- Bitcoin’s 1M 25 Delta Skew fell to -6.1%, exhibiting greater demand for calls over places within the choices market.

- Whale Trade Steadiness Change dropped to -49.7K BTC over 30 days, confirming decrease sell-side stress.

Though Bitcoin [BTC] has struggled to maintain an upward momentum and continued to commerce underneath a straight consolidation channel, sentiment stays bullish.

The king coin continues to see sturdy demand from all market contributors.

Name choices surge

In line with Glassnode, Bitcoin’s 1M 25 Delta Skew has dropped to -6.1%, exhibiting name choices now carry greater implied volatility than places.

At current, 205,447.56 BTC are allotted to name choices—round 60% of the full. Places account for simply 131,697 BTC, or 39%.

That imbalance exhibits a transparent directional bias.

When calls dominate like this, it sometimes displays sturdy upward conviction amongst market contributors.

CoinGlass knowledge confirms this pattern. Merchants seem keen to pay a premium for upside publicity, positioning for a rally moderately than hedging danger.

This construction sends a risk-on sign, supporting bullish continuation.

Whales accumulate as netflows keep unfavorable

We will see this demand throughout market contributors from each retail merchants and whales.

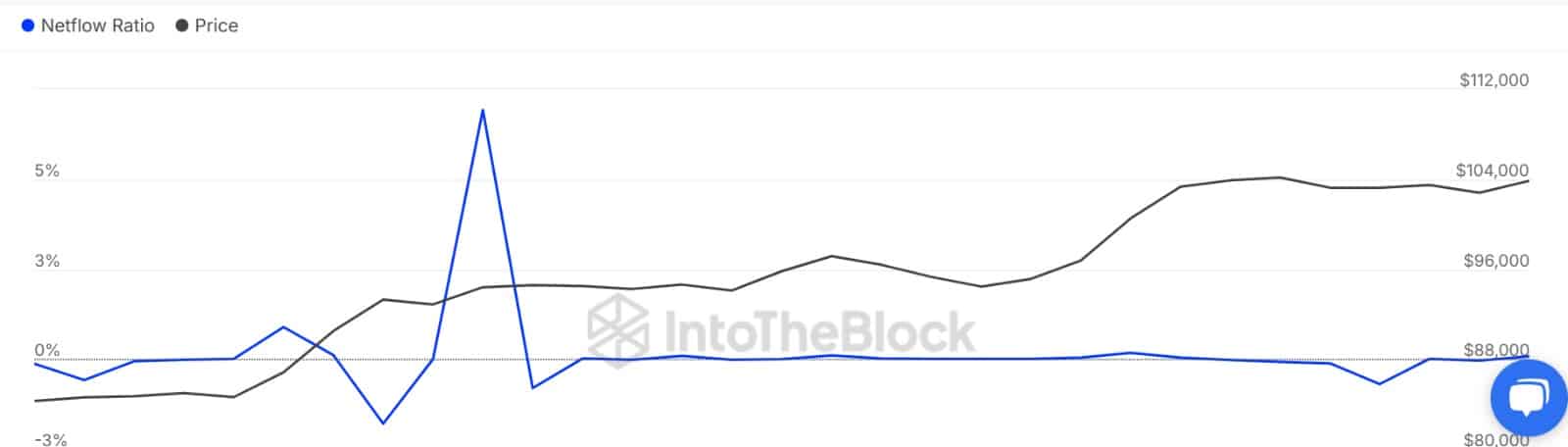

For starters, Bitcoin’s spot Netflow has held inside the unfavorable territory over the past 5 days. It sat at -$48.9 million at press time, reflecting a robust accumulation pattern.

Wanting additional, this demand for Bitcoin is much more aggressive amongst giant holders. Whales have been accumulating BTC over the past 30 days.

Thus, Whale Trade Inflows have considerably declined over the past months. For example, on Binance, whale influx has declined to hit a 6-month low.

On prime of that, Whale Trade Steadiness Change hit -49.7K BTC over the past 30 days, whereas giant whales (1K–10K BTC) confirmed a -26K stability shift.

Merely put, whales usually are not sending cash to exchanges—they’re holding tight.

Moreover, Bitcoin’s Massive Holders Netflow to Trade Netflow Ratio has dropped from 6.93% to 0.08% over the past 30 days.

This additional confirms lowered alternate influx from whales, as they’re promoting much less whereas they’re accumulating extra.

What’s subsequent: Breakout or rejection?

With name choices dominating the Futures market, it means that buyers are bullish and anticipate costs to rise even additional. Thus, merchants usually are not solely assured in BTC, however speculators are aggressively betting on it.

Demand for Bitcoin stays sturdy amongst whales and retail buyers, positioning it for potential features. If tendencies maintain, BTC may escape of consolidation and attain $107,225.

Nevertheless, if short-term holders take income, it might retrace to round $101,530.

| CoinFN