- BTC was down by 5% within the final 24 hours.

- The king coin may attain a brand new ATH by the top of 2024.

Bitcoin [BTC] has been witnessing a number of value corrections, which pushed the coin’s value beneath $65k. Nevertheless, traders should not lose hope, as BTC gave the impression to be following a historic value pattern within the buildup to the halving.

So, if historical past repeats itself, BTC may witness an extra value drop earlier than it beneficial properties momentum and reaches $100k.

Bitcoin goes beneath $65k

After touching an all-time excessive, BTC’s value was fast to plummet. In line with CoinMarketCap, BTC was down by over 10% within the final seven days.

Actually, within the final 24 hours alone, the king of cryptos’ value dropped by over 5%. On the time of writing, BTC was buying and selling at $64,509.53 with a market capitalization of over $1.27 trillion.

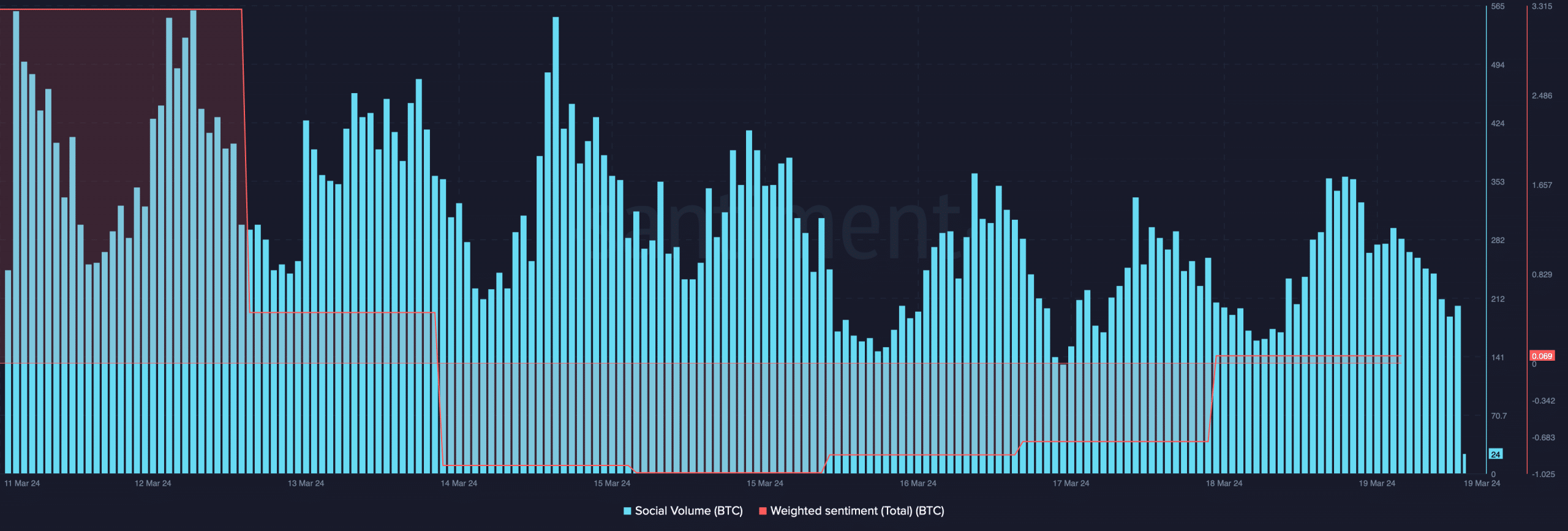

Because of the value drop, Bitcoin’s Social Quantity declined, suggesting that its recognition considerably fell. Its Weighted Sentiment additionally dropped, that means that bearish sentiment across the coin was dominant.

Nevertheless, this declining pattern was not unexpected, as Rekt Capital posted an analysis concerning BTC following a historic pattern forward of its upcoming halving.

As per the evaluation, Bitcoin first entered the pre-halving rally section. Throughout that section, BTC managed to succeed in an all-time excessive a number of days in the past.

The Pre-Halving Rally breakout was a little bit forward of schedule by a handful of days. Nevertheless, Bitcoin was slowly transitioning away from its “Pre-Halving Rally” section and into its “Pre-Halving Retrace” section.

Will Bitcoin’s worth plummet additional?

Since Bitcoin entered the pre-halving retracing section, the possibilities of the coin registering an extra value drop appeared probably. Rekt Capital’s tweet talked about that the pre-halving retrace tends to happen 28 to 14 days earlier than the halving occasion. The section resulted in 20% and 38% value drops in 2020 and 206, respectively.

This time round, BTC may as properly contact $60k.

To examine whether or not that’s attainable, AMBCrypto took a take a look at CryptoQuant’s data. Our evaluation revealed that BTC’s web deposit on exchanges was excessive in comparison with the final seven-day common, indicating excessive promoting stress.

Two extra bearish indicators have been its SOPR and Binary CDD, as each of them have been crimson, hinting at excessive promoting stress.

To examine how a lot the coin may fall, AMBCrypto then took a take a look at its liquidation heatmap. As per our evaluation, BTC has robust assist close to the $64,000 mark.

Due to this fact, BTC’s value may rebound after touching that stage. Nevertheless, if it fails to check the assist and falls beneath it, then the possibilities of BTC hitting $60k are excessive.

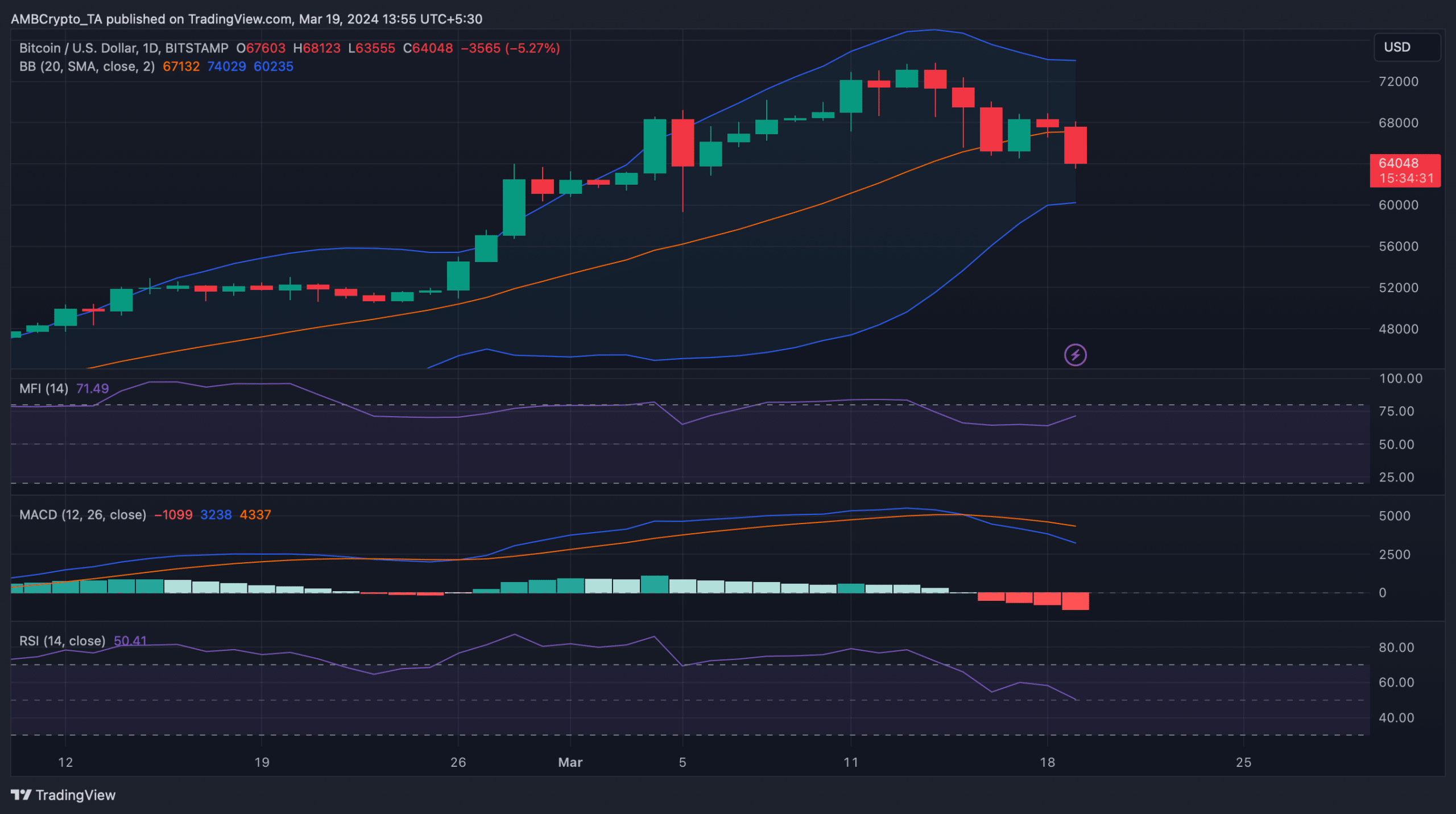

To higher perceive the possibilities of a continued value drop, AMBCrypto checked Bitcoion’s each day chart. The king of cryptos’ Relative Power Index (RSI) registered a pointy downtick.

Its MACD additionally displayed a bearish benefit, suggesting that the coin’s value may decline additional within the coming days.

Nonetheless, the Cash Circulation Index (MFI) registered an uptick. As per the Bollinger Bands, BTC’s value was in a much less risky zone, which could forestall the coin’s worth from dropping additional.

Bitcoin may contact $100k after halving

Although BTC’s value may witness one more value correction, issues in the long run seemed bullish. Notably, after the pre-halving retrace section, BTC will enter the re-accumulation and parabolic uptrend phases.

The buildup section may as properly final for almost 5 months. Apparently, on this cycle, it will be the very first time that this re-accumulation vary might develop across the New All-Time Excessive space.

The evaluation talked about,

“As a result, this re-accumulation range may simply take the shape of a regular sideways range and may not last very long before additional uptrend continuation.”

After that, BTC would enter the parabolic uptrend zone, which could permit BTC to create a brand new ATH. Traditionally, this section has lasted simply over a 12 months.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Nevertheless, with a possible accelerated cycle occurring proper now, this determine might get lower in half on this market cycle.

Due to this fact, traders may see BTC contact $100k throughout that section, which could occur on the finish of this 12 months.