This text relies on analysis and evaluation initially offered by Matt Crosby of Bitcoin Magazine Pro.

Bitcoin has made waves in current weeks, with the bitcoin price surging previous $95,000 after months of lackluster efficiency. For a lot of merchants and traders, this shift marks the return of the bull market that’s been long-awaited. The query on everybody’s thoughts: Can Bitcoin lastly break its earlier all-time excessive of $108,000, or is that this simply one other fleeting rally?

On this article, we’ll study the elements driving Bitcoin’s current momentum, dive into the technical and on-chain information, and talk about the broader macroeconomic context to gauge whether or not the main cryptocurrency can maintain this bullish run.

A Fast Rebound: Bitcoin’s Current Surge

Bitcoin’s value had beforehand skilled a major dip of over 30%, falling from its all-time excessive of $100,000+ into the $70,000 vary. Nonetheless, after a interval of uncertainty, the king of cryptocurrencies has regained its footing and surged again into the $90,000s. This value restoration comes after a multi-month consolidation part, which many noticed as a bearish market construction. However current developments recommend that Bitcoin could possibly be on the cusp of a significant breakout, supporting a renewed wave of bitcoin price prediction fashions coming into the dialogue.

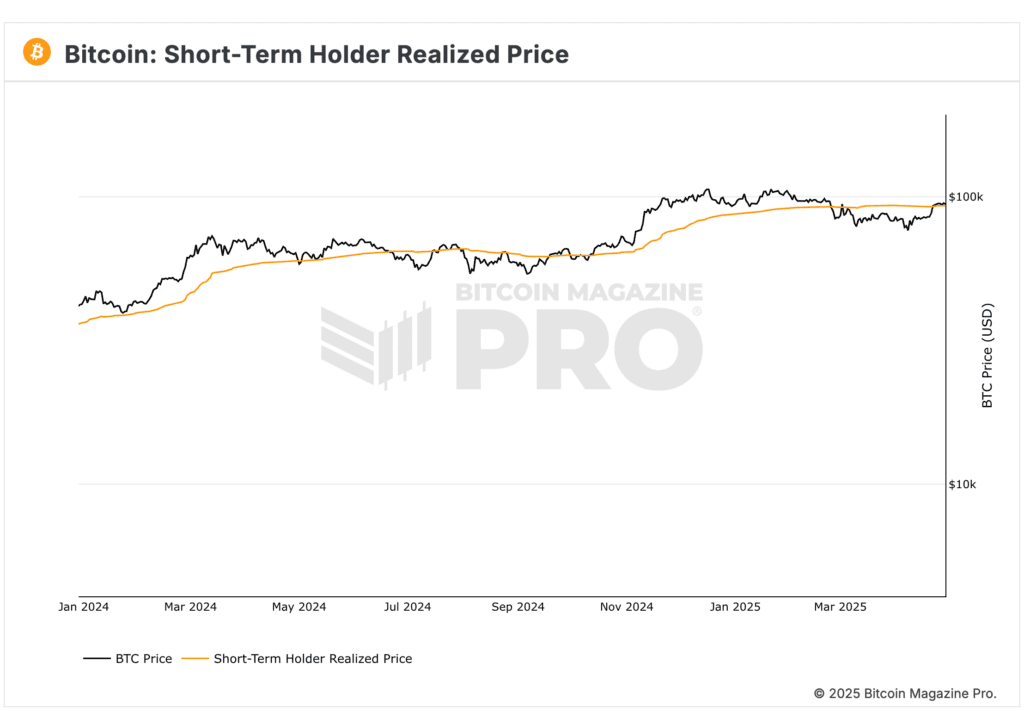

Bitcoin’s value motion has lately reclaimed a number of key ranges, together with the crucial short-term holder realized price (STH realized price), which is commonly seen as a significant sign of market energy. Traditionally, throughout bull markets, the short-term holder realized value acts as a degree of assist. When this metric flips from resistance to assist, it sometimes signifies a sturdy basis for additional upward motion.

Over the previous few weeks, the bitcoin value (BTC) has reclaimed the extent of round $93,000 to $95,000, signalling that the market could possibly be gearing up for a extra substantial rally. Provided that earlier bull cycles have seen related conduct after reclaiming key value ranges, many are beginning to really feel more and more bullish concerning the potential for a brand new all-time excessive in 2025.

On-Chain Knowledge: The Bullish Indicators of Market Energy

When analyzing Bitcoin, it’s not simply the worth motion that issues—it’s additionally the on-chain information. This information helps us perceive the conduct of market members and gives perception into the well being of the community. The current shift within the long-term holder supply is one such indicator that factors to Bitcoin’s strengthening outlook.

For the previous few months, Bitcoin had been experiencing an uncommon sample the place long-term holders (those that have held Bitcoin for over a 12 months) have been actively promoting their holdings, doubtlessly locking in income. This had led many to fret that Bitcoin’s value was close to its peak. Nonetheless, current information exhibits a reversal on this pattern. Long-term holders have began accumulating once more, which is commonly a powerful bullish sign in a Bitcoin market cycle. Traditionally, when long-term holders shift to accumulation mode, it sometimes marks the start of a brand new bull part.

Moreover, the presence of ETF inflows additional bolsters this optimistic outlook. Prior to now few weeks, Bitcoin ETFs have seen tons of of hundreds of thousands of {dollars} circulate into them, which signifies rising institutional confidence in Bitcoin. These inflows come amid a interval the place conventional markets, just like the S&P 500, have confronted volatility, however Bitcoin has managed to carry its floor and even rally regardless of broader market corrections.

The Position of Market Fundamentals: Why This Transfer Feels Completely different

There’s a elementary shift going down within the Bitcoin market proper now, one that means this isn’t simply one other transient rally. Bitcoin’s present upward momentum seems to be pushed primarily by spot-driven shopping for, moderately than over-leveraged buying and selling. When Bitcoin’s value rises as a consequence of elevated spot demand moderately than extreme leverage, the transfer is usually extra sustainable and fewer susceptible to sharp reversals.

One of many key drivers of this extra natural upward stress of the bitcoin value is the decline of the US greenback energy index (DXY). Over the previous few weeks, the DXY has been dropping, signaling a lower in demand for the greenback. This pattern has made risk-on property like Bitcoin extra enticing. As global liquidity has increased as a consequence of varied financial coverage actions, Bitcoin stands to profit from this broader market pattern. The discount within the greenback’s energy additionally indicators a possible shift in investor sentiment, with extra capital flowing into property that might outperform in a weaker greenback surroundings.

Furthermore, Bitcoin’s correlation with conventional fairness markets, significantly the S&P 500, has been a key issue to watch. For a lot of 2023, Bitcoin has shown a strong positive correlation with the stock market. Because of this when the S&P 500 rallies, Bitcoin tends to observe swimsuit. Current value motion has proven that Bitcoin has been capable of maintain its floor regardless of a short lived dip in fairness markets, additional suggesting that the bullish sentiment in Bitcoin could possibly be sustained, particularly if conventional markets proceed to rebound.

Macro Components: The State of International Liquidity

The broader financial context can’t be ignored. Large quantities of liquidity have been injected into world markets from 2020 to 2022 by central banks. Whereas this liquidity initially drove asset inflation throughout all markets, it’s now displaying indicators of positively influencing Bitcoin as properly.

Bitcoin has traditionally correlated with world liquidity traits, and up to date information means that the elevated liquidity within the monetary system is lastly beginning to influence the cryptocurrency market. Bitcoin’s current surge coincides with this rising liquidity, additional strengthening the case for a extra extended bullish part.

Nonetheless, there may be nonetheless a vital issue to contemplate: the state of worldwide equities and their potential to have an effect on Bitcoin’s value. The S&P 500, whereas displaying a powerful rebound, continues to be going through resistance at key ranges. Bitcoin’s value has been carefully linked to the broader efficiency of equities, and if the inventory market faces additional turbulence, it may dampen Bitcoin’s prospects as properly.

What’s Subsequent for Bitcoin: $100,000 and Past?

The $100,000 degree is the quick goal for the Bitcoin value, however the true query is: can it break by this resistance and push into new all-time excessive territory? The current reclaiming of key ranges, such because the short-term holder realized value and the transferring averages (100-day, 200-day, 365-day), exhibits that Bitcoin is in a powerful place to check $100,000 once more.

From a technical perspective, Bitcoin is at present at a defining juncture. If it may maintain above the $90,000-$95,000 vary and proceed to construct assist, the trail towards new all-time highs turns into more and more seemingly. The subsequent massive resistance will seemingly be round $108,000, which is the present all-time excessive. If Bitcoin can break by that degree, we may see a speedy transfer in the direction of increased ranges—doubtlessly reaching as excessive as $130,000 within the subsequent cycle.

Nonetheless, there’s all the time the opportunity of a retracement. If Bitcoin fails to carry its assist ranges or if world market situations flip bearish, we may see the worth fall again into the $80,000 vary. A bearish retest could be a crucial second for the market, as failure to reclaim assist may set the stage for extra important draw back.

Conclusion: A Bullish Outlook with Cautious Optimism

All indicators level to a possible Bitcoin rally, with sturdy on-chain information, a good macro surroundings, and optimistic sentiment within the derivatives markets. Nonetheless, the important thing to sustaining this bullish momentum lies in Bitcoin’s means to carry its present assist ranges and navigate potential market corrections. The sturdy correlation with the S&P 500 stays a vital issue to observe, as any downturn in equities may influence Bitcoin’s value motion.

Within the coming weeks, all eyes can be on Bitcoin’s means to reclaim $100,000 and set the stage for brand spanking new all-time highs. Whereas there’s loads of room for optimism, merchants ought to stay vigilant and ready for any potential volatility. As all the time, the important thing to success within the crypto market is to stay data-driven and regulate to the market situations as they evolve.

To discover stay information and keep knowledgeable on the newest evaluation, go to bitcoinmagazinepro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your individual analysis earlier than making any funding choices.

| CoinFN