- The STH-SOPR surpassed a price of 1, suggesting doable short-term profit-taking.

- An analyst famous that Bitcoin may hit $58,000, however the retracement could be surprising.

Whether or not it’s good or unhealthy information for you, Bitcoin’s [BTC] correction has turn out to be more and more nearer than you assume. Nevertheless, there may be one main problem with the forecast that has put market gamers on reverse sides.

Will the drawdown occur earlier than the having or after?

Curiously, AMBCrypto got here throughout an opinion that BTC would right pre-halving. Across the identical interval, we observed one other analyst saying that Bitcoin would surpass its yearly excessive earlier than the occasion.

One facet takes the preliminary

CryptoOnchain, a pseudonymous writer on CryptoQuant, posted that Bitcoin may plummet to $48,000 within the coming days.

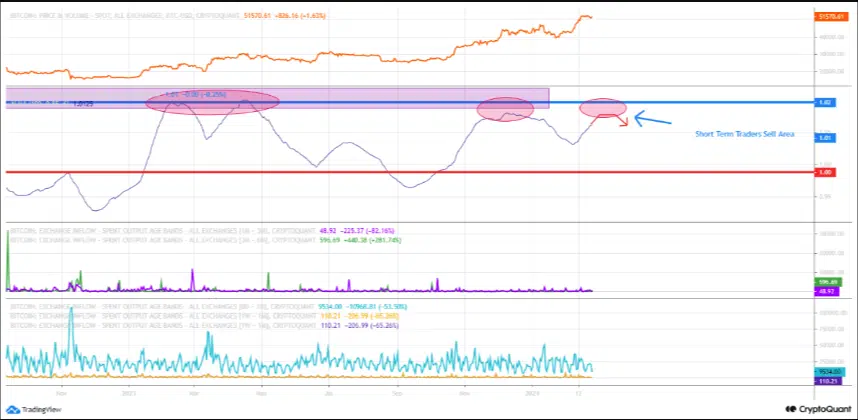

The writer made his conclusion based mostly on the Quick Time period Holder (STH) Spent Output Revenue Ratio (SOPR).

The STH-SOPR assesses the habits of short-term traders by contemplating the output youthful than 155 days. Values of the STH-SOPR over 1 counsel that traders are promoting at a revenue.

However when the worth is beneath 1, it means traders are cashing out at a loss.

Nevertheless, the chart above confirmed that the worth had risen above 1. It additionally revealed that the SOPR was at some extent the place Bitcoin’s worth corrected over the previous few months.

Along with the on-chain evaluation, CryptoQuant additionally examined the technical angle. Regarding this half, the analyst wrote,

“Bitcoin is approaching the selling area of short-term investors. Examining the technical chart also confirms this issue. Bitcoin is in the area below the resistance in the technical chart.”

The opposite sticks with historical past

Nevertheless, Michaël van de Poppe didn’t share an analogous view. In keeping with him, Bitcoin’s correction would occur, however not earlier than costs climb to $54,000 or $58,000.

In his level, the analyst additionally talked about that the decline could possibly be more durable, noting that BTC may drop as little as 40,000 after the halving.

Traditionally, Bitcoin’s worth has elevated earlier than the halving. After the occasion, the coin shreds a major a part of its worth earlier than heading for a brand new excessive.

AMBCrypto went forward to research the worth motion earlier than the final two halvings.

The second halving occurred on the ninth of July 2016. From our remark, BTC climbed to $617 earlier than the occasion. Afterward, the worth plunged.

The same incidence passed off in the course of the third halving, when Bitcoin’s worth jumped to $9,619. Weeks after the occasion, the worth considerably decreased.

Is your portfolio inexperienced? Take a look at the BTC Profit Calculator

AMBCrypto believes that Bitcoin may go both method this time, depending on the place capital rotates. If market contributors determined to drive liquidity into BTC, then the worth may rise towards $54,000.

Nevertheless, rotation into altcoins may see BTC’s worth shrink. However on the identical time, the presence of institutional cash, which was not current within the final two halvings, may change issues.