- Whale accumulation of over 43,100 BTC and falling trade reserves sign bullish power.

- Bitcoin’s ascending triangle and rising community exercise help a possible breakout towards $98K.

Bitcoin’s [BTC] MVRV ratio has not too long ago formed a golden cross with its 365-day SMA, a sample that traditionally precedes main bullish rallies.

On the identical time, worth hovered just under key resistance, with bulls intensifying accumulation. At press time, BTC traded at $94,650.57, barely down 0.18% on the day.

Subsequently, the convergence of technical and on-chain indicators is elevating expectations for a breakout. A key query now could be whether or not this setup can propel BTC past $95.3K and towards the $98K goal.

Are whales quietly getting ready Bitcoin for lift-off?

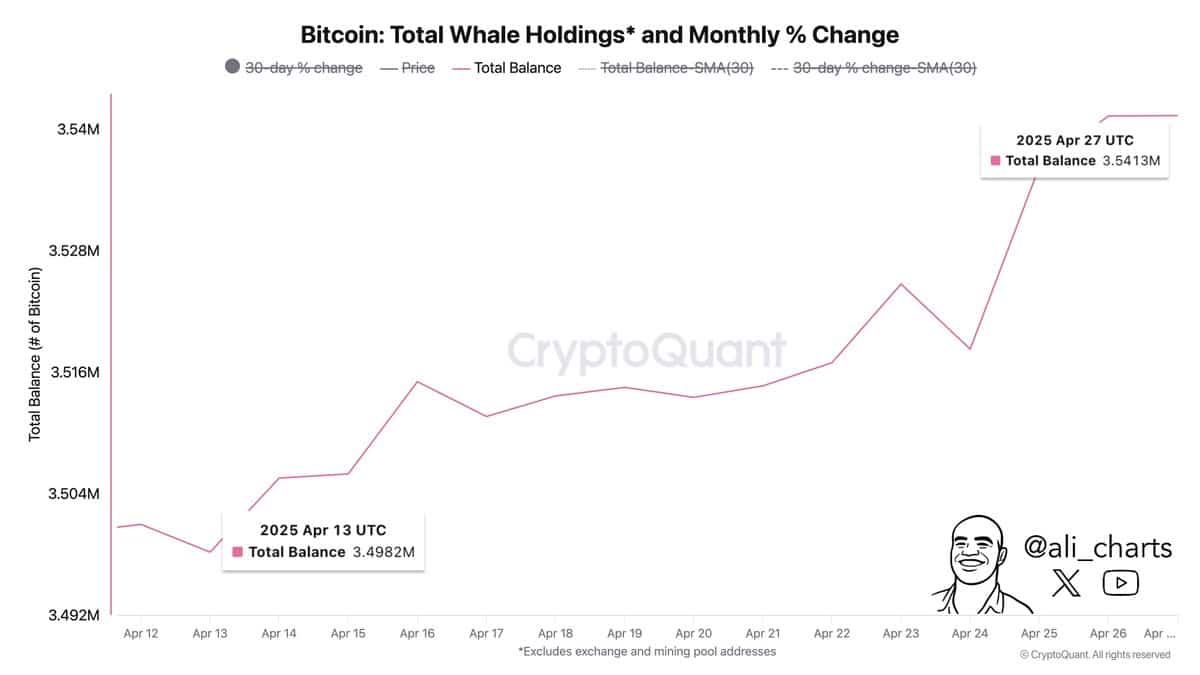

Over the previous two weeks, whales acquired 43,100 BTC, growing their holdings from 3.498 million to three.541 million BTC.

This aggressive accumulation, value practically $4 billion, indicators sturdy conviction amongst massive buyers and sometimes foreshadows bullish momentum.

Moreover, such shopping for throughout consolidation displays long-term confidence relatively than short-term hypothesis. Subsequently, this surge in whale exercise provides important upside stress and reinforces the potential for a breakout.

In actual fact, previous rallies have typically adopted such accumulation phases, particularly when costs flirted with resistance zones.

Will shrinking trade reserves set off a provide squeeze?

On high of that, Trade Reserves declined by 2.33% in simply seven days, now resting at 2.48 million BTC. This sustained decline confirms that fewer cash stay accessible on the market on centralized exchanges.

When mixed with elevated accumulation, this pattern typically signifies a tightening provide dynamic that may amplify worth surges.

Subsequently, the likelihood of a supply-driven breakout will increase as reserves proceed to say no.

Is BTC on the verge of breaking previous $95.3K?

Bitcoin was forming an ascending triangle on the 4-hour chart at press time, with worth repeatedly testing the $95.3K resistance.

Every failed rejection from resistance confirmed sellers shedding power, whereas bulls continued to use stress. Subsequently, a breakout seems imminent if bulls maintain stress.

Ought to Bitcoin shut above this threshold, it might rally towards $98K, according to historic technical habits following related formations and provide situations.

Does community exercise justify the present bullish setup?

The NVT ratio has dropped to 187.33, suggesting elevated transaction quantity relative to Bitcoin’s market cap.

This decline sometimes indicators more healthy community fundamentals and rising utility, supporting a sustainable worth transfer.

Moreover, the falling NVT ratio throughout worth consolidation signifies that the rally could also be pushed by actual utilization relatively than hype.

Regardless of bullish indicators, sentiment stays barely bearish, with 115 bears versus 111 bulls, in accordance with IntoTheBlock.

Nevertheless, sentiment typically trails behind precise market shifts, particularly when massive buyers are driving accumulation. If Bitcoin breaks above $95.3K, sentiment might rapidly reverse and entice broader market participation.

Will BTC escape towards $98K?

Bitcoin now stands at a tipping level. Whale accumulation, falling reserves, and technical power all level towards a $98K transfer.

Regardless of blended sentiment, underlying metrics argue that momentum is constructing, and if bulls keep energetic, a breakout seems inevitable.

| CoinFN