Towards the falling Bitcoin (BTC) change fee, the every day liquidation quantity on the crypto market approached $700 million.

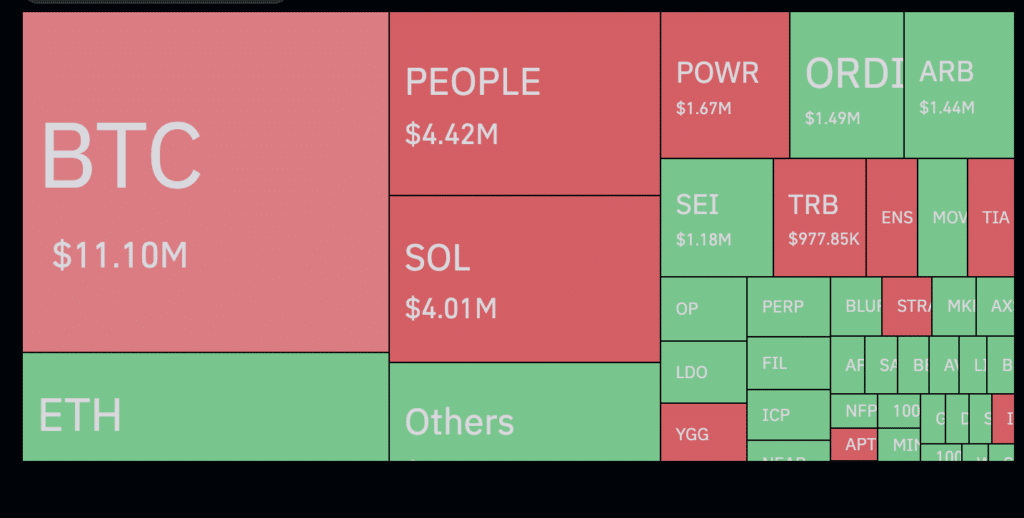

Merchants liquidated $698 million value of positions within the final 24 hours, in line with Coinglass information.

The bulk got here from BTC, $11.1 million, with the overwhelming majority coming from quick positions. Ethereum (ETH) grew to become the second hottest asset for liquidation, with merchants liquidating $5.57 million value of positions, most of which got here from lengthy.

Positions have been primarily liquidated on crypto exchanges Binance, OKX, and Bybit. Essentially the most important liquidation order was the BTC-USDT place on the Huobi cryptocurrency change for $14.26 million.

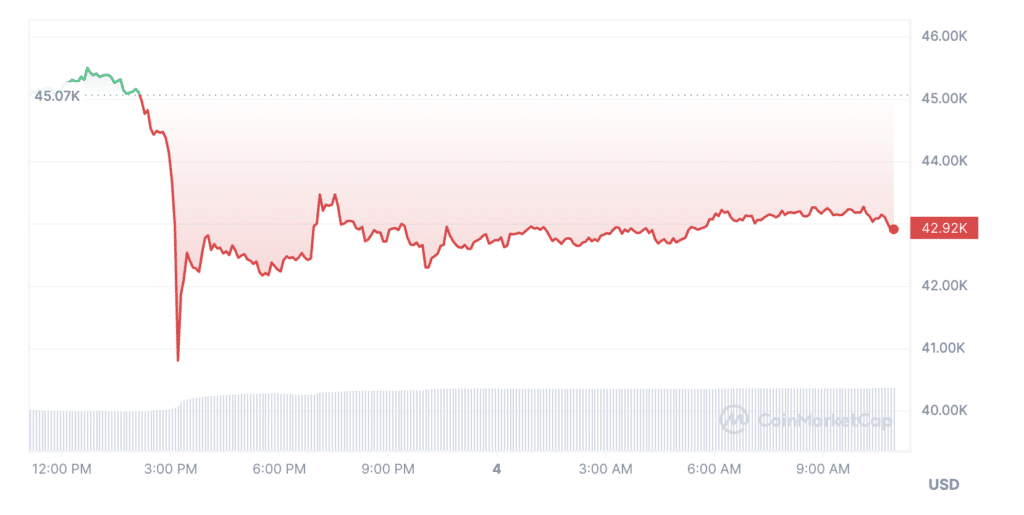

On Jan. 3, 2024, the speed of the primary cryptocurrency showed a sudden drop, instantly falling to the extent of $41,500. On the time of publication, BTC is making an attempt to realize a foothold above $42,800. The collapse of the bitcoin fee additionally damage the alt-coin sector. Over the previous 24 hours, the worth of most property fell by a mean of 13%.

The collapse got here shortly after Matrixport analysts reported that the U.S. Securities and Trade Fee (SEC) won’t approve spot Bitcoin ETFs this month. Consultants recommended that the company will start registering funding crypto-funds solely after the applicant corporations fulfill all of the company necessities. Matrixport representatives consider this might occur in Q2 of 2024.