Market Overview: FTSE 100 Futures

FTSE 100 futures moved increased final week with a two-bar robust reversal, closing above the 20-MA. The bulls want a great follow-through bar right here to persuade merchants it’s all the time in lengthy. However the bears bought 3 bars in a row, in order that they in all probability want another bar themselves. We must always go sideways to up subsequent week.

FTSE 100 Futures

The Weekly FTSE chart

- The FTSE 100 futures final week was an enormous bull bar closing on its excessive, a powerful reversal.

- The bar additionally went above the excessive of final week’s large bear bar however didn’t shut above it. So, it isn’t as bullish because it could possibly be.

- The bears see 3 consecutive bear bars, one large and shutting on its low beneath the MA. However merchants wanted to see another bar to conclude it might be all the time in brief.

- It was additionally a bear microchannel with a micro hole between the primary and third bars.

- It’s a Excessive 1 promote sign – however the reversal was so robust I’d not take it right here.

- The bulls see a powerful bull spike, a BO of a triangle and a check again right down to the apex. They count on a second leg, so its unlikely this bar is the completion.

- When you look left, you possibly can see we’re in a buying and selling vary – so who has the market management? Large units of consecutive bull and bear bars.

- It’s a disappointing setting, so merchants will possible BLSHS and take fast earnings.

- The bulls need a follow-through bar to get all the time in lengthy and begin a three-push transfer as much as the ATH. But it surely in all probability gained’t go straight up.

- The bears need a decrease excessive for a head and shoulders reversal.

- The issue for bearsis the 200-MA which has been help for thus lengthy, it limits the draw back.

- Count on sideways to up subsequent week if the robust reversal will get follow-through.

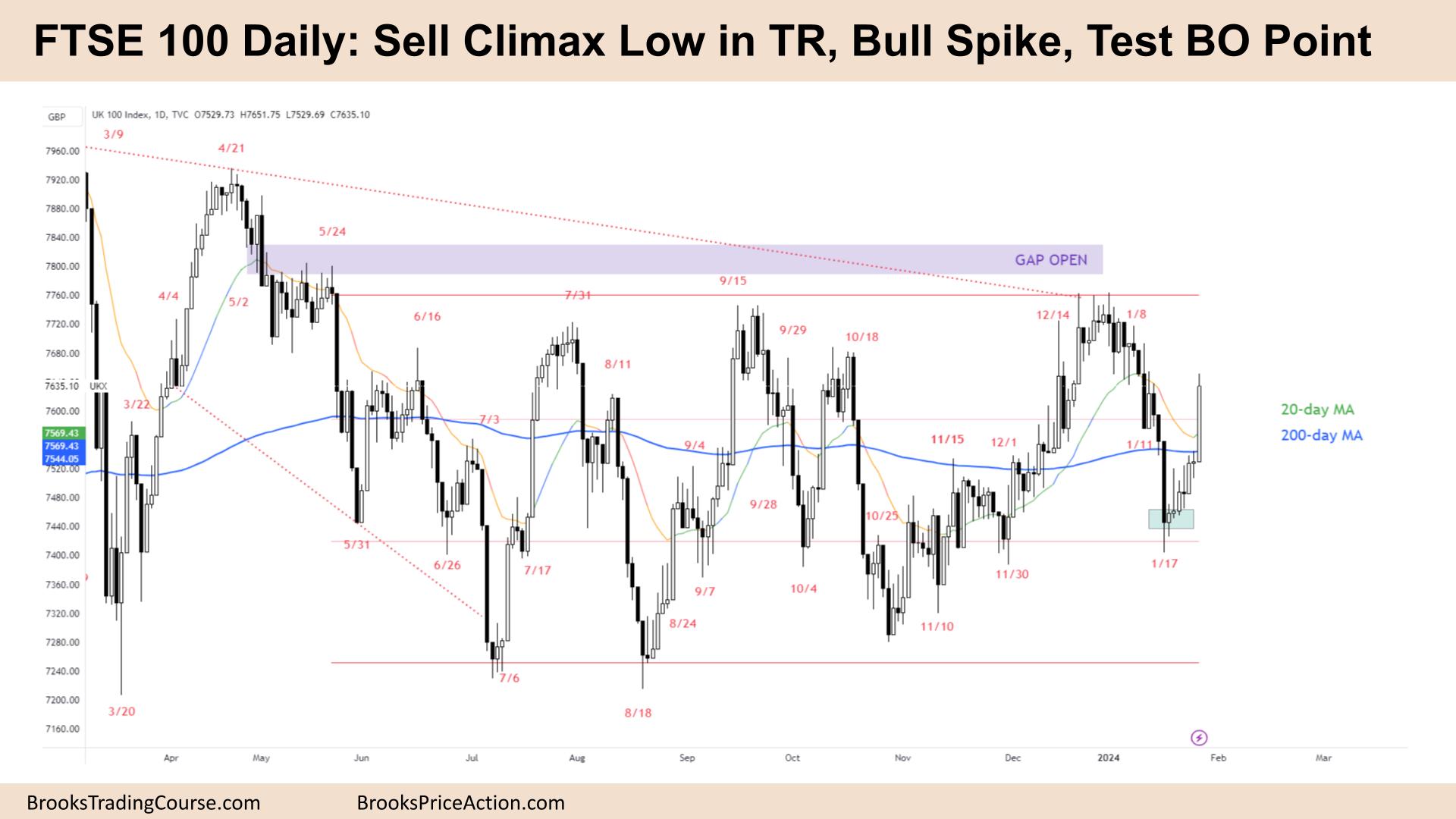

The Each day FTSE chart

- The FTSE 100 futures on Friday was an enormous bull bar closing close to its excessive, so we’d hole up on Monday.

- It’s the seventh consecutive bar in a bull microchannel, so a spike, and can possible we adopted by a channel up.

- The bulls see a break above a bull channel and now a check beneath it. However we had been within the decrease third of a buying and selling vary, which is an affordable purchase zone for the bulls.

- It was additionally a Excessive 2 purchase, the Excessive 1 was the Friday earlier than with the large tail.

- The bears see a promote climax after a powerful bear spike. They needed one other leg down.

- Bears might need offered the highs of the final 2 robust bear bars – they’re all trapped proper now.

- But it surely was a deep pullback for them, after a deep pullback for the bulls – so TR value motion.

- Bears see the large bear bar as a fade setup. It’s climactic as is unlikely to get follow-through and not using a pullback.

- Thursday was a weak sign bar, so some merchants may count on us to return and check it.

- However the HTF context is nice for a swing up, so if the bulls get FT, then these bears should panic out.

- The bulls are testing these merchants who purchased the MA in a bull channel and it failed. They purchased decrease and now can get out breakeven on their first commerce and a revenue on the second.

- Count on sideways to up subsequent week.

Market evaluation studies archive

You possibly can entry all weekend studies on the Market Analysis web page.