Previously 24 hours, Hyperliquid, a widely known derivatives DEX that has lately confronted a number of whale assaults, has as soon as once more been exploited as a result of a value manipulation vulnerability involving the JELLY token. This incident not solely brought on a pointy decline within the complete worth locked (TVL) in Hyperliquid’s liquidity vault (HLP) but additionally raised issues throughout the Web3 neighborhood concerning the alternate’s safety and transparency.

Contained in the Hyperliquid Price Manipulation

Background of the Case

Hyperliquid is a decentralized alternate (DEX) specializing in perpetual futures buying and selling. It operates by itself Layer-1 blockchain, HyperEVM, designed for quick and environment friendly transactions.

Hyperliquidity Supplier is an inside liquidity vault of Hyperliquid that acts as a market maker and handles liquidations. Customers can deposit USDC into HLP to share in its income or losses. The HLP vault on Hyperliquid is accountable for liquidity administration and supporting the system in circumstances of pressured liquidations.

Supply: Medium

$JELLY is a low-market-cap token, initially starting from $10-20 million, being listed on Hyperliquid – newly rumored to record on CEX like Binance or OKX. Attributable to its small capitalization, it’s prone to cost manipulation.

JELLY Price Manipulation from The Whale

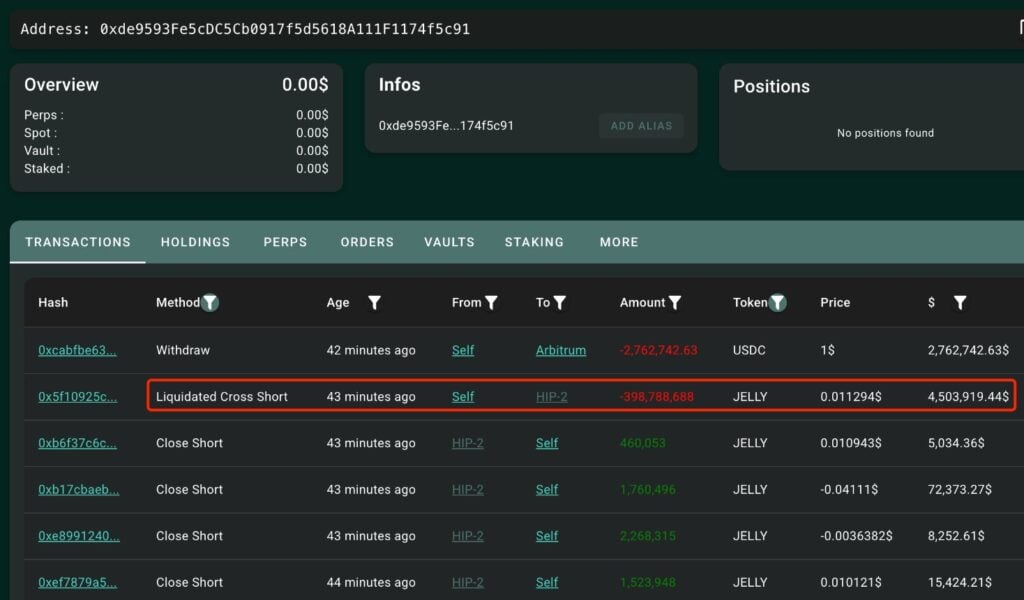

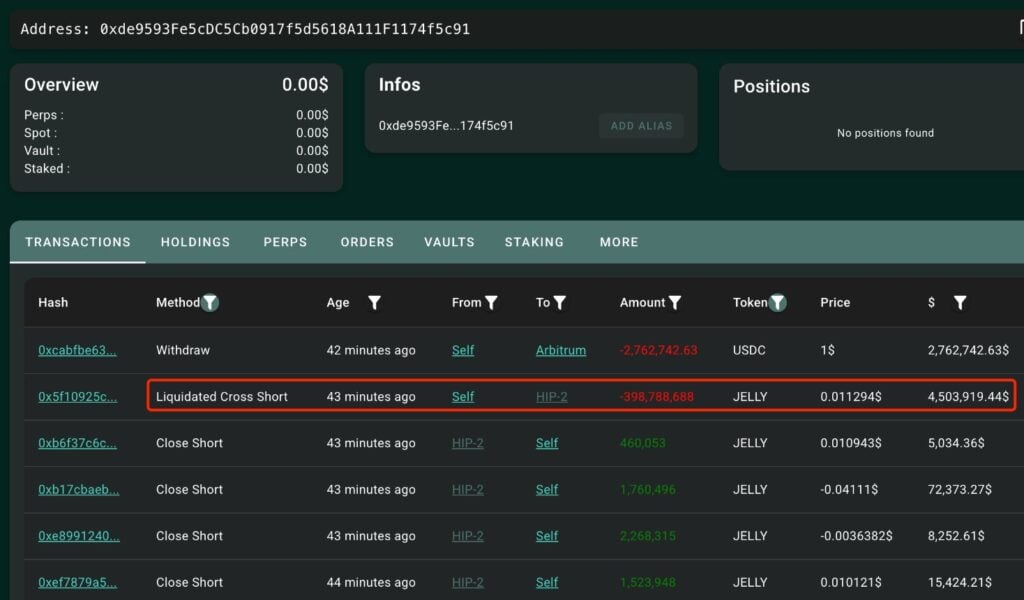

The occasion on March 26 started when a whale, utilizing pockets 0xde95, opened a massive short position price roughly $8 million on $JELLY by way of Hyperliquid. This place, equal to 126 million JELLY, was massive sufficient to govern JELLY’s market value.

The whale then intentionally eliminated the margin, eliminating the mandatory collateral to keep up the place. This triggered an automated liquidation, forcing Hyperliquid’s HLP vault to take over the large brief place (pressured liquidation).

Supply: Hypurrscan

Pockets 0xde95 aggressively pumped JELLY’s value on-chain, buying a considerable amount of $JELLY within the spot market to artificially inflate its worth. Inside lower than an hour, JELLY’s market cap surged from $10 million to over $50 million, inflicting a brief squeeze—forcing brief positions to shut at a loss. In consequence, HLP incurred an unrealized lack of as much as $12 million. In accordance with analyst Abhi, if JELLY’s market cap have been to achieve $150 million, Hyperliquid may face full insolvency.

Amid the chaos, a brand new pockets (0x20e8) opened a big lengthy place on Hyperliquid and rapidly gathered an unrealized revenue of roughly $8.2 million as $JELLY’s value surged.

The loopy squeeze brought on Hyperliquidity Supplier (HLP) to lose ~$12M prior to now 24 hours!

0xde95 shorted $JELLY on @HyperliquidX and eliminated the margin, inflicting HLP to passively liquidate $4.5M brief positions.

A newly created pockets “0x20e8” opened a protracted place on… pic.twitter.com/fagfO1UPJP

— Lookonchain (@lookonchain) March 26, 2025

Seeing the acute volatility, centralized exchanges (CEXs) comparable to Binance and OKX swiftly listed perpetual futures (perps) for $JELLY, additional fueling buying and selling exercise and value fluctuations.

Rumors counsel wallets 0x20E8 and 0x67f have been Binance-funded, in line with an investigation by ZachXBT. Whereas unverified, Hyperliquid faces relentless assaults from whales and main CEXs.

Learn extra: Centralized Exchanges Intend to Destroy Hyperliquid?

Hyperliquid’s Responses Amid the Chaos

Recognizing the chance, Hyperliquid took decisive motion to counter the assault and mitigate potential monetary losses. The validator group held an emergency assembly and voted to delist JELLY perps, alter JELLY’s oracle value to $0.0095 per token, and shut all open positions associated to $JELLY.

Hyperliquid delists #JellyJelly / $JELLY after Binance and OKX futures listings

What a transfer pic.twitter.com/G4ppft5al6

— LANGERIUS (@langeriuseth) March 26, 2025

In consequence, HLP not solely prevented main losses but additionally secured a internet revenue of $700K. Hyper Basis pledged to compensate affected customers, excluding wallets concerned within the manipulation. Nevertheless, not everyone seems to be pleased with this decision!

HLP Vault and Price Manipulation from DEX?

After the incident, many praised Hyperliquid for its fast and decisive actions to guard customers. Nevertheless, the alternate’s strikes—each delisting JELLYJELLY and adjusting the oracle value to keep away from losses—have raised critical questions throughout the crypto neighborhood concerning the true decentralization of this DEX.

Hyperliquid later introduced on X that after detecting suspicious buying and selling exercise, the validators determined to intervene and voted to delist JELLYJELLY. The alternate defended the validators’ accountability to intervene for system integrity however acknowledged the necessity for better transparency within the voting course of.

After proof of suspicious market exercise, the validator set convened and voted to delist JELLY perps.

All customers aside from flagged addresses can be made entire from the Hyper Basis. This can be executed routinely within the coming days based mostly on onchain information. There isn’t a…

— Hyperliquid (@HyperliquidX) March 26, 2025

But, this clarification didn’t fulfill everybody in the neighborhood.

Moreover, Hyperliquid’s blended vault mechanism may very well be a serious vulnerability, making it prone to well-planned, intentional manipulation by whales. The HLP vault on Hyperliquid is accountable for liquidity administration and dealing with pressured liquidations. This is identical mechanism an anonymous whale exploited per week in the past by shorting BTC and longing ETH, securing thousands and thousands in income.

Gracy Chen, CEO of Bitget, in contrast Hyperliquid to “FTX 2.0”, criticizing its unprofessional dealing with of the state of affairs and high-risk monetary product design. She argued that the blended vault construction places customers at an obstacle, compounded by the shortage of KYC/AML compliance, elevating critical regulatory issues.

#Hyperliquid could also be on monitor to turn out to be #FTX 2.0.

The best way it dealt with the $JELLY incident was immature, unethical, and unprofessional, triggering person losses and casting critical doubts over its integrity. Regardless of presenting itself as an revolutionary decentralized alternate with a…

— Gracy Chen @Bitget (@GracyBitget) March 26, 2025

The whole worth of the HLP fund has plummeted from $283 million earlier than the assault to $190 million on the time of writing. In the meantime, Hyperliquid’s HYPE token HYPE is down 6%, because the shorting of JELLYJELLY inflicted vital losses on the challenge.

Supply: Hyperliquid

After Hyperliquid delisted JELLY from its platform to keep away from losses, the neighborhood has grown more and more skeptical concerning the decentralization of a DEX. This has severely broken person belief and presents a major problem for the challenge’s builders—balancing true decentralization whereas stopping manipulative incidents just like the latest one. This serves as a harsh lesson for Hyperliquid, highlighting the dangers of itemizing an illiquid token that may have its provide managed by way of decentralized exchanges.

| CoinFN