- James Wynn crypto liquidation wipes out $99.3M as Bitcoin slipped beneath $105K, marking one of many cycle’s largest single losses.

- Brief-Time period Holders are exiting the market, signaling waning speculative curiosity and a possible shift in value drivers.

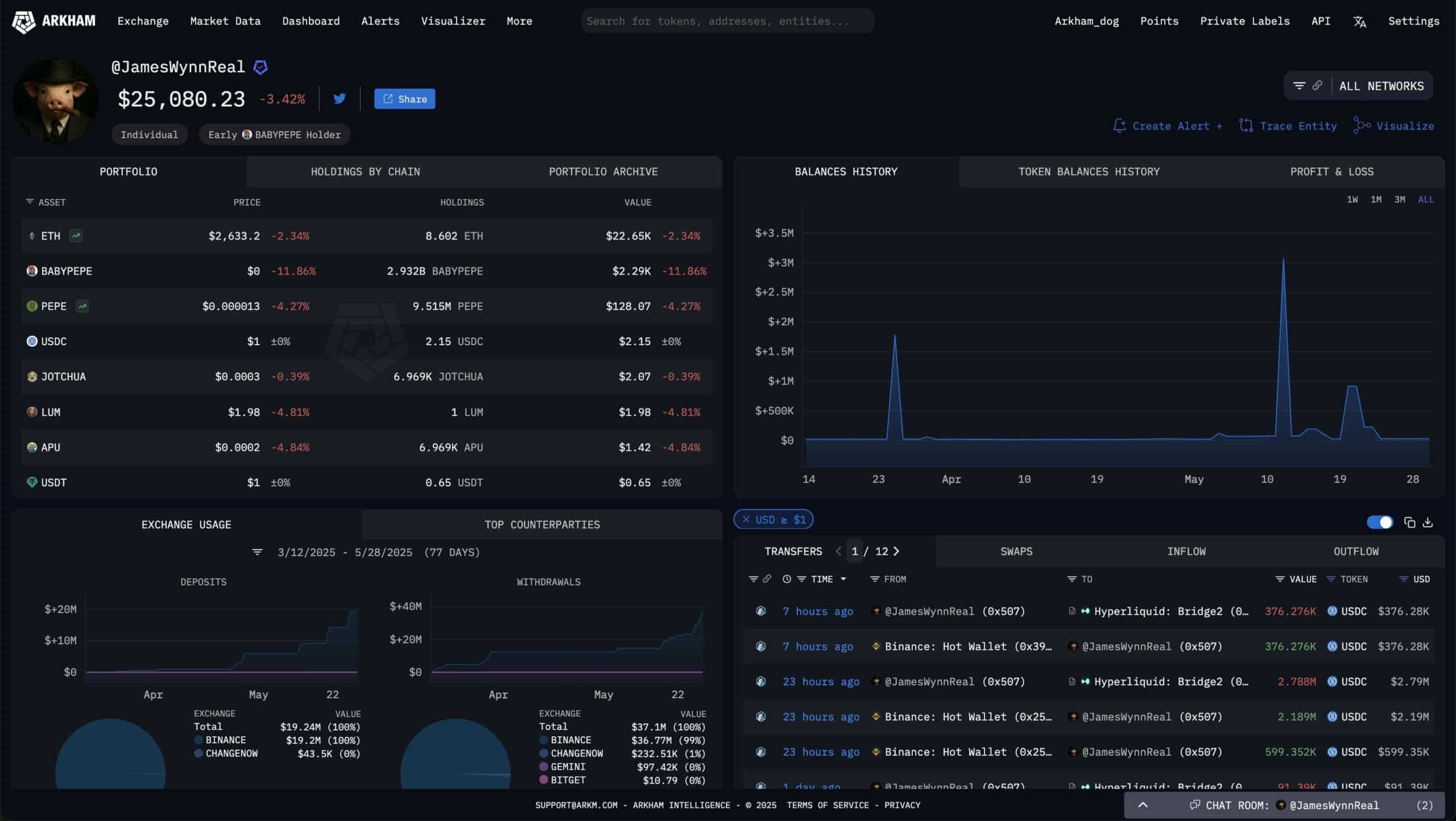

Whale investor James Wynn’s crypto portfolio has taken an unlimited loss not too long ago.

Whereas Bitcoin [BTC] briefly fell beneath the $105,000 mark, Wynn was liquidated for 949 BTC — price roughly $99.3 million.

The liquidation is due on the heels of a broader sell-off all through the market, which has triggered cascading liquidations.

The steep fall is including to Wynn’s already current woes. Final week, the whale misplaced greater than $99 million in unrealized worth as BTC failed to carry necessary assist ranges.

Bitcoin’s fall triggered mass liquidations

The dip below $105K didn’t simply shake one whale. It sparked a broader wave of liquidations throughout crypto exchanges.

Wynn’s large exit headlined a risky session.

Derivatives information confirmed Open Curiosity spiked briefly, then collapsed—traditional indicators of leveraged wipeouts taking part in out in actual time.

Brief-term holders taking a step again

The impression has not stopped being unique to whales.

On-chain information reveals an enormous discount in short-term holders following the correction. This refers to addresses holding Bitcoin for fewer than 155 days.

The autumn within the cohort indicators lowered speculative urge for food, additional sparking rising hesitance indicators amongst merchants who’ve been contributing to the present rally.

With short-term holders offloading, long-term holders’ dominance may rewrite BTC’s short-term value patterns quickly.

What this implies for Bitcoin going ahead

James Wynn’s liquidation is a narrative of warning. The occasions reveal how risky and unforgiving the present market circumstances will also be for seasoned buyers.

Although value motion has not maneuvered a transparent path, the shrinking pool of short-term holders could recommend a interval of consolidation is imminent.

| CoinFN