- Bitcoin as an institutional asset for Nvidia makes full sense for 2 key causes

- Its model positioning as a forward-thinking asset is about to reinforce if this occurs

Crypto Twitter is abuzz with speculation that Nvidia could also be contemplating a strategic allocation of Bitcoin [BTC] to its company treasury.

In accordance with AMBCrypto, this thesis isn’t far-fetched although. The truth is, key macro and market dynamics instructed this could possibly be a calculated transfer to diversify stability sheet publicity and hedge towards fiat depreciation.

If confirmed, such an allocation might act as a big bullish catalyst for Bitcoin. The truth is, it has the potential to draw extra institutional traders into the market.

Strategic sense behind Bitcoin’s position in Nvidia’s treasury

The U.S. economic system is simply midway by way of Trump’s re-election cycle and but, high public firm shares have fallen by over 20% in Q1. Nvidia, ranked among the many high three public corporations with a market cap of $2.72 trillion, isn’t any exception.

At press time, its inventory valuations had been down 24.44% from its Q1 opening of $138. Nevertheless, this might simply be the start of a bigger decline.

As a tech large deeply invested in Synthetic Intelligence (AI), Nvidia is squarely positioned on the intersection of the U.S.-China commerce battle. This exposes the corporate to potential geopolitical dangers that might additional stress its inventory worth.

Furthermore, with rising inflation eroding the buying energy of the usDollar, Nvidia might face larger operational prices, significantly for elements and provide chain logistics.

Given these macroeconomic pressures, it’s no shock that extra publicly traded corporations are turning to Bitcoin to hedge towards these dangers.

The truth is, Metaplanet recently issued 3.6 billion JPY in 0% peculiar bonds to accumulate extra Bitcoin. It’s positioning itself as a part of the rising pattern of corporations including crypto property to their company reserves.

Proof is within the numbers

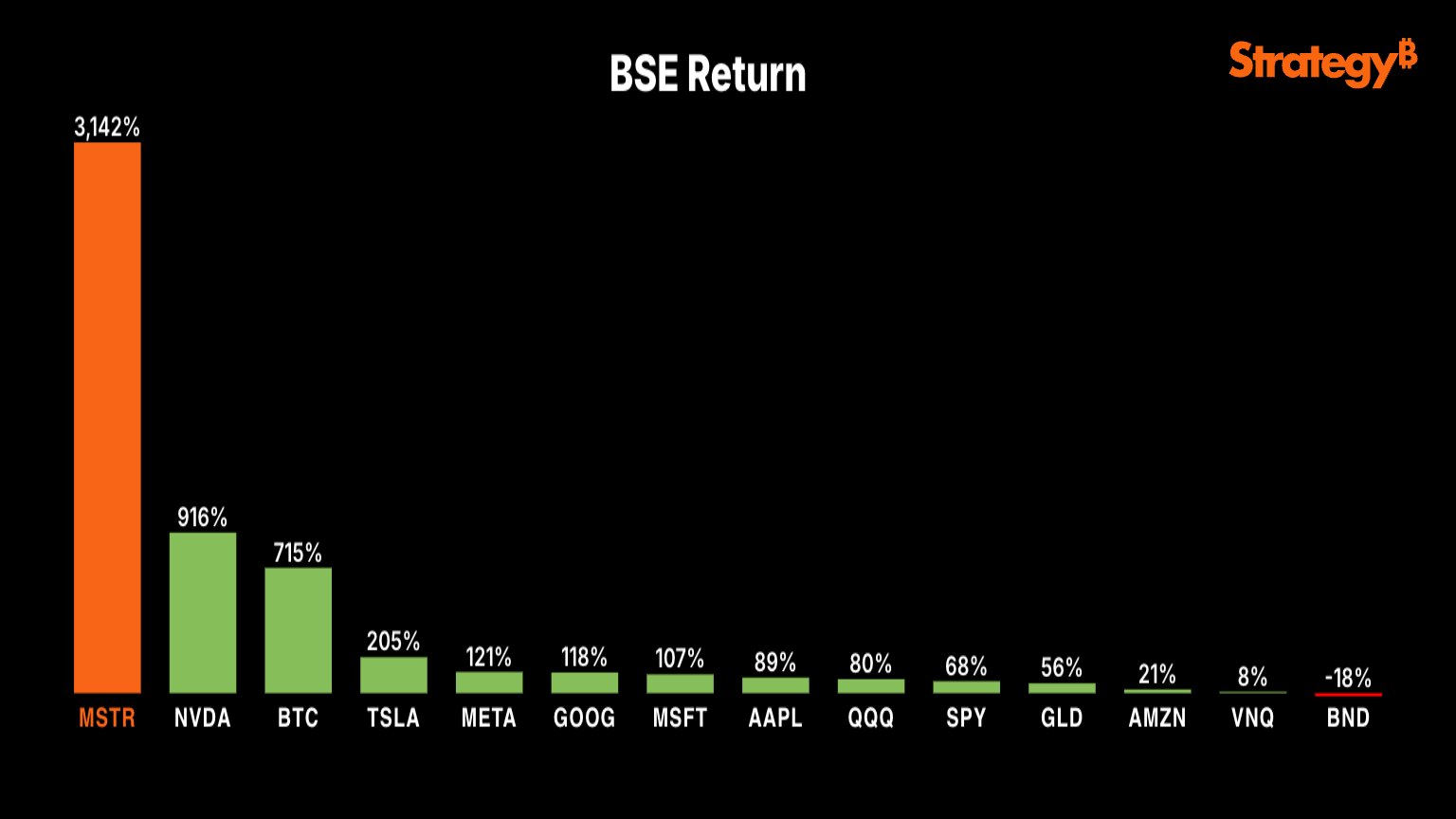

MicroStrategy’s [MSTR] inventory has seen a staggering 3,000% return over the previous 5 years, largely pushed by its Bitcoin publicity. It has considerably outperformed most tech equities. This has translated to an annualized development charge of 600%.

As compared, Nvidia’s inventory posted returns of “just” 916%. Although it trails MicroStrategy by a big margin.

This stark divergence highlights the outsized influence of Bitcoin on MicroStrategy’s efficiency.

Bitcoin’s surge from $10,000 in 2020 to $96,172 at press time, reflecting a year-to-date worth achieve of 715%, additional substantiates its position as a vital driver of portfolio returns for corporations like MicroStrategy.

With outcomes like these, it’s no surprise that different large gamers may quickly leap on the bandwagon. And guess what? Nvidia appears to be like prefer it’s subsequent in line to make that daring transfer!

| CoinFN