- BTC’s value moved marginally within the final 24 hours.

- Market indicators regarded bearish on the coin.

Bitcoin’s [BTC] value has been in a consolidation section for the previous few days, because it was sticking close to the $70k mark. Actually, there have been possibilities of BTC falling close to the $60k zone within the quick time period. If that occurs, then it will be the correct alternative for buyers to stockpile.

Is Bitcoin beneath risk?

AMBCrypto reported earlier that BTC’s value was in a consolidation section and was transferring in between $60k and its ATH. Our evaluation of IntoTheBlock’s data revealed that greater than 97% of BTC holders have been in revenue. At first look, this would possibly look optimistic, however in actuality, it could actually trigger hassle.

When such a excessive variety of buyers are in revenue, they typically promote their holdings to take an exit with the money, which will increase promoting stress. After we checked CryptoQuant’s data, it was discovered that BTC’s aSORP was purple.

This meant that extra buyers are promoting at a revenue. In the midst of a bull market, it could actually point out a market prime, hinting at a value decline.

In response to CoinMarketCap, BTC’s value moved marginally within the final 24 hours and, at press time, was buying and selling at $70,446.45.

Traders are nonetheless shopping for BTC

It was attention-grabbing to notice that regardless of these aforementioned purple flags, BTC buyers confirmed immense confidence within the coin as they continued to build up.

Ali, a preferred crypto analyst, lately posted a tweet highlighting that BTC confirmed a powerful accumulation rating whereas consolidating round all-time highs.

An evaluation of BTC’s metrics additionally instructed that purchasing stress remained excessive. As an example, BTC’s change reserve was inexperienced. As per CryptoQuat’s information, BTC’s Coinbase Premium was additionally inexperienced, which means that purchasing sentiment was dominant amongst US buyers.

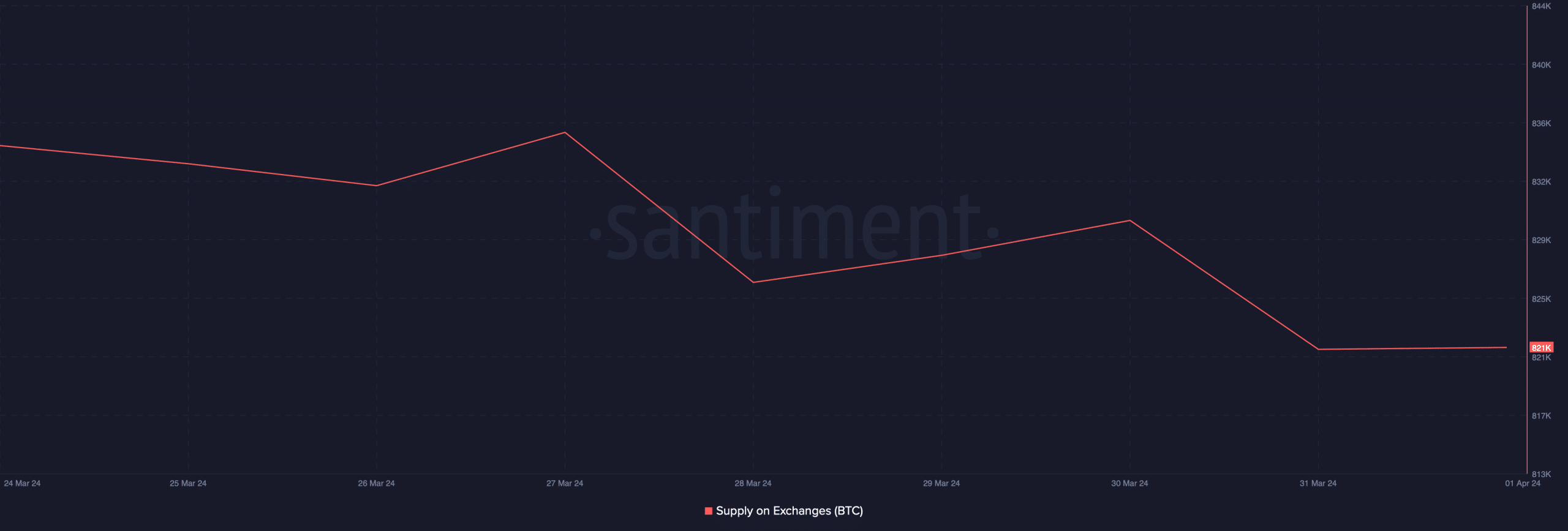

On prime of that, BTC’s provide on exchanges dropped during the last week, additional establishing the truth that buyers have been shopping for BTC whereas the coin was in a consolidation section.

Excessive shopping for stress won’t be sufficient to cease the bears, as moist market indicators instructed a value correction, rising the possibilities of BTC hitting $60k.

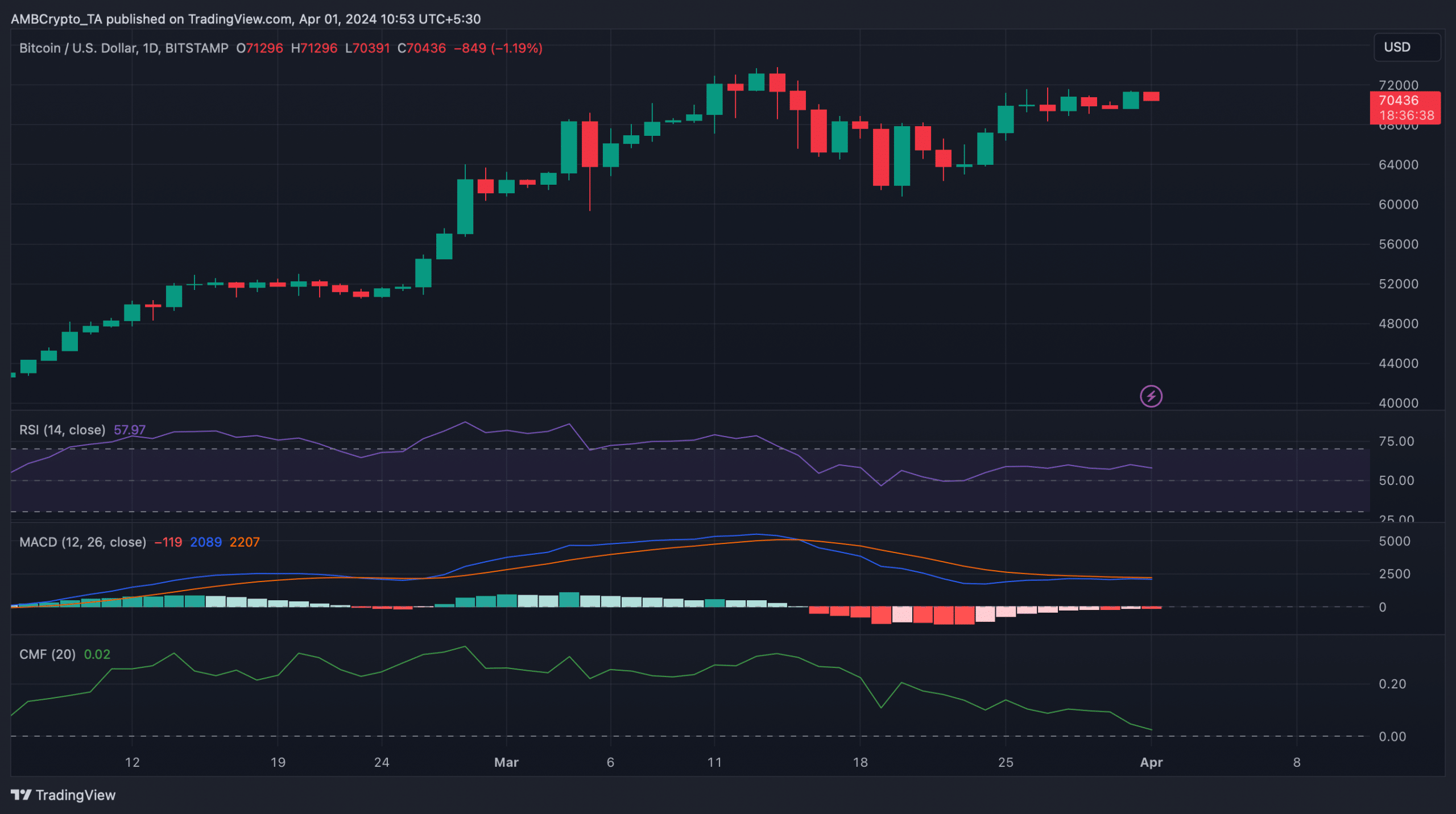

For instance, the MACD displayed a bearish crossover. The Relative Energy Index (RSI) registered a downtick after days of sideways motion.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Furthermore, Bitcoin’s Chaikin Cash Stream (CMF) went down sharply and was headed in direction of the neural mark. These indicators hinted that BTC would possibly quickly witness a value correction.

Due to this fact, buyers would possibly think about ready longer earlier than rising their accumulation.