itemizing: Listing the RWA token on a decentralized trade for liquidation and buying and selling.

The right way to create non-fungible tokens for RWAs?

- Establish the actual world belongings (RWAs) to be minted as NFTs.

- Choose an NFT platform for asset tokenization.

- Create the NFT.

- Hyperlink the NFT to the underlying actual world asset by embedding a near-field communication (NFC) chip or attaching a fast response (QR) code.

Advantages of Tokenizing Actual-World Property

Fractionalization

Asset tokenization breaks high-value belongings into smaller and reasonably priced models. It divides historically illiquid belongings resembling actual property into tons of of digital tokens, every representing a stipulated space of the property. Customers can promote, switch, or commerce these tokens on peer-to-peer networks utilizing blockchain know-how immediately.

With RWA tokens, making actual property investments and transferring possession is a breeze. Traders can now personal a number of sq. toes of land or a home with out incurring the complete value of shopping for the property.

By enabling fractional possession, tokenized actual property additionally creates crowdfunding alternatives, the place quite a few traders pool sources and personal elements of the property.

As actual property grows sooner in worth in comparison with different bodily belongings, monetary planners typically suggest tokenized properties for portfolio diversification.

Debt financing

You’ll be able to pledge RWAs as collateral for DeFi loans. Because the underlying asset’s worth grows, the mortgage will get paid sooner.

Price-efficiency

Tokenization reduces the prices related to asset administration, resembling authorized fees and documentation charges, by eliminating entry obstacles and intermediaries prevalent in conventional markets.

Liquidity and suppleness

Not like conventional monetary markets which have mounted buying and selling hours, blockchain networks facilitate 24/7 buying and selling, enabling customers to transact or have interaction with the token repeatedly.

Digitization

Tokenization creates digital footprints of off-chain actual world belongings by integrating them into blockchains.

Challenges and Dangers in RWA Tokenization

Safety

Safety is likely one of the prime considerations surrounding tokenized actual world belongings as a result of it’s robust to determine if the token certainly represents the asset you wish to purchase.

Digital belongings are additionally liable to hacks and fraud that may make their restoration inconceivable. Bugs in good contracts make it simpler for malicious entities to steal belongings or modify phrases, inflicting monetary losses and disruptions in performance.

As anonymity can compromise the safety of RWA tokens, blockchains should implement regulatory compliance necessities like know-your-customer(KYC) and Anti-Cash Laundering (AML).

Asset custody and authorized compliance

Regulatory uncertainties or irregularities typically go away a significant slice of the tokenized belongings market untapped by locking out traders.

Establishing the authorized custody of tangible or intangible belongings reliably can be a significant problem. Managing RWA vaults entails complicated duties of making certain regulatory compliance and valuing actual world belongings exterior the blockchain.

These vaults additionally require authorized frameworks that contain third-party custodians and trustees to safe the underlying belongings and guarantee asset house owners have enforceable claims.

Actual property tokenization should navigate extra authorized complexities because it should adhere to each world and native legal guidelines governing property possession, switch, and acquisition.

Asset possession

When RWAs are generated as NFTs, collectors maintain, commerce, or promote them. Because the NFT transfers from one collector to a different, the possession of the corresponding intangible or tangible asset additionally adjustments fingers.

Except the vendor and purchaser agree to maneuver the possession of bodily and digital objects collectively by way of a trusted custodial home, significantly for high-value belongings, there could be issues pertaining to asset possession sooner or later.

High RWA Cash by Market Cap

1. Chainlink (LINK)

Supply: Coinmarketcap

Chainlink is a decentralized oracle community hosted on Ethereum with LINK as its native token. It helps create and replace tokenized belongings with actual world knowledge resembling reference, pricing, identification data, and PoR. Its scalable infrastructure ensures RWAs are enriched with key data, which is synchronized in real-time.

With its reliable off-chain knowledge and cross-chain interoperability, Chainlink enhances the liquidity, safety, programmability, and utility of RWA tokens. It additionally hyperlinks current monetary methods to public and personal blockchain networks, enhancing the time-to-market of digital tokens.

Other than securely bridging off chain belongings on to a blockchain, Chainlink has PoR verification methods to allow customers to implement well timed circuit breakers in case the worth of the underlying belongings diverge from that of their tokenized variations.

Utilizing Chainlink, traders also can fortify on-chain markets with decentralized knowledge sources on conventional monetary belongings, cryptocurrencies, financial indicators, and extra.

2. Ondo Finance (ONDO)

Supply: Coinmarketcap

Ondo Finance is a proof-of-stake Layer 1(L1) blockchain community, enabling trades in 1000’s of RWAs backed by standard shares, authorities bonds, trade traded funds (ETFs) and different regular collateral. With cutting-edge threat administration measures in place, Ondo helps traders generate steady dollar-denominated yields.

Via its institutional-grade choices and infrastructure, Ondo goals to convey conventional monetary markets into the blockchain realm. ONDO is its prime governance token.

It allows customers to create predictable income streams by depositing standard securities on the platform for tokenization. It additionally facilitates cross-chain bridging of belongings and presents liquidity-as-a-service (LaaS).

For enhancing community safety, Ondo chain permits its permissioned validators, comprising regulated monetary establishments, to stake RWAs or high-quality liquid belongings.

3. Algorand (ALGO)

Supply: Coinmarketcap

Algorand is a quantum-secure and energy-efficient proof-of-stake L1 blockchain with excessive throughput, nominal charges, and ALGO as its principal utility token.

The Algorand ecosystem contains the EXA NFT market, People Finance DeFi protocol, and NFDomains for buying and selling non-fungible .algo domains.

Property created on the Algorand blockchain are generally known as Algorand Customary Property (ASAs), which embody digital representations of loyalty factors, stablecoins, in-game objects, system credit, and many others. Customers can create ASAs with each mutable and immutable traits.

Lofty.ai, a fractionalized actual property market, leverages the Algorand blockchain to tokenize actual property and democratize entry to homeownership. It has simplified actual property funding throughout the U.S. and promoted fractional possession of properties, enabling holders to earn rental revenue with out worrying about down costs, property charges, or rigid phrases.

Different asset tokenization platforms residing on Algorand are TravelIX to tokenize journey tickets, ClimateTrade for buying and selling carbon credit, and Meld for gold buying and selling.

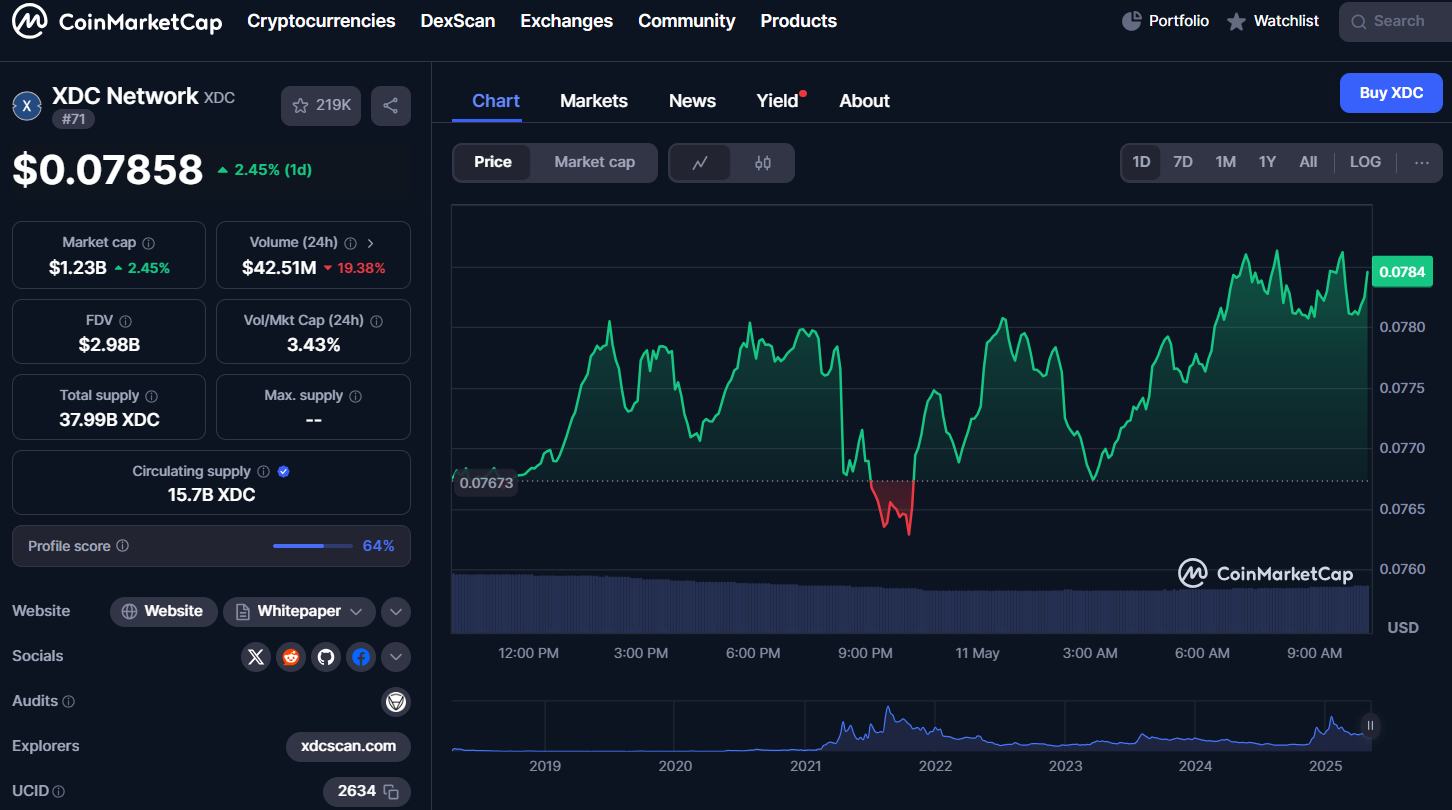

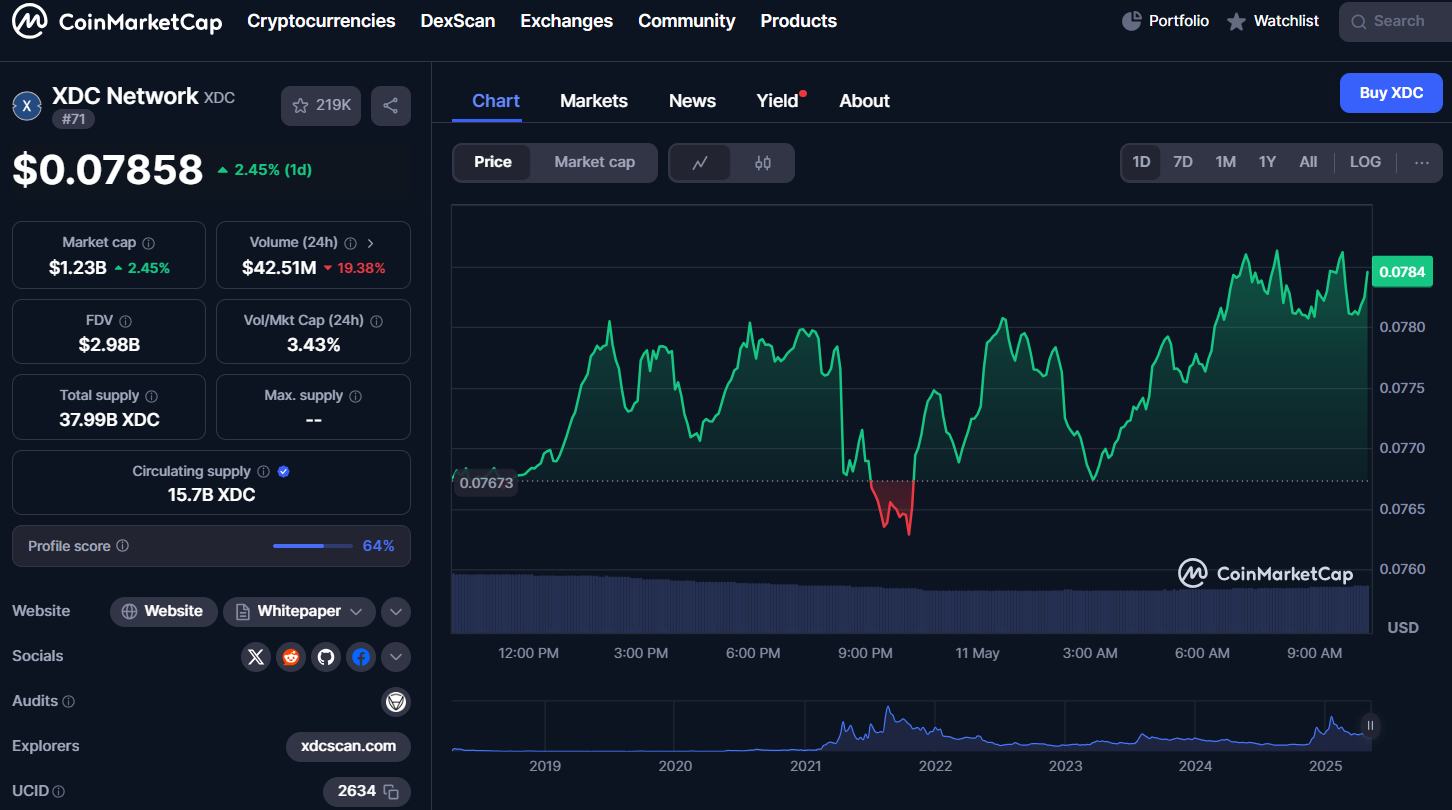

4. XDC Community (XDC)

Supply: Coinmarketcap

XDC Community is an open-source L1 blockchain with the Ethereum Digital Machine (EVM) compatibility and XDC as its native token. It goals to decentralize, remodel, and liquify the commerce finance sector by way of the tokenization of RWAs and monetary belongings.

Other than tokenized U.S. Treasuries, XDC Community presents tokenized personal credit score, resembling shopper, actual property, vehicle, fintech, and carbon loans, to companies.

Its RWA monitoring and evaluation device, RWA.xyz, has emerged as a go-to answer for monitoring tokenized stablecoins, personal credit score, and U.S. treasuries. If you wish to discover initiatives in various RWA classes, XDC Community’s actual world asset intelligence database is useful.

Different key options of XDC Community embrace swift transaction processing, low charges, eco-friendly structure, strong infrastructure, and multi-chain interoperability.

RWA Credit score Protocols in DeFi

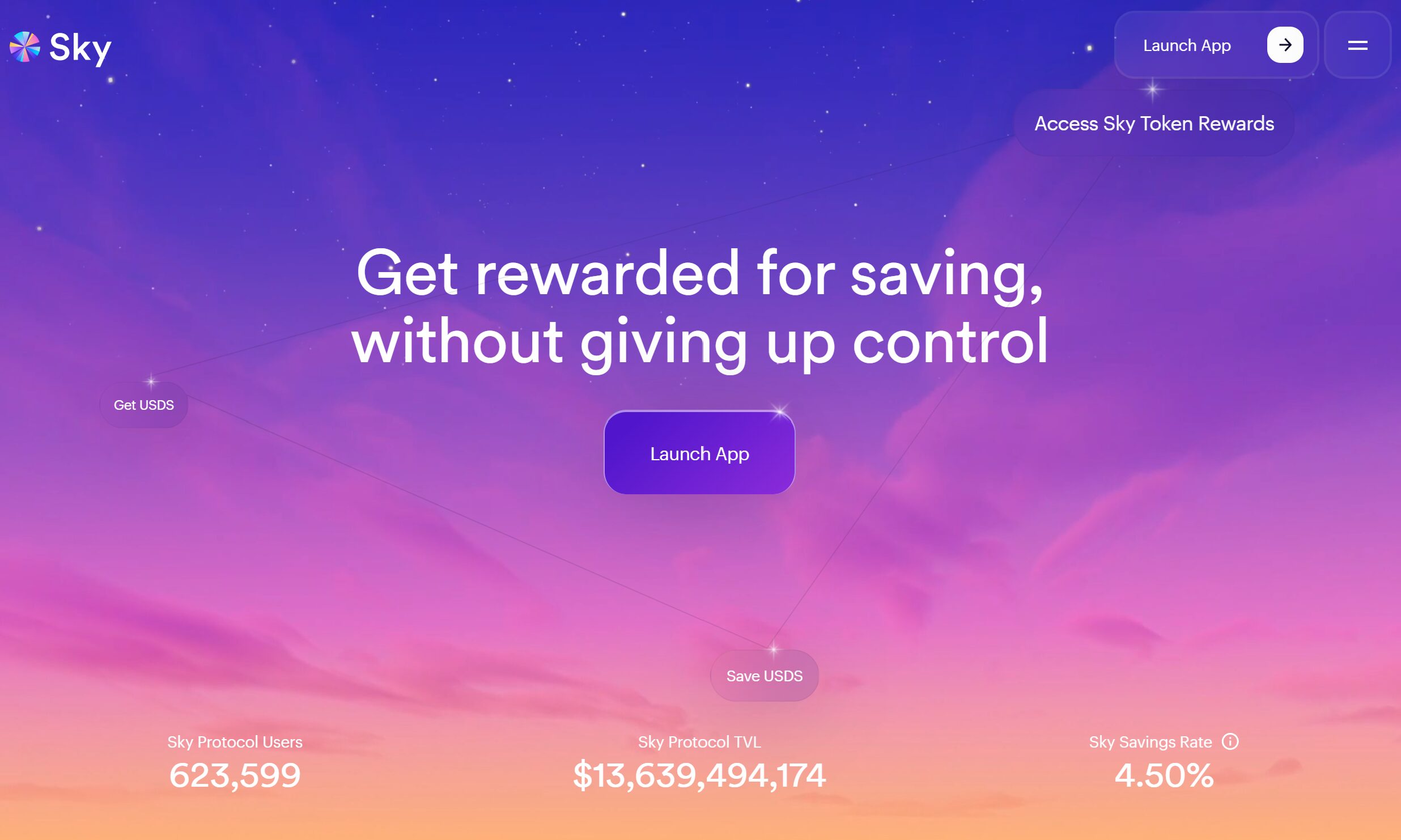

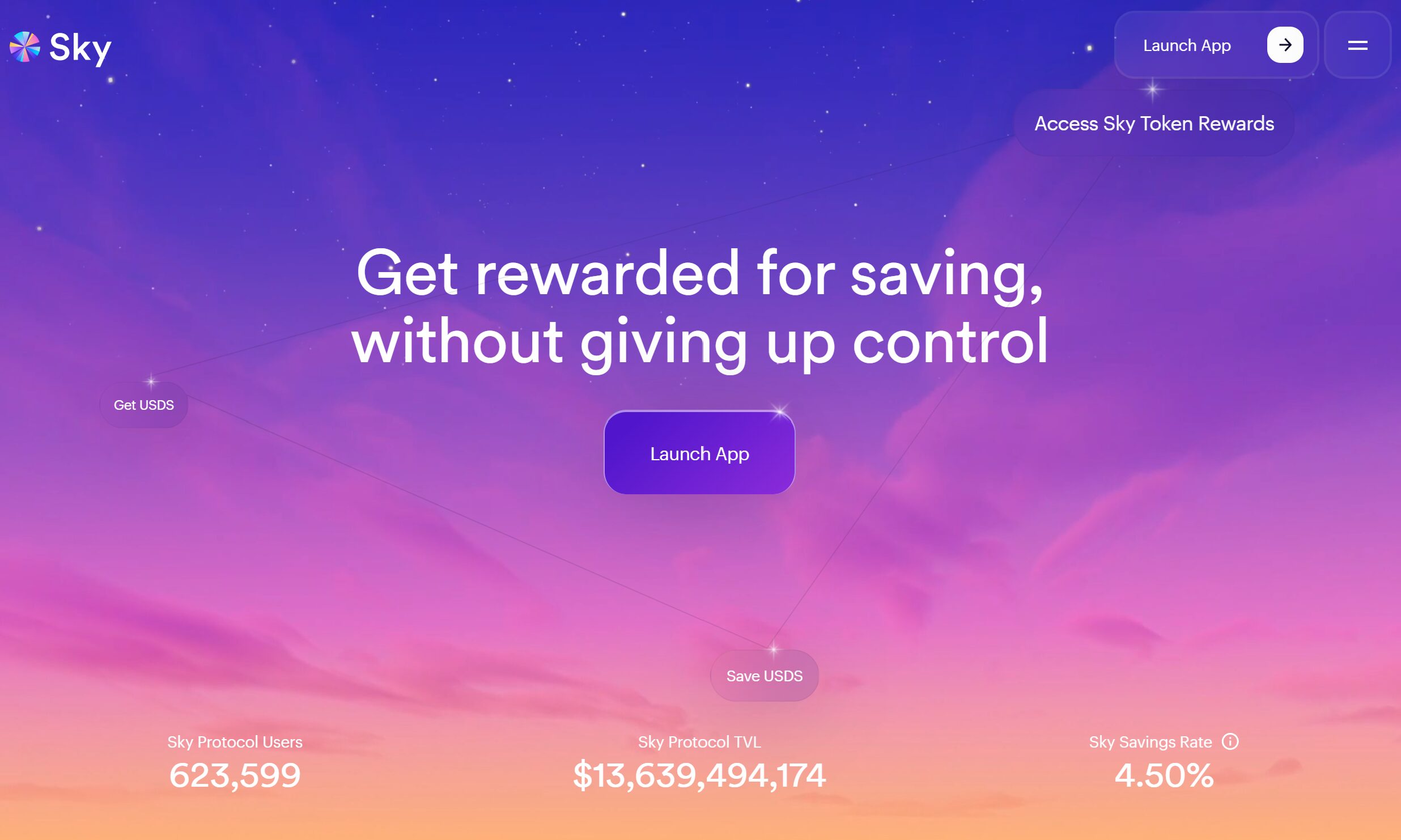

1. Sky

Sky (previously MakerDao) presents RWA vaults underneath its Multi-collateral Dai (MCD) system to assist customers harness their belongings to create stablecoins with out disrupting the protocol’s decentralization and over-collateralization.

These vaults enable customers to realize publicity to conventional monetary belongings, that are ruled by off-chain authorized frameworks and require tokenization. They’re executed as a set of predetermined guidelines and differ from conventional vaults with regard to the kind of collateral they help and the mechanisms required to handle them.

RWA vaults are liquidated off-chain, possess a various collateral base, and don’t rely a lot on unstable cryptocurrencies.

The protocol has additionally carried out strong safety measures within the type of formal verification of the codebase, bug bounties, and impartial audits by trusted third-parties.

As part of its Endgame overhaul, MakerDao will launch NewStable to get resilient and legally compliant actual world belongings. The brand new coin can even purchase the RWA and TradeFi integrations of DAI, Maker’s crypto-collateralized stablecoin.

2. Creditcoin (CTC)

Creditcoin is a multichain RWA protocol and a Layer1 blockchain, providing credit score infrastructure and a decentralized community for monetary establishments in rising markets. It combines RWAs with EVM-friendly good contracts, serving to builders leverage cryptographic primitives to create decentralized functions for tapping the peer-to-peer, borderless monetary system.

It nurtures an inclusive credit score market panorama by enabling entrepreneurs, small companies, and people to construct an on-chain credit score popularity and acquire microloans.

The Creditcoin protocol encompasses 4 events:

- Creditcoin: A credit score historical past protocol capturing, verifying, and securing the credit score transactions of its institutional and retail clients. CTC is its governance token.

- Debtors: Fintech lenders, companies, and entrepreneurs looking for debt capital.

- Lenders: Customers who be a part of the investor decentralized autonomous group(DAO) to lend to debtors.

- Gluwa: It consists of the protocol’s builders who establish debtors from rising markets and combine them into Creditcoin after thorough due diligence. In addition they help in negotiating mortgage phrases and suggest debtors to lenders. Via Gluwa, Creditcoin supplies DeFi fans with funding alternatives, which they will settle for or decline.

Prime use instances

- Facilitates cross-border transactions between non-custodial wallets, particularly for the unbanked inhabitants.

- Allows lending and borrowing of safe loans.

- Promotes the event of functions with built-in decentralized identifiers to make sure creditworthiness, privateness, and entry to world credit score markets.

- Helps create world monetary worth by tokenizing actual world belongings into yield-bearing merchandise.

3. Maple Finance (MPL)

Maple Finance is a decentralized finance platform facilitating digital asset lending, capital flows by way of safe on-chain loans, and yield era from unproductive cryptos. It additionally supplies a capital market infrastructure for institutional debtors to leverage the DeFi ecosystem.

Via its cryptocurrency-backed lending swimming pools that provide uncollateralized loans to establishments, Maple has revolutionized the world monetary system. The permissioned nature of yield sources minimizes counterparty dangers for liquidity suppliers or yield earners who deploy their capital for lending.

If you wish to decrease slashing and counterparty dangers additional, Maple offers the choice of staking for specific cryptocurrencies like Bitcoin.

The Maple ecosystem has 4 members:

- Company debtors: Hedge funds, crypto exchanges, and market makers who require debt financing.

- Lenders: DeFi traders who deposit funds into Maple Finance lending swimming pools.

- Pool delegates: A group of credit score professionals who assess debtors for creditworthiness, examine mortgage phrases, and handle liquidity swimming pools.

- Stakers: Customers who soak up the chance on loans in case of a default by staking Balancer Pool Tokens.

Together with its native crypto, MPL, Maple points a permissionless yield token, SYRUP, specifically designed for the DeFi group. Thus, customers needn’t bear detailed KYC procedures to deposit funds or earn funding yields.

4. Goldfinch (GFI)

Goldfinch is a lending protocol, offering on-chain publicity to the globe’s high institutional-grade multi-billion-dollar personal credit score funds. GFI is its native crypto. These fund swimming pools comprise over 90% senior secured loans, lower than 5% in-kind curiosity earnings, and non-accrual charges beneath 0.75%.

Whereas personal credit score has fashioned a outstanding a part of institutional portfolios as a consequence of its excessive returns and low volatility, it has typically been an inaccessible monetary device for people.

Detailed documentation, meticulous vetting course of, and restricted funding alternatives are the principle challenges retail clients encounter when looking for personal credit score.

For creating diversified credit score swimming pools, GoldFinch makes use of blockchain know-how and an reasonably priced stablecoin, USDC. It additionally has a group of vetted managers to arrange customized swimming pools.

Debtors bear mortgage eligibility checks earlier than being onboarded to the GoldFinch community to entry capital. As soon as permitted, debtors type credit score swimming pools and outline mortgage phrases, which comprise rate of interest, fee frequency, fees, and limits.

Traders – backers and liquidity suppliers – provide capital. The previous deposits funds in borrower swimming pools and earn larger funding yields because of the larger threat of first loss capital. The latter contributes capital to Goldfinch, which is distributed throughout all credit score swimming pools.

The Position of RWAs in Decentralized Finance (DeFi)

Actual world belongings (RWAs) have kick-started the following DeFi spring and a brand new wave of crypto adoption. They’ve stimulated the creation of on-chain digital belongings by connecting conventional belongings with blockchain know-how.

RWAs are additionally changing into more and more widespread within the banking area, given its myriad advantages resembling instantaneous settlements, nominal prices, 24/7 buying and selling, and transformation of historically illiquid belongings into liquid devices.

For stablecoin holders, tokenized US treasuries function a hedge towards the de-peg threat of stablecoins. They assist diversify funding portfolios and enhance capital circulate in blockchains. The danger-free returns generated by US treasuries make their tokenized type much more interesting to traders.

One other fascinating use case of DeFi is the rise of tokenized cash market funds. Institutional traders view them as a way to digitize fund possession on blockchain and streamline short-term investing. They are often traded exterior of standard market hours and in smaller denominations. These MMFs also can create new income streams by way of integration with DeFi staking and lending platforms.

Lastly, RWAs have redefined DeFi lending by unraveling liquidity, facilitating fractional possession, and providing asset-backed loans throughout monetary markets globally.

The Backside Line

Since RWA tokens convey conventional finance on-chain, your intangible and tangible belongings are not a mere retailer of worth. They help in asset administration by changing unproductive belongings into digital tokens with larger world accessibility, scalability, and tradeability.

Whereas blockchain and different digital applied sciences goal to construct a extra clear DeFi marketplace for all, each funding alternative comes with its personal dangers. Therefore, traders should do their very own analysis and due diligence as a substitute of following any funding recommendation blindly.

FAQs

What’s RWA in crypto?

RWAs in crypto are on-chain tokens, akin to bearer belongings, which give holders a declare over belongings current exterior the digital world. Every token represents a tangible or intangible asset resembling mental property, actual property, currencies, equities, and commodities.

Are RWA cash protected to spend money on?

Although investing in RWA cash carries some dangers associated to regulatory compliance, good contract bugs, and custody of underlying belongings, its benefits outweigh its pitfalls. RWA cash present enhanced liquidity, accessibility, flexibility, and affordability. In addition they allow fractional possession of belongings and energy modern use instances throughout DeFi platforms.

What’s an instance of a actual world asset?

Examples of actual world belongings embrace authorities bonds, cash market funds, land, unique music rights, artworks, collectibles, and industrial gear.

What are actual world belongings in SIS?

Symbiosis Finance (SIS) is a decentralized trade that swimming pools liquidity from L1 and L2 EVM and non-EVM blockchains. It lets you swap or port digital belongings, together with RWA non-fungible tokens, throughout chains.

The place can I purchase actual world belongings?

You should purchase RWA tokens from crypto exchanges resembling Binance, Coinbase, OKX, KuCoin, and Bybit. Nevertheless, for customers looking for a DeFi-native expertise, some RWA tokens are additionally out there on decentralized exchanges (DEXs) and blockchain-native platforms like Goldfinch or Ondo.

| CoinFN