The beneath is an excerpt from a current version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Because the Argentine financial system is racked by document inflation, its persons are turning to Bitcoin as a strategy to defend their financial safety.

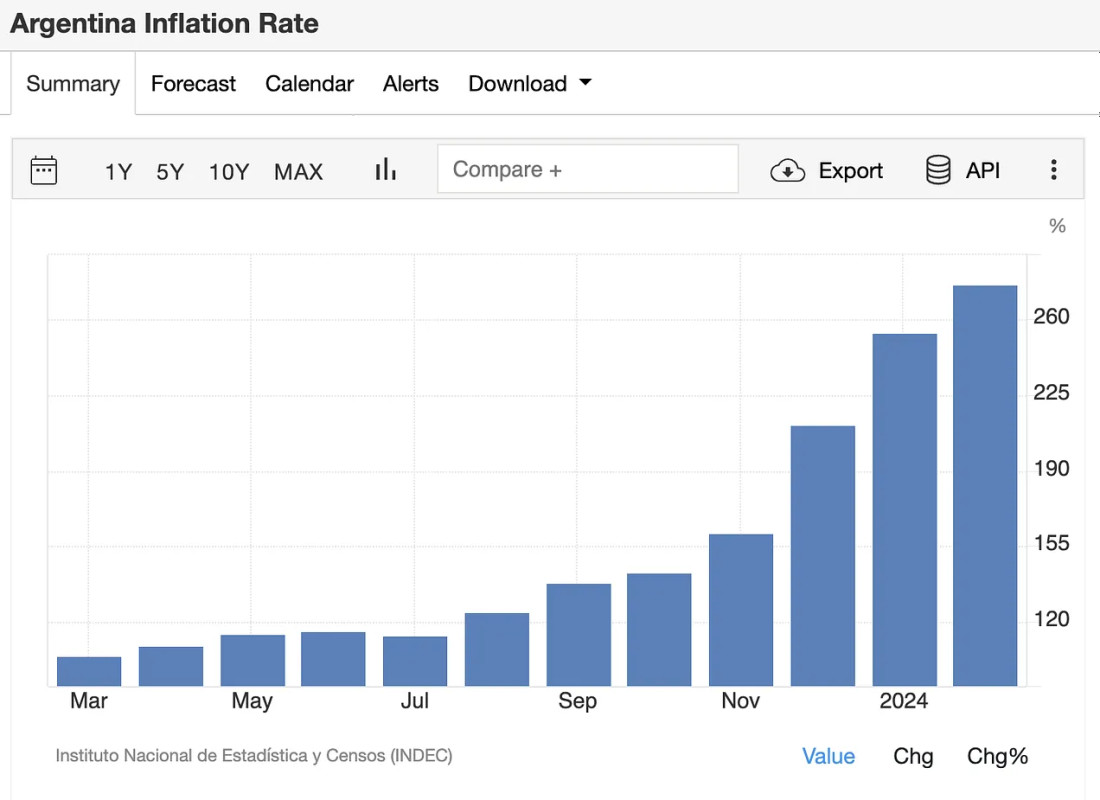

The Argentine Republic is at the moment experiencing the worst inflation charges on this planet. The nation’s financial system has skilled low ranges of inflation, someplace round 25%, for many years; but the pandemic sharpened a downward development to devastating impact. The inflation charge hit 70% in 2022 and reached 100% the next February, however 2023 proved to be a completely murderous 12 months for Argentina’s financial system. Inflation charges crossed the 200% level across the time that Bitcoin-friendly president Javier Milei first took workplace in December, and the speed at the moment sits at a mind-boggling 274%. With figures like this, extraordinary residents’ wages and life financial savings have evaporated virtually in a single day, and persons are wanting in direction of extra radical options to get their lives on observe.

In a very encouraging growth, extraordinary residents are turning to Bitcoin in document numbers for its traditional use-case as a retailer of worth. Already a nation with a high charge of Bitcoin acceptance, Argentina has doubled down on the decentralized forex as the preferred native alternate experiences 20-month highs in buying and selling quantity. Lemon Money, the alternate in query, claimed that Bitcoin transactions within the first full week of March 2024 had been greater than double the common charge all through 2023. Belo, one other outstanding alternate primarily based within the nation, reported year-to-year will increase that had been nearer to tenfold. A very attention-grabbing wrinkle within the growth is that Bitcoin will not be solely changing {dollars}, but additionally dollar-backed stablecoins which noticed buying and selling volumes lower by 60-70%. Belo’s CEO Manuel Beaudroit said that “The user decides to buy Bitcoin when they see the news that the currency is going up, while stablecoin is more pragmatic and many times used for transactional purposes, as a vehicle to make payments abroad”.

Satirically, Bloomberg claims, a few of President Milei’s financial positions have truly influenced the swap from the greenback to Bitcoin, however by way of some sudden and oblique means. The unconventional libertarian has begun his administration with a sequence of broad-reaching reforms to try to management the state of affairs, decreasing spending and making an attempt to dismantle or privatize a wide range of state-owned companies. A specific purpose of his administration up to now has been to construct a price range surplus for the federal authorities, for a wide range of causes: utilizing these funds extra intentionally, reaching targets primarily based on agreements with the Worldwide Financial Fund (IMF) and naturally starting a constructive development in Argentina’s financial statistics. A component of this surplus coverage has been to construct an analogous reserve of American bucks, decreasing their circulation throughout the nation. The alternate charge of pesos to {dollars} took a severe hit, and the once-popular retailer of worth grew to become much less enticing than the skyrocketing Bitcoin.

Reports from Chainalysis put some exhausting numbers onto these normal traits: Argentina leads all of Latin America in transaction quantity, and is second place general when it comes to grassroots adoption. Representatives from Lemon Money estimated on this report that the variety of Argentinians utilizing Bitcoin or different digital currencies is round 5M, out of a inhabitants of 45M! Such spectacular figures are usually not merely the results of a short interval of financial misfortune, however ought to as an alternative be thought-about as a type of tipping level: Bitcoin acceptance has been quietly rising for years, and now the disaster is offering the soar for it to develop into a totally mainstream fiat different. The speed of development has been so prodigious that an sudden “cousin” of the trade has even been creating, with crypto-related scam and phishing exercise rising fivefold. Clearly, the market is filled with folks new to Bitcoin’s chaotic ecosystem.

Related to the rise of unsavory exercise focusing on new Bitcoin customers, Argentina is starting to cross some new laws over the trade. The Senate unanimously passed a brand new regulation in March, opening up a brand new set of requirements that digital asset service suppliers should adhere to. The requirements are usually associated to numerous shopper safety and anti-fraud precautions, with the nation’s primary securities company set to implement these new requirements. The prevailing Bitcoin group has reacted to those new legal guidelines with consternation, fearing that this laws will result in market consolidation. Giant operations, in any case, would have the assets to adjust to these new necessities instantly, whereas smaller startups could discover themselves swamped. Nonetheless, legislators are additionally engaged on a sequence of tax exemptions for digital asset holders, that will hopefully assist easy over a few of this animosity.

Curiously absent from these proceedings, nevertheless, is President Milei. The person espoused some pro-Bitcoin views on the marketing campaign path, and has a normal financial philosophy that aligns with a few of Bitcoin’s core fundamentals, however nonetheless he has held little public presence in a lot of Bitcoin’s developments. Even the incidental rise of Bitcoin fueled by his personal insurance policies haven’t led him to make public statements on the state of affairs. Nonetheless, Milei has had his palms full from a far-reaching series of financial reforms and austerity insurance policies, balancing the boldness of world markets with a regarding rise in poverty throughout a number of metrics. Milei has managed to slow the ballooning inflation considerably, however at nice value: diminished authorities spending is pushing extra residents over the brink. As Reuters reported, the disaster is much from over, with gross sales, exercise and manufacturing all on a downward slope.

In different phrases, it appears seemingly that Milei personally has Bitcoin on the again burner, as he has a a lot larger precedence in getting the financial system below management and tempering the potential of social unrest. His normal recognition is holding up regardless of these adversities, however a contentious subject like bitcoinization could merely be a battle he’s unwilling to begin. As soon as issues relax, we could look ahead to his endorsement of Bitcoin as soon as once more, however nothing is actually sure. Nonetheless, regardless of his lack of direct Bitcoin-friendly initiatives, the legislature remains to be making constructive strikes in its personal proper. It appears not possible that Argentina will flip actively hostile to Bitcoin within the face of this inflation, akin to with Nigeria’s crackdown amidst a lagging forex.

In the end, the way forward for Bitcoin in Argentina is as much as the Bitcoiners themselves. Financial disaster has introduced the group with document highs in adoption, and Bitcoin is nicely previous a family title. Will this development proceed because the financial system recovers? Will a fledgling group of Bitcoin-related companies and builders find yourself reworked right into a dynamic and worthwhile trade? There are too many variables to say for sure. However, Bitcoin is a chaotic market that was itself based within the wake of the USA’ personal financial woes of the 2008 collapse. The worldwide group has displayed an progressive and enterprising spirit that may result in success in even probably the most marginal conditions. Bitcoin has been on the rise globally, in different phrases, and there’s no cause to doubt that it received’t hold rising in Argentina too.