- BTC hits $64,000 for the primary time since 2021.

- Open curiosity is now near $27 billion.

Bitcoin [BTC] not too long ago made waves, showcasing important value hikes and robust strikes in a few of its metrics.

Bitcoin steps into a brand new value zone

On the twenty eighth of February, Bitcoin exhibited noteworthy value motion, closing at about $62,393 on the day by day timeframe chart, marking a notable enhance of over 9%.

Nevertheless, a extra detailed examination of decrease timeframes revealed that BTC reached a peak of $64,000 earlier than retracting to its closing vary. This over 9% surge concluded a five-day streak of consecutive will increase for BTC.

Moreover, it’s value highlighting that this value stage marked the primary time since 2021 that Bitcoin reached the $60,000 vary.

On the time of this writing, Bitcoin was buying and selling near $63,000, with an nearly 1% enhance noticed. Moreover, the latest upswing has propelled Bitcoin into the oversold zone, as indicated by the Relative Energy Index, which was at over 85 on the time of this writing.

Key Bitcoin metrics present yearly highs

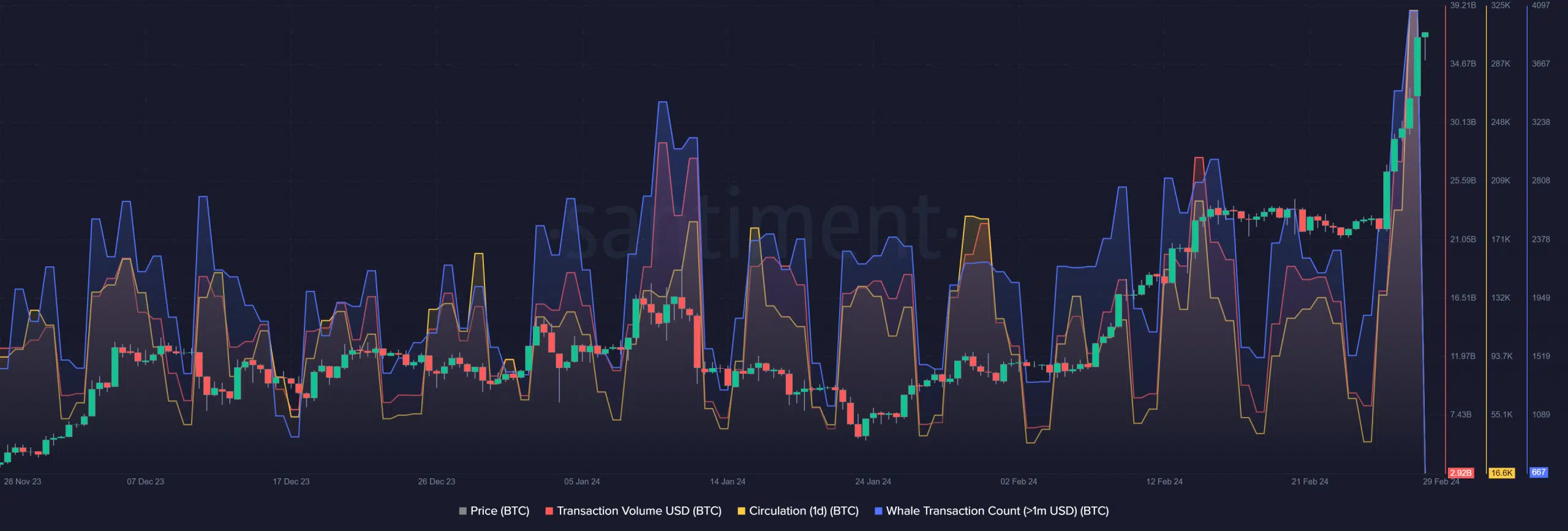

Evaluation of Santiment knowledge confirmed that Bitcoin skilled important will increase in its value, whale transactions, transaction quantity, and day by day circulation. These metrics have reached unprecedented ranges since 2022.

By the tip of twenty eighth February, transaction quantity rose to over $38 billion, whale transactions exceeded 4,000, and day by day circulation surpassed 322,000.

On the time of this writing, transaction quantity was nearing $3 billion, whale transactions had surpassed 600, and day by day circulation had exceeded 16,000.

Moreover, an examination of BTC quantity confirmed that it closed at over $80 billion on twenty eighth February, reaching a peak. Presently, the quantity is over $93 billion, marking the primary time since 2022 that it reached these elevated ranges.

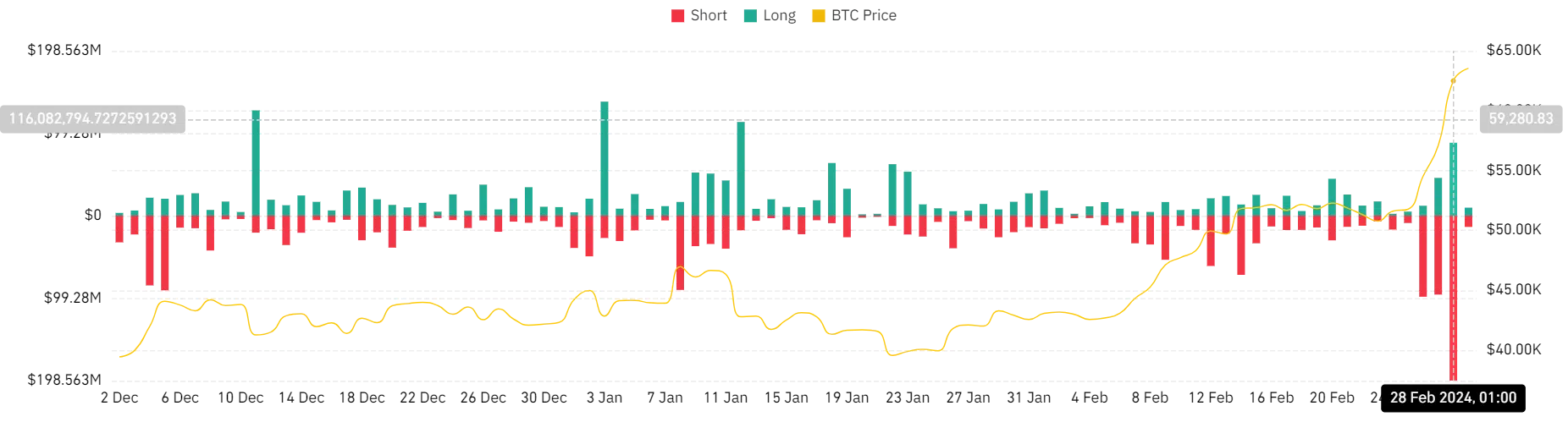

Quick and lengthy positions take important hits

The notable surge in Bitcoin’s value led to a considerable liquidation of positions, in response to knowledge from Coinglass. On twenty eighth February, the BTC liquidation quantity was over $286 million.

An in depth breakdown revealed that brief positions skilled essentially the most important liquidation, totaling over $198 million. Compared, lengthy positions noticed almost $88 million in liquidation.

Is your portfolio inexperienced? Take a look at the Bitcoin Profit Calculator

Apparently, regardless of the substantial liquidation quantity, there was a steady inflow of funds into BTC.

An evaluation of the Open Curiosity metric confirmed a surge to its highest level in months, approaching $27 billion on the time of this writing.