Picture supply: Getty Pictures

As inflation continues to run sizzling, I want to seek out methods to get my cash to work as exhausting as doable for me. My favoured method is to purchase high-yielding FTSE 100 shares, to spice up my passive earnings streams. With a decade-long monitor report of accelerating payouts, I don’t must look any additional than shares in Authorized & Normal (LSE: LGEN).

Rising dividends

At the beginning, I put money into companies dedicated to shareholder worth creation. Since 2016, Authorized & Normal has paid out dividends of over £7.7bn, and its dividend per share (DPS) has elevated 46%.

What I actually like is that it has clearly laid out its dividend coverage for each the 2023 and 2024 monetary years.

For the monetary yr ending March 2024, it intends to pay out 20.34p. Of this, 5.71p has been paid via an interim dividend. That is 5% increased than final yr.

Subsequent yr, DPS will develop one other 5% to 21.36p. At at the moment’s share value, that places it on a ahead yield of 8.5%, one of many highest within the FTSE 100. However, in fact, no dividend is ever assured.

Dividend sustainability

Naturally, I solely wish to put money into companies that may assist dividend will increase into the longer term.

In 2020, it laid out its five-year ambition of rising earnings per share (EPS) quicker than DPS. With money and capital technology rising quicker than dividends, I anticipate to see this translate right into a pipeline of progress alternatives.

In the present day, it invests in progress industries together with clear expertise, renewable power, well being and life sciences, and concrete regeneration packages.

Enterprise mannequin synergies

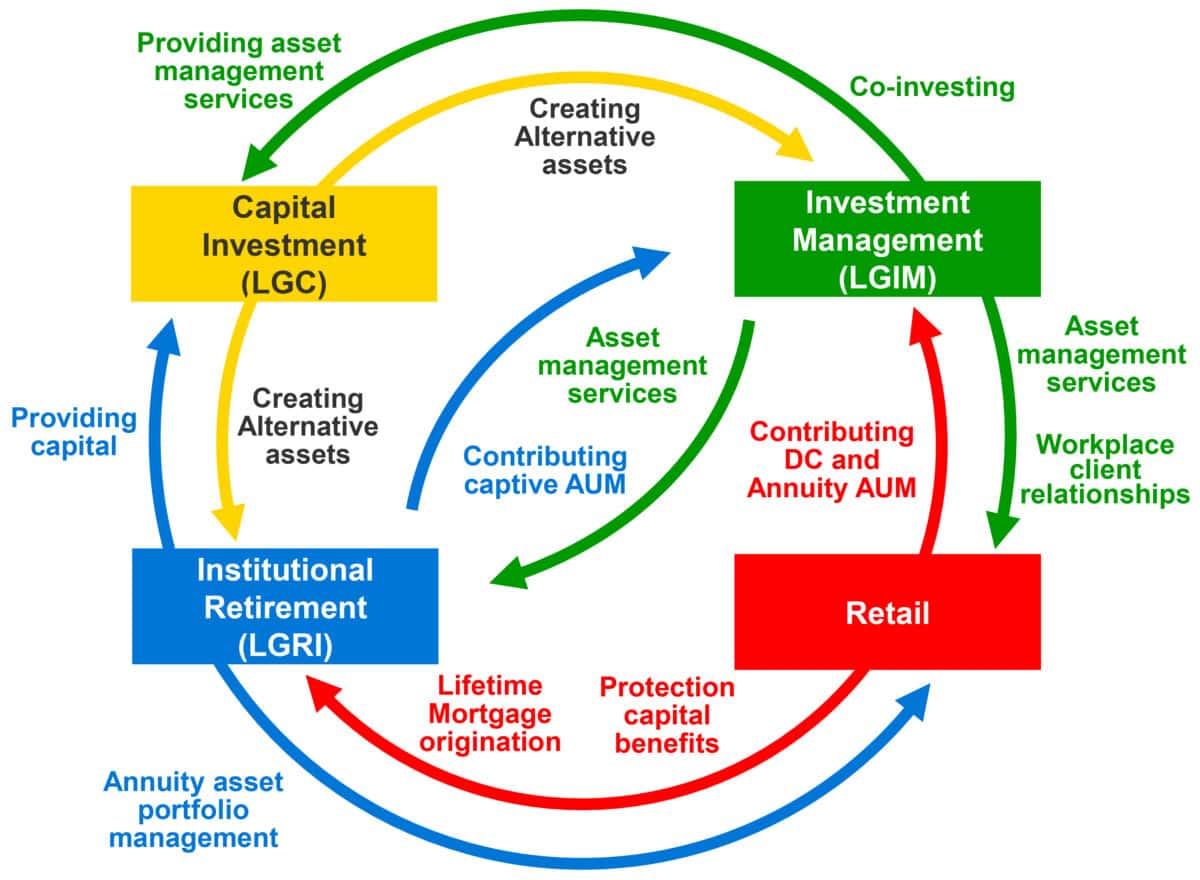

One attribute of Authorized & Normal’s enterprise mannequin that I believe isn’t absolutely appreciated by the market is the extent of the constructive interaction between its 4 divisions. This interconnectivity permits it to drive a constant return on fairness (ROE) of 20%.

The next infographic highlights the synergies between these 4 divisions.

Supply: Authorized & Normal

This synergy is a supply of aggressive benefit for the enterprise. It demonstrates to me that the worth and efficiency of its 4 divisions mixed is larger than the sum of its separate components.

Recession danger

My base case stays that the UK, and certainly world, financial system is heading right into a recession. If this performs out then there may be little doubt that inventory markets will decline, most likely considerably.

As an funding administration agency, Authorized & Normal’s destiny is intertwined with the broader financial setting, one thing of which it has no management over. Final yr’s banking disaster highlighted how volatile its share value can develop into when dangerous information hits.

Nonetheless, I view the corporate as having some of the compelling progress tales over the following 10-plus years. Ageing demographics and the rising development of people taking extra management over retirement financial savings is one such mega alternative.

The agency can be on the forefront of investing in the actual financial system. A big a part of the federal government’s ‘levelling up’ programme is bringing in personal sector institutional capital to assist regeneration of the constructed setting.

I’m so assured within the long-term efficiency of its share value, that it’s one in all solely a handful of firms during which I at all times re-invest my dividends.