Rising scalability has all the time been the primary precedence for blockchains attempting to seize extra customers. A fast gander at L2fees.info and L2beat exhibits transaction prices of lower than $0.01 at quite a few L2s, not far off Solana’s miniscule charges. So whereas it’s too early to say we’ve achieved scalability, we’re awfully shut.

Now, the mindshare of researchers, builders and traders turns to fixing the thorny issues that forestall mainstream adoption. Unresolved MEV points and the shortage of regularity readability are hurdles to beat, however the major impediment to mainstream adoption is the poor UX from an absence of chain interoperability, particularly amongst Ethereum L2s. To attain frictionless interoperability, researchers and builders have coalesced behind the abstraction meme, be it account or chain abstraction. Under, Zhev appears at how these purpose to enhance UX, and which meme will finally win out.

– Chris

Blockchain builders are cussed, with strong opinions. This has led to the dominance of ideologically-driven improvement that’s inflexible, and as such, esoteric debates loom bigger than the consumer preferences of the market.

Divergence amongst these ideologies has ostensibly led to the fragmentation of capital and innovation throughout siloed ecosystems. This definitely makes issues spicy and infrequently grants us front-row seats to spats of drama between these ecosystems. But there isn’t any doubt that the way forward for the “new internet” will probably be far much less tribalistic than it presently is. Ultimately.

The subsequent billion customers will not be involved with underlying ideologies. Quite, they’ll care concerning the outcomes of their transactions and finally UX. But the present fragmented panorama hinders builders attempting to construct seamless experiences.

Interoperability is vital to enhancing UX, however bridges are too clunky of their present state. A broad remodeling of mechanisms on the very base layer – the place a lot of the issues emanate – will probably be wanted for an interoperable future to stay possible.

On this piece, we consider the essential properties of blockchains that trigger fragmentation, and supply an outline of outstanding mechanisms being explored to resolve this (inside and past single ecosystems). On this approach, we take a bottom-up method to understanding the newest meme craze of abstraction at each the account and chain ranges. And the way these affect the interoperability dialogue.

Blockchains are notoriously known as a shared ledger, however these within the know name this ledger the blockchain state. On blockchains, a state is just not static. It’s all the time being up to date with extra transactions.

How these transactions are added to the state (or ledger) is known as a state mannequin, which decides what’s a sound transaction, how consensus is reached, and methods to keep a shared ledger state throughout an sincere majority of a blockchain’s nodes. Most significantly, the state mannequin specifies how a sequence ought to deal with conflicting state updates. For instance, when two transactions wish to spend the identical asset, or when two conflicting transactions wish to entry the identical state.

Blockchain interoperability means a single consumer initiates a transaction that impacts the state mannequin on two separate chains in some trustless and decentralized approach. Not all state fashions are the identical. In actual fact, the 2 largest blockchains have vastly totally different buildings.

The 2 main state fashions are:

-

Unspent transaction output (UTXO) mannequin: State is managed by monitoring particular person transaction outputs (represented as belongings) – that may both be spent or not – and the restrictions on spending them (represented because the asset’s holder). Spent outputs and their corresponding inputs are trackable to a public key, which can be utilized to approve mentioned enter for future spends by verifying key possession. Thus, every asset is tracked utilizing the final transaction during which they had been spent, and the present restrictions on spending them once more (its present holder).

-

Account mannequin: Maps an deal with to its steadiness and present state. Versus monitoring every asset within the community, this mannequin tracks every account within the community and balances for every asset on a unified ledger. All interactions in an account-based chain are implicitly interlinked, so there’s just one world tree of interdependent transactions that are each state and time-variant.

Bitcoin makes use of the UTXO mannequin, with restricted programmability. Nonetheless, this disadvantage comes with varied execution benefits. Essentially the most notable is transaction localisation, which signifies that as an alternative of making a brand new department as a part of a worldwide state tree for every interplay (as within the account mannequin), remoted state transitions could be represented and executed as an remoted native state tree.

The account mannequin, in the meantime, is usually utilized by Ethereum and different smart-contract chains. It’s much less rigorous as a result of it leaves willpower of a transaction’s state to good contracts. This makes issues a bit difficult as good contracts principally specify state modifications based mostly on the chain’s present state. Within the presence of a number of contracts, this will simply result in surprising outcomes if the present state is modified by one other transaction earlier than the good contract’s desired state change could be attained.

The important thing takeaway: so long as settlement happens on a worldwide state tree with a single-threaded and sequential execution scheme, there’ll all the time be implicit interdependence between good contracts. Which means that transactions are neither time- nor state-invariant, and could be invalidated on account of one other legitimate transaction that comes earlier than them. It additionally means a “double spend” is not obvious till a contract is executed – versus a UTXO mannequin, the place an invalid state change could possibly be decided with out utilizing any of the execution layer.

The widespread adoption of the account mannequin makes it a really perfect part to construct interoperability infrastructure. But to do that, a brand new perspective round accounts, somewhat than blockchains themselves, is required. This definitely appears in line with the broader development: Stephane Gosselin of Frontier Research lately compared the shift from a chain-centric view of crypto to an account-centric view to the shift from a geocentric worldview to a heliocentric worldview.

Ethereum accounts are decomposed into 4 fields: a nonce, a steadiness, a codeHash, and a strorageHash. These assist outline the 2 forms of accounts in Ethereum: externally-owned accounts (EOAs) and contract accounts (CAs). EOAs could be managed by anybody holding the personal keys and have empty codeHash and storageHash fields (and by extension, do not have entry to persistent storage).

CAs are managed by code deployed on to the community (aka, a wise contract). Their interactions are completely pull-based, i.e., they’ll solely ship particular transactions in response to a transaction from one other account. Thus, the actions of a CA are considerably static and predetermined by its code’s logic. They need to be constructed/derived from an account creator’s deal with and its nonce worth, and the account creator should be an EOA account with a steadiness to pay for the account’s storage utilization.

Briefly, EOAs present customers with full autonomy (i.e., they’ll start transactions) at the price of programmability (i.e. their logic is strictly constricted), whereas contract accounts take the opposite route (programmability at the price of autonomy).

Reaching interoperability is necessary as a result of to function on a brand new chain, a 3rd social gathering should ship a transaction on the consumer’s behalf. In fact, blockchains are constructed to forestall this, so new protocol guidelines should be launched.

Presently, for transactions from any account to be thought of legitimate after which executed, there are 4 checks (or what we name “constraints”) it should fulfill: 1) Authentication 2) Authorization 3) Replay safety, and 4) Gasoline cost.

For EOAs, every of those checks are constrained to make sure a single legitimate outcome. Authentication and authorisation are offered by the EOA’s personal key; replay safety is offered by the transaction’s nonce, and fuel cost should be offered by the account from which the transaction originates. These enshrined constraints restrict EOAs.

Contract accounts enable extra programmability round these validity checks. Authentication and authorisation of transactions are depending on its code’s logic, granting a number of leeway round key administration and entry insurance policies (fuel cost could also be settled by one other account, e.g., its caller). The shortage of granular constrictions permits transactions originating from contract accounts to be extra programmable, granting them coveted options reminiscent of atomicity.

Okay, now that we perceive the final construction of accounts on Ethereum and what’s wanted to ship a sound transaction, we are able to have a look at the account-based technical options aiming to boost interoperability.

Like Bitcoin, Ethereum launched solely with EOAs however first imagined “smart accounts” in 2017 with the introduction of EIP-86. Sensible accounts are supposed to mix the perfect properties of EOAs and CAs with the intention to start a brand new, composable primitive, however the course of has been sluggish and tedious.

The problem for the Ethereum group is needing to improve two various kinds of accounts (EOAs & CAs). Though researchers mentioned they had been shifting ahead with each, it all the time appeared like upgrading EOAs was much less of a precedence, given the view of many – together with Vitalik – that good contract wallets are the endgame for normal customers.

A imaginative and prescient for this good contract wallet-led future started to coalesce across the concept of Account Abstraction, which might make all accounts on Ethereum contract-based. AA would take away all deterministic constraints on accounts from the consensus layer, and outline probabilistic constraints inside the execution layer, which might create a single normal for accounts throughout the EVM world.

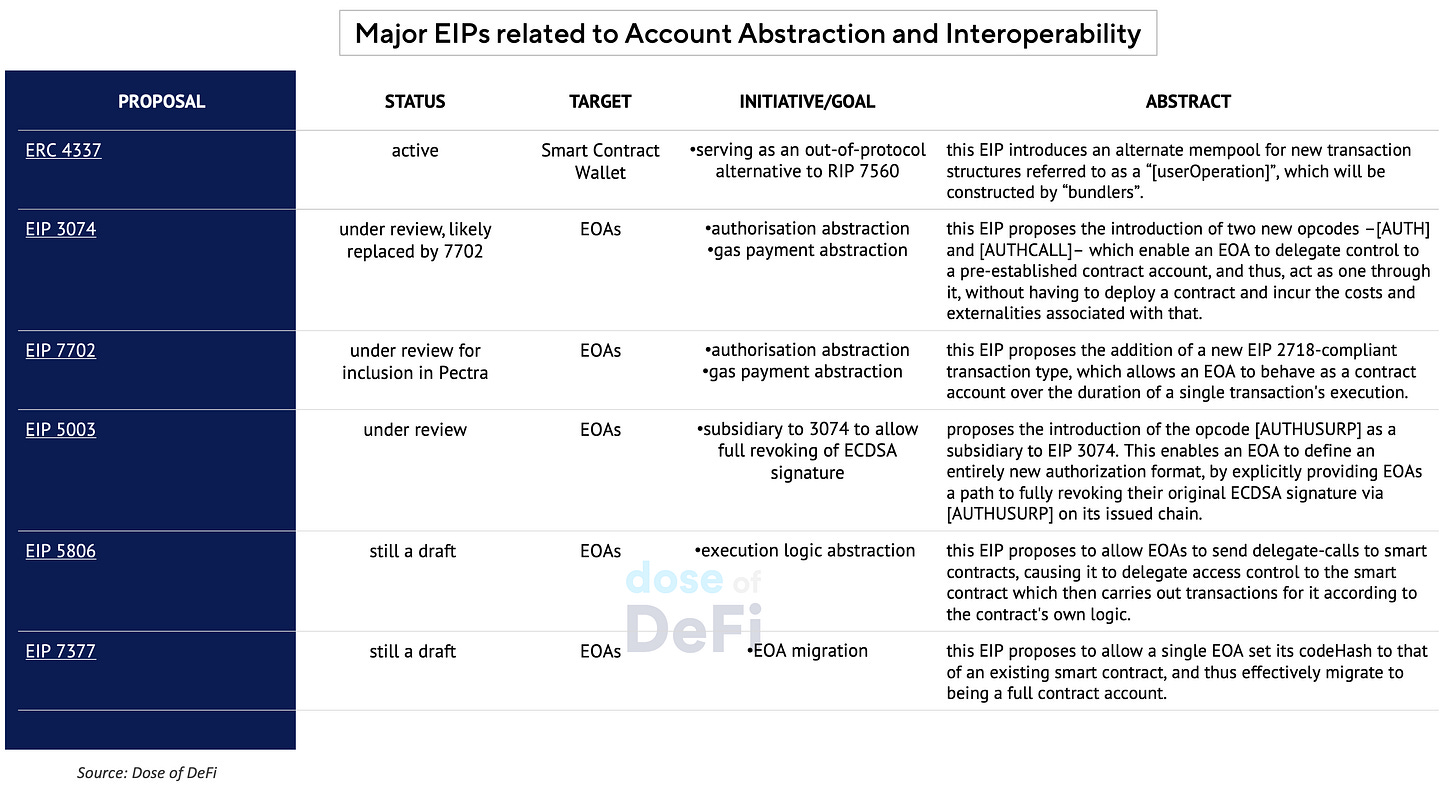

The cornerstone of this imaginative and prescient is ERC-4337, which was applied final 12 months and allows accounts to package up the actions they wish to take right into a UserOperation, which is shipped to a devoted mempool the place bundlers can put all of them right into a transaction that makes a single name.

A devoted mempool is a big step however attaining the total imaginative and prescient of AA would require a number of modifications to the Ethereum protocol, together with the consensus layer, which is all the time a delicate space. As such, Ethereum has been sluggish in implementing upgrades to its account mannequin that might improve interoperability.

So even when good contracts and AA are the longer term, EOAs are nonetheless in huge observe right now so many software builders have been pushing for upgrades alongside the push for protocol modifications to boost good contract wallets.

ETH researchers listened and deliberate EIP-3074 for inclusion within the subsequent Pectra replace, however acquired vital pushback from supporters of EIP-4337. They argued the brand new transaction kind proposed can be incompatible with EIP-4337 and solidify the 2 parallel observe fashions for EOAs and CAs. There have been additionally issues about rising censorship however the necessary level was that EIP-3074 would damage the long run imaginative and prescient of Account Abstraction and EIP-4337. There additionally might have been aggressive worries about getting new customers on good contract wallets if EOAs had the identical performance.

Responding to the pushback, EIP-3074 was withdrawn and Vitalik wrote EIP 7702 in 22 minutes to realize the identical ends as EIP-3074 however is forward-compatible with EIP-4337, and importantly, doesn’t introduce any new opcodes to the EVM.

We consider there’s a center floor that maintains Ethereum’s gradual method to attaining AA but additionally enhances the expertise of EOAs, in order that interoperability infrastructure could be constructed now. On condition that upgrading EOAs with extra programmability signifies that solely some of the deterministic constraints are faraway from current account requirements, we confer with this as “constraint abstraction”.

Constraint abstraction is taken into account a viable various on account of many elements: together with, the complexity related to absolute abstraction, EOA enshrinement in dAPPs’ UI/UX, and customers’ fears.

Having components of an account as modules somewhat than irreversibly built-in verticals opens up varied channels for interoperability. These channels that may transcend chain boundaries characterize a brand new method to fixing the fragmentation downside, and have been collectively known as chain abstraction.

Much like account abstraction – an supposed finish state with quite a few pathways to its realization – chain abstraction seeks to unify and simplify customers’ actions throughout all (most, in the event you search to be pragmatic) current ecosystems. Whereas it’s straightforward for anybody chain to level fingers and proclaim that their stack is healthier, it must be all too apparent at this level that one of the simplest ways ahead is a collaborative effort for UX simplification.

OneBalance, which emerged out of Frontier Analysis, was created with this goal: a collaborative that transcends execution environments to offer a single account normal for customers throughout all ecosystems.

It describes its proposed resolution – credible accounts – as “ultra HTLCs”, and we are inclined to agree. HTLCs are an incredible primitive that by no means acquired their medals as a result of complexity related to implementations when first ideated. Perhaps now now we have a dependable mechanism to summary this complexity from customers.

With out clear technical definitions, the distinction between account, chain and constraint abstraction is totally on the meme facet of issues. What is clear is that no matter path the trade strikes, the brand new system will probably be powered by intents and the idea {that a} set of extra specialised brokers – pushed by some definable quantity of (non-detrimental) extractable worth – can be prepared to compete to assist customers settle their requests.

Whereas there are various fanciful definitions for intents, they’re merely a consumer expressing their desired final result/purpose for a broadcasted request. A simplification of their request, eradicating pointless restrictions within the “how” of the request and putting them within the “what”.

Specialised actors known as “solvers” then take it upon themselves to determine probably the most cost-effective pathway (the “how”) that respects the consumer’s purpose (the “what”).

HTLCs didn’t take off once they had been first launched in 2017-2018 as a result of perceived complexity. Now greater than ever, with the presence of MEV-hardened solvers within the combine, it would be nice to see them get the love they deserve. HTLCs are one of many easiest iterations of a expertise powering interoperability; then again the rise and funding of intent-centric designs has proven that consumer welfare is paramount.

We consider that if crypto needs to take the onboarding downside significantly, then it should prioritize consumer welfare at each potential degree. With interoperability, we consider intent-powered HTLCs are a step in the suitable path. We additionally consider a number of the present work being branded chain abstraction is pointless; a lot of the options have existed within the shadows for a very long time on account of complexity of use. It’s now merely time for synergy.

There has all the time been a necessity for a easy UX and a want to implement interoperability. What’s been lacking is the motivation (pushed by market demand for cross-chain buying and selling) and the elevated functionality of solvers to execute the advanced cross-chain transactions. Solvers can be a superb match, however there’s a threat, abstraction additional entrenches block builders.

New improvements should now be inspired to synchronize with outdated ones with out introducing additional vaporware. And intents + HTLCs appears an incredible place to begin in redefining cross-chain UX.

-

SEC sues Consensys over MetaMask swaps and staking companies Link

-

Gnosis to launch threshold-encrypted mempools by Shutterized in July Link

-

Balancer begins planning v3 Link

-

James Prestwich on the Infinite Jungle podcast from Galaxy Link

-

Arbitrum proposes TimeBoost, a brand new transaction ordering coverage Link

-

Studying listing for Trusted Execution Environments (TEEs) Link

-

Curve founder suffers liquidation cascade on CRV-baced loans Link

-

Restaked ETH reaches $13bn (3.7m ETH) in market measurement Link

That’s it! Suggestions appreciated. Simply hit reply. Nice to have Zhev go deeper on the protocol degree. Plenty of of nice dialogue within the Ethereum analysis group this week as properly.

Dose of DeFi is written by Chris Powers, with assist from Denis Suslov, Zhev and Financial Content Lab. I spend most of my time contributing to Powerhouse, an ecosystem actor for MakerDAO. All content material is for informational functions and isn’t supposed as funding recommendation.