As crypto heads we all the time talk about crypto is an exit from the tyranny of paper currencies that slowly steal from the inhabitants. The previous week has been significantly defining within the acceleration of that. Nonetheless, earlier than we discuss in regards to the previous week lets discuss in regards to the previous few weeks.

On April 2nd, Trump introduced widespread sweeping tariffs that shocked the worldwide economic system. Many believed that he was bluffing, however this time it appeared like Donny was useless severe about his unhinged concept. World markets believed it too, and that was clearly mirrored in our portfolios as they tanked. RIP.

Anyhow, it’s necessary to unpack what actually occurred and why it was the important thing defining second, or might be marked as one in historical past books.

By saying that items imported into America will price extra it created just a few counter reactions. Primarily, the price of items will go up as the prices might be handed to customers or eaten by producers/exporters. Consequently you’ve got two reactionary pathways that kick off:

a) Elevated prices for customers

-

Weak client spending projected in S&P500 inventory earnings (stonks go down, scramble to protected property)

-

Inflation projections imply increased calls for to compensate for threat (bond yields go up)

b) Elevated prices for producers

-

American corporations have to spend extra to make the identical product (earnings go down)

-

Worldwide exporters have to undercut to take care of the identical costs or enhance costs to save lots of margins (sovereigns not joyful)

What’s wonderful in each a) and b) is that nobody wins. Nonetheless, most significantly all of this creates MASSIVE uncertainty in world markets as we noticed. The half we have to focus in all of that is the bond market. It doesn’t matter in case you’re Trump or God, it’s essential to respect the bond market.

Why? I touched on this, partly, in a earlier article (https://kermankohli.substack.com/p/usdjpy-the-most-important-chart-in) nonetheless I’ll lengthen a bit extra right here.

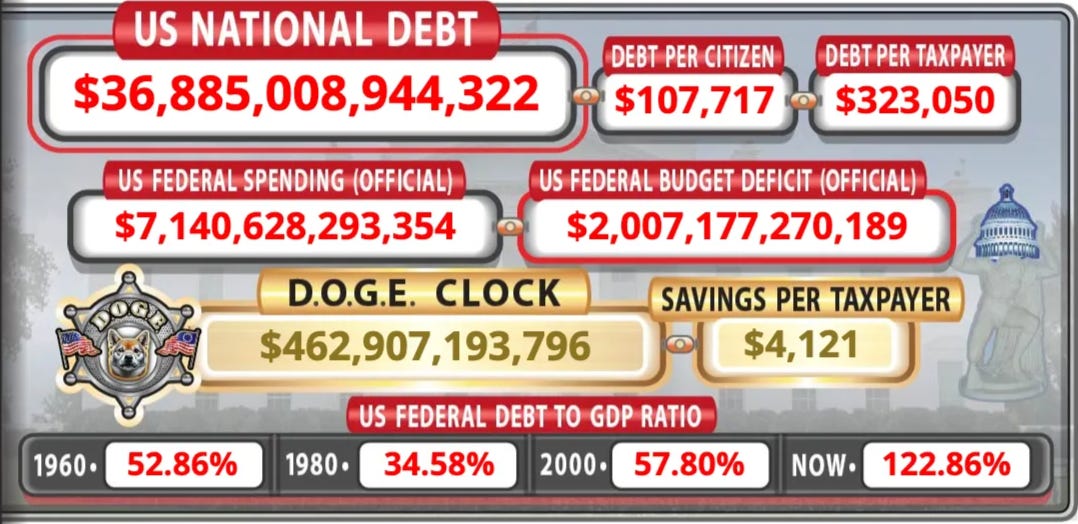

As everyone knows the US is in lots of debt, like $36T value. Nonetheless, that conditions will get even worse when your rates of interest are increased. Bear in mind, promoting bonds means the yields enhance. Price down, yields up.

So, if the rate of interest in your debt have been to go up, it makes this case even worse. Now what occurs once you put in sweeping tariffs that undermine economical sense, two actually unhealthy issues:

-

Buyers promote bonds realising that the US is digging themselves right into a deep gap

-

Your allies threaten to promote bonds as a result of their economies depend on exporting items to the US

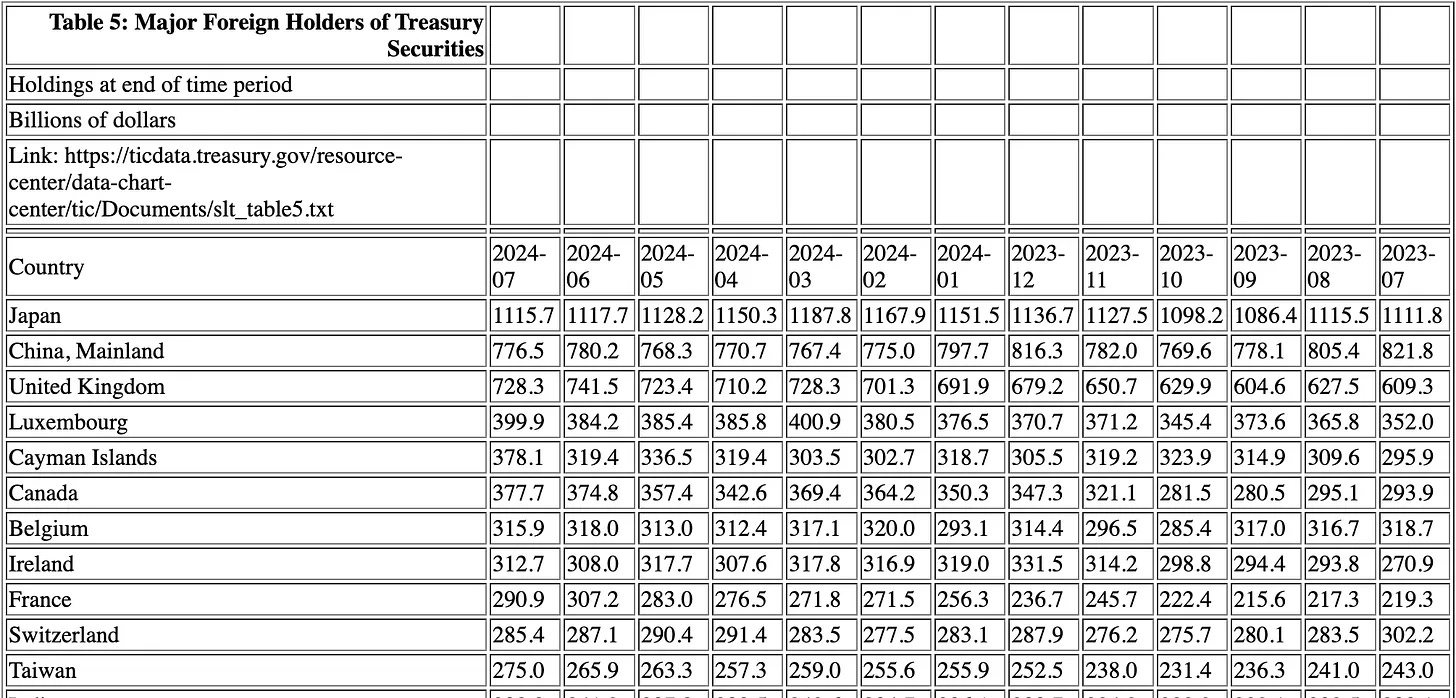

Right here’s a chart of nations that maintain US Treasuries and by how a lot. The very last thing you’d wish to do is to implement sweeping tariffs on them (which absolutely you wouldn’t do proper)? Haha.

It didn’t take very lengthy for Trump and his advisors to understand the financial severity of their selections and that’s why we noticed a softening stance round “implementing a pause” and “speaking with allies”. Whereas the US thought they’d leverage in a single division, their glass jaw was mercilessly uncovered by the worldwide sovereign neighborhood. Right here’s a chart of the US 10 yr treasury yields, as you see they shot up from 3.99% to 4.55% in simply over a month! The bond market shouldn’t be joyful.

Outdoors of the monetary impression, there’s a actual human impression these tariffs have had too. You see the most important purchasers of treasuries are these different international locations. Given all of the hostility in the direction of them and the rhetoric that they should pay premium for the United State’s bodily safety, they’re all beginning to query why they assist such a rustic and begin to re-evaluate their relationship. This re-evaluation comes within the type of treasury bond purchases and holdings. We’ll contact on this later however the important thing half to recollect is:

The price of debt for the US goes to extend as buyers demand extra yield for the uncertainty imposed.

We’ve talked so much about treasuries however there’s one other equation we have to discuss, and that’s Elon Musk’s efforts with the Division of Authorities Effectivity. The concept with it that it might save as much as $2T from the finances. Nonetheless that determine fell quick massively and we solely bought $150b, if that’s even doable to confirm.

Funnily sufficient this was sort of bearish for crypto as a result of prices might come down by that a lot, there likelihood of Bitcoin being wanted has exhausting cash diminished. Not solely are the financial savings gone, Elon can be gone from DOGE. If somebody like him can’t carry the state of affairs underneath management, it’s extremely unlikely that anybody else will. As Lyn Alden says: “nothing stops this train”.

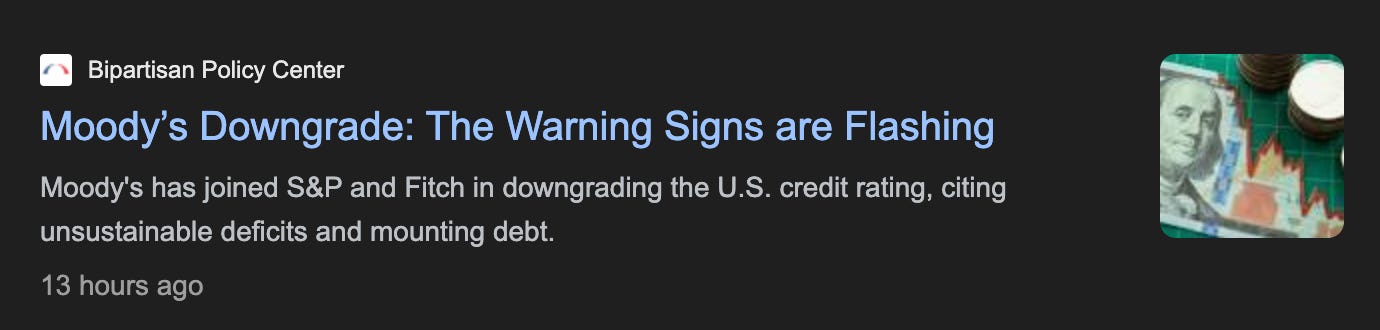

Now let’s quick ahead to the previous week or so. There have been two newsworthy occasions that bought misplaced within the noise. The primary was the downgrade of US treasuries being AAA rated (the literal definition of being the very best high quality debt in the marketplace) to AA. If the factor that’s meant to be the “risk free rate” is abruptly extra dangerous… then what can we do?

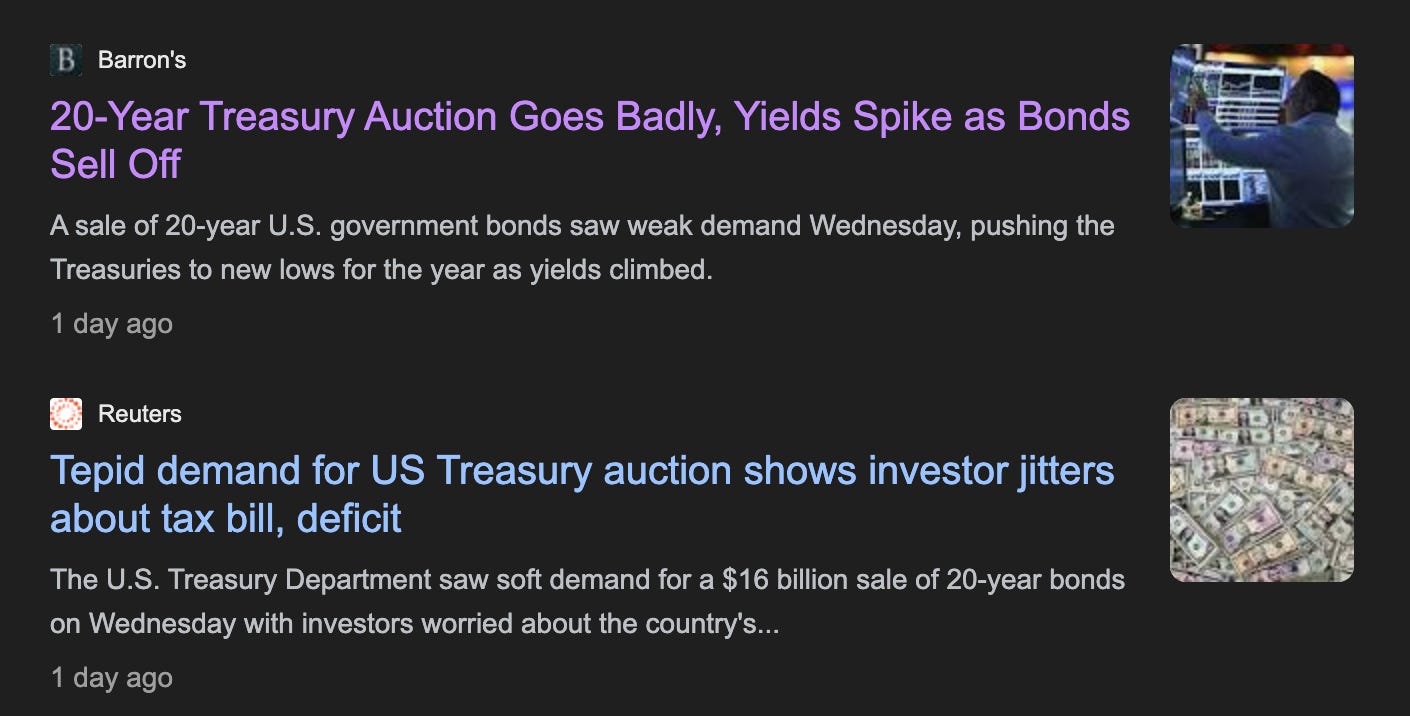

Nicely the primary reply, is that we demand extra money for this elevated threat. That’s precisely what the bond market determined to do. Longer dated treasury bonds are the primary to be caught on this firing line as a result of individuals should take a 20 yr view on the US authorities when the present yr isn’t trying nice.

Each month US treasury bonds are auctioned off. This week, the 20 yr public sale went badly. Why? Nicely nobody actually wished to purchase them.

Consequently, we noticed 20 yr treasury yields spike to the very best they’ve been since 2007! The pattern shouldn’t be wholesome.

Is there something that may be completed to reverse this pattern? Not likely sadly. To ensure that issues to enhance both of those 4 issues have to occur:

-

The US authorities has to make much more cash

-

The US authorities has to spend so much much less cash

-

The US authorities wants to have the ability to borrow cash at a decrease fee

-

The US grows GDP massively by way of AI/crypto (doable however has too many variables to correctly issue)

Not a single one among this stuff is a slam dunk to unravel. On the primary level, we even have the alternative being proposed with tax cuts that will lower income.

Is there any escape from this? No, probably not. We have now entered an financial black gap the place all paths are net-negative for the greenback. How so? Nicely to get out of this there may be solely pathway.

The Fed should step in and buy bonds to make sure future treasury auctions don’t fail. The place do they get this cash from? Cash printerrrrr. Not solely will they wish to stop them from failing, they are going to use these recent prints to artificially management yields. When you don’t know the way this story goes, please learn my Japan Yen article right here:

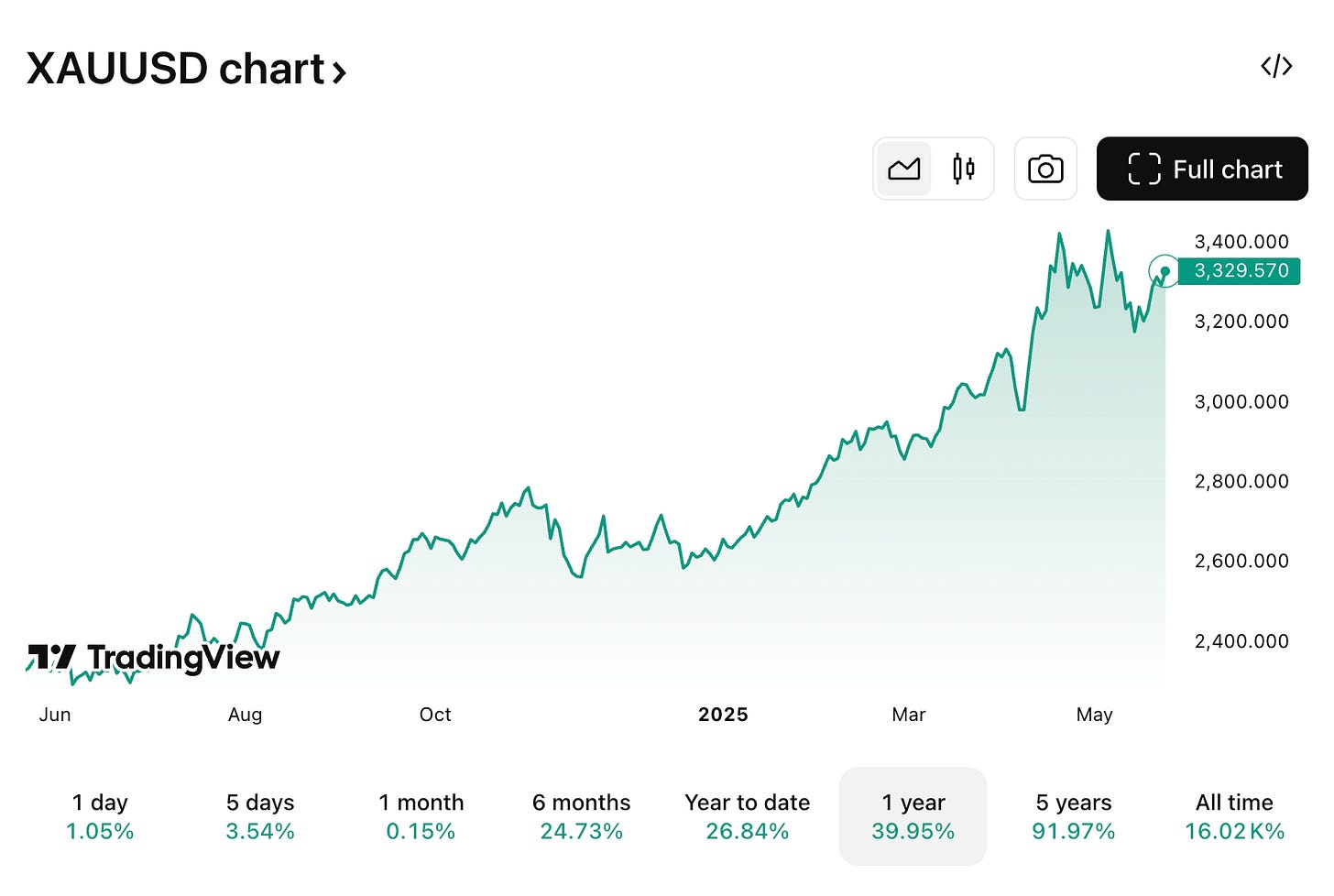

I’m not some uncommon genius who is aware of this, the broader market understands this and we are able to see it being mirrored in these two charts:

or this chart in case you’re extra of a boomer.

In case it isn’t clear: there’s a actual flight to security and property that may shield in opposition to the inevitable printing of cash are hovering an anticipation of this future.

It’s really a bit grim once you consider it: a lot of the world believes within the sovereign paper they’re issued to retailer their life power, just for it to be stolen from them silently by way of advanced abstractions they aren’t educated sufficient to know. Their solely likelihood of escaping this lure is crypto which they deem to be a rip-off.

We’re coming into a really unusual territory the place Bitcoin will proceed to climb increased, not due to retail mania, however as a result of the neatest cash on the planet is already betting on the collapse of the greenback.

Nothing cease this practice. Simply hope your seat is sweet sufficient and also you’re positioned properly for it. The beginning of the tip is right here and also you’re alive to expertise it in sluggish movement because it occurs.

Consider in the correct issues.

| CoinFN