Figuring out methods to scale blockchain to web ranges has been a focus for researchers ever since Bitcoin launched. There have been a lot of lifeless ends (Plasma, state channels, sharding), however the trade ultimately coalesced round rollups as the perfect scaling answer. Rollups have since moved from theoretical dialogue to sensible improvement. This month, Denis expands on his evaluation of modular blockchains from last November, and examines how the key rollup initiatives purpose to scale previous proof-of-concept – and finally construct sustainable methods that would underpin a brand new web.

– Chris

Rollups have emerged because the main answer to unravel blockchain’s scalability dilemma. For Ethereum, Vitalik’s vision of a rollup-centric future is progressively materializing.

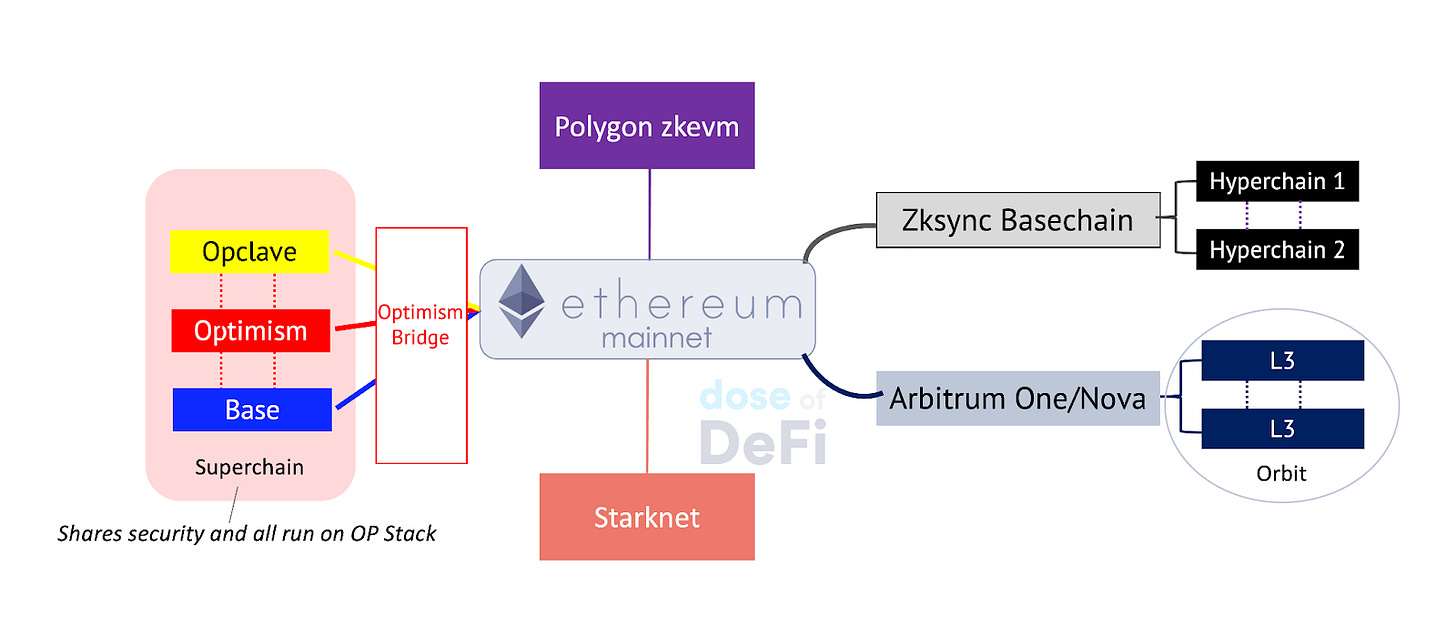

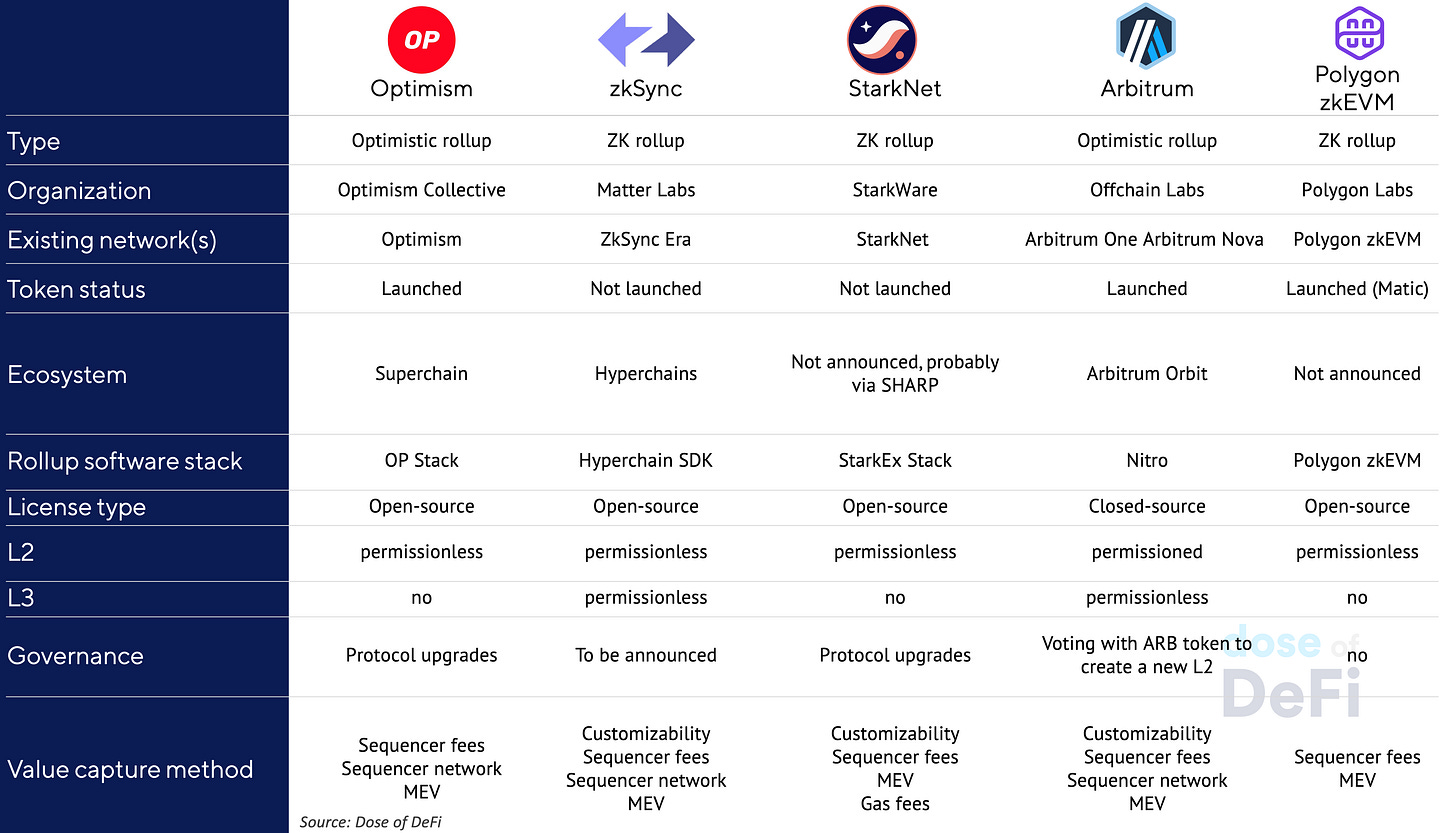

To recap, rollup know-how provides enhanced pace and throughput by working as an unbiased, high-performance blockchain that shops compressed archives of transactions on an L1 community. Optimistic rollup know-how has been efficiently deployed within the type of initiatives similar to Arbitrum and Optimism, which have reliably served customers for nearly two years. In the meantime, zero-knowledge (ZK) rollups like Starkware, zkSync and the Polygon zkEVM lastly absolutely opened to the general public over the previous few months.

That these rollups have confirmed viable means consideration can now flip to the practicalities of launching and sustaining a whole lot (1000’s?) of rollups. And with this, lastly attaining blockchain scalability. To win the following part, current rollup initiatives have to have a technical structure that limits deployment prices and permits for some composability inside the rollup ecosystem. This might permit simple motion from rollup to rollup with out instantly interacting with Ethereum. These initiatives – which we are going to go into additional element on beneath – should additionally embody sustainable worth seize strategies to lure customers and builders.

If these multi-varied rollup ecosystems reach scaling Ethereum, it signifies that Cosmos (and Solana, and even Polkadot) might be “swallowed by Eth flavored variants of Cosmos originated ideas like roll apps and Eigenlayer,” in the words of Cosmos OG Zaki Manian. And if the rollup ecosystems change into core blockchain infrastructure, they should take care of the thorny issues of decentralization and MEV.

Arbitrum launched Ethereum’s first optimistic rollup in September 2021 (Arbitrum One), adopted by a less expensive however much less safe optimistic rollup (Abritrum Nova) in July 2022.

In March this yr, it introduced Arbitrum Orbit, a imaginative and prescient for chains constructed on prime of Arbitrum One or Arbitrum Nova. It refers to those as “L3 chains” and hopes to draw builders in search of customizability. Anybody can fork and “modify the Arbitrum source code as they see fit.” These L3 rollups can pay ETH to the Arbitrum sequencers for transaction charges.

There may be one other means for Arbitrum to seize worth. Whereas creating a brand new L3 is permissionless, launching an L2 much like One/Nova is permissioned. To create a brand new L2 chain, approval from the Arbitrum DAO is required. This can be achieved via the governance proposal mechanism. Such a proposal necessitates holding 5 million tokens in a pockets to be submitted. Tasks considering launching Arbitrum stack-based L2s will drive the demand for ARB tokens. Curiously, this course of is considerably much like Polkadot’s method, the place chains should deposit DOT tokens to safe a ‘slot’ and share Polkadot’s safety.

Optimism launched its Optimistic Rollup quickly after Arbitrum in December 2021. Earlier this yr, Optimism revealed the OP Stack and the Superchain, its vision to “merge Optimism Mainnet and other chains into a single unified network of OP chains”. The Superchain shares the identical community of sequencers, and eliminates the necessity for a separate bridge for every chain.

Any mission may launch an OP rollup on the Superchain; it operates on an open-source MIT license. It’s doable to vary Optimism Stack’s code in keeping with a mission’s wants, nonetheless this might require establishing its personal safety measures, because it would not be suitable with Superchain.

The primary member of Superchain is Coinbase’s Base; Conduit will be part of the community later. Opclave and Restaking.wtf are additional platforms that may use this particular mannequin. Opclave is an enhancement to the OP Stack that allows customers to create and make the most of non-custodial wallets, utilizing contact/face ID authentication on Apple units, with out the necessity for seed phrases. However, Restaking.wtf offers the potential to make use of any ERC20 token to concurrently validate a number of on-chain belief networks. This platform will play an important position in decentralizing Optimism’s sequencer.

In the future, Optimism will use a community of sequencers the place to change into a sequencer, one should deposit OP tokens, driving the demand for it. General, Optimism’s “OP-chains” are actually much like “appchains” on Cosmos as a result of they permit for the event of numerous decentralized purposes on devoted chains. Cosmos-SDK is equal to Optimism Stack.

Optimistic rollups got here to market first, however ZK rollups are thought-about technically superior as a result of they use validity proofs versus fraud proofs, which drastically lowers the time to L1 finality (sidenote: the distinction between ZK rollups and optimistic rollups is a superb ChatGPT immediate). The three most promising ZK initiatives with outlined launch plans are zkSync, Starkware, and Polygon’s zkEVM.

-

zkSync could have an ecosystem of Hyperchains which might be all related to the Basechain. The Basechain shouldn’t be totally different from another Hyperchain, however instantly settles its blocks on the L1 Ethereum and features because the default computational layer for general-purpose good contracts, plus acts as a settlement layer for all different Hyperchains (L3 and past). Hyperchains may be developed and deployed by anybody in a permissionless method. Nevertheless, to make sure belief and seamless interoperability, every Hyperchain should be powered by the very same zkEVM engine as the first zkSync L2 occasion.

-

StarkNet constructed by StarkWare is one other ZK answer. It launched an alpha on Mainnet in November 2021, however was not made publicly accessible till March. As per its newest announcement, its code may also be open-sourced, however not for launching forks of StarkNet, however only for the sake of transparency and having extra eyes to evaluation the code. Starkware has not unveiled technical plans or instruments to make it simpler to launch a Starknet or make them interoperable. Not like Optimism and Arbitrum, StarkNet’s token shall be used for paying transaction charges (as a substitute of ETH) and likewise for staking within the community’s consensus mechanism, and as a governance token (formal governance construction has not but been determined).

-

Polygon can be engaged on a zkEVM solution, Polygon zkEVM. Curiously, it would settle on to Ethereum, to not the prevailing Polygon PoS chain. One may say that the Polygon staff used to scale Ethereum with a sidechain and is now additionally scaling it with a zkEVM. Nevertheless, it seems like they aren’t constructing an ecosystem of Hyperchains; they most likely don’t see a market alternative for a multi-rollup ecosystem and need initiatives to launch as smart-contracts in an ‘old-school’ means.

Regardless of the know-how, initiatives might want to have a sustainable system with a purpose to absolutely scale and attain the community impact of a big ecosystem. In all of the complexity of open/closed-source licenses, permissioned and permissionless L2 and L3s, we determine three main worth seize strategies amongst rollup initiatives that may foster a sustainable ecosystem.

-

First, for circumstances the place it’s doable to repeat the software program code, free assist and ensures are solely given if the code is precisely replicated. Nevertheless, when customizing the code to suit the mission’s particular necessities, the rollup developer both waives the ensures (OP Stack-based ‘Hacks’), or requires the mission to pay for the code in some kind.

-

Second, rollups go the transaction charges paid by customers to the sequencers. These sequencers carry out very important duties and bear operational prices similar to upkeep and cloud supplier charges. It’s cheap to seize worth inside this technique module. This has been applied in numerous methods, at L2 degree like within the Optimism Superchain, or at L3 degree like in zkSync Hyperchain or the Arbitrum Orbit case.

-

The third methodology of worth seize includes governance tokens of the initiatives. It’s extremely seemingly that almost all of rollups will transfer in direction of decentralization, requiring their tokens to be staked with a purpose to be part of the shared sequencer community. Some rollups have already announced such plans, and we count on others to observe go well with.

Looming over every thing is MEV. To this point, rollups have operated with a single sequencer who (graciously) declines to extract MEV. Arbitrum and Optimism have diametric views on MEV. Arbitrum nonetheless maintains that it may be eradicated or enormously lowered via truthful ordering, whereas Optimism argues for auctioning off MEV and returning to token holders.

More and more, shared sequencers are seen as the solution to each decentralization and MEV considerations. A good-ordering system, like what Arbtirum favors, requires an trustworthy majority assumption and that solely works inside a decentralized community. Alternatively, if MEV is to be democratized and distributed, as Optimism favors, a shared sequencer unlocks more MEV potential for a transaction as a result of it may be executed atomically throughout rollups.

-

Matcha releases Matcha Auto with larger safety towards failed trades Link

-

3% of US adults used cryptocurrencies for non-speculation; unbanked 5% Link

-

Dai backed by USDC decreases to 25% from 40% a month in the past Link

-

Twister Money governance assault defined Link

-

A listing of assets to know Maker’s endgame Link

-

CFTC chair says DeFi shall be regulated even when they’re ‘simply code’ Link

-

Compound v3 launches on Arbitrum Link

-

dYdX v4 deep dive Link

-

Bancor DAO hit with class-action go well with over impermanent loss claims Link

That’s it! Suggestions appreciated. Simply hit reply. Written in Nashville within the midst of potty coaching. Pleased Memorial Day!

Dose of DeFi is written by Chris Powers, with assist from Denis Suslov and Financial Content Lab. All content material is for informational functions and isn’t meant as funding recommendation.