Market Overview: Nifty 50 Futures

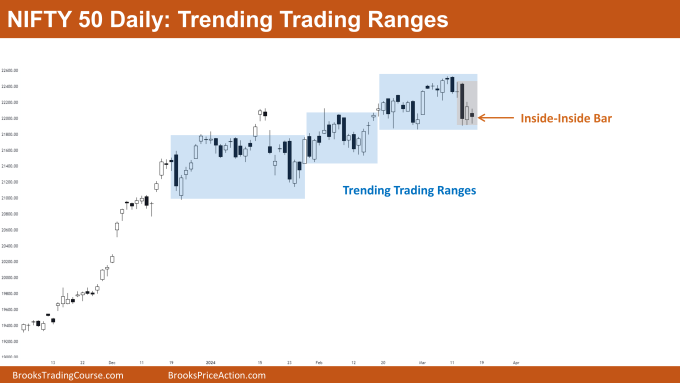

Nifty 50 Wedge High on the weekly chart. This week, the market showcased a major bearish momentum, mirrored by a robust bear bar. Nevertheless, it stays throughout the confines of a bullish channel, diminishing the chance of an instantaneous reversal. Regardless of the bearish breakout from the wedge prime, bears require a considerable follow-through bar to substantiate the breakout. Nifty 50 hovers close to the pivotal 22000 mark, suggesting potential buying and selling vary behaviors throughout weekly and smaller time frames. On the day by day chart, Nifty 50 demonstrates a trending buying and selling ranges sample, characterised by inside-inside bar formations.

Nifty 50 futures

The Weekly Nifty 50 chart

- Basic Dialogue

- The market persists inside a sturdy bull channel amidst a prevailing bullish pattern, implying {that a} single bear bar is inadequate to immediate a reversal.

- Bears are suggested to train warning earlier than promoting, awaiting affirmation via a convincing bear follow-through.

- Lengthy-positioned bulls ought to chorus from exiting trades except confronted with consecutive sturdy bear bars.

- A subsequent sturdy bear bar in Nifty 50 might signify a possibility for bears to provoke promoting for a possible double prime main pattern reversal.

- Merchants ought to notice that reversals carry decrease success possibilities, emphasizing the significance of sustaining a minimal 1:3 risk-to-reward ratio.

- Deeper into Price Motion

- Regardless of latest developments, bears have struggled to supply two consecutive sturdy bear bars. One other bear bar might elevate the chance of a buying and selling vary situation.

- Observations over the previous ten bars reveal elevated tail formations and diminished candle physique sizes, indicating a possible impending buying and selling vary.

- Patterns

- The bearish breakout from the wedge prime usually presents thrice the chance of success in comparison with a bullish breakout.

- Ought to the market generate a follow-through bar, adherence to the traditional market cycle would acquire credibility.

The Every day Nifty 50 chart

- Basic Dialogue

- The market at present operates inside buying and selling ranges, permitting each bulls and bears to capitalize by shopping for close to lows and promoting close to highs.

- With Nifty 50 nearing the numerous 22000 mark, merchants ought to anticipate sustained buying and selling vary behaviors on the day by day chart.

- Deeper into Price Motion

- Trending buying and selling ranges resemble broad bull channels, providing revenue alternatives for each consumers and sellers.

- A bearish breakout from the buying and selling vary might end in an in depth buying and selling vary, aligning with market cycle idea predictions.

- Patterns

- Presently, the market displays an inside-inside bar sample, generally noticed in the course of the buying and selling vary part.

- Ought to bears obtain a breakout from the buying and selling vary, a measured transfer down equal to the vary’s top may very well be anticipated, with converse implications for bulls.

Market evaluation experiences archive

You’ll be able to entry all weekend experiences on the Market Analysis web page.