The cryptocurrency market is experiencing a sturdy rally as we speak, with Bitcoin (BTC) and Ethereum (ETH) main the cost. As of Might 9, 2025, Bitcoin has soared previous $100,000 for the primary time since early February, whereas Ethereum is exhibiting vital power, climbing to round $2,200.

The full crypto market capitalization has breached $3,3 trillion, reflecting a 3.4% enhance within the final 24 hours. This bullish momentum is pushed by a mix of macroeconomic developments, institutional adoption, and technical breakouts.

Bitcoin Breaking the $100,000 Barrier

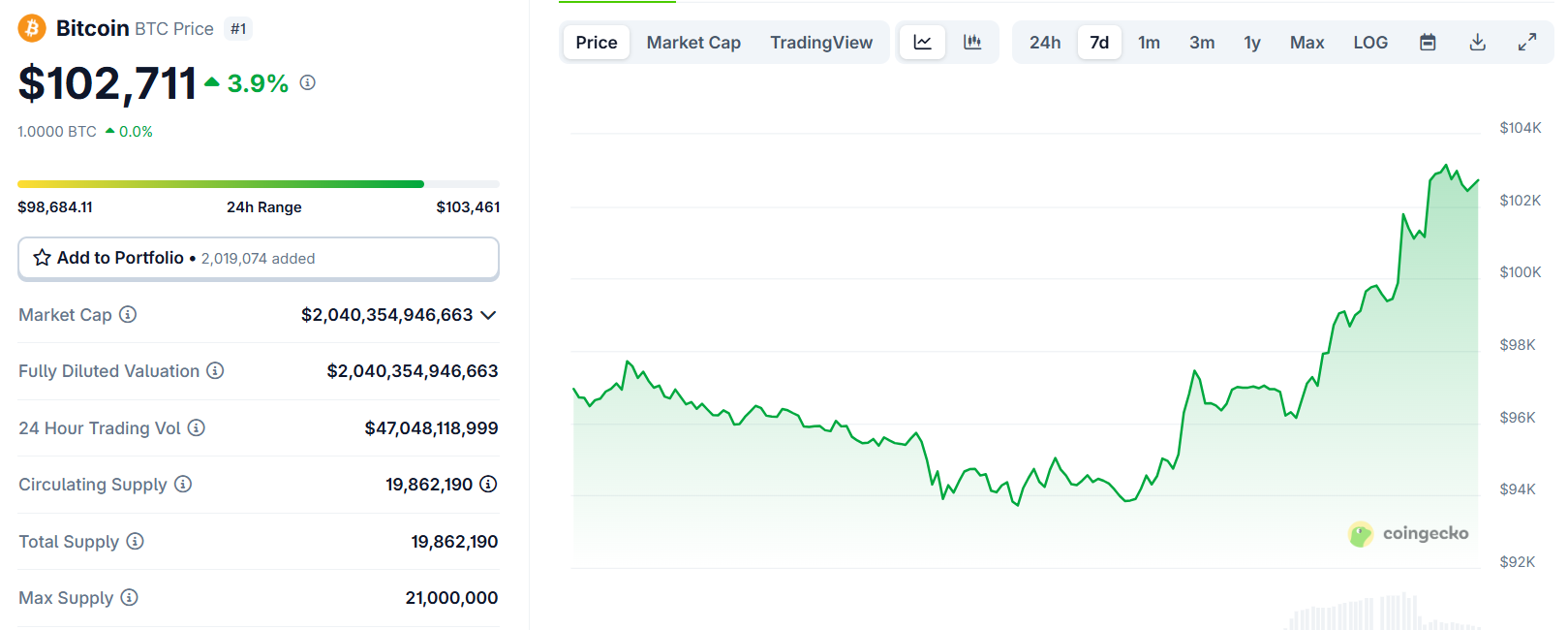

Bitcoin is buying and selling at roughly $102,700, up practically 4% within the final 24 hours, with every day buying and selling quantity surging to $47 billion. This marks a big milestone, as BTC has reclaimed the $100k level after dipping to $75,000 in early April following commerce tariff issues.

Supply: CoinGecko

A number of momentums are behind this rally:

- Easing US-China Commerce Tensions: Optimism over potential progress in US-China commerce talks has boosted risk-on sentiment throughout international markets, together with cryptocurrencies. China’s commerce ministry not too long ago signaled openness to negotiations, decreasing fears of escalating tariffs that beforehand weighed on danger belongings. This has pushed Bitcoin’s value, as buyers view it as a hedge towards financial uncertainty.

- Large Quick Liquidations: The derivatives market has seen vital exercise, with $341 million in brief Bitcoin positions liquidated within the final 24 hours. This imbalance displays sturdy bullish momentum, as bearish merchants are pressured to cowl their positions, additional pushing costs upward.

Supply: CoinGlass

- Institutional and Regulatory Tailwinds: Latest developments, such because the US Workplace of the Comptroller of the Foreign money (OCC) stress-free guidelines to permit banks to purchase and promote consumer crypto belongings, have bolstered institutional confidence. Moreover, Arizona’s passage of a Bitcoin reserve invoice and file inflows into Bitcoin ETFs sign rising mainstream adoption.

- Federal Reserve’s Regular Charges: The Federal Reserve’s determination to take care of rates of interest at 4.25%-4.50% on Might 7 has bolstered Bitcoin’s attraction as a retailer of worth, particularly amid stagflation fears. Buyers are more and more turning to BTC as “digital gold” to hedge towards fiat foreign money erosion.

Ethereum Driving the Altcoins Wave

Ethereum is buying and selling at round $2,200, reflecting a 16.8% achieve within the final 24 hours and a 20.2% surge over the previous week. ETH’s market capitalization stands at $267.45 billion, solidifying its place because the second-largest cryptocurrency.

Supply: CoinGecko

The latest activation of Ethereum’s Pectra improve on Might 7 has additional fueled optimism. Pectra launched sensible accounts, larger staking limits, and improved scalability by key Ethereum Enchancment Proposals (EIPs). Options like EIP-7702 (enabling externally owned accounts to behave as sensible contracts) and EIP-7691 (growing knowledge blobs for layer-2 scalability) have enhanced Ethereum’s utility for dApps and sensible contracts, attracting builders and buyers.

Be taught extra: Ethereum Price Prediction after Pectra Upgrade in May

Like Bitcoin, Ethereum has seen vital brief liquidations, with $283 million in brief ETH positions worn out within the final 24 hours.

Warning forward

The crypto market is using a wave of optimism pushed by easing commerce tensions, pro-crypto insurance policies, and robust technical breakouts. Bitcoin’s surge previous $100k and Ethereum’s rally to $2,200 replicate a potent mixture of institutional inflows, brief liquidations, and macroeconomic tailwinds.

Whereas dangers like potential Fed coverage shifts and technical pullbacks loom, the present momentum underscores crypto’s rising function as a mainstream asset class. Buyers ought to keep knowledgeable and cautious, because the market’s volatility stays a double-edged sword.

| CoinFN