Zora – as soon as hailed as a promising NFT infrastructure platform, has come below fireplace following the launch of its ZORA token airdrop. Slightly than being celebrated, the occasion shortly drew widespread criticism attributable to its controversial tokenomics, unclear utility, and an execution course of that many customers described as poorly managed.

Lack of Utility, Lack of Belief in a “For Fun” Token

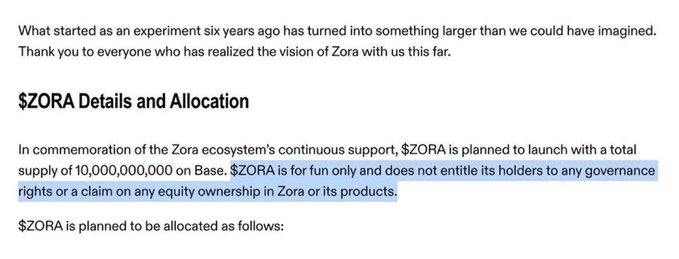

ZORA has been described as a token with no clearly outlined advantages for holders. The undertaking brazenly acknowledged that the token carries no governance rights, no fairness illustration, and performs no important position within the operation of the platform. On its official channels, Zora even emphasised that the replace was a “for fun” launch – a nontraditional strategy designed to spark consideration.

Nevertheless, in an setting the place customers more and more count on clear token distribution, tangible utility, and alignment with decentralized values, Zora’s positioning has backfired. Slightly than being considered as a artistic experiment, the dearth of clear use instances has led many to see the ZORA token as extra of a speculative asset than a significant contributor to the NFT ecosystem.

Supply: Zora

The state of affairs raises an essential query: if the token serves no function, why launch it within the first place? For a model that after held a powerful popularity within the NFT area, launching a token with no clear perform now seems like opportunism, hypothesis disguised as “fun.” Customers argue that if Zora had no intention of creating the token helpful, the least it may have accomplished was to make sure a good distribution. But, that too fell brief.

Not solely does ZORA lack utility, however it additionally debuted at a comparatively excessive market valuation, regardless of providing no concrete advantages to holders. This has fueled additional confusion, particularly because the group and early traders management the vast majority of the token provide. With 65% held by insiders, ZORA’s excessive value, no utility, and skewed drop drew sharp Web3 backlash.

Some analysts recommend the choice was a authorized grey-area transfer to attenuate regulatory stress. However by doing so, Zora could have damage its popularity, simply as Web3 shifts towards long-term, value-driven constructing.

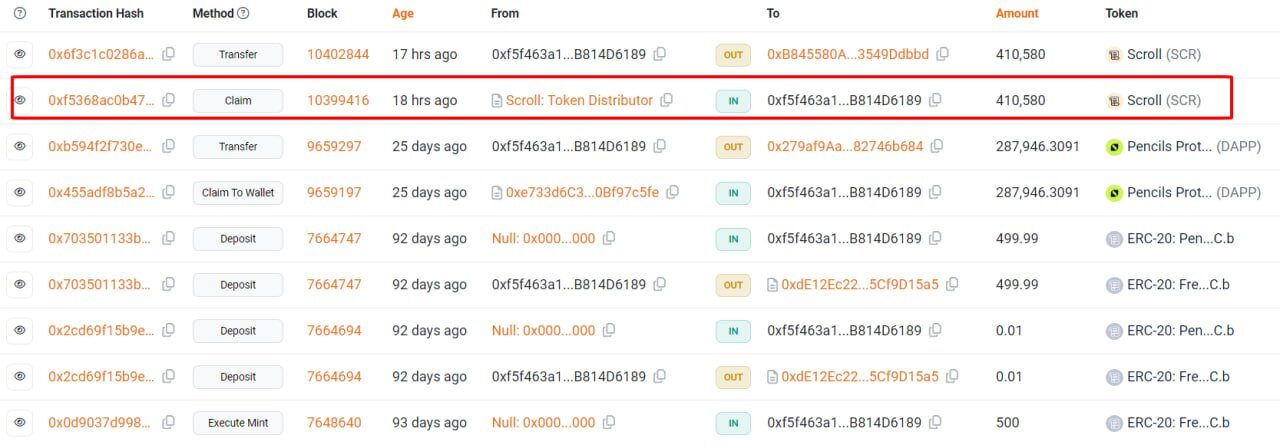

Skewed Allocation: Zora’s Belief Downside In comparison with zkSync and Scroll

Zora gave 65% of its tokens to insiders, 18.9% to the group, 20% to reserves, and 26.1% to traders. That leaves simply 35% for the group, break up into 10% for airdrops, 20% for group initiatives, and 5% for liquidity.

Supply: Zora

This uneven distribution drew backlash, particularly since ZORA was pitched as a “for fun” token with no actual use. Critics argue that this launch seems to prioritize insiders slightly than genuinely foster group participation, as many had hoped.

zkSync put aside simply 33.3% for insiders, leaving 67% for the group, much more balanced than its friends. This consists of 17.5% for airdrops and broader ecosystem initiatives managed by the nonprofit ZKsync Basis. The vesting schedule spans 4 years, with a one-year cliff.

Scroll allotted 23% to the group, 17% to traders, and 10% to its basis about 50% to insiders. The opposite 50% goes to the group, 35% for ecosystem incentives, 15% for airdrops distributed in deliberate phases.

Each zkSync and Scroll beforehand confronted backlash for insider-friendly allocations throughout testnet or pre-TGE phases.

The group criticized zkSync for unclear airdrop guidelines that overlooked many longtime testnet customers. Scroll additionally confronted backlash after experiences surfaced that some inner addresses acquired early allocation privileges.

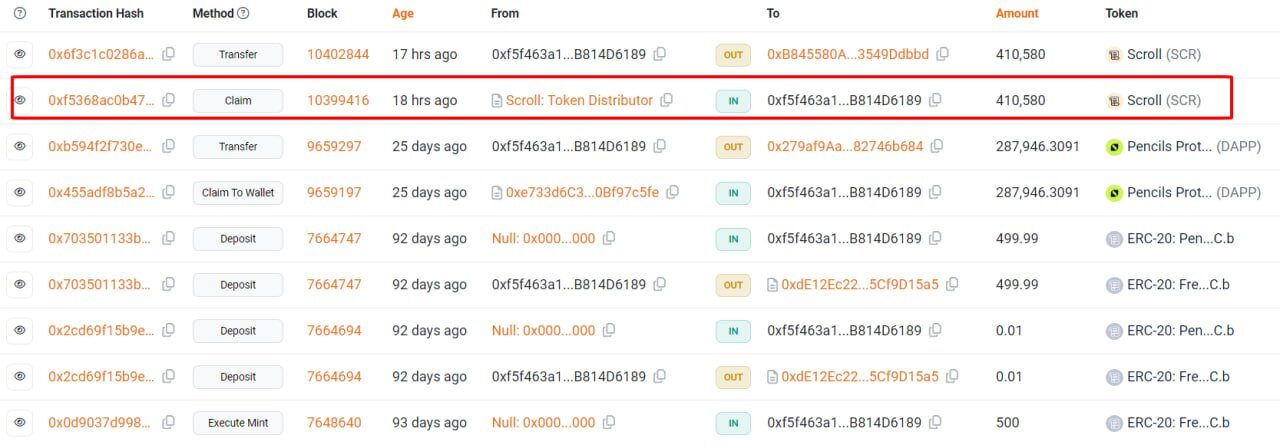

Supply: Scroll Explorer

In distinction, Zora not solely surpasses zkSync’s insider ratio (65% vs. 33.3%) but in addition departs basically in worth proposition. Whereas zkSync and Scroll hyperlink tokens to governance and utility, ZORA presents none, regardless of greater insider allocations.

This disparity explains the wave of backlash throughout platforms like X and Discord. Many now see Zora as insider-led, in contrast to zkSync and Scroll’s community-first strategy.

Throughout the Web3 area, it’s widespread to see insider allocations starting from 20–30%. Zora’s 65% allocation led many to name it a stealth token sale, not an airdrop.

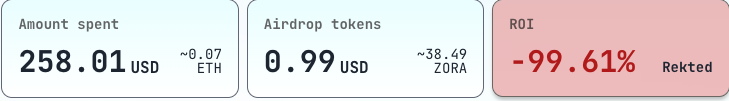

Group Backlash, On-Chain Knowledge, and ‘Rekt’ Tales

Knowledge reveals that the worth of ZORA dropped over 50% inside just some hours after itemizing, signaling a powerful wave of sell-offs. Trading quantity additionally plummeted – from $31 million to only $9 million inside 48 hours, highlighting the dominance of short-term hypothesis over long-term conviction.

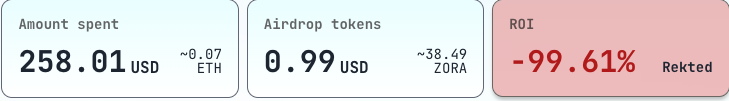

Past the market metrics, many customers have shared their private disappointments. One broadly circulated case concerned a person who spent $258 (~0.07 ETH) interacting with the platform in hopes of receiving a significant airdrop allocation. As a substitute, they acquired solely $0.99 price of ZORA, equal to only 38.49 tokens, reflecting a brutal damaging ROI of 99.61%. The story shortly unfold throughout X, stamped with the phrase “Rekted”, a logo of the collective sense of betrayal echoing all through the group.

Moreover, the group found that many wallets with little to no significant interplay with the platform nonetheless acquired substantial airdrop allocations. This raised suspicions of potential insider involvement or so-called “ghost allocations.”

A Dune Analytics dashboard monitoring recipient pockets exercise reveals that some addresses acquired massive token quantities regardless of having no on-chain engagement. In the meantime, many extremely energetic customers – together with business KOLs, acquired minimal rewards, typically not even sufficient to cowl the gasoline charges that they had spent (with common prices exceeding $1,000).

Why ZORA is being criticized proper now🤣🤣

1. ZORA non-interactive pockets tackle receives airdrop

– Suspected insider or group member

– https://t.co/i9hx2HOvKI (Verify attainable)2. Prime KOLs spend about $1000+ on gasoline, however haven’t generated even $100 in income

ZORA is the…

— Naback | Korea KOL (@Naback222) April 24, 2025

Whereas some metrics such because the variety of creators and tokens minted on Zora proceed to indicate development, the prevailing sentiment on social media stays overwhelmingly damaging. Many customers argue that the airdrop created no sustainable worth and as a substitute served primarily as a liquidity exit for a small group of insiders.

Conclusion

Zora launched its airdrop as a lighthearted experiment – a “for fun” token drop meant to energise the group. As a substitute, it has triggered widespread backlash and broken belief in a platform that was as soon as thought-about a cornerstone of the NFT infrastructure motion.

In a market that more and more rewards transparency, utility, and long-term imaginative and prescient, Zora’s strategy has raised uncomfortable questions on accountability in Web3. For customers and builders alike, the fallout serves as a stark reminder: within the age of decentralization, group belief is hard-won and simply misplaced.

Learn extra: Top 5 Airdrop Farming Projects on Solana (Part 2)

| CoinFN