As Bitcoin continues to indicate indicators of sustained energy, it’s value zooming in on probably the most extremely leveraged performs on BTC’s long-term thesis: MicroStrategy (MSTR), lately rebranded as “Strategy.” On this article, we’ll assess the size of Technique’s accumulation, study its danger/reward profile, and discover whether or not this fairness proxy may very well be primed for a interval of outperformance versus Bitcoin itself. With a number of indicators converging and capital rotation presumably underway, this can be a crucial inflection level for traders.

Technique’s Bitcoin Accumulation Soars to 550,000 BTC

It’s clear from our Treasury Company Analytics knowledge that the tempo of Bitcoin accumulation by Technique over current months has been nothing wanting exceptional. Beginning the 12 months with roughly 386,700 BTC, the corporate now holds over 550,000 BTC, a staggering improve that means a transparent and deliberate technique to front-run a possible breakout occasion.

Led by Michael Saylor, this acquisition marketing campaign has been methodical, with common weekly purchases that now whole billions of {dollars} in dollar-cost-averaged BTC. The corporate’s common acquisition value sits close to $68,500, translating to a present mark-to-market revenue of near $15 billion. With their whole spend now round $37.9 billion, Technique has develop into the biggest company holder of Bitcoin by a large margin, positioning themselves not simply as a participant on this cycle, however as a defining participant.

BTC/MSTR Ratio Alerts MSTR’s Potential Outperformance

As an alternative of solely evaluating each belongings in opposition to the U.S. greenback, a extra revealing evaluation comes from pricing BTC instantly in Technique inventory. This ratio supplies perception into which of the 2 belongings is comparatively outperforming or lagging.

Proper now, the BTC/MSTR ratio is sitting at a key historic assist degree, matching the lows set in the course of the 2018–2019 bear market backside. If this degree breaks, it might point out that Technique is on the verge of a sustained interval of relative energy versus BTC itself. Conversely, a bounce from this assist would recommend Bitcoin may resume dominance and supply the higher short- to mid-term danger/reward.

This chart alone is value watching intently over the approaching weeks. If the ratio confirms a breakdown, we might even see important capital rotation towards Technique, significantly from institutional allocators in search of publicity to a high-beta BTC proxy with public market entry.

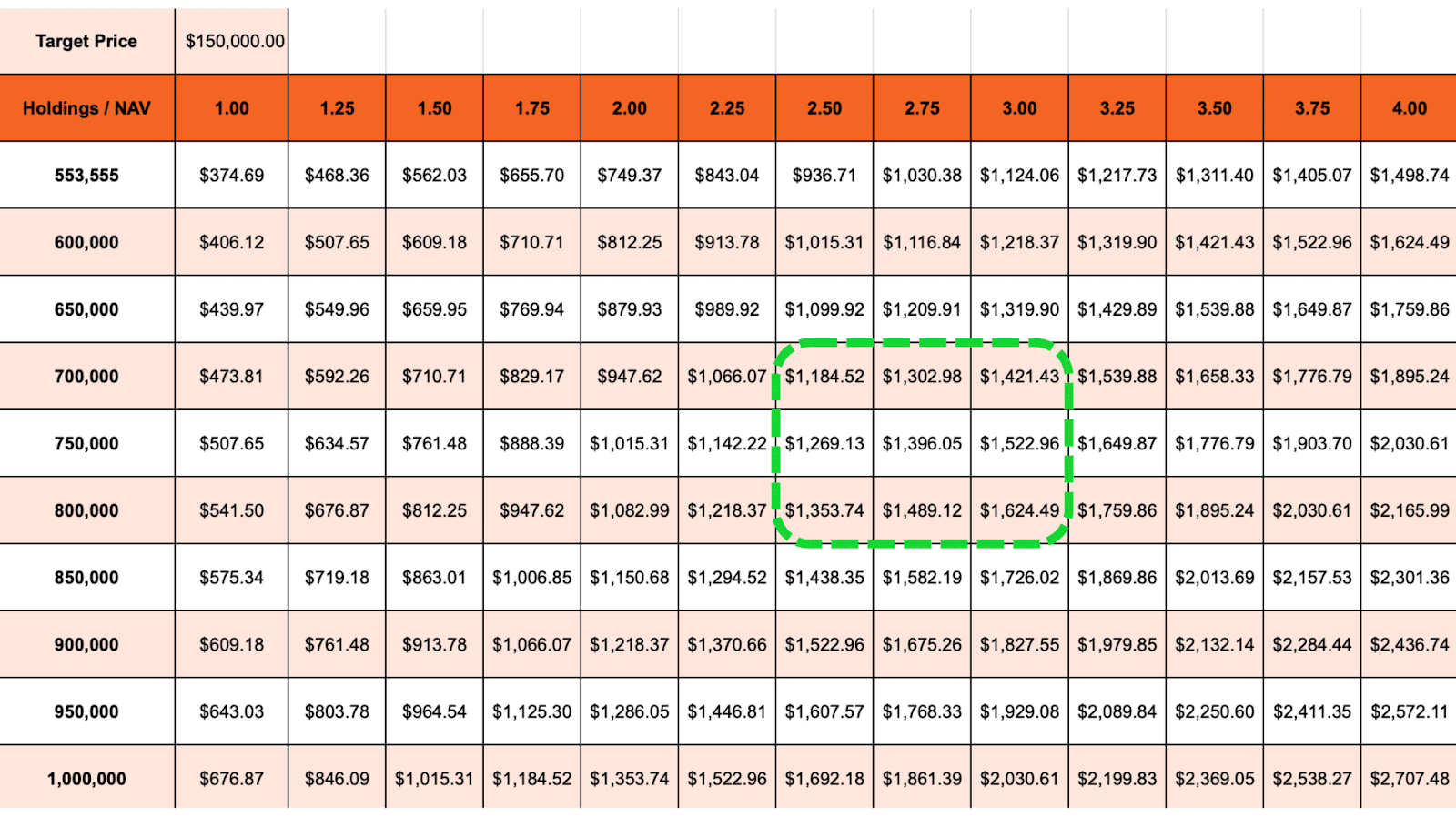

MSTR Price Targets: $1,200-$1,600 with Bitcoin’s 2025 Rally

Though predicting actual outcomes is unimaginable, we will extrapolate ahead from Technique’s present trajectory and apply believable Bitcoin cycle assumptions. At their present fee of acquisition, Technique is on monitor to finish 2025 with between 700,000 and 800,000 BTC. If Bitcoin rallies to $150,000, a generally projected peak for this cycle, and we apply a web asset worth premium of two.5x to 3x (in keeping with historic precedents that reached as excessive as 3.4x), this might yield a projected share value between $1,200 and $1,600.

These figures level to a really favorable uneven setup, particularly in comparison with Bitcoin itself. In fact, this projection assumes sustained bullish circumstances. However even underneath extra conservative eventualities, the mathematics helps the concept Technique has a significant upside benefit, albeit with extra volatility.

Technique: Excessive-Beta Proxy for Bitcoin’s 2025 Surge

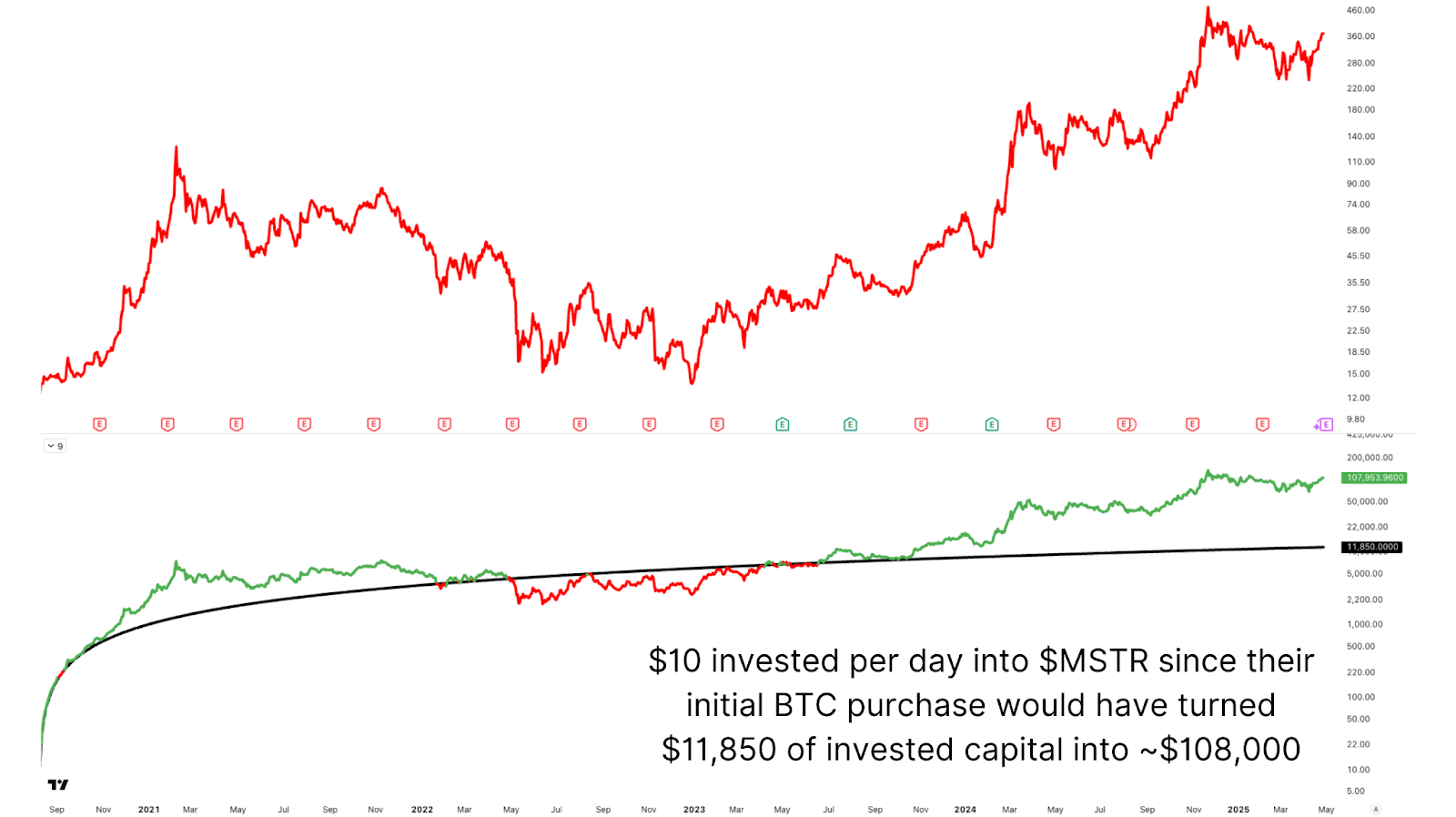

To strengthen this case additional, we will examine historic dollar-cost averaging efficiency between BTC and Technique. Utilizing the Dollar Cost Average Strategies instrument, you possibly can see that should you had invested $10 day by day into Bitcoin over the previous 5 years, you’d have contributed a complete of $18,260, now value over $61,000. That’s a formidable outcome, outperforming almost each different asset class, together with Gold, which itself has surged to new all-time highs lately.

The identical $10/day technique utilized to Technique inventory since its first BTC buy in August 2020 would have resulted in an funding of $11,850. That place would now be value roughly $108,000, considerably outperforming Bitcoin over the identical window. This reveals that whereas BTC stays the foundational thesis, Technique has provided much more upside for traders prepared to abdomen the volatility.

It’s vital to acknowledge that Technique is successfully a high-beta instrument tied to Bitcoin. This correlation amplifies positive aspects, but it surely additionally amplifies losses. If Bitcoin had been to enter a protracted retracement, say, a 50% to 60% correction, Technique’s inventory may drop by considerably extra. This isn’t merely hypothetical. In prior cycles, MSTR has exhibited excessive swings, each to the upside and the draw back. Buyers contemplating it as a part of their allocation have to be snug with greater volatility and the potential for deeper drawdowns in periods of broader BTC weak point.

Why MSTR Might Lead Bitcoin’s 2025 Rally as a Prime Proxy

So, is Technique value contemplating as a part of a diversified crypto-forward funding portfolio? The reply is sure, however with caveats. Given its tightly wound relationship with Bitcoin, Technique gives enhanced upside potential by leverage, in addition to a traditionally validated return profile that has outpaced BTC itself in recent times. However that comes with the trade-off of larger danger, particularly in turbulent markets.

The present BTC/MSTR ratio is sitting at a technical pivot. A breakdown would sign incoming outperformance from Technique. A bounce, nevertheless, might reaffirm Bitcoin because the extra favorable asset within the close to time period. Both means, each belongings stay important to look at. If this cycle enters a renewed part of energy, anticipate important institutional capital to movement into each BTC and its most distinguished proxy, Technique. The rotation may very well be quick, aggressive, and rewarding for these positioned early.

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to a rising neighborhood of analysts, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your individual analysis earlier than making any funding choices.

| CoinFN