Mantra OM, the native token of the MANTRA DAO ecosystem, just lately skilled a historic crash in April 2025, plunging over 90% in only a few hours. This occasion not solely despatched OM’s value tumbling from multi-dollar highs to under $1 but in addition severely shook investor confidence within the venture.

This text will present a complete evaluation of the crash’s influence, assess OM’s value tendencies throughout quick to medium-term timeframes, study key influencing components (total market circumstances, macroeconomic information, tokenomics, and the event staff), and provide insights into the dangers and funding alternatives surrounding OM at this essential juncture.

OM’s April 2025 Crash and the Harm to Investor Confidence

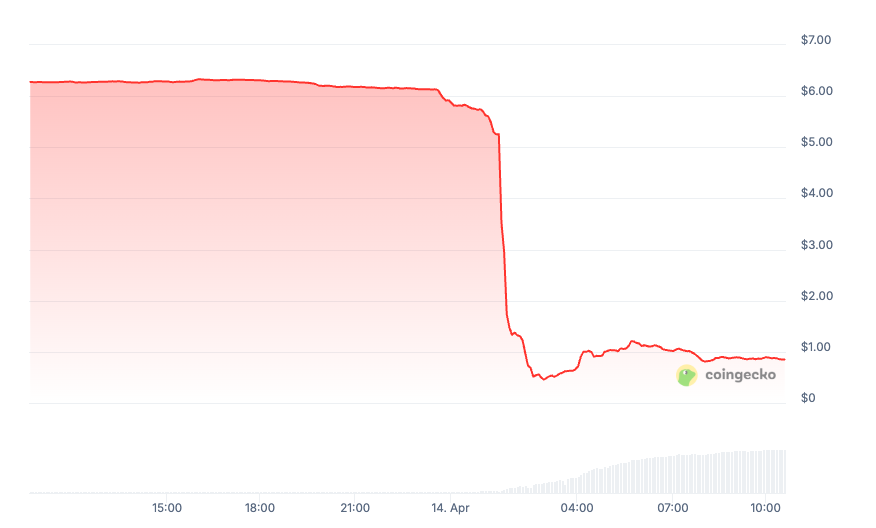

Round April 13–14, OM’s value plummeted from ~$6.30 to under $0.50, wiping out over 90% of its market worth in a single day. OM’s market cap collapsed from roughly $6 billion to beneath $700 million.

The crash drew speedy comparisons to the LUNA/UST meltdown of 2022, triggering widespread concern and speculative rumors. Rumors circulated that the staff had bought off 90% of the full token provide, main some merchants to suspect an insider manipulation or rug pull.

OM crashed in 2 hours – Supply: CoinGecko

In response to rising backlash, the Mantra DAO staff moved shortly to reassure the neighborhood. John Patrick Mullin, Mantra’s co-founder, denied any rug pull and acknowledged that the drop was triggered by “forced liquidations” on a centralized trade (CEX).

He defined that one trade – unnamed however confirmed to not be Binance, unexpectedly froze and liquidated OM positions throughout a interval of low market liquidity.

To revive confidence, the staff introduced a sequence of corrective measures. Mullin revealed a plan to purchase again and burn a considerable amount of OM, lowering circulating provide.

He additionally unveiled a $108 million ecosystem fund to help expertise growth, partnerships, and advertising.

These actions had been thought-about an effort to “atone” and restore investor belief utilizing the venture’s remaining sources. As well as, neighborhood calls had been held to supply transparency across the incident and description the restoration roadmap.

Learn extra: Mantra Disastrous Meltdown: $5.5 Billion Vanishes Overnight in Collapse Echoing Luna Disaster

Nonetheless, the psychological harm from a 90% crash runs deep. A transparent signal: even after the optimistic bulletins, OM’s value solely noticed a weak bounce and has continued to commerce under $1.

Technical and Elementary Evaluation by Timeframe

Quick-Time period (1-3 Months)

The technical outlook for OM stays bearish. After hitting a backside round $0.38–$0.50 in the course of the main sell-off, OM briefly rebounded to the $0.80–$1.00 vary, however was shortly bought off once more. As of mid-April, the token is buying and selling sideways between $0.60 and $0.80.

The $0.68–$0.70 zone is rising as a short-term psychological help stage, performing as a brief “floor” following the crash.

Nevertheless, $1.00 has now flipped into a robust resistance zone – beforehand a key help stage, and OM has didn’t reclaim it decisively, highlighting weak shopping for momentum.

Trying forward over the following 1 – 4 weeks, draw back threat stays elevated. If total market sentiment doesn’t enhance, OM could retest its latest backside close to $0.35 – $0.40, which many technical indicators now flag as a possible breakdown zone.

Influx and outflow of OM -Supply: Nansen

There’s additionally a threat that OM may dip additional to round $0.32–$0.36 earlier than discovering robust shopping for curiosity.

Conversely, OM could present indicators of lowered promoting stress. At this stage, it’s doubtless that the token will commerce inside a slim vary and steadily decline till the scenario stabilizes.

Medium-Time period (3-6 Months)

Within the medium time period, OM is coming into a essential “trust-testing” part. A couple of months will probably be sufficient for the market to judge whether or not the venture is genuinely delivering on its guarantees to get better.

The general pattern stays bearish to impartial till a transparent reversal sign seems. On the weekly chart, pattern indicators have turned destructive: the Supertrend, which had proven a purchase sign for a number of months, has now flipped to promote following the crash. Moreover, a dying cross has shaped between the long-term EMAs, with the EMA12 crossing under the EMA26 on the weekly timeframe.

Supply: TradingView

These indicators recommend that OM’s medium-term pattern stays weak. OM may slide additional towards the $0.32 help zone.

Nevertheless, given how briskly OM has already dropped, a sideways accumulation part could unfold within the coming weeks or months, as promoting stress steadily subsides. In that case, OM may commerce inside a narrower vary, presumably between $0.50 and $1.00, because the market makes an attempt to ascertain a brand new value flooring.

In a extra optimistic situation, if robust demand re-emerges, OM may rally again to round $2.18, the place it will encounter important resistance.

On the elemental aspect, the main target on this timeframe will probably be on execution. The neighborhood will intently monitor whether or not the Mantra staff follows via with its token burn commitments and utilization of the $108 million ecosystem fund. If OM buybacks and burns start in earnest throughout the subsequent 3-6 months, it may assist stabilize the value and steadily restore investor confidence.

Like LUNA or FTT, OM may bounce onerous as soon as promote stress fades earlier than a brand new accumulation part. With the precise catalyst or staff motion, OM may see a 30–40% rebound from present ranges.

Excessive-risk part, however short-term rebounds doable if market calms or shock catalysts seem.

Conclusion

The latest crash of Mantra (OM) was a painful occasion, however it doesn’t essentially mark the top of the venture. If belief returns, OM may ship outsized good points from its present fear-driven value stage.

On the flip aspect, this stays a extremely speculative funding, and losses may deepen if current dangers materialize. Subsequently, traders ought to proceed with warning and intently monitor the staff’s subsequent steps within the coming months.

Learn extra: How Market Makers Become Executioners: A Lesson from the Mantra Collapse.

The publish Mantra (OM) Price Prediction: Last Chance for Profit Gainers? appeared first on NFT Evening.

| CoinFN