Following the listings of a number of restaking initiatives, together with KernelDAO, Solayer, and Babylon – on Binance in Q2 2025, one query emerges: Is “restaking” turning into the subsequent dominant narrative within the crypto market?

What Is Restaking and Why Does It Matter?

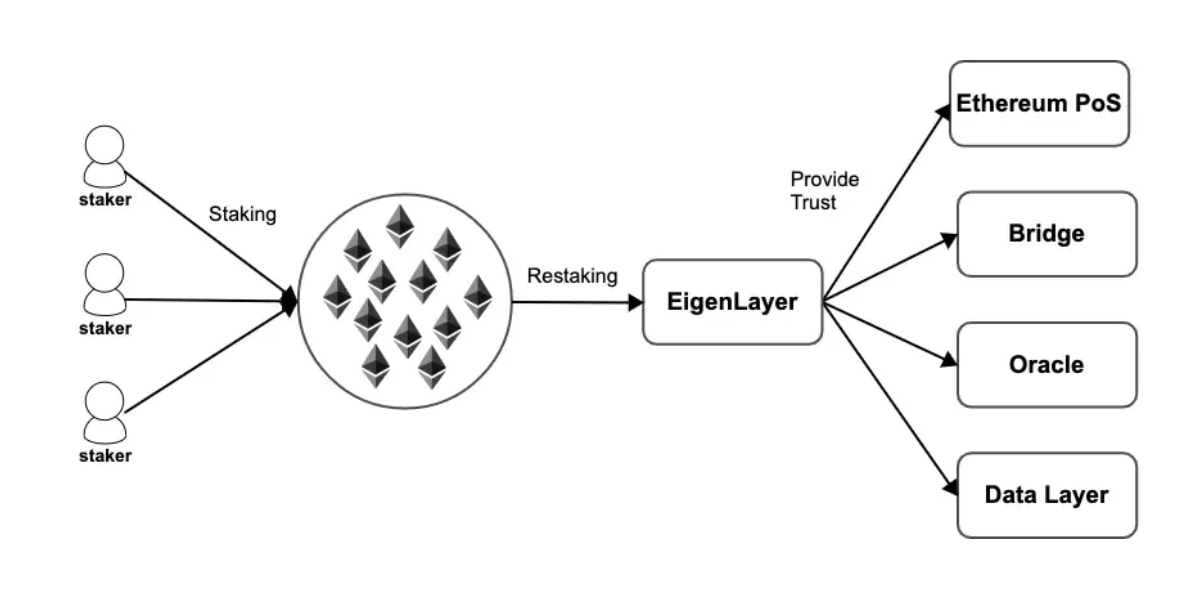

Restaking is a mechanism that permits customers to reuse staked belongings (usually ETH) to safe different networks or purposes with out having to withdraw these belongings from the unique staking platform. This represents a serious breakthrough in capital effectivity inside blockchain ecosystems, because it permits a single pool of belongings to be utilized for a number of safety functions, fostering the expansion of latest infrastructure layers with out compromising the integrity of the bottom community.

This mechanism considerably lowers the safety barrier for brand spanking new initiatives. Historically, launching a brand new blockchain or appchain meant securing a devoted validator set and sourcing new staking capital. With restaking, initiatives can “rent” safety from already-staked tokens on Ethereum or appropriate chains, thereby lowering time-to-launch and boosting early-stage belief.

The idea of restaking was pioneered by EigenLayer, a mission broadly anticipated to turn out to be the secondary safety pillar of Ethereum. EigenLayer permits customers to restake ETH already secured on Ethereum to supply safety for auxiliary modules akin to oracles, bridges, or rollups. Initially, EigenLayer centered on enabling builders to construct plug-and-play safety modules, however this has advanced into a complete ecosystem dubbed “Restaking-as-a-Service.”

Learn extra: What is Restaking in Crypto? The Beginner’s Guide

Supply: EigenLayer

This mannequin just isn’t restricted to Ethereum. Different chains like Solana and BNB Sensible Chain have additionally begun integrating or enabling comparable approaches, leveraging their native tokens (e.g., SOL, BNB) to increase staking mechanisms in a extra versatile method — aligning with the modular safety calls for of the subsequent technology of Web3 infrastructure.

The Restaking Ecosystem Is Quickly Increasing

As of April 2025, a number of main restaking initiatives have made notable progress:

- KernelDAO (BNB Chain): The primary native restaking protocol on BNB Chain, backed by Binance Labs. After itemizing on Binance on April 14, KERNEL’s token reached a completely diluted valuation (FDV) of over $300M earlier than sharply correcting to the $0.17 vary. Nonetheless, it stands as a transparent testomony to the rising attraction of the restaking narrative throughout the Binance neighborhood.

- Solayer (Solana): A pioneer in bringing “liquid restaking” to the Solana ecosystem, Solayer permits customers to stake SOL whereas receiving liquid belongings to proceed collaborating in DeFi. The mission was listed on Binance on April 22 with an preliminary FDV of roughly $900 million. Solayer additionally plans to combine restaking modules for Actual World Belongings (RWA) and Web3 gaming.

- Babylon (Bitcoin): Increasing the idea of restaking to Bitcoin, Babylon permits BTC holders – usually holding a non-yielding asset, to safe appchains or rollups. With a modular safety mannequin and backing from main funds like Polychain and Binance Labs, Babylon was listed on Binance on April 25 and shortly turned one of many prime 5 most traded new tokens of the week.

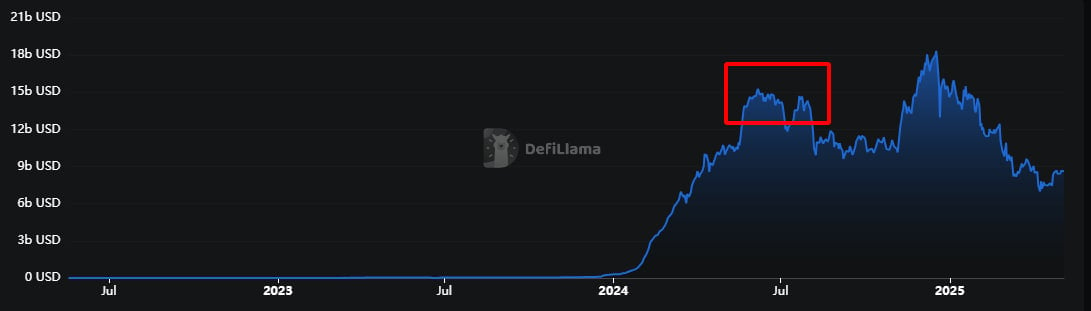

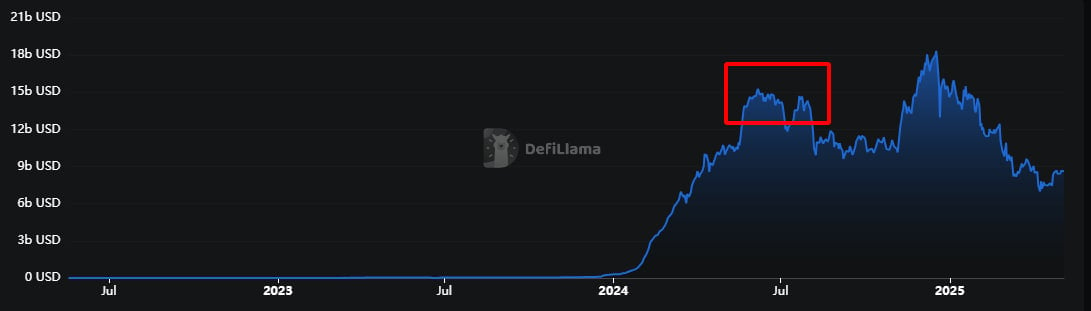

Why Restaking Dominated in 2024

The restaking narrative rose to prominence in late 2023 by means of protocols like EigenLayer, which launched a novel thought: utilizing staked belongings (particularly ETH) to safe further providers akin to oracle networks, information availability layers, and appchains. This idea quickly gained traction for a number of causes:

- Capital Effectivity: Customers may earn layered yield by repurposing already-staked belongings.

- Safety-as-a-Service: New protocols not wanted to bootstrap validator networks from scratch.

- Protocol Income: Restaking opened new income streams for infrastructure and middleware initiatives.

EigenLayer’s meteoric rise, coupled with strategic enterprise capital backing, made restaking the defining infrastructure narrative of that cycle.

Liquid Restaking Protocols’ TVL rise considerably in 2024 – Supply: DeFiLlama

Can Restaking Make a Comeback in 2025?

Whereas narratives like AI x Crypto, SocialFi, and Modular Gaming have dominated early 2025 headlines, the latest listings of KernelDAO, Solayer, and Babylon counsel a rekindling of curiosity in restaking infrastructure. These new entrants mirror a maturation of the narrative, spanning a number of chains (BNB, Solana, Bitcoin) and broadening use circumstances past Ethereum.

Nonetheless, whether or not restaking can reclaim its standing as the highest narrative stays unsure. A lot will depend upon:

- Actual adoption of restaked safety throughout rollups, video games, and RWAs.

- Regulatory readability round staking-as-a-service.

- Continued innovation in modular design and cross-chain compatibility.

If these components align, restaking may as soon as once more transfer from narrative to necessity, providing the spine for the subsequent section of decentralized safety infrastructure.

The fast succession of restaking mission listings on Binance has reworked what was as soon as thought of a “technical niche” into one of the crucial dominant funding narratives of Q2 2025.

MilkyWay stands out on BNB Chain, aiming to increase decentralized safety for satellite tv for pc chains in Web3. As an alternative of conventional BNB staking, customers restake to safe apps and earn MILK with out dropping liquidity.

The MILK token launched through Binance Pockets by means of a Wallet Initial Offering (WIO) on April 29, 2025. This isn’t only a new decentralized fundraising mannequin. It’s additionally a powerful sign that Binance is giving MilkyWay particular consideration, just like its help of KernelDAO and Babylon.

Study extra: Milkyway Price Prediction

Supply: MilkyWay

MilkyWay makes use of a multi-layered structure to allow cross-chain staking between Ethereum and BNB Sensible Chain. This not solely extends its safety base but in addition enhances compatibility with DeFi initiatives throughout each ecosystems.

In contrast to Puffer Finance (PUFFER) and Swell (SWELL), which confronted airdrop sell-offs, MilkyWay could profit from a lightweight FDV technique. MilkyWay retains valuation conservative and grows TVL steadily to help wholesome post-listing efficiency.

Conclusion

Three listings in two weeks—KernelDAO, Solayer, and Babylon, present Binance backs the restaking narrative. Because the market recovers, restaking grows past tech, turning into a key pillar of the Web3 ecosystem.

MilkyWay is probably going the subsequent piece on this rising pattern. Traders ought to observe unlocks, TVL development, and Binance ties to gauge MILK’s medium-term potential.

Restaking was as soon as a imaginative and prescient. Now, it’s turning into a actuality – validated by the market itself.

Learn extra: Top 5 Pre-TGE Projects Backed by YZI Labs (Binance Labs)

| CoinFN