- Analysts predict the crucial $50K BTC assist will maintain.

- Elevated pockets actions on Bitcoin indicators long-term bullish sentiment.

The concept Bitcoin [BTC] has hit its backside isn’t confirmed. For a real backside, the worth must revisit the assist stage a number of instances.

Costs don’t often backside out and keep there; they usually type a double backside, make the next low, or transfer sideways to build up.

If the $50k-$52k stage is to carry, the worth would have revisited it 95% of the time, as we’re seeing now. If this stage isn’t the underside, the worth will fall via on this revisit.

Nevertheless, if it’s the backside, the worth ought to come again to this stage with a gradual pullback.

To be assured out there’s subsequent transfer, let the worth construct assist. Merchants and buyers can now use dollar-cost averaging or make investments when the worth confirms this assist.

Mayer A number of is on the lowest stage since 2022

The Mayer A number of measures Bitcoin’s present value towards its 200-day transferring common. This 200-day common is a well known indicator to find out if the market is usually rising or falling.

At present, the Mayer A number of is at its lowest stage because the 2022 Bear Market Backside. Should you suppose Bitcoin’s value will rise within the subsequent 6-12 months, now is a good time to purchase. This era presents a possibility to speculate at decrease costs.

Whales purchase extra BTC through the dip

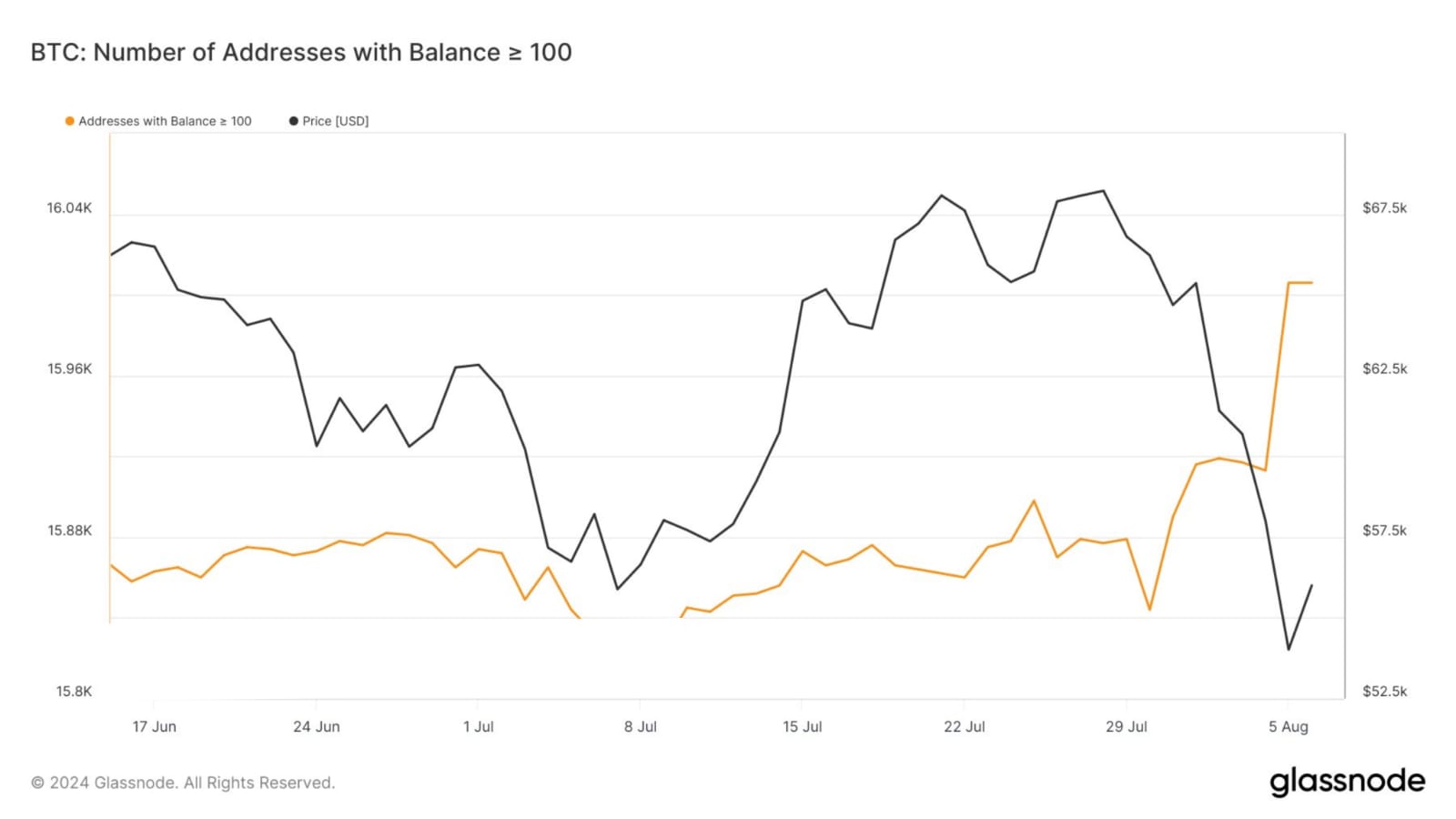

The variety of Bitcoin addresses holding over 100 BTC rose from 15,913 to 16,006 through the latest market dip, exhibiting that giant buyers purchased extra Bitcoin.

Former MicroStrategy CEO Michael Saylor, a significant Bitcoin holder, introduced he owns over a billion {dollars}’ price of Bitcoin. Knowledge from Glassnode exhibits this metric reached its highest level in 2024.

Is your portfolio inexperienced? Take a look at the BTC Profit Calculator

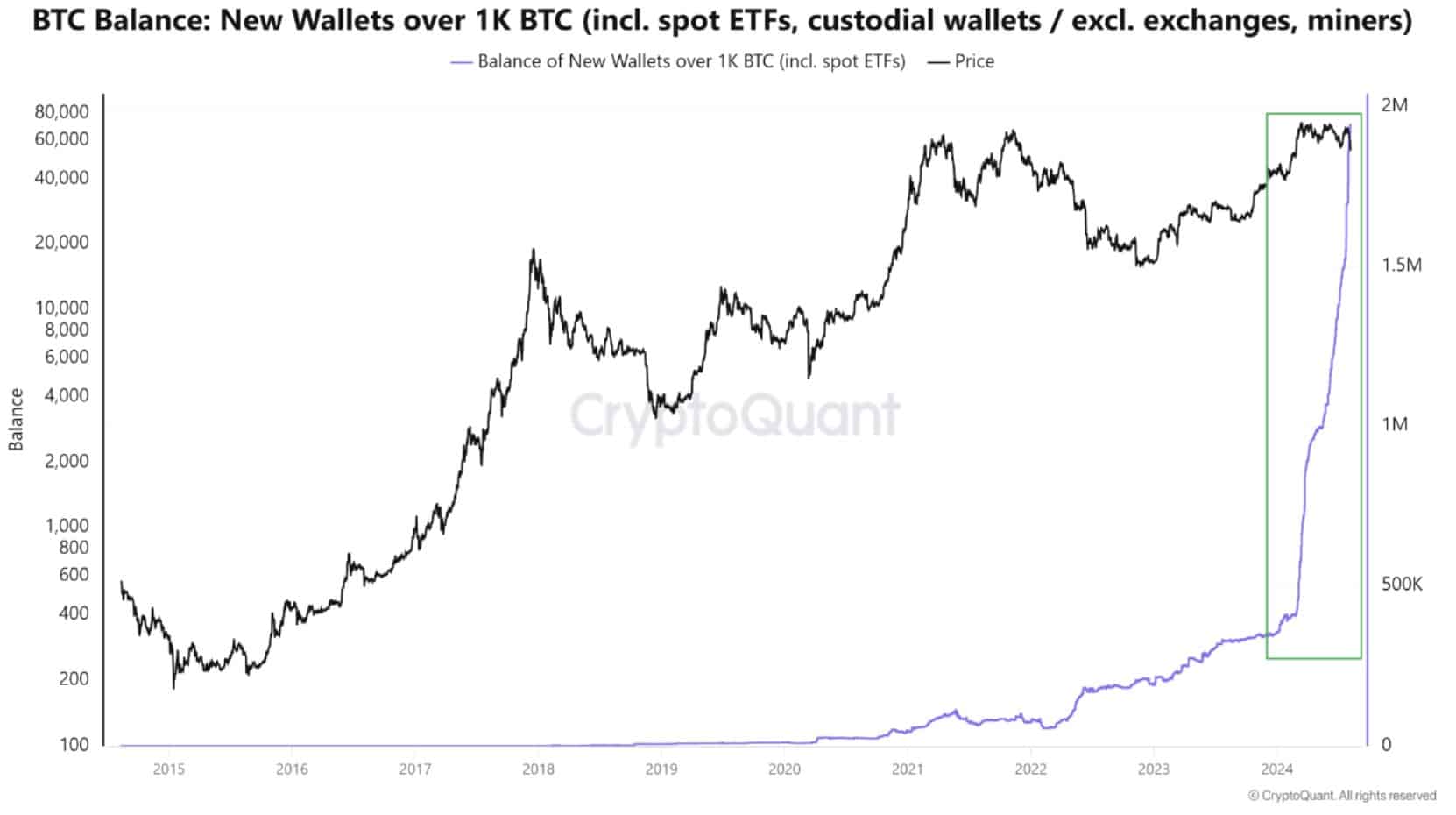

Knowledge from CryptoQuant confirmed that because the Spot Bitcoin ETF was launched, the variety of new Bitcoin wallets holding over 1,000 BTC has surged to an all-time excessive.

This improve signifies that giant, savvy buyers are shopping for extra Bitcoin, whereas smaller buyers and merchants are promoting in a panic.