Market Overview: FTSE 100 Futures

FTSE 100 futures moved greater final week after a dip down with an out of doors up bar closing on its excessive. Swing bulls are nonetheless of their longs and have been shopping for the 200 MA as assist. The highest third of a buying and selling vary, so we’ll see subsequent week if bears step in. The bulls want another bar to seal it.

FTSE 100 Futures

The Weekly FTSE chart

- The FTSE 100 futures moved greater final week after a dip down with an out of doors up bar closing on its excessive.

- The bulls see a broad bull channel, a better low in October and a better excessive in December.

- The bulls are nonetheless on the swing purchase from the double backside or any purchase on the 200 MA.

- The bears see a failed breakout above a DT, a potential wedge bear flag within the high third of a buying and selling vary.

- My solely drawback with this view is the bears would have been stopped out of their shorts in December.

- Solely new bears may have pale the buying and selling vary. Most will hand over after 2 robust bull closes. We now have simply had the second.

- They’d a bear microchannel and a second leg down, which is probably going completed.

- We’re both in breakout mode or lengthy.

- We’re most likely all the time in lengthy, so it’s higher to be lengthy or flat.

- Some bulls wish to see a second consecutive bullbar above the MA. Different bulls need to purchase solely under bars till it’s clear.

- The bears see an out of doors up bar, so there’s a decrease likelihood purchase sign. They wished a second leg and acquired it. They most likely have another likelihood right here, or they’ll hand over.

- The bulls need a measured transfer up above the December excessive. They see the bears as having given up already.

- There’s additionally a small open hole above, which might be the subsequent goal.

- Count on sideways to up subsequent week.

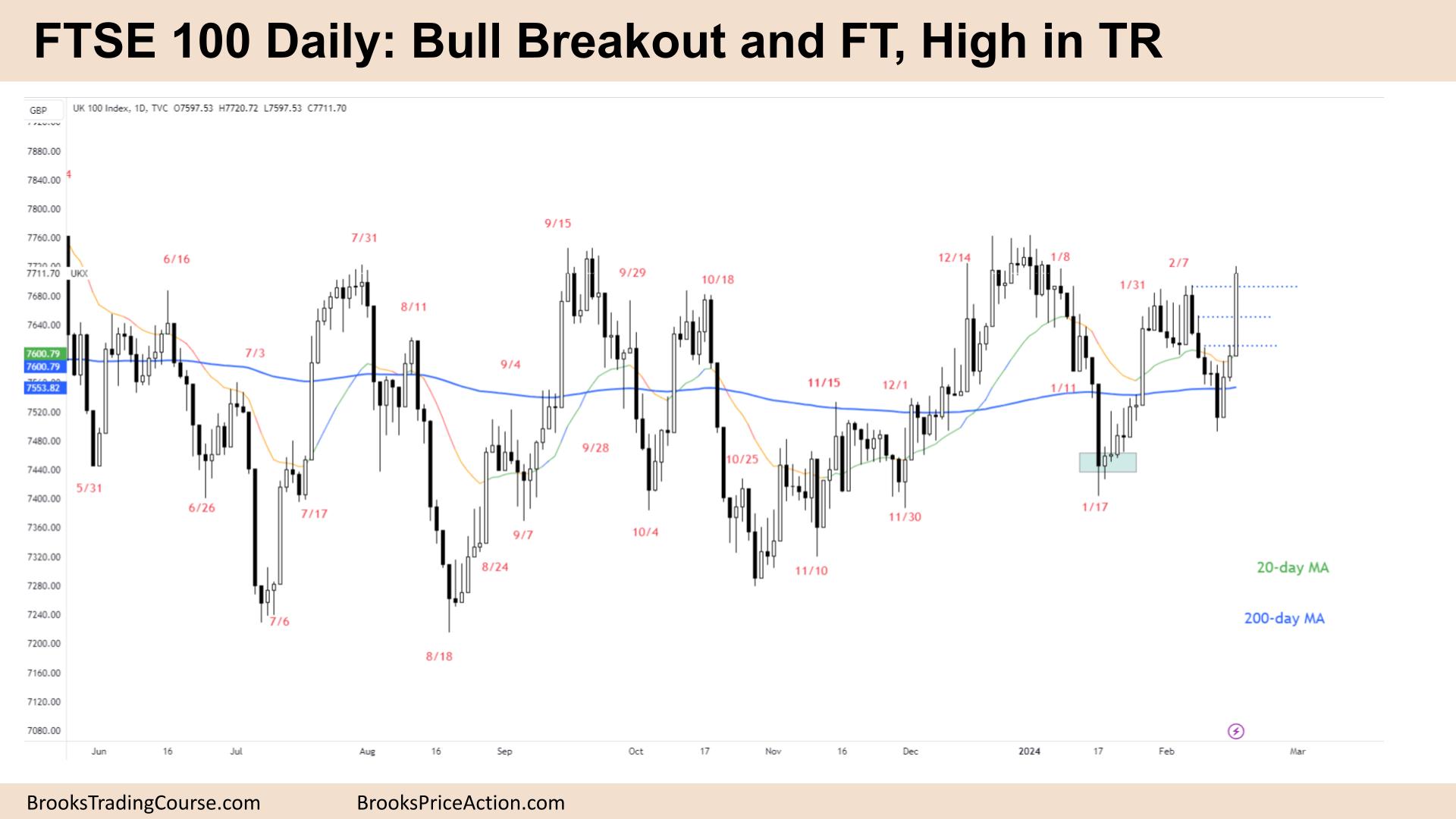

The Every day FTSE chart

- The FTSE 100 futures moved greater on Friday, with 3 consecutive bull bars closing on or close to their highs.

- Bulls see a robust breakout and follow-through, as we exceeded the earlier February excessive.

- Bears see we’re nonetheless in a buying and selling vary, and they’re but to get stopped out of their shorts from January.

- However I believe 3 robust bull closes will imply the bears gained’t let that cease get hit.

- New bears may fade a second entry above the TR, betting on an increasing triangle. However this transfer is powerful.

- Merchants must be lengthy or flat.

- Subsequent week, count on sideways to up. We would want to check the bear microchannel fade areas above the bars to the left.

- The ache commerce will probably be if we don’t come again to these entries. Bears should hand over greater, inflicting a stronger breakout.

- The bulls need a small bull follow-through bar after such a bull shock. The bar is climactic and can most likely lead to profit-taking.

- The bulls should take a look at the breakout level however not shut bear bars again into that vary.

- Disappointing can be a two-bar reversal right here.

- The bears see a buying and selling vary and know that disappointment will probably be widespread.

- Larger time frames assist the bulls.

- So in a buying and selling vary like this, not solely ought to merchants BLSHS, however choose the upper likelihood aspect (55%) and follow coming into in that path. That can stop an enormous loss on the breakout.

Market evaluation studies archive

You possibly can entry all weekend studies on the Market Analysis web page.