Uniswap (UNI) enters June 2025 with renewed momentum, fueled by robust whale accumulation, protocol upgrades by way of v4, and rising developer exercise throughout its increasing ecosystem.

Basic Developments

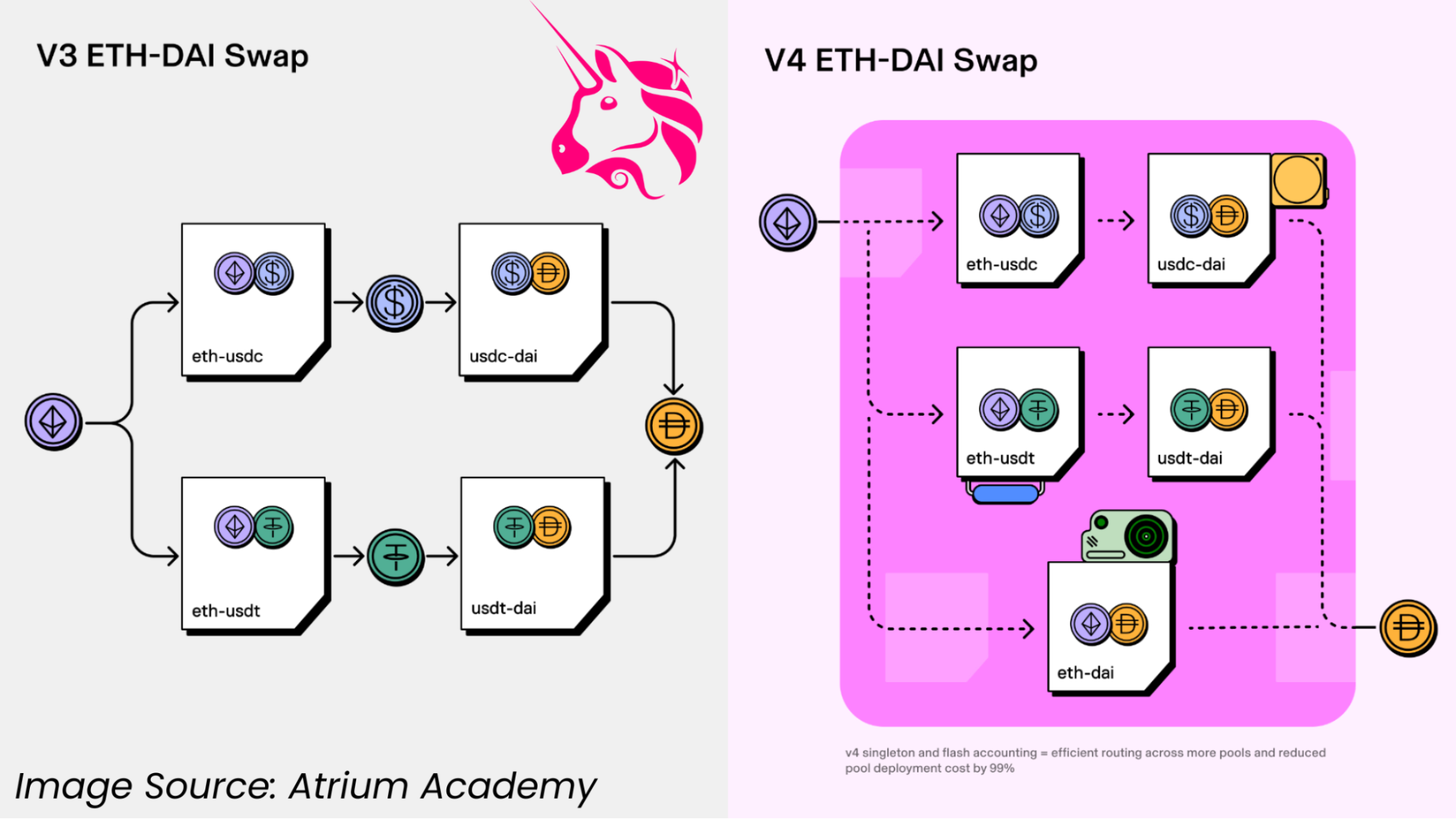

Uniswap’s core protocol continues evolving. Most just lately, Uniswap v4 launched with a serious architectural overhaul. Key amongst its options is a brand new “Hooks” mechanism permitting builders to run customized code earlier than/after swaps.

This permits superior performance (built-in restrict orders, customized worth oracles, dynamic charge administration, automated liquidity methods, and so forth.). Different v4 enhancements embrace dynamic charges, gasoline optimizations (e.g. “flash accounting”), native ETH help (no wrapped-ETH wanted), and a number of pool sorts.

These upgrades intention to spice up capital effectivity and person flexibility, probably attracting extra merchants and liquidity to Uniswap.

A number of new tasks are already constructing on v4’s hooks (e.g. Bunni for dynamic liquidity administration, Flaunch for structured memecoin launches), suggesting rising developer curiosity within the platform’s newest instruments. Briefly, v4’s rollout has been clean, and its superior options might reinforce UNI’s long-term worth by enhancing Uniswap’s competitiveness.

Supply: Atrium Academy

Along with protocol logic, Uniswap Labs has broadened its community attain. In Feb 2025 it formally launched Unichain, a local Layer-2 rollup constructed on the Optimism OP Stack. Over 100 purposes/protocols (together with Uniswap itself, Coinbase, Circle, Lido, and so forth.) are already deploying on Unichain.

Importantly, Circle (issuer of USDC) is actively integrating on Unichain, enabling native USDC utilization and yield options (mentioned beneath). This Layer-2 enlargement ought to improve Uniswap’s scalability and accessibility.

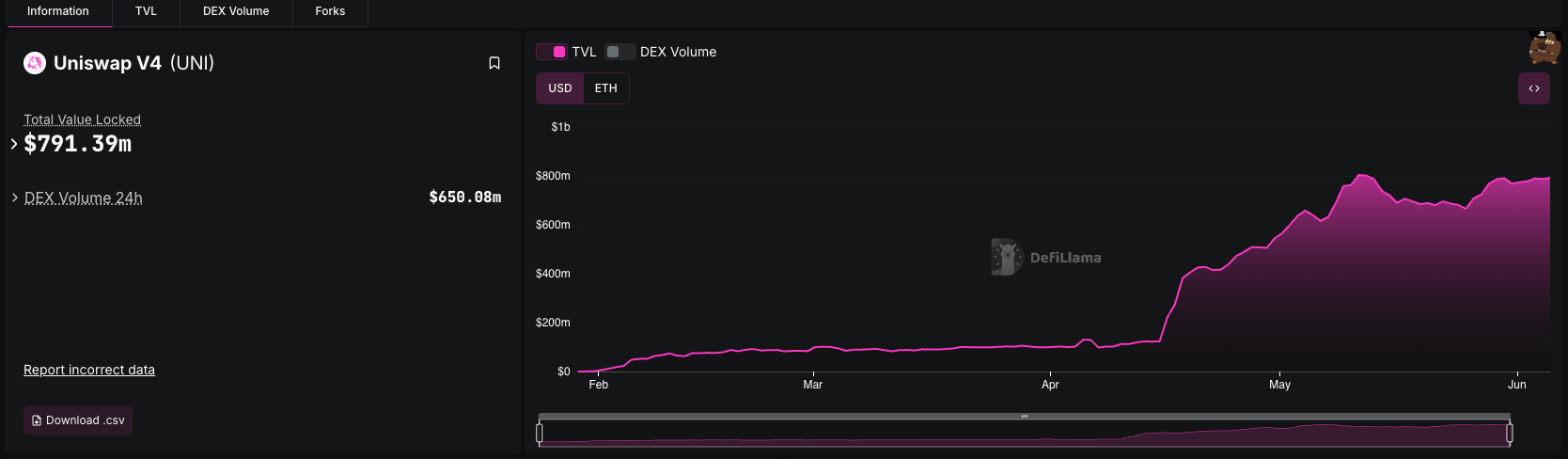

Uniswap already spans many chains – DefiLlama reveals ~$4.96B TVL cut up throughout Ethereum L1 and quite a few L2s: $3.335B on Ethereum, $511M on Unichain, $445M on Base, $293M on Arbitrum.

Tokenomics & On-chain Metrics

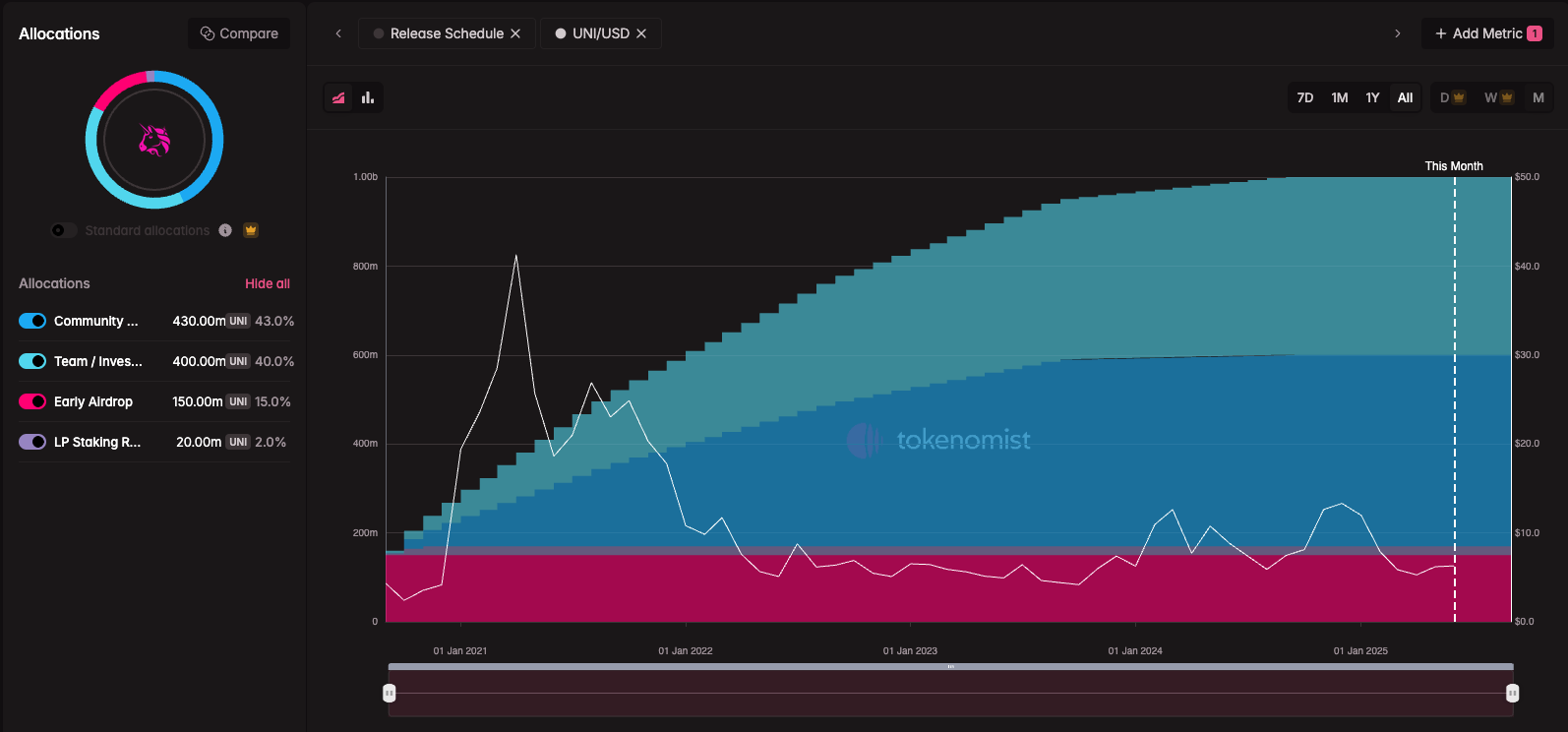

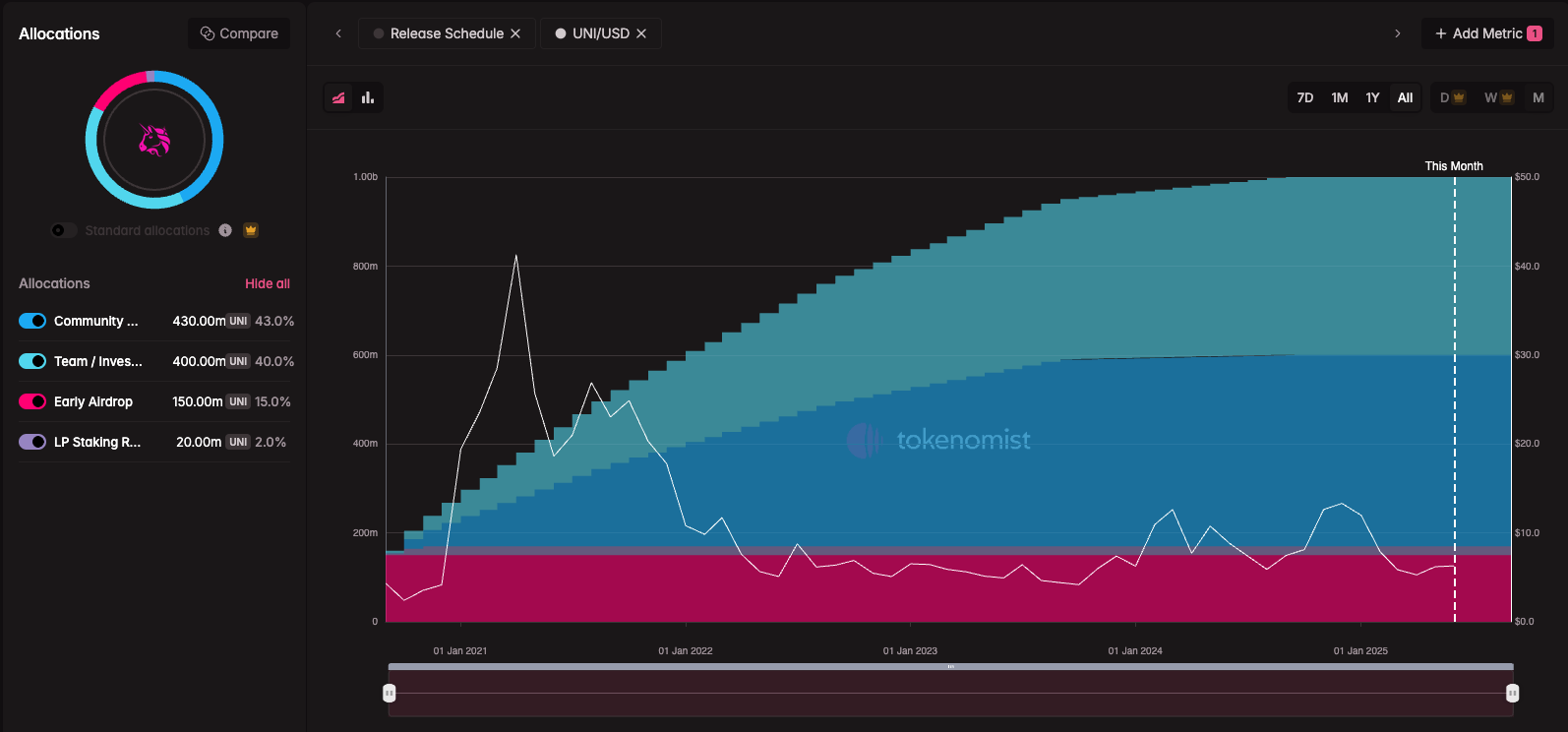

The UNI token itself has a completely unlocked provide of ~1.00 billion. In accordance with Tokenomist knowledge, UNI’s “Total Unlock Progress” is 100%, that means no main vesting stays. Thus, UNI has no imminent unlock-related inflation to strain the worth. The token’s market capitalization is round $3.9–4.0B (worth ~$6.4–6.8).

Supply: Token Unlocks

The on-chain treasury is minimal (DefiLlama lists solely ~$167K in UNI), so there’s little counter-cyclical promote strain from protocol reserves is distributed to liquidity suppliers, not on to token holders, so UNI itself has no scheduled token burns or direct yield.

Total, the tokenomics are impartial: no new inflation, but in addition no inherent token sink moreover platform development.

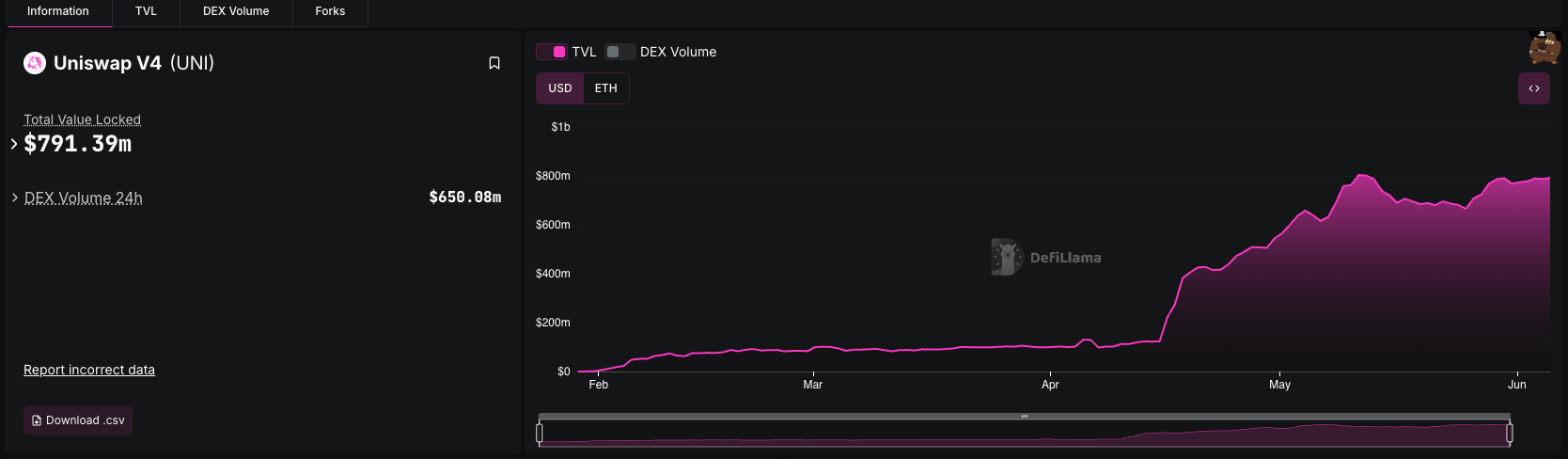

Uniswap’s Complete Worth Locked is roughly $4.92B, unfold over a number of chains. This TVL is down from its 2021 peak (when it briefly hit ~$10–12B), but it surely stays wholesome.

Supply: DeFiLlama

A lot of the older liquidity (v2/v3 on L1) has been secure; TVL solely slowly declined from 2021 peaks as LPs withdrew some funds when yields dropped. That mentioned, new liquidity is flowing in on rollups and v4 swimming pools; Uniswap v4 launched with incentives; however nonetheless, enthusiastic customers can count on greater yields and new pool designs.

Round 7,261 distinctive addresses used Uniswap in 24h, exhibiting robust every day exercise from merchants and LPs.

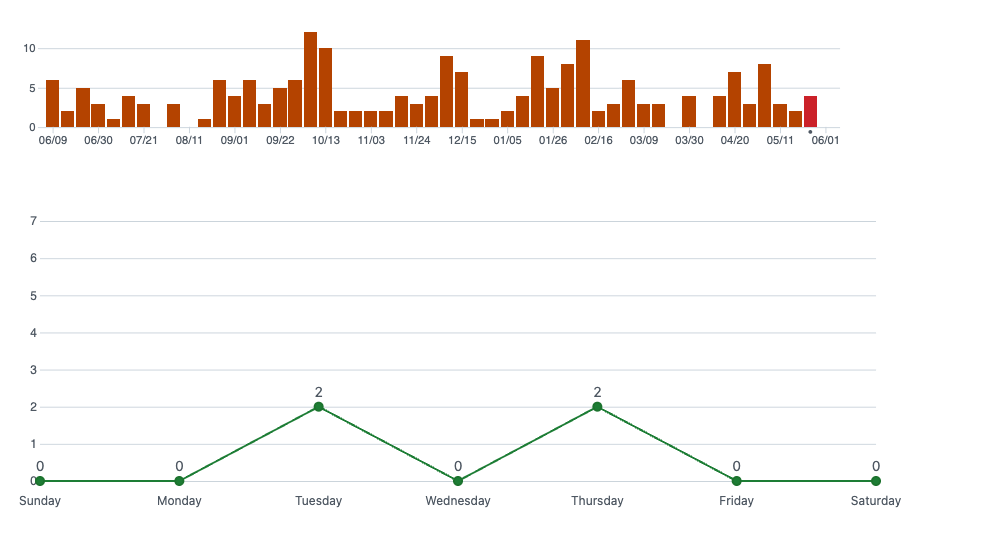

The variety of new addresses is probably going a fraction of that, however continued excessive deal with counts present regular utilization. Uniswap’s GitHub is energetic, with 8 weekly commits by 3 builders as of early June 2025.

Supply: GitHub

This means ongoing upkeep and have work. In contrast, many smaller tasks hardly see any commits. Energetic devs and frequent updates sign that Uniswap Labs is frequently iterating, which helps confidence within the protocol’s future.

This highlights Uniswap’s resilience even amid the crypto increase – it captured roughly one-quarter of all DEX trades in 2024. The implication is that any development within the DeFi market will largely profit Uniswap because the incumbent DEX.

Conversely, critical competitors might chip away at market share, however no important challenger has emerged but. For now, Uniswap stays the flagship DEX on Ethereum, giving UNI a robust elementary backing.

Market Sentiment and Trading Conduct

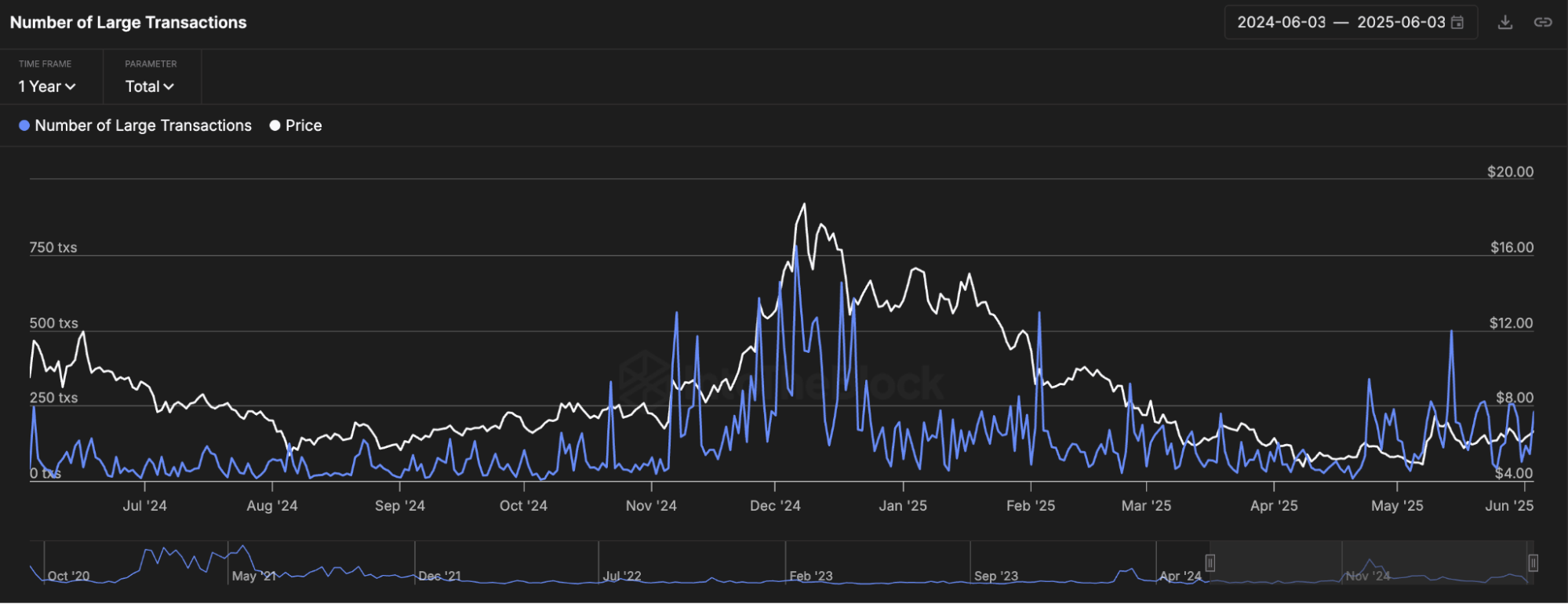

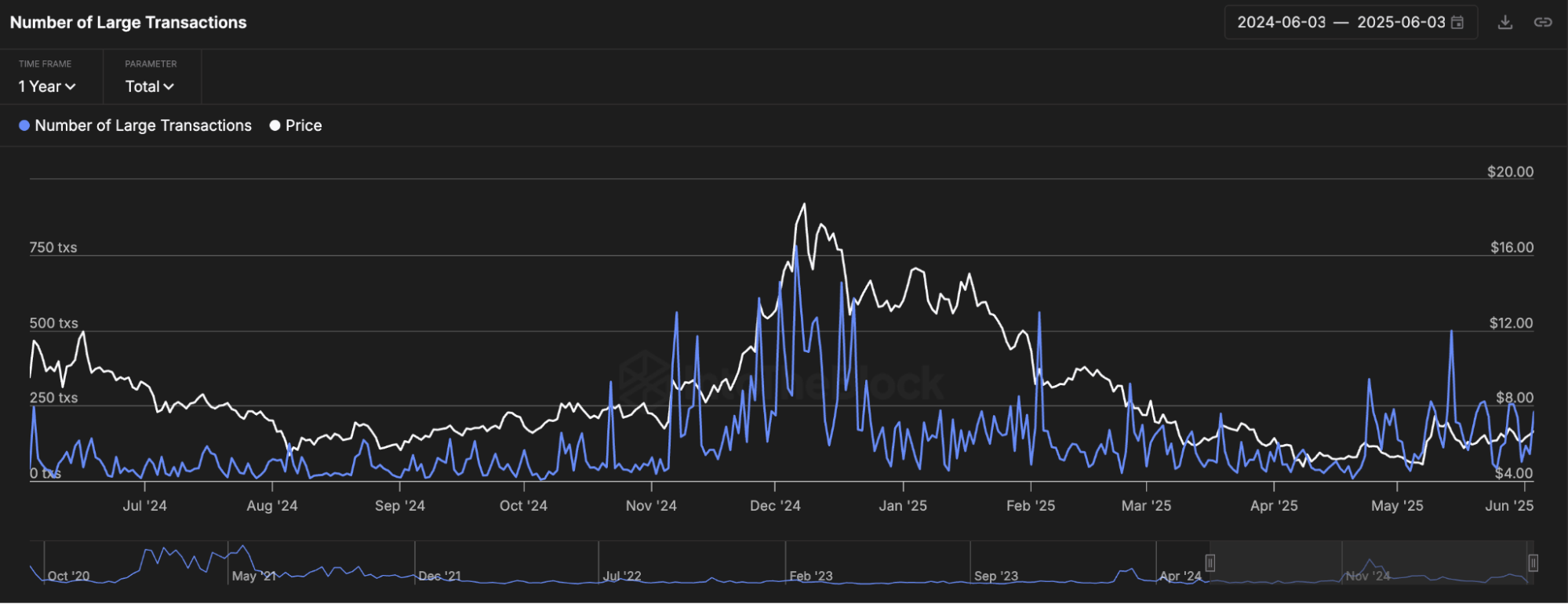

A hanging current development is rising whale curiosity. Crypto analysis studies have famous a pointy uptick in massive UNI transactions and accumulations. IntoTheBlock’s knowledge reveals that the rely of transactions >$100K has risen considerably in late Might/early June.

Such surges are sometimes interpreted as institutional or large-wallet accumulation. For instance, on June 3 a whale-driven breakout drove UNI from ~$6.45 to $7.00 (a 7% intraday bounce).

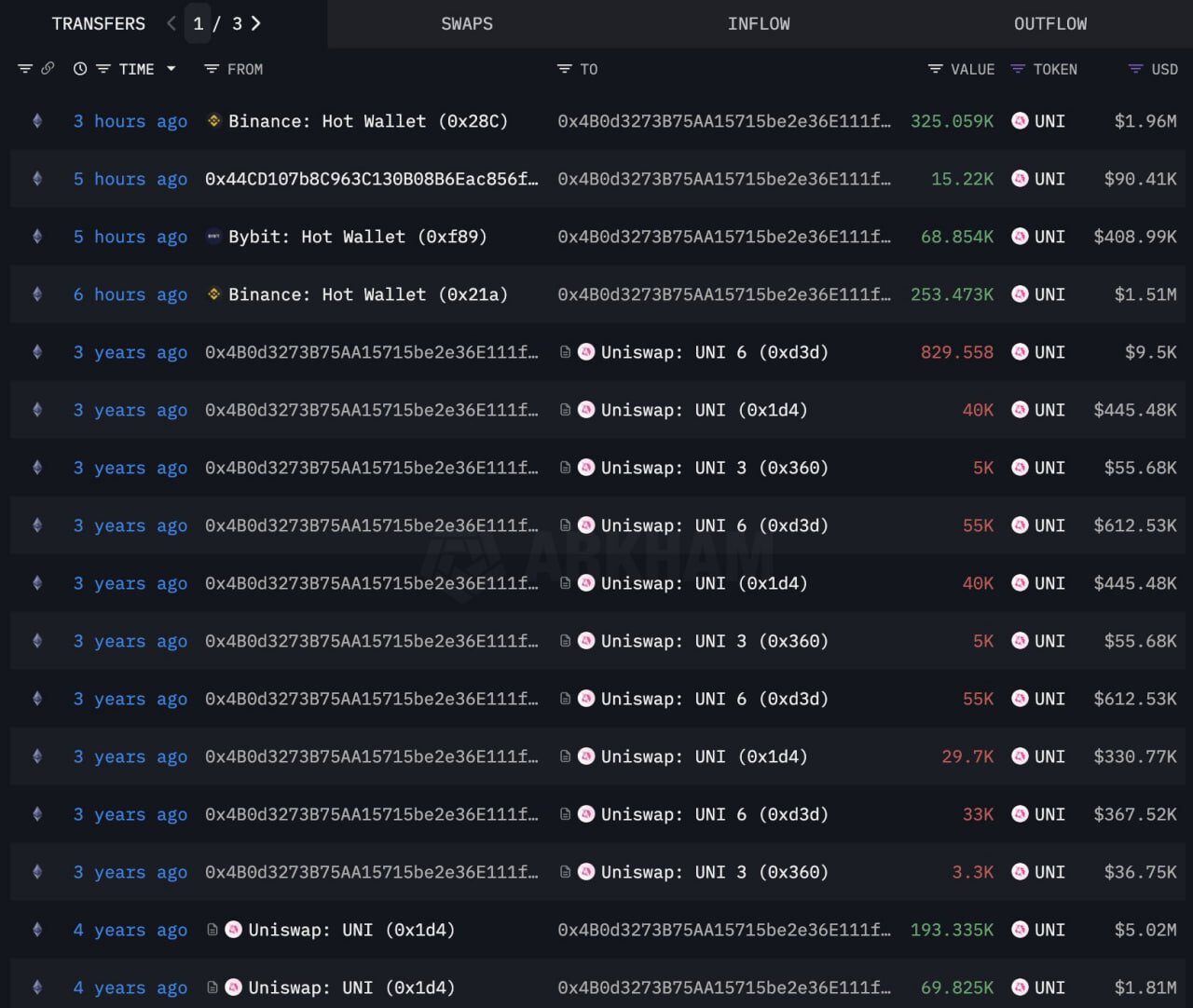

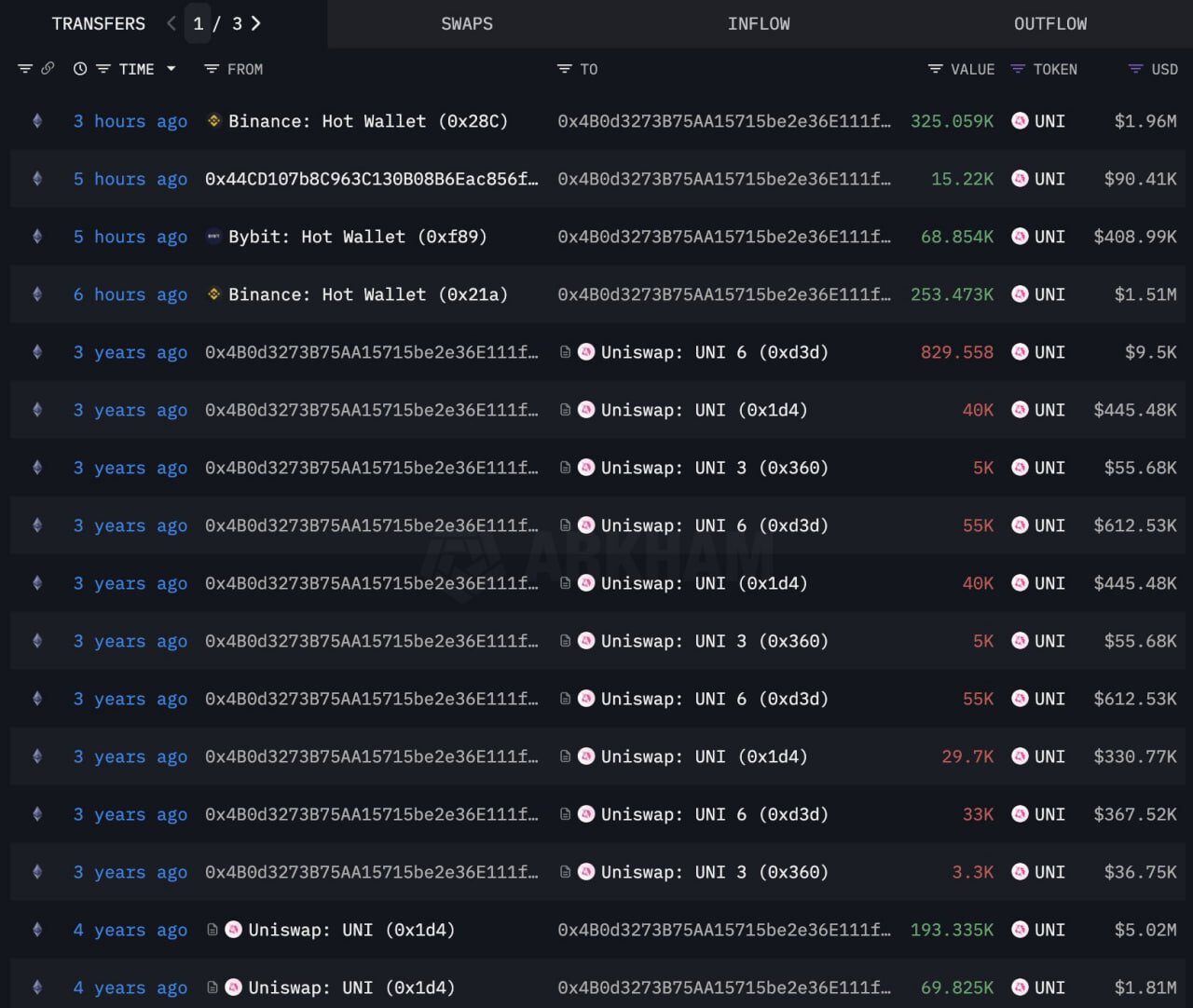

On Might 21 a recognized “UNI whale” bought 662,606 UNI ($3.97M) and on June 1 one other whale withdrew 401,573 UNI ($2.46M) from Binance.

Supply: Arkham

These are clear indicators that enormous buyers are positioning into UNI. Such exercise tends to affect worth: withdrawals from exchanges cut back fast promote strain (suggesting holding or protocol staking), whereas massive buys can drive the market up.

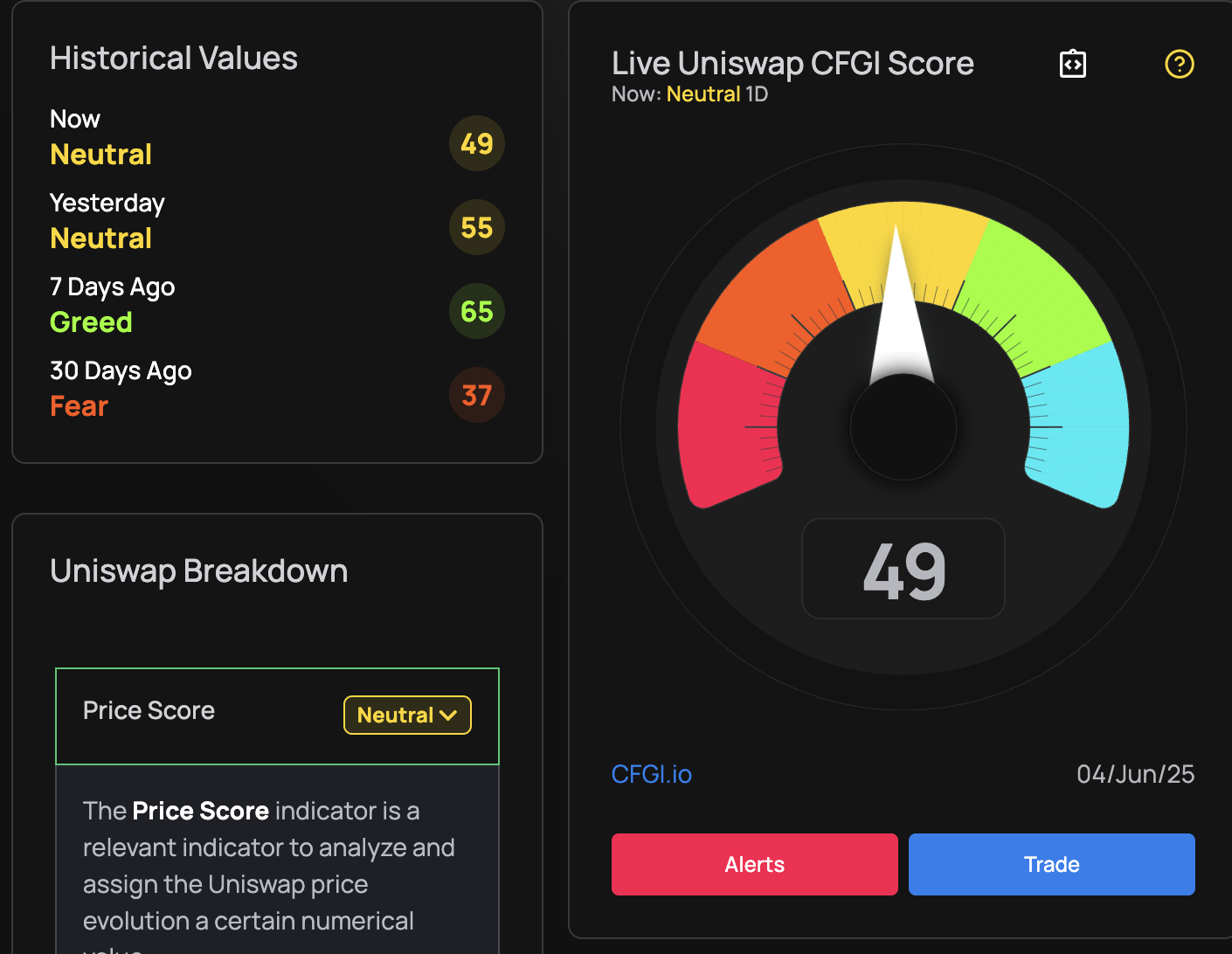

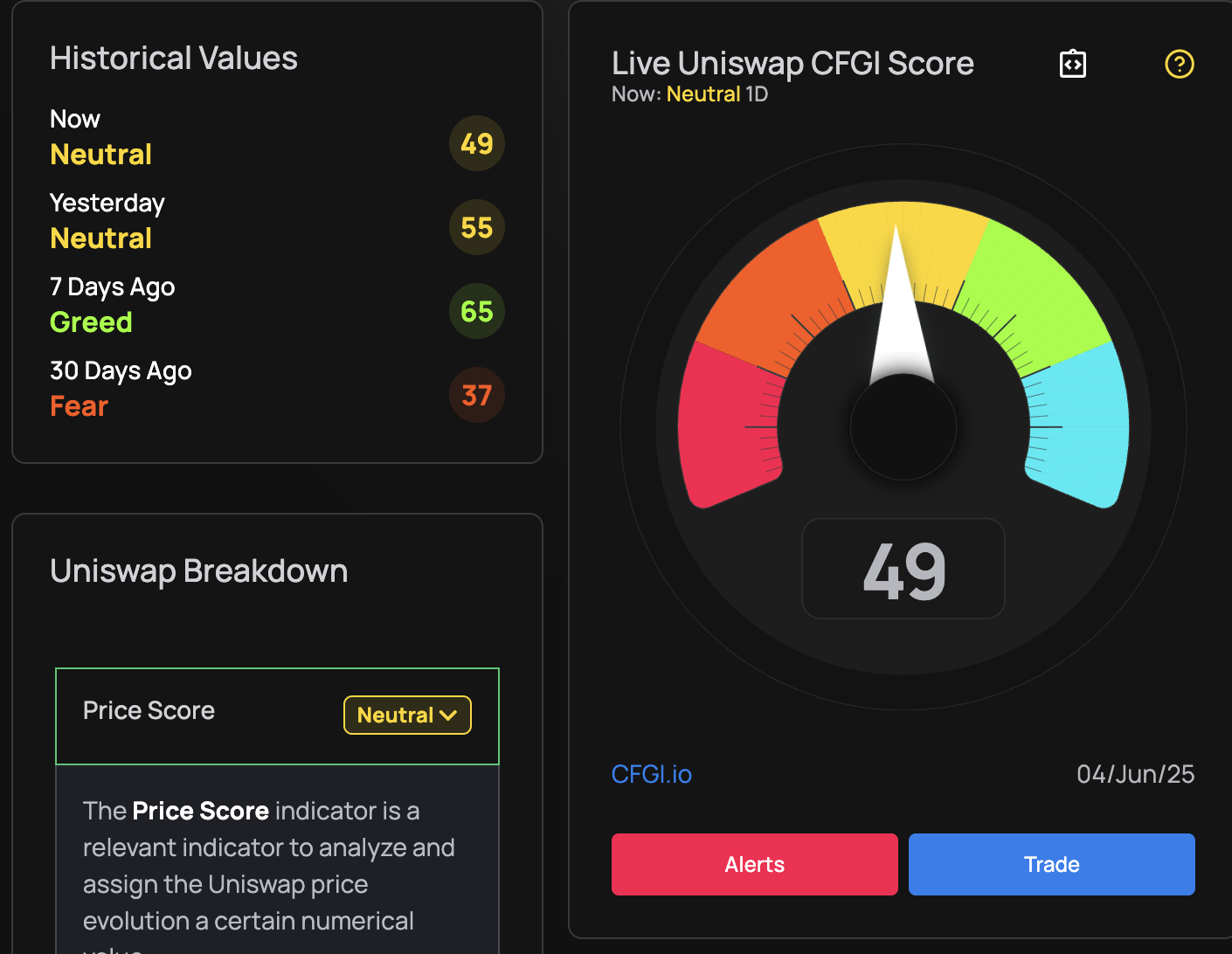

Social sentiment and on-chain urge for food have lifted just lately. Crypto fear-and-greed measures for Uniswap (UNI Concern & Greed index) rose from “fear” ranges (~37) a few month in the past to a reasonably bullish “greed” (65) one week in the past, earlier than settling at ~49 (impartial) as of June 4.

This swing means that group optimism has returned after the Might dip. On X and Telegram, UNI discussions have been selecting up with constructive information. Market buzz might be self-reinforcing; the current steep rally moved UNI from $5.65 (early Might lows) to ~$6.94 (June 4 peak), which naturally elevated visibility.

In the meantime, “Fear & Greed” reveals sufficient room for extra pleasure (RSI < 70, Concern & Greed ~56 just isn’t excessive). In abstract, crowd sentiment seems cautiously bullish, aligned with on-chain whale strikes.

Technical Evaluation: Key Ranges to Look ahead to UNI in June

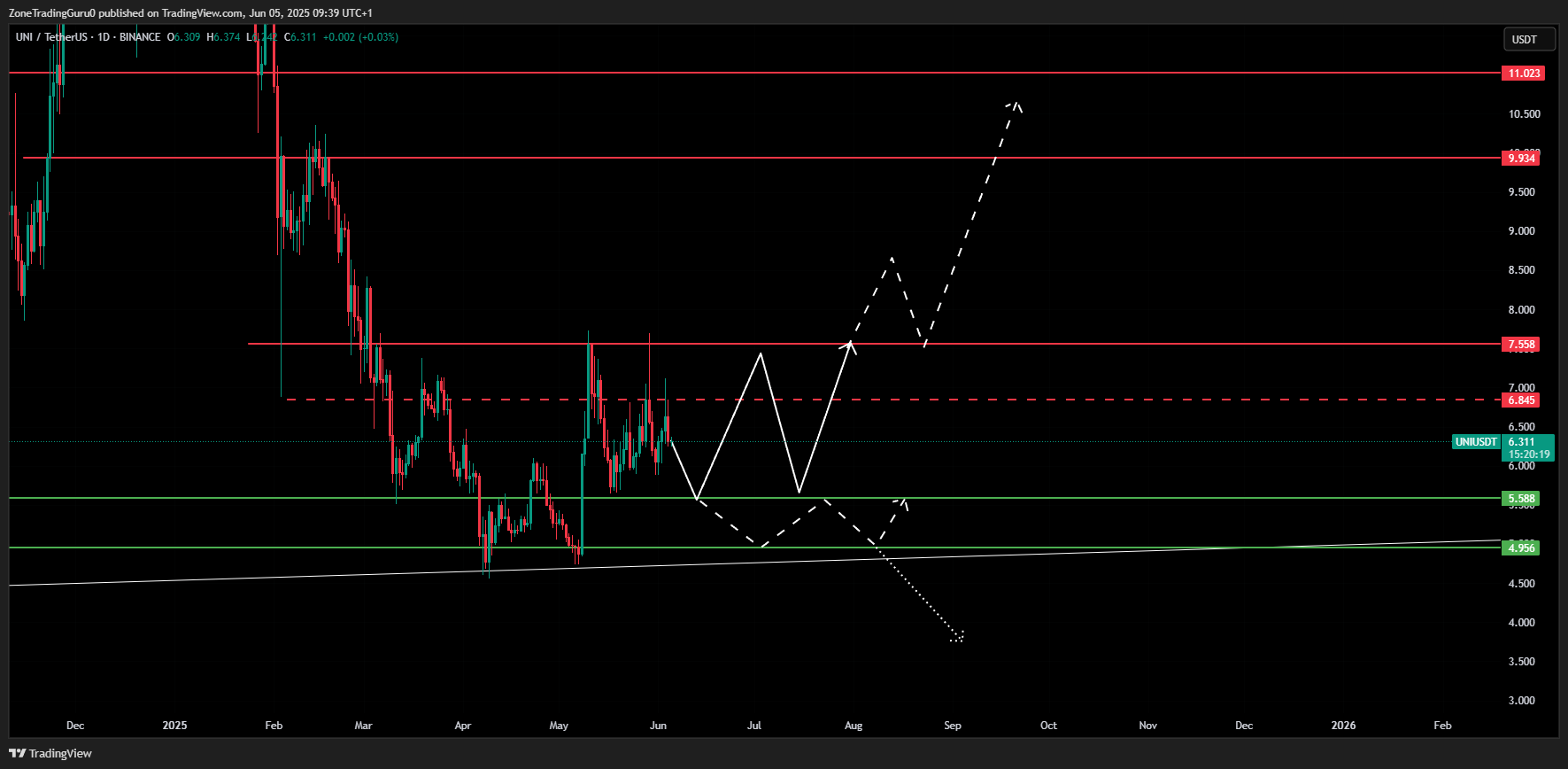

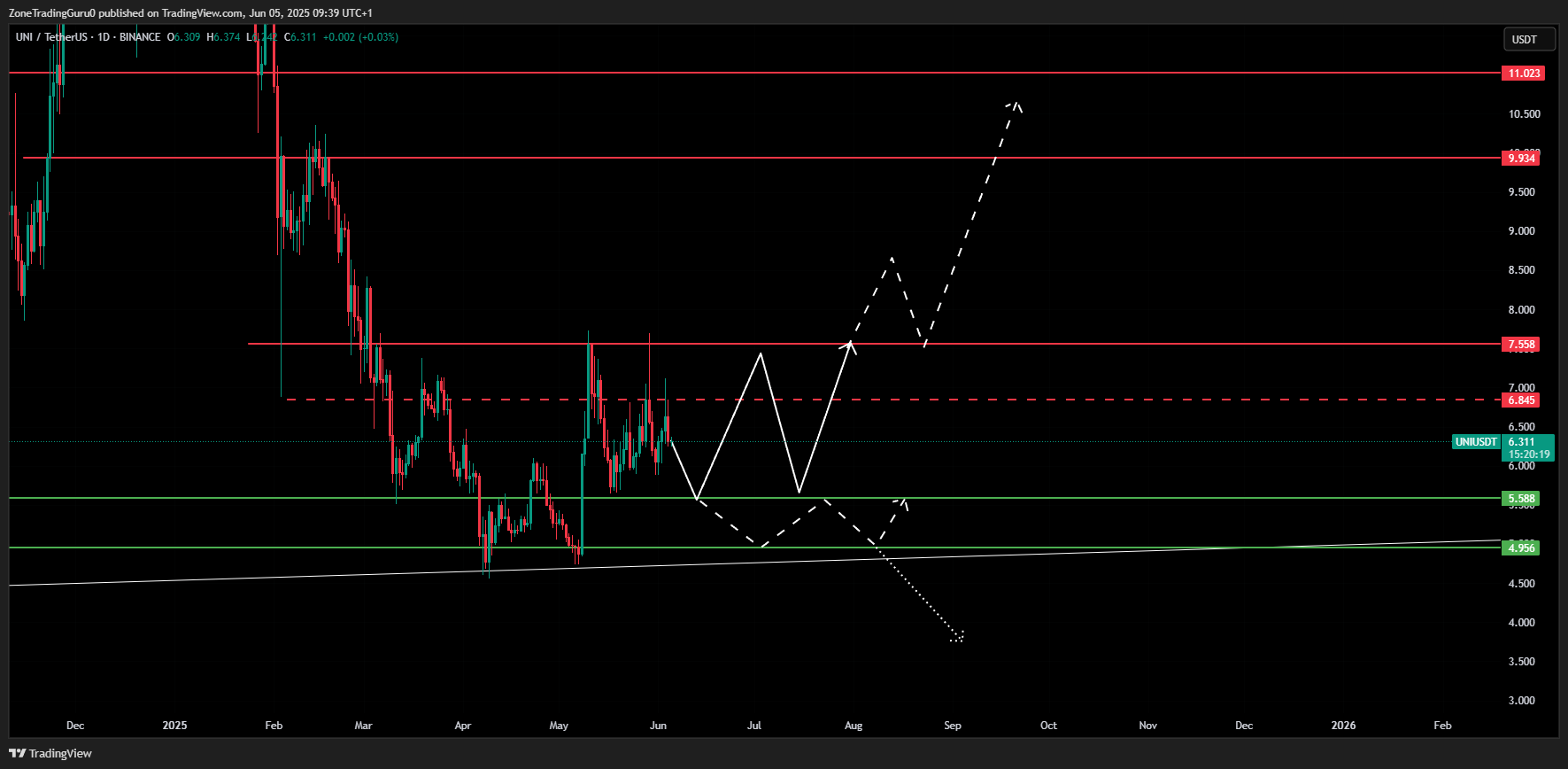

A every day (D1) shut above $7.558 can be a essential technical affirmation that UNI has transitioned from a corrective section to a brand new bullish impulse.

Ought to this breakout materialize, upside targets lengthen towards the following resistance band at $9.934–$11.023, which coincides with historic provide zones and Fibonacci extensions from earlier swing highs.

Conversely, failure to carry above $5.588 opens the door to a retest of deeper help at $4.956, the place a rising trendline intersects – a construction that has traditionally supplied robust shopping for curiosity. A weekly (W1) shut beneath $4.956 would invalidate this help and probably set off a pointy decline, as it could affirm a break of long-term development help.

Merchants must also monitor the Relative Power Index (RSI) and transferring averages, notably the 50-day and 100-day EMAs. UNI is at the moment hovering close to the 100-day EMA (~$7.00), which acts as a pivot zone. A sustained shut above this dynamic resistance, with increasing quantity and constructive market breadth, would strengthen the bull case.

Uniswap Price Prediction

If Uniswap’s momentum continues – supported by whale accumulation, robust liquidity, and the most recent elementary upgrades – UNI might steadily climb by means of June. On this case we would see UNI reclaim $7.00–7.30 by mid-June.

Importantly, this degree coincides with the 100-day EMA, which many short-term merchants view as a pivot line between bullish and bearish momentum. A clear every day shut above $7.00 – ideally accompanied by rising quantity and robust market breadth – would possible set off follow-up shopping for from trend-following algorithms, market makers, and even sidelined retail contributors ready for affirmation of a breakout.

In that case, bullish momentum might speed up, notably if broader market sentiment (together with Bitcoin stability and DeFi capital flows) stays favorable.

All forecasts stay topic to speedy change given crypto’s volatility. Merchants ought to watch the $6.70–6.90 zone: a clear break above there, on excessive quantity and supported by constructive macro cues, would affirm a bull breakout.

Nonetheless, merchants ought to stay cautious of false breakouts, notably if the transfer above $6.90 lacks follow-through or happens on low quantity.

In such instances, UNI might be weak to a rejection wick and a pullback towards $6.30–$6.10 help. Nonetheless, the presence of robust whale help, rising developer traction on Uniswap v4, and integrations like Spark and Unichain present a agency elementary basis that would assist take in draw back volatility.

Learn extra: Trading with Free Crypto Signals in Evening Trader Channel

| CoinFN