- Based on Pompliano, BTC might outperform gold.

- Tariff uncertainty and weak BTC sentiment might prolong gold’s lead within the brief time period.

Gold has outperformed Bitcoin [BTC] in 2025 amid tariff uncertainty as buyers flee to it as a haven.

Quite the opposite, BTC reacted like a risk-on asset and adopted U.S. equities’ efficiency till lately. BTC has dropped 10%, whereas gold was up over 25% on a YTD (year-to-date) foundation.

In a latest CNBC interview, Anthony Pompliano, a BTC investor and founding father of Skilled Capital Investments, said that BTC might outperform gold in the long term. He said,

“Gold always leads these rallies. When gold runs, about 100 days or so later, Bitcoin always catches up and runs much harder.”

BTC vs. gold

Certainly, BTC (yellow) has a historical past of positively correlating with gold (cyan) after decoupling durations, as Pompliano said.

Per the chart, BTC and gold decoupled in early November and February however turned positively correlated once more in December and January.

Even so, gold has outperformed BTC by 37% in 2025 per BTC/gold ratio. Though the indicator retreated to pivotal trendline assist at press time, it stays to be seen if BTC might regain misplaced floor in opposition to gold.

Prior to now few days, BTC has tightly consolidated between $83K and $85K, whereas the U.S. equities dumped.

Reacting to the resilience, Bloomberg ETF analyst Eric Balchunas said,

“$MSTR up 7% YTD while $QQQ is down 10% is not something i would have predicted. I’m also surprised BTC is at $85k after all this; both good signs imo, shows toughness and counters that its just high beta version of tech.”

He added that Michael Saylor and ETFs purchased a lot BTC previously 12 months that it discovered a stronger base than previous cycles.

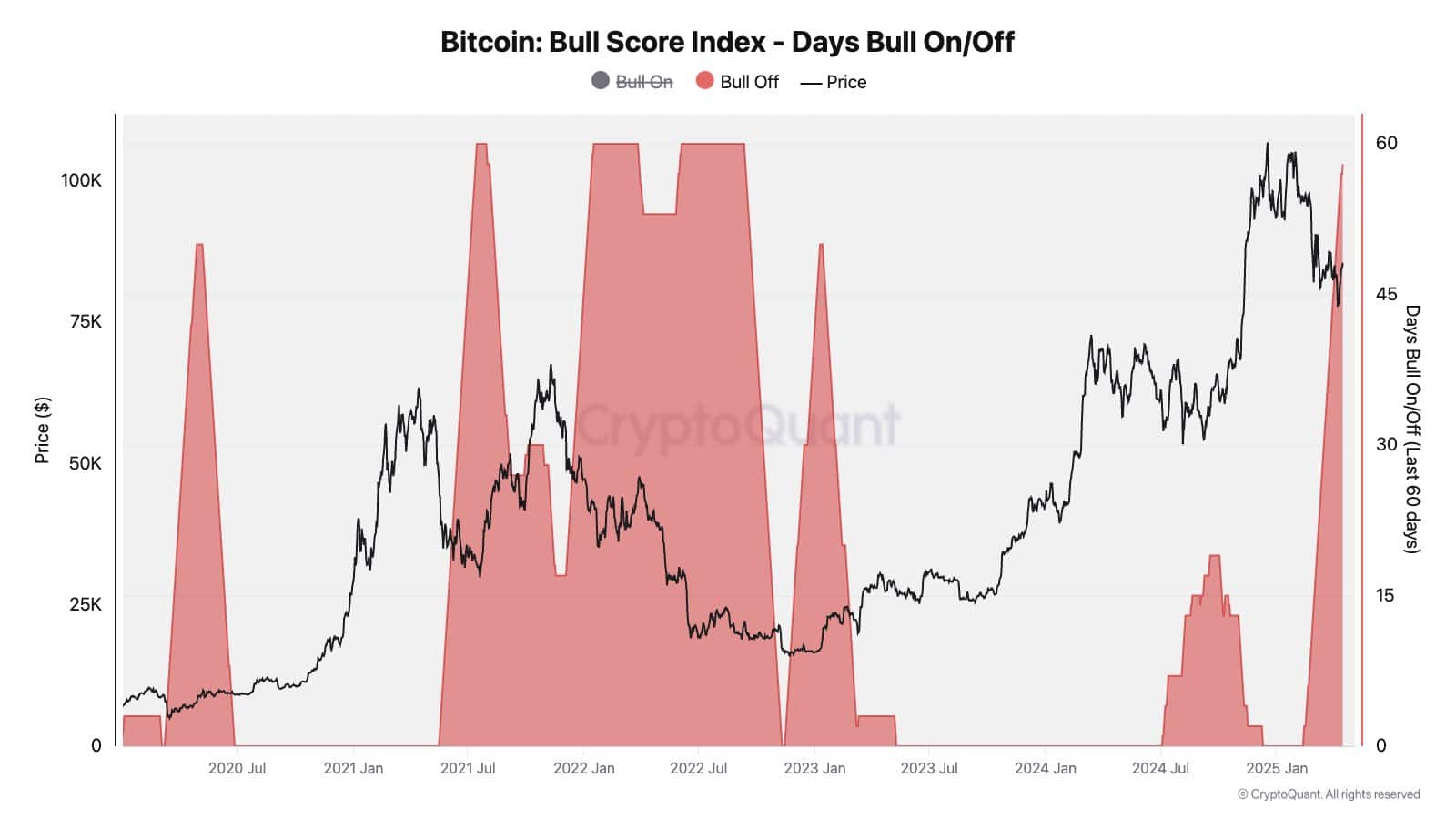

That mentioned, general demand and bullish circumstances for BTC remained elusive. Based on CryptoQuant’s Bitcoin Bull Rating Index, it has been a ‘Bull Off’ season previously 60 days.

This mirrored the weak circumstances seen throughout the 2022 crypto winter and was marked by unfavourable worth motion.

The general market sentiment has been ‘fear’ since February, and a decisive rebound might solely be decided by an finish to ongoing tariff uncertainty.

Within the meantime, the uncertainty might tip gold to increase its profitable streak in opposition to BTC.

| CoinFN