Main U.S. banks are in early talks to launch a joint stablecoin enterprise, whereas the Trump household’s USD1 stablecoin surges to prominence, highlighting blockchain’s rising function in reshaping digital funds and elevating moral issues.

A Stablecoin Mission Backed by America’s Prime Banks

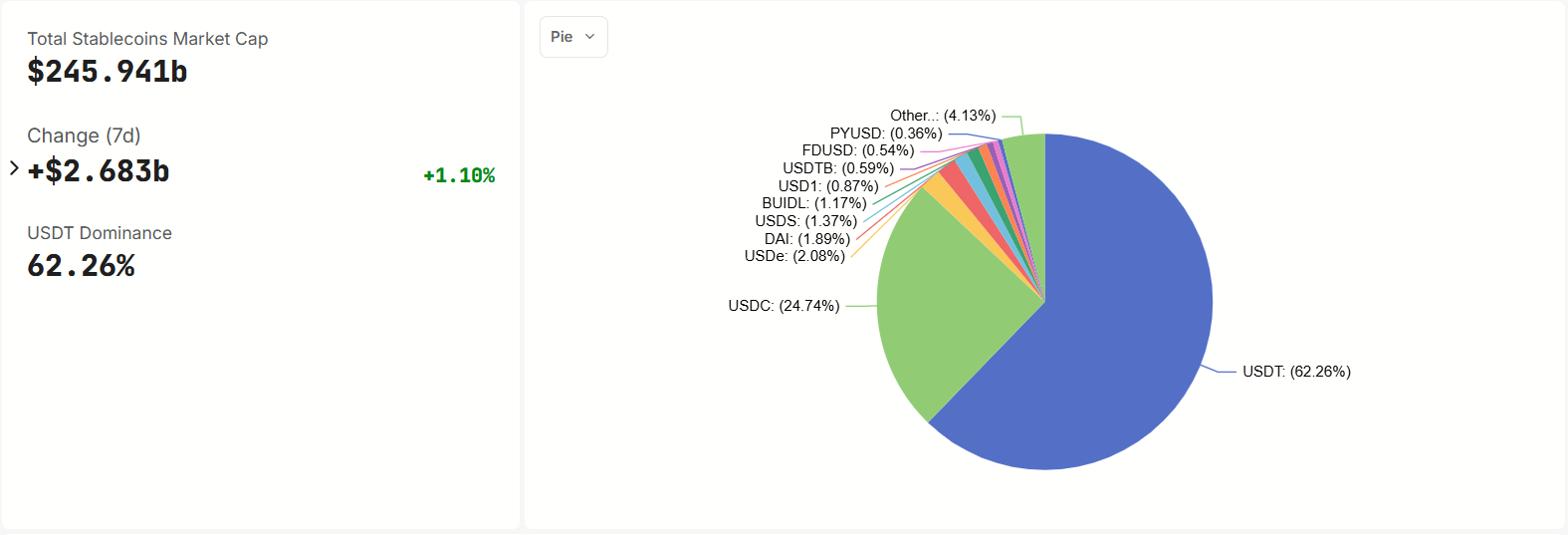

Main U.S. banks, together with JPMorgan Chase, Financial institution of America, Citigroup, and Wells Fargo, are exploring a collaborative stablecoin initiative to compete within the $245 billion stablecoin market, at present led by Circle’s USDC and Tether’s USDT.

Supply: DefiLlama

In response to The Wall Street Journal, these discussions contain fee corporations like Early Warning Companies (Zelle’s operator) and The Clearing Home, co-owned by the banks. The transfer goals to counter the rising affect of crypto-based digital funds, which threaten conventional banking’s deposit bases and transaction volumes.

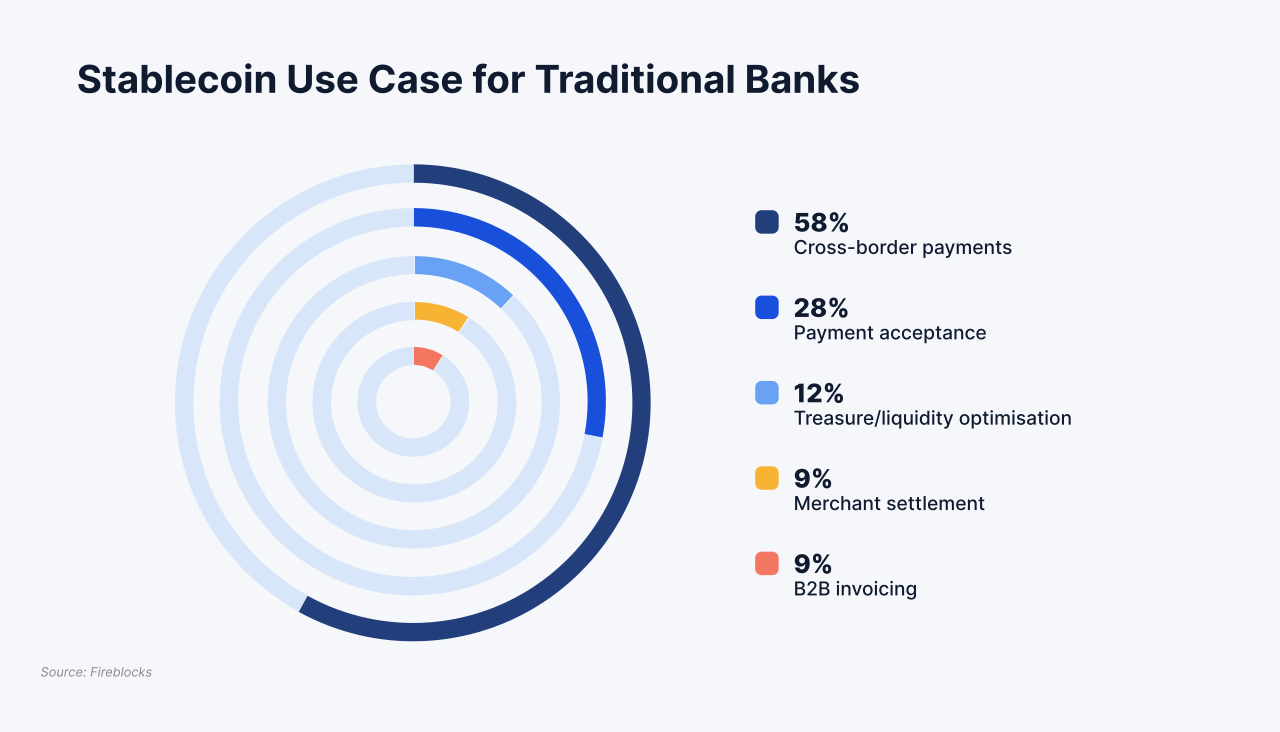

Stablecoins, pegged to the U.S. greenback, provide quick, low-cost cross-border transfers, making them engaging for international finance. A Fireblocks survey notes that 58% of conventional banks already use stablecoins for such funds, reflecting institutional adoption.

Supply: Fireblocks

The banks’ consortium mannequin might allow broader participation from different monetary establishments, enhancing the stablecoin’s attain. Nevertheless, the enterprise’s progress depends upon U.S. stablecoin laws, significantly the GENIUS Act, which not too long ago cleared a Senate procedural vote with bipartisan assist. The Act requires stablecoins to be 1:1 backed by liquid reserves, addressing regulatory issues like anti-money laundering and shopper protections.

USD1 Stablecoin by World Liberty Monetary Fuels Progress and Debate

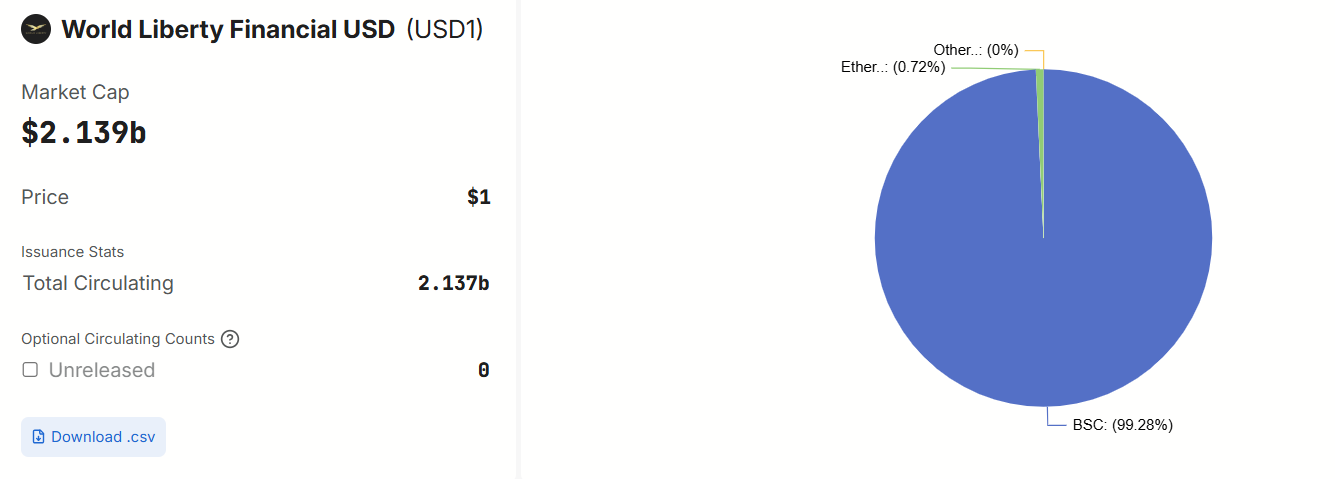

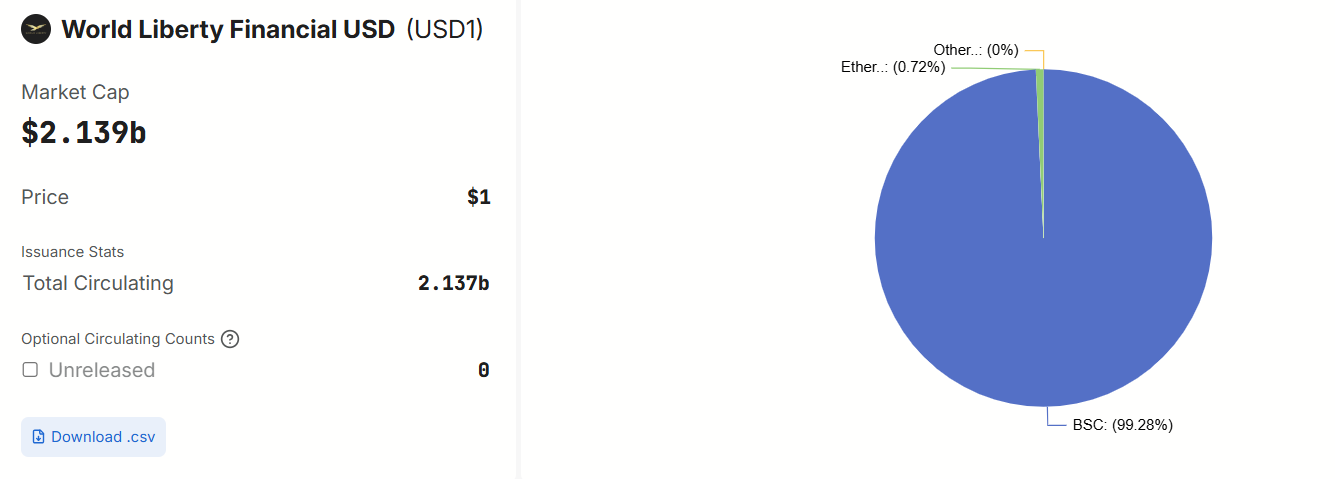

Parallel to the banks’ efforts, the Trump household’s World Liberty Monetary has launched USD1, a dollar-backed stablecoin that has quickly gained traction. Issued by BitGo Belief Firm below U.S. regulatory compliance, USD1 has surged to a $2.14 billion market cap, rating because the second-largest stablecoin on BNB Chain after USDT.

A major increase got here from a $2 billion funding by Abu Dhabi’s MGX fund to accumulate a stake in Binance utilizing USD1, highlighting its international enchantment. The Trump household holds a 60% stake in World Liberty Monetary, elevating moral issues about potential conflicts of curiosity, particularly given President Trump’s crypto-friendly insurance policies.

Study extra: World Liberty Financial Launches Stablecoin USD1

Critics, together with Senator Elizabeth Warren, argue that USD1’s rise, fueled by overseas investments just like the UAE deal, dangers corruption, particularly because the GENIUS Act progresses. The stablecoin’s integration with Chainlink for multi-chain transfers additional enhances its utility, however issues persist about transparency and regulatory oversight.

The U.S. goals to dominate the crypto sector, echoing President Trump’s remarks at a TRUMP token holders’ occasion, the place he likened crypto management to America’s international financial dominance by way of the USD. The banks’ stablecoin enterprise and USD1’s rise replicate this ambition, positioning the U.S. to form the way forward for digital finance. By leveraging blockchain’s effectivity, banks goal to modernize funds, whereas USD1’s fast progress alerts crypto’s mainstream potential.

Nevertheless, challenges like regulatory readability, public belief, and monetary stability dangers, highlighted by critics evaluating stablecoins to unstable money-market funds, might hinder progress. Each initiatives underscore blockchain’s transformative energy, however their success depends upon navigating moral issues and regulatory hurdles.

| CoinFN