AT&T Inc. is an iconic determine within the telecommunications and media panorama, an organization whose roots are related with the very inception of telephonic communication. Its journey begins within the wake of Alexander Graham Bell’s revolutionary invention of the phone in 1876. AT&T began out because the Bell Phone Firm, which shortly became the American Phone and Telegraph Firm in 1885. The corporate had huge objectives proper from the beginning, aiming to attach an enormous community of telegraphs and telephones throughout the nation, making a future the place folks may speak throughout continents immediately. This dream led AT&T to develop quick, taking up smaller firms and changing into the one huge participant within the U.S. telecommunications area. By the early 1900s, AT&T was all over the place in American communication. However being on high meant AT&T was watched carefully. Its management over the telecommunications market caught the eye of presidency regulators, resulting in one of many greatest authorized battles over monopoly practices in U.S. historical past. In 1982, a court docket resolution compelled AT&T to separate off its regional firms, referred to as the “Baby Bells,” altering the trade and AT&T’s path. On this article, we’ll discover AT&T inventory worth, its future market potential and determine whether or not it’s a great funding possibility relying on T dividend historical past.

AT&T: A Fast Introduction

AT&T Inc. is a number one American multinational telecommunications firm, with its headquarters positioned in Whitacre Tower, Downtown Dallas, Texas. It ranks because the world’s fourth-largest telecom firm by income and holds the title of the largest wi-fi service within the U.S. As of 2023, it’s positioned thirteenth on the Fortune 500 listing, boasting revenues of $120.7 billion.

For the higher a part of the twentieth century, AT&T monopolized the U.S. phone service. It began its journey in 1878 because the American District Telegraph Firm in St. Louis. By mergers, it expanded into Arkansas, Kansas, Oklahoma, and Texas, ultimately changing into the Southwestern Bell Phone Firm in 1920, beneath the umbrella of American Phone and Telegraph Firm (AT&T), which itself was an offshoot of Alexander Graham Bell’s unique Bell Phone Firm based in 1877.

AT&T took over because the father or mother firm in 1899, and in 1994, it up to date its title to AT&T Corp. The 1982 antitrust lawsuit led to AT&T shedding its native subsidiaries, which fashioned the seven “Baby Bells,” together with Southwestern Bell Company (SBC), which later rebranded as SBC Communications Inc. in 1995.

In 2005, SBC acquired AT&T Corp., adopting its title, legacy, and iconic branding. This merger was accomplished on December 30, 2005. Following this, AT&T Inc. purchased BellSouth Company in 2006, bringing the final of the unbiased Child Bells and their three way partnership, Cingular Wi-fi (which had acquired AT&T Wi-fi in 2004), beneath its full possession. Cingular was renamed AT&T Mobility. The acquisition of Time Warner in 2016, finalized in 2018, aimed to create a media empire, subsequently rebranded as WarnerMedia. Nevertheless, AT&T spun off its media property to merge with Discovery, Inc., forming Warner Bros. Discovery in 2022.

Immediately’s AT&T integrates a lot of the unique Bell System, together with 4 of the seven Child Bells and the previous AT&T Corp., sustaining its legacy in long-distance communications.

AT&T: Controversies And Historical past

In 1982, U.S. regulators ended AT&T’s monopoly, making it divest its native firms into seven “Baby Bells.” AT&T saved its long-distance operations however confronted new competitors from firms like MCI and Dash.

Southwestern Bell Company (SBC), one of many “Baby Bells,” aggressively expanded by acquisitions, together with taking up different telecommunications firms and two different “Baby Bells.” It modified its title to SBC Communications Inc. within the late Nineteen Nineties.

In 2005, SBC acquired AT&T Company for $16 billion, taking up the AT&T title and model. The merger included buying BellSouth in 2006, making their three way partnership, Cingular Wi-fi, totally owned by AT&T, and rebranding it as AT&T Mobility. AT&T additionally purchased Time Warner in 2016, aiming to increase its media holdings, however spun off these property in 2021 to merge with Discovery, Inc., forming Warner Bros. Discovery.

Latest years noticed AT&T buying Mexican carriers Iusacell and DirecTV, making an attempt to purchase T-Cell (a deal that finally failed), and venturing into Latin America. In efforts to streamline and reduce prices, AT&T introduced main cost-cutting strikes in 2020, together with divesting from DirecTV and merging WarnerMedia with Discovery. The corporate additionally offered Crunchyroll to Sony and Xandr to Microsoft, marking vital shifts in its enterprise technique and portfolio.

Political Involvement And Controversies

From 1989 to 2019, AT&T was the fourteenth-largest donor in U.S. federal political campaigns, giving over $84.1 million, with 42% to Republicans and 58% to Democrats. In 2005, it donated the utmost $250,000 to President George W. Bush’s second inauguration. AT&T can also be concerned with the American Legislative Alternate Council (ALEC), a bunch that drafts conservative laws.

The corporate spent $380.1 million on lobbying between 1998 and 2019, specializing in broadband web entry rights amongst different points. It supported the Federal Communications Fee Course of Reform Act of 2013, aiming for extra clear FCC rulemaking processes.

In 2018, it was reported AT&T paid $600,000 to Important Consultants, a agency linked to President Trump’s lawyer Michael Cohen, for steerage on varied points, together with its tried merger with Time Warner and adjustments in internet neutrality insurance policies. The FCC chairman denied Cohen inquired about internet neutrality on AT&T’s behalf. AT&T was contacted by Mueller’s Particular Counsel investigation concerning these funds.

In early 2019, the Democratic Home Judiciary requested information from the White Home associated to the AT&T-Time Warner merger. Regardless of supporting LGBTQ causes, AT&T has additionally donated to sponsors of anti-transgender laws in a number of Republican-governed states.

Over time, AT&T has been concerned in varied controversies over time:

- Hemisphere Database: Since 1987, AT&T has maintained an in depth document of all calls passing by its community, sharing knowledge with legislation enforcement upon request with out court docket orders.

- Censorship: In 2007, AT&T confronted criticism for a authorized coverage that would terminate providers for harming its popularity however later revised its phrases to assist freedom of expression.

- Privateness Controversy: The Digital Frontier Basis sued AT&T in 2006, accusing it of permitting NSA warrantless monitoring of communications. Regardless of allegations and authorized battles, AT&T’s involvement with authorities surveillance, together with a large calling database shared with the NSA, has been a major difficulty.

- Copyright Enforcement: AT&T deliberate to filter Web visitors for copyright violations in 2008 however shifted to a program based mostly on content material proprietor notifications quite than direct filtering.

- Discrimination in opposition to Public-access TV: In 2009, AT&T was accused of limiting entry to native public-access TV channels, relegating them to a cumbersome menu system.

- Info Safety: Safety breaches have been an issue, together with a 2010 incident the place e-mail addresses of iPad 3G service clients had been uncovered.

- Accusations of Enabling Fraud: In 2012, AT&T confronted a lawsuit for allegedly facilitating fraudulent use of IP Relay providers, settling for $21.75 million in 2013.

- Aaron Slator Controversy: In 2015, AT&T fired an govt over racist texts, amidst protests and a defamation lawsuit.

- Overcharging Authorities Companies: In 2020, AT&T settled a lawsuit for $48 million over accusations of not offering the bottom price providers to authorities entities.

- One America Information Community: A 2021 report revealed AT&T’s vital function in supporting the far-right TV community OAN, contributing to its income and affect.

- Leaking Knowledge to Wall Avenue: In 2021, AT&T was sued by the SEC for unauthorized disclosures of nonpublic data to analysts, settling for $6.25 million in 2022.

- 2024 Outage: A nationwide mobile service disruption in 2024 affected hundreds of thousands, resulting in investigations by the FBI and Division of Homeland Safety. The FCC opened an investigation following AT&T’s declare that the outage was as a consequence of a server replace, not a cyberattack.

AT&T Inventory Price Prediction: Price Historical past

Reflecting on AT&T’s inventory worth historical past requires a dive into a long time of telecommunications evolution, market fluctuations, and strategic company selections which have formed the corporate into a world communications behemoth.

Following the divestiture of AT&T in 1984, which broke up the Bell System, the corporate’s inventory went on a brand new path. Its worth began buying and selling round $4, adjusting to the brand new market realities with out its regional bell working firms.

This era set the stage for what could be a sequence of reinventions for AT&T. The tech increase of the late 90s seemingly boosted AT&T’s inventory. This period underscored AT&T’s efforts to diversify and increase its providers past conventional telephony.

Over the subsequent few years, AT&T inventory worth made a skyrocketing rally and touched a excessive of $40 within the early 2000s. Nevertheless, the inventory worth declined towards $15 by 2005’s finish. A landmark second got here in 2005 when SBC Communications acquired AT&T Corp., resulting in the latter adopting the storied AT&T model. This transfer, aimed toward making a stronger competitor within the telecommunications area, influenced the inventory worth.

In 2007, the inventory worth once more climbed and surpassed the $30 mark. With a bearish pullback under $20 once more in 2010, T inventory worth misplaced its momentum. Although it tried to interrupt the $30 stage in 2016 and 2019, it failed to fulfill consumers’ expectations. Because of this, the value is now consolidating under $20.

AT&T (T) Dividend Historical past

A deep dive into the T dividend historical past from 1987 to the current day reveals development, adaptation, and strategic selections mirrored by its dividend funds.

Within the late Nineteen Eighties and early Nineteen Nineties, AT&T’s dividend funds confirmed a sample of regular development, ranging from $0.58 in early 1988 and growing to $0.73 by 1992. Nevertheless, a pivotal second in AT&T’s dividend historical past occurred within the early 2000s. The corporate started to regulate its dividend funds extra continuously, reflecting each the alternatives and challenges introduced on by the dot-com bubble, elevated competitors, and regulatory adjustments.

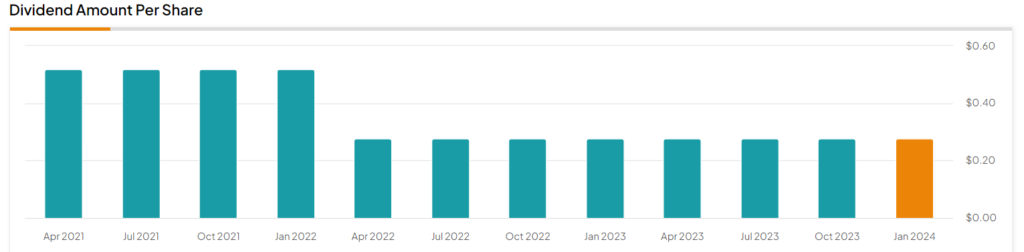

A major second was noticed in 2022 when AT&T lowered its dividend from $0.52 to $0.2775, a transfer that confirmed the corporate’s strategic transfer in the direction of lowering debt and investing in development areas like 5G and fiber optic infrastructure. This adjustment was a transparent indication of AT&T’s intent to prioritize long-term sustainability and competitiveness over short-term shareholder returns.

All through the years, the timing of dividend declarations, document dates, and cost dates have been comparatively constant, showcasing AT&T’s reliability in rewarding its shareholders.

Lately, AT&T processed its ex-dividend fee on January 9 and the quantity was $0.2775.

Function Of T Dividend

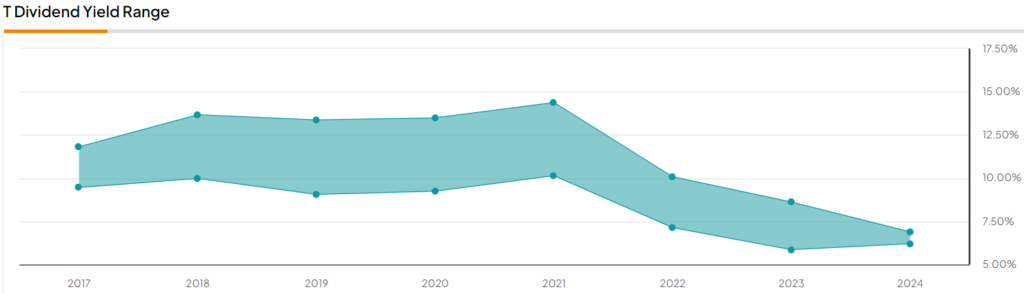

Allocating funds into shares that distribute dividends is commonly a strong method for these seeking to generate common earnings and improve the stableness of their funding assortment. One notable instance is the telecommunication large AT&T (NYSE:T), famend for its substantial dividend yield of 6.45%, considerably surpassing the trade common of two.5%. Moreover, market specialists forecast a promising development trajectory for AT&T’s shares, anticipating a rise of greater than 58% inside the upcoming 12 months.

The agency’s initiative to spice up its free money move by a discount of bills by roughly $6 billion is promising. Furthermore, its dedication to enhancing the standard of its 5G community and broadening its fiber community’s attain is a constructive signal for sustained development.

Wolfe Analysis analyst Peter Supino regards AT&T as a promising possibility for buyers on the lookout for steady, long-term development. He factors out that the corporate is enhancing its main operations, changing into extra environment friendly, and lowering its debt. Furthermore, regardless of dealing with stiff competitors, AT&T succeeded in rising its internet postpaid cellphone buyer base in the newest quarter.

On March 5, in an funding evaluation, Supino upgraded AT&T’s inventory to a “Buy” ranking from a earlier “Hold,” setting a worth goal of $21, which suggests a possible enhance of twenty-two.1% from its present worth.

Moreover, hedge funds have proven their confidence in AT&T, buying 4.8 million shares within the final quarter. Presently, AT&T is considered favorably out there, with a Very Constructive Hedge Fund Confidence Sign.

AT&T Inventory Price: Technical Evaluation

Currently, AT&T inventory has seen a noticeable surge in worth, inflicting a push in its upward journey. Nevertheless, bears proceed to defend the resistance channels, leading to a minor correction for the T inventory worth. Market situations, largely pushed by the corporate’s monetary outcomes and settlements and T dividend history, have had a constructive impact on the corporate’s share worth. An in-depth examination of AT&T technical charts reveals some bullish indicators, though they may quickly fade if sellers intensify their bearish dominance. Traders are inspired to train warning, given the unsure short-term development prospects of AT&T inventory worth. The sturdiness of a surge seems unsure, elevating doubts about T inventory’s capability to keep up its top-tier funding standing.

TradingView experiences that AT&T shares at the moment stand at $17.05, showcasing a slight uptick of greater than 0.2% prior to now day. An in-depth examination of T inventory worth signifies that whereas the downward development should be current, there’s a robust chance for a bullish turnaround because the inventory beforehand witnessed a robust bullish surge. Regardless of the inventory dealing with challenges at its instant resistance ranges, there’s an underlying potential for elevated shopping for curiosity close to instant Fib channels that would drive a constructive momentum shift. A look on the day by day worth chart reveals that T shares have discovered a assist line across the $15 mark, a degree from which the share worth may goal to beat the subsequent resistance barrier. With T inventory worth lately crossing a number of EMA development strains following a surge above $18, it’s believable that buyers could also be lured to enter lengthy positions, probably driving the share worth upwards within the following days. The Stability of Energy (BoP) indicator at the moment resides in a bullish space at 0.63, suggesting additional upward correction could possibly be on the horizon.

To completely analyze the value of T shares, it’s essential to try the RSI-14 indicator. The RSI indicator lately skilled a decline under the midline because it hovers round a promoting area at 44-level. It’s anticipated that AT&T inventory worth will quickly try to interrupt above its 38.6% Fibonacci stage to attain its short-term bullish objectives. If it fails to climb above this Fibonacci area, a downtrend would possibly happen.

Because the SMA-14 continues its upward swing close to the 48-level, it trades method above the RSI line, probably accelerating the inventory’s downward correction on the value chart. Nevertheless, if T shares break above the consolidation zone and surge above the EMA20 development line, it may pave the best way to the essential resistance of $18. A breakout above the sturdy resistance will drive the share worth towards the higher restrict of the Bollinger band at $22.

Conversely, if T inventory worth fails to carry above the essential assist stage of $16, a sudden collapse could happen, leading to additional worth declines and inflicting the AT&T share to commerce close to the essential assist zone at $13.5.

AT&T Price Prediction By Blockchain Reporter

AT&T Price Prediction 2024

The AT&T inventory is anticipated to see fluctuations in 2024, influenced by market volatility and company-specific developments. The value is predicted to achieve a minimal worth of $22.00, with the potential to climb to a most worth of $28.00. The common buying and selling worth all year long is anticipated to be round $25.00.

AT&T Price Prediction 2025

In 2025, AT&T may expertise development pushed by strategic initiatives and the growth of its digital providers. The inventory is anticipated to achieve a minimal worth worth of $23.50. The value may attain a most worth of $30.50, with the typical worth estimated at $26.50.

AT&T Price Prediction 2026

The value of AT&T is predicted to proceed its upward trajectory in 2026, supported by developments in 5G expertise and broader market adoption. A minimal worth of $25.00 is anticipated, with a attainable most worth of $33.00. The common buying and selling worth is anticipated to be round $28.00.

AT&T Price Prediction 2027

By 2027, AT&T’s investments in infrastructure and expertise may begin paying off considerably. The inventory is forecasted to achieve a minimal worth of $27.00 and will attain a most of $36.00, with a mean worth of $30.50.

AT&T Price Prediction 2028

Anticipating additional market penetration and profitable execution of long-term development methods, AT&T’s inventory may obtain a minimal worth of $29.00 in 2028. The value may peak at $39.00, with the typical worth seemingly round $33.00.

AT&T Price Prediction 2029

With the potential maturation of the corporate’s investments and continued adaptation to technological improvements, AT&T would possibly see its inventory attain a minimal worth of $31.00. The utmost worth could possibly be round $42.00, with a mean buying and selling worth anticipated to be $35.50.

AT&T Price Prediction 2030

Trying in the direction of 2030, assuming regular development and favorable market situations, AT&T’s inventory is anticipated to achieve a minimal worth of $33.50. The value has the potential to achieve a most worth of $45.00, with the typical worth forecasted at $38.00.

Conclusion

AT&T (Ticker: T) is thought to be a strong possibility for retirees and income-focused buyers, primarily as a consequence of its vital dividend yield. As of the newest evaluation, AT&T presents an annual dividend of $1.11 per share, leading to a dividend yield of 6.53%, which is larger than 75% of all dividend-paying shares. This positioning makes it a number one participant within the dividend area. The dividend payout ratio stands at 56.63%, indicating a wholesome and sustainable stage under 75%.

Analysts have blended emotions about AT&T’s inventory however lean in the direction of a constructive outlook. The common worth goal amongst 16 analysts is $20.22, suggesting a possible enhance of 18.5% from the present inventory worth. Estimates vary from a low of $14 to a excessive of $29. One other supply forecasts the inventory worth may rise to $23.13 or larger subsequent 12 months, indicating an upside potential of +20%.