Picture supply: Getty Photos

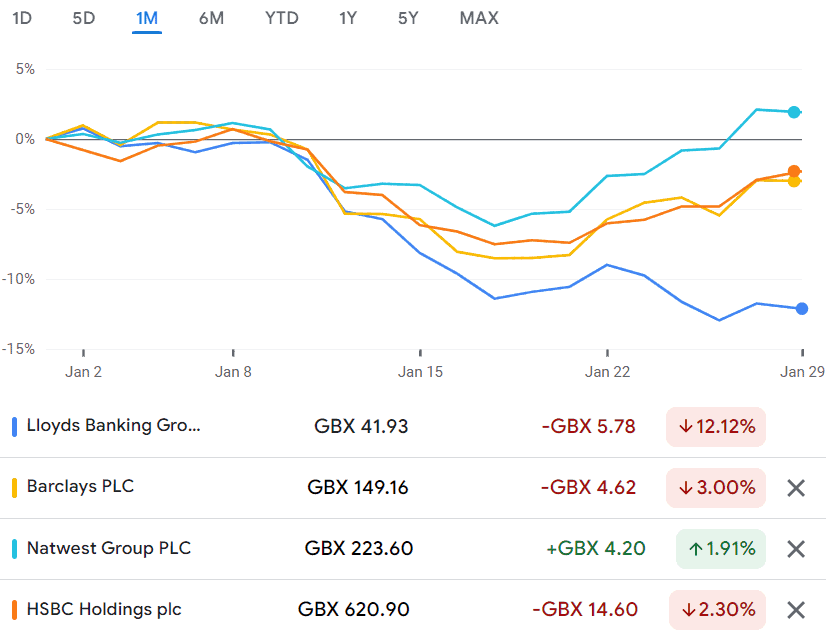

Immediately, I’m one financial institution inventory that I believe is promoting at a discount – Lloyds (LSE:LLOY). After climbing 12% throughout December, the Lloyds share worth hit a snag at first of the 12 months and is now again the place it was final November. If it falls a lot additional, will probably be at its lowest stage in over two years.

The dip resumes a pattern that persevered all through 2023, a 12 months that noticed the worth fall from 54p a share to a low of 39.7p. That was the one time for the reason that pandemic the worth dipped beneath 40p, which has served as a key assist stage for the previous three years.

With the worth now hovering simply above 40p, I don’t count on to see a major lower from right here.

Lloyds will not be alone in its wrestle – most UK excessive road banks suffered an analogous destiny this month, albeit to a lesser diploma. It appears the preliminary pleasure about rate of interest cuts has subsided. At a gathering this Thursday, the Financial institution of England (BoE) is predicted to keep up the present fee for an additional month.

Even so, I believe the UK banking sector is hinting at a gentle restoration after a troublesome 2023. As such, I imagine this could possibly be a chance to seize some Lloyds shares whereas they’re nonetheless low cost.

What analysts are saying

Regardless of the falling share worth, Lloyds had an excellent 12 months in 2023. Earnings grew by 125%, with internet revenue margins now as much as 32% from solely 19% final 12 months. Though that’s not anticipated to proceed — wanting forward, earnings are forecast to say no by 11% per 12 months for the subsequent three years.

Will that damage the share worth? Not everybody thinks so.

With the share worth now so low, some analysts estimate it to be buying and selling at 32% beneath honest worth. I believe it’s unlikely we’ll see it enhance that a lot in 2024 however I’ve seen a fair proportion of optimistic evaluation. Some forecast a worth enhance of as much as 67p!

However I believe that’s a bit hopeful.

Until actually significant fee cuts change into a actuality once more, I’d count on one thing within the way more conservative 50p–55p vary. Both means, I believe the share worth unlikely to fall beneath 40p and may achieve once more when inflation lastly settles. Nonetheless, if the present recession fears change into a actuality, then it runs the danger of falling additional.

Dividends

One additional profit is that Lloyds has an excellent monitor file of paying out a dependable dividend. Its dividend yield is at present set at a really beneficial 6% and is predicted to extend to eight.5% in three years.

That makes Lloyds a sexy funding to me, even when the share worth has a lacklustre 12 months. I believe grabbing some shares now whereas the worth is affordable will safe me an honest little bit of passive income from dividends.

Naturally, if the share worth does fall additional it’ll negate these positive factors — however I’m assured sufficient to take that threat.