- XRP Futures ETF debuts sturdy with almost $6M in first-day buying and selling quantity.

- Spot XRP ETF approval features momentum regardless of SEC delay and ongoing authorized hurdles.

Ripple [XRP] is attracting renewed institutional curiosity after its regulatory headwinds lastly got here to an finish after 4 years.

On the nineteenth Might, CME Group launched its XRP Futures ETF, recording a formidable every day buying and selling quantity of almost $6 million on debut.

CME’s XRP ETFs outperform ETH ETFs?

That being stated, the newly launched XRP ETFs have rapidly outpaced Ethereum [ETH] Futures ETFs in efficiency, signaling strong institutional curiosity.

If this momentum continues, XRP may problem Bitcoin [BTC] Futures ETFs. Nevertheless, reaching that stage stays bold. BTC ETFs recurrently see buying and selling volumes within the billions.

Nonetheless, the early success of XRP merchandise strengthens the case for Future spot ETF approvals.

Driving this institutional wave, XRP has seen a major value rally. It jumped 1.33% to $2.33, with Open Curiosity surging to $4.69 billion, at press time.

Day considered one of buying and selling — Particulars

CME Group knowledge reveals that XRP Futures had a robust debut. On launch day, 4 commonplace contracts traded fingers, every representing 50,000 XRP. This accounted for about $480,000 in notional quantity at a mean value of $2.40.

A lot of the exercise got here from 106 micro contracts, every overlaying 2,500 XRP. Collectively, they contributed over $1 million in further quantity.

This buying and selling sample signifies that giant gamers are getting into the market. On the identical time, smaller institutional members are actively partaking with XRP Futures from the beginning.

Regardless of the SEC delaying its ruling on a number of crypto ETFs, together with these tied to XRP and Solana [SOL], momentum round XRP funding autos retains rising.

ETF Retailer President feedback on spot XRP ETF

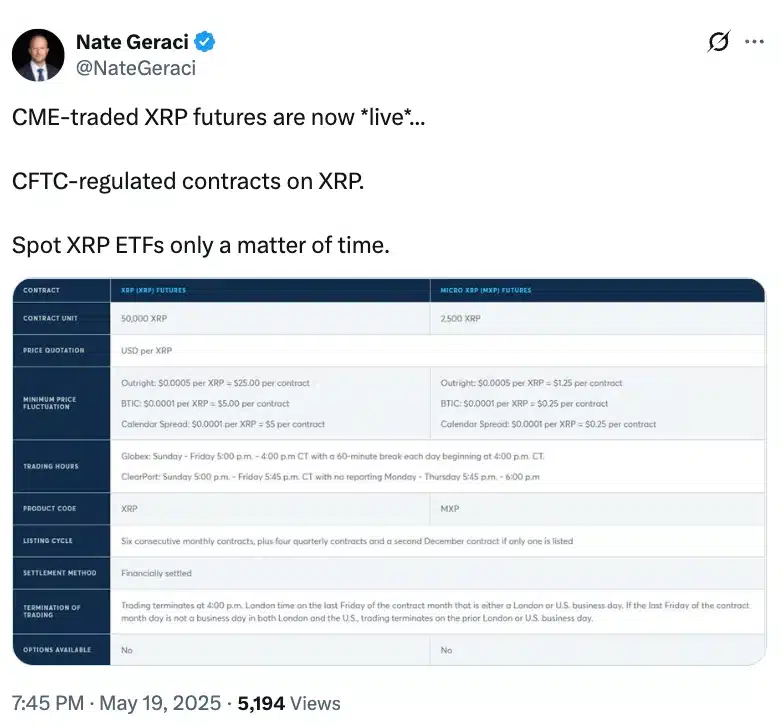

Remarking on the identical, the president of the ETF Retailer, Nate Geraci, not too long ago emphasised on X (previously Twitter) that spot XRP ETFs are inevitable.

This highlights the importance of CME’s dwell, CFTC-regulated XRP Futures contracts.

Actually, sentiment on decentralized prediction platform Polymarket additionally stays optimistic, with an 83% likelihood priced in for eventual approval.

However, with Franklin Templeton’s utility now pushed to the seventeenth of June, the approaching weeks could show pivotal in shaping the subsequent part of institutional entry to XRP.

| CoinFN