Bitcoin is fixing cash.

Because of Bitcoin, anybody on the earth is free to switch cash over a peer-to-peer community with out having to undergo a monetary establishment. Cash that can’t be censored by authorities, devalued by governments, monopolized by firms, or stopped by borders.

Nonetheless, relating to buying and selling, going by way of a trusted third occasion nonetheless stays vital. Why is that an issue? As a result of trusted third events all the time have been, and proceed to be, safety holes.

Bitcoin Trading Is Damaged

People and monetary establishments alike depend on trusted third events reminiscent of clearinghouses and exchanges to clear their Bitcoin spot and derivatives transactions.

“Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.” – Satoshi Nakamoto, 2 Nov 2009

Sound acquainted? Sure, that’s precisely what occurred throughout the 2022 contagion occasion the place Celsius, Terra, Three Arrows Capital, BlockFi, Voyager, FTX and lots of extra collapsed. More often than not, finish customers, who trusted these third events, misplaced all the things.

Centralized exchanges are inherently insecure as a result of funds might be pooled collectively with none oversight. Trading and custody ought to by no means, ever be combined.

Trying on the above listing of bankruptcies, one might really feel helpless and declare Bitcoin buying and selling a no go. As a substitute, we took a re-evaluation and questioned: does Bitcoin buying and selling really want to happen within the books of a trusted third occasion? Actually not. And Bitcoin itself supplies the answer!

Bitcoin is a fancy and dynamic system that has not but discovered its equilibrium, and nobody can predict the last word function it is going to play. Defining Bitcoin is difficult as a result of it intersects a number of domains. Some view it as a monetary asset, others as a forex, a community, and even as an ideological manifesto.

As builders of revolutionary buying and selling options, we’re notably serious about one dimension: Bitcoin as a technical infrastructure. This technical dimension is the least seen, in all probability on account of its relative complexity, but we discover it one of the fascinating points of this Unidentified Monetary Object (UFO).

And we firmly consider that Bitcoin the protocol supplies the perfect constructing blocks for the event of sound monetary providers.

Constructing The Future Of Trading On Bitcoin

Bitcoin’s code consists of operations that, when assembled, type a script. This listing of obtainable elementary operations advanced over time, with the addition of latest operations to allow extra complicated scripts. These evolutions are sometimes gradual, however this gradual tempo helps protect the steadiness and safety of the protocol.

The best script, after all, is the peer-to-peer switch of a unit of worth. The primary buying and selling platforms had been constructed by integrating this performance: it turned attainable to switch funds immediately from a pockets to a platform for processing.

The Lightning Community is an software constructed from a extra complicated script. It permits for the risk-free and instantaneous switch of BTC. LN Markets was the primary buying and selling platform to combine this new protocol into its core growth.

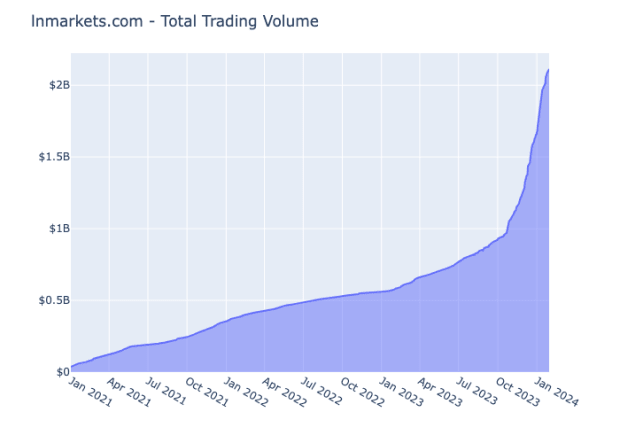

Focusing on the retail market, its worth proposition is an excessive simplification of the buying and selling expertise: it takes only some seconds for a consumer to deal with all the things from account creation to collateral switch, all accomplished immediately from a Lightning pockets. The worth proposition of immediate buying and selling introduced greater than $2 billion cumulative buying and selling quantity.

Constructing on this success, it was solely pure for us to show our consideration to Discreet Log Contracts. A DLC is a local “smart contract” constructed on Bitcoin which permits the supply of a payoff relying solely on the publication of a worth by an oracle.

At present, we expect it’s time to construct on the DLC protocol to allow full trustless buying and selling and put an finish to the pooling of funds by trusted third events.

Belief Minimized Trading On Bitcoin Is Now A Actuality

Over the previous few months, we’ve been constructing in stealth mode a trustless OTC derivatives buying and selling platform designed to satisfy the wants of crypto monetary establishments: DLC Markets.

Any form of monetary instrument might be traded on DLC Markets with nearly no counterparty threat: Bitcoin futures and choices, merchandise on hashrate and blockspace, and doubtlessly any asset on the earth.

Historically, buying and selling for establishments has all the time been centralized and standardized. In some unspecified time in the future, a clearinghouse (CCP) takes management of the funds and manages settlement. Paradoxically, regardless of technological developments, Bitcoin buying and selling is far riskier than conventional buying and selling: no regulation, buying and selling and custody in the identical place, conflicts of curiosity, quite a few dangers, and frequent bankruptcies.

DLC Markets goals to handle these points. Drawing inspiration from conventional OTC buying and selling, we’re growing a market the place members can meet and transact. Just like an ISDA/CSA settlement, collateral is exchanged immediately between friends.

To handle settlement, a sensible contract (DLC) acts as a CCP. This good contract is exclusive to every transaction, making certain segregated fund administration, full transparency for transaction members, and confidentiality from exterior actors.

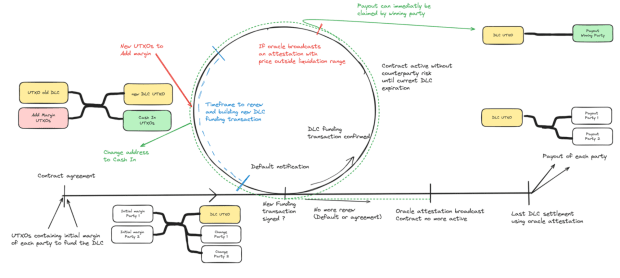

Market members can chat and submit bilateral requests for quotes (RFQ) to one another. Upon mutual settlement for a commerce, they affirm the trades parameters and submit the preliminary margin to a sensible contract on the Bitcoin blockchain. All through the lifetime of the commerce, margin calls, liquidation, and settlement might happen and unlock the corresponding final result within the good contract. The computation of any settlement is contingent solely on the publication of an impartial oracle.

The oracle is a trusted third occasion to confirm sure occasions precisely. Not like an escrow, the oracle shouldn’t be tasked with deciphering or executing the contract. No specific approval is required from the oracle to ascertain or unilaterally settle the contract. The one requirement is using information printed usually by the oracle, which is each freely out there and shareable.

Whereas conventional DLCs might be cumbersome to implement, we introduce a novel method with a coordinator to resolve the free-option dilemma when the DLC is initiated. This method additionally makes it attainable to combine margin calls, liquidation and netting within the DLC course of.

Time circulate chart of margin name steps and hedged interval for DLC with most anticipated transactions format

For a technical deep dive on our resolution, examine our white paper.

The Future Is Now

DLC Markets represents a paradigm shift, providing a trustless and safe various to the centralized exchanges which have lengthy dominated the monetary sector. You possibly can already sign up to check out our Beta!

To speed up Bitcoin as an infrastructure, we’ve accomplished the increase of a $3 million seed spherical led by ego death capital, together with Lemniscap and Timechain, becoming a member of our present buyers Arcario, Bitfinex and Fulgur Ventures. We’re very excited to companion with buyers who share our perception that bitcoin-native firms will change the world.

Welcome to a brand new period of transparency, effectivity, and resilience in derivatives buying and selling.

Extra data: https://lnmarkets.com/ & https://dlcmarkets.com/

This can be a visitor submit by LN Markets. Opinions expressed are totally their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.