Picture supply: Getty Photographs

Not too long ago, I’ve been looking for the best-performing shares on the FTSE 100 over the previous 20 years.

The saying “Past performance is no guarantee of future results” is frequent in finance. It highlights to buyers that an organization performing properly previously received’t essentially proceed to take action. Nonetheless, I discover some consolation in figuring out the shares I put money into have a historical past of strong development.

I measured the proportion of share-price development from the bottom level in 2004 to right this moment’s worth. Whereas I couldn’t manually examine the efficiency of all 100 constituents, I discovered three that I’m positive are close to the highest.

Listed here are my outcomes.

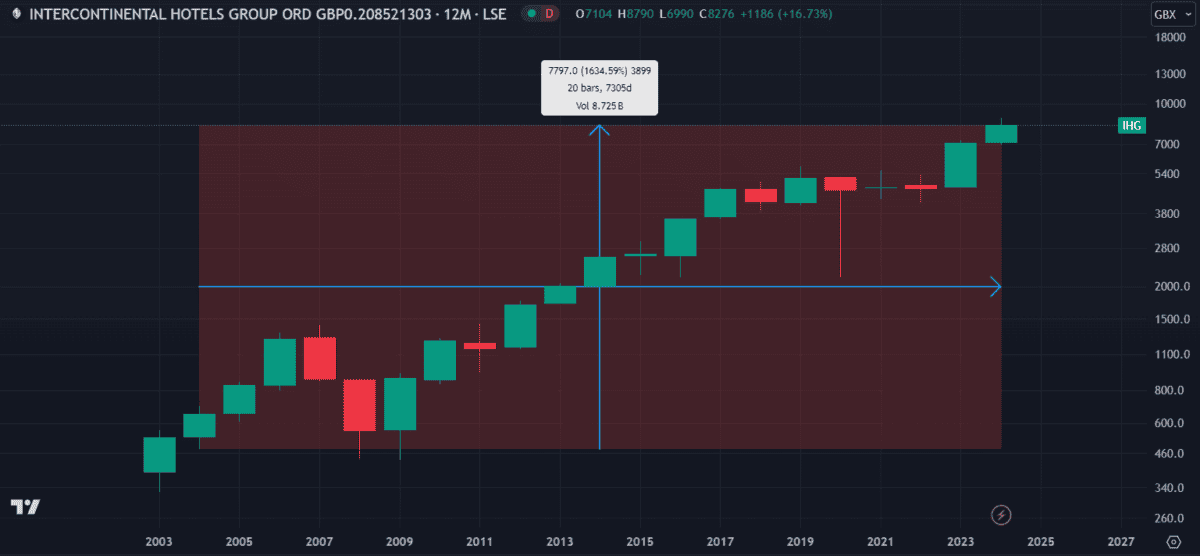

5-star critiques

Intercontinental Resort Group (LSE:IHG) may very well be the best-performing FTSE inventory over the previous 20 years, price-wise. It’s up an enormous 1,634% since its lowest worth level in 2004. Because the mother or father firm of Vacation Inn, Crowne Plaza and Regent accommodations, it operates in 100 international locations worldwide. Out of the previous 20 years, Intercontinental Resort Group completed greater in 14 of them. In simply the previous yr alone, earnings grew 100% and the share worth elevated 60%.

However Intercontinental Resort Group could also be in a questionable place, financially.

It has $6.76bn in liabilities (of which $3.6bn is debt) and solely $4.8bn in belongings with $1.33bn in money. This places it within the precarious place of falling foul of mortgage defaults if working earnings declines. If this example improves I could think about it for my portfolio, however for now I’m erring on the aspect of warning.

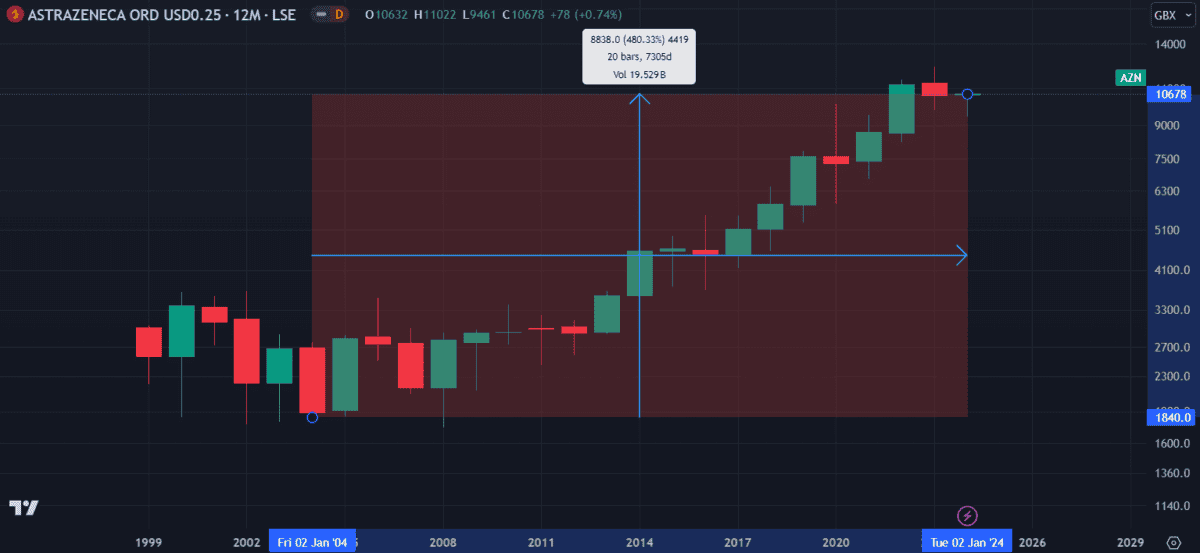

The pharma big

As one of many first corporations to develop a Covid vaccine, AstraZeneca (LSE:AZN) rapidly turned a family identify in the course of the pandemic. And but, regardless of reaching a brand new all-time excessive in June 2020, it closed the yr down. Prescription drugs is a extremely aggressive business, susceptible to regulatory hurdles and delayed medical trials that may run up debt. Whereas AstraZeneca is doing properly at present, the unsure way forward for the business may pose important challenges.

Nonetheless, AstraZeneca has climbed 480% since 2004, with a lot of the good points made previously decade. The share worth closed in revenue eight out of the ten years between 2013 and 2023. Regardless of an enormous £22.6bn debt invoice, the pharma big’s balance sheet is pretty strong. The £166bn firm has $80bn in belongings and $39.17bn in fairness.

It’s been on my watchlist for a very long time and is now solidly on my purchase checklist for April.

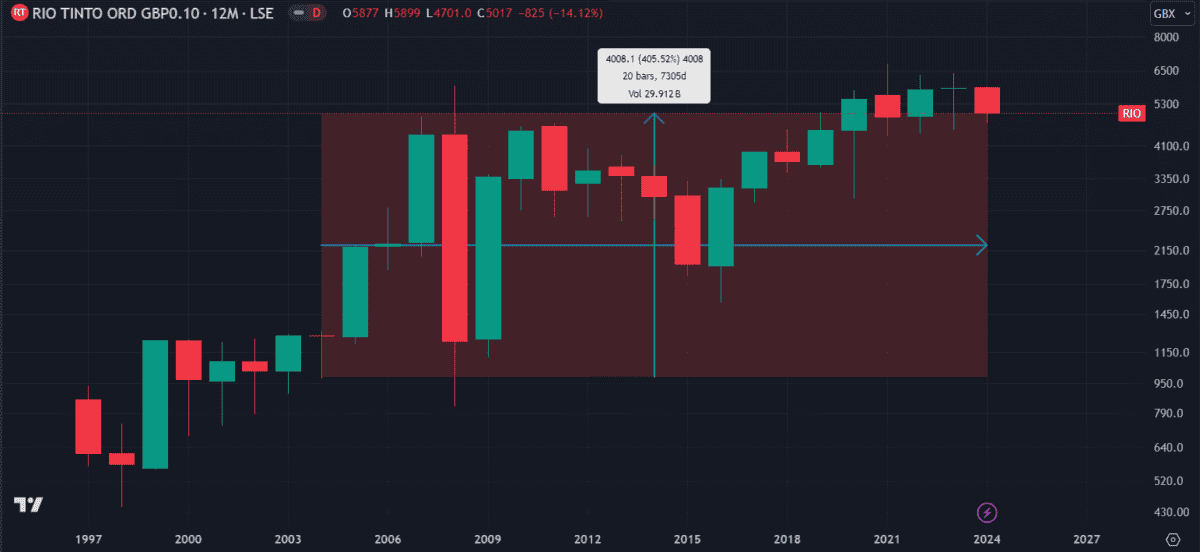

A worldwide mineral miner

Main mining conglomerate Rio Tinto (LSE:RIO) operates iron ore, aluminium and copper mines worldwide. The shares fell 8.5% over the previous yr however for the reason that 2004 low are up 405%. For 12 out of the previous 20 years, the share worth has closed greater.

However mining is a dangerous sector, susceptible to commodity worth fluctuations, geopolitical tensions, and sustainability necessities. Rio Tinto operates in a number of areas with unstable governments, together with South Africa, Guinea, and Madagascar. Moreover, rising commerce tensions with China threaten its iron ore enterprise.

Nonetheless, analysts estimate the shares to be undervalued by 52% and predict a median 22% improve over the subsequent 12 months. A low price-to-earnings (P/E) ratio of 10.1 reinforces these estimates. Add the 6.8% dividend yield and I feel Rio Tinto is a no brainer purchase for my portfolio quickly.