There’s an old trope in business and technology: “there are only two ways to make money in business: one is to bundle; the other is unbundle.” That is true in conventional industries however much more true on this planet of crypto and DeFi, given its permissionless nature. On this piece, we’ll have a look at the surging recognition of modular lending (and those enlightened folks that are already post-modular), and study the way it’s upending the DeFi lending stalwarts. With unbundling, a brand new market construction emerges with new worth flows – who will profit most?

– Chris

There’s already been an amazing unbundling on the core base layer, the place Ethereum used to have a single resolution for execution, settlement and information availability. Nevertheless, it has since moved towards a more modular approach, with specialised options for every core component of the blockchain.

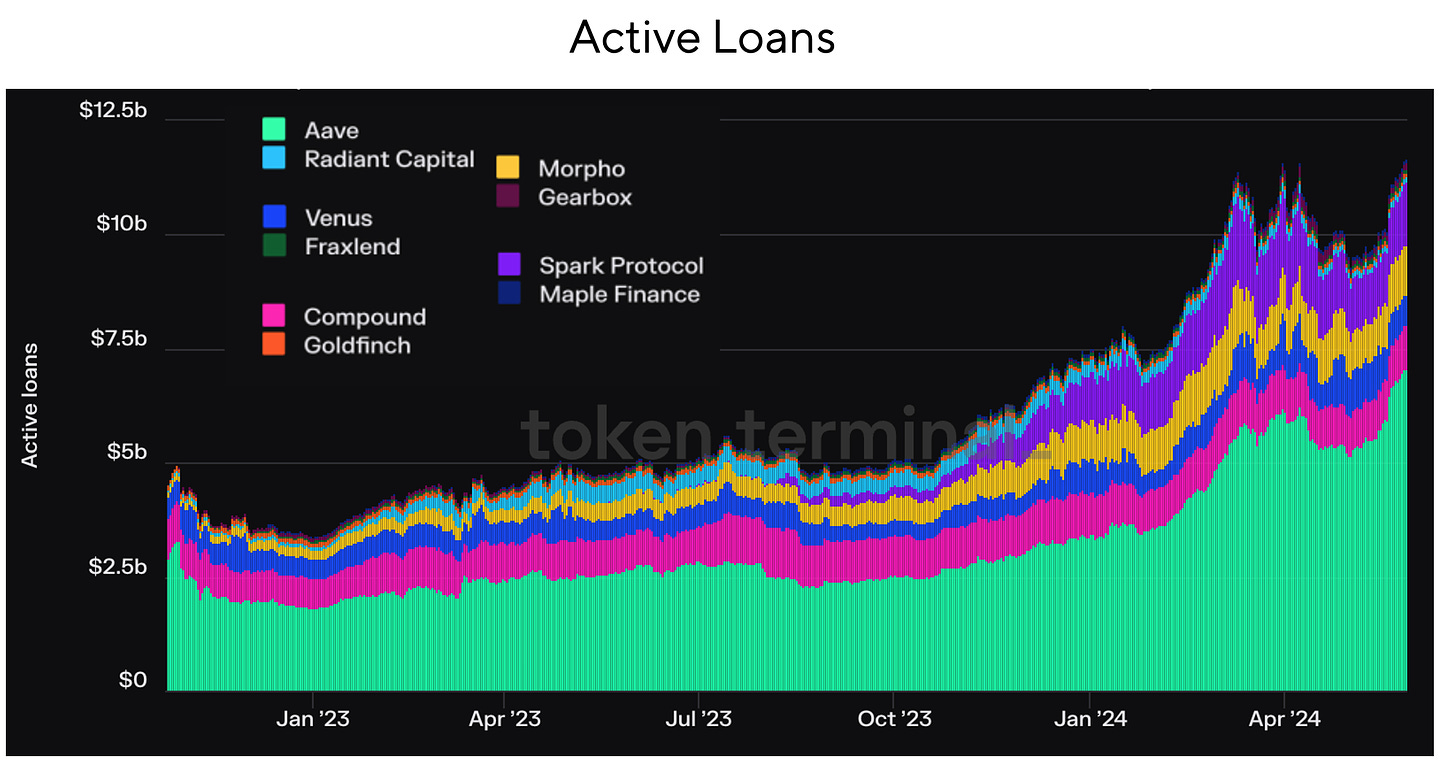

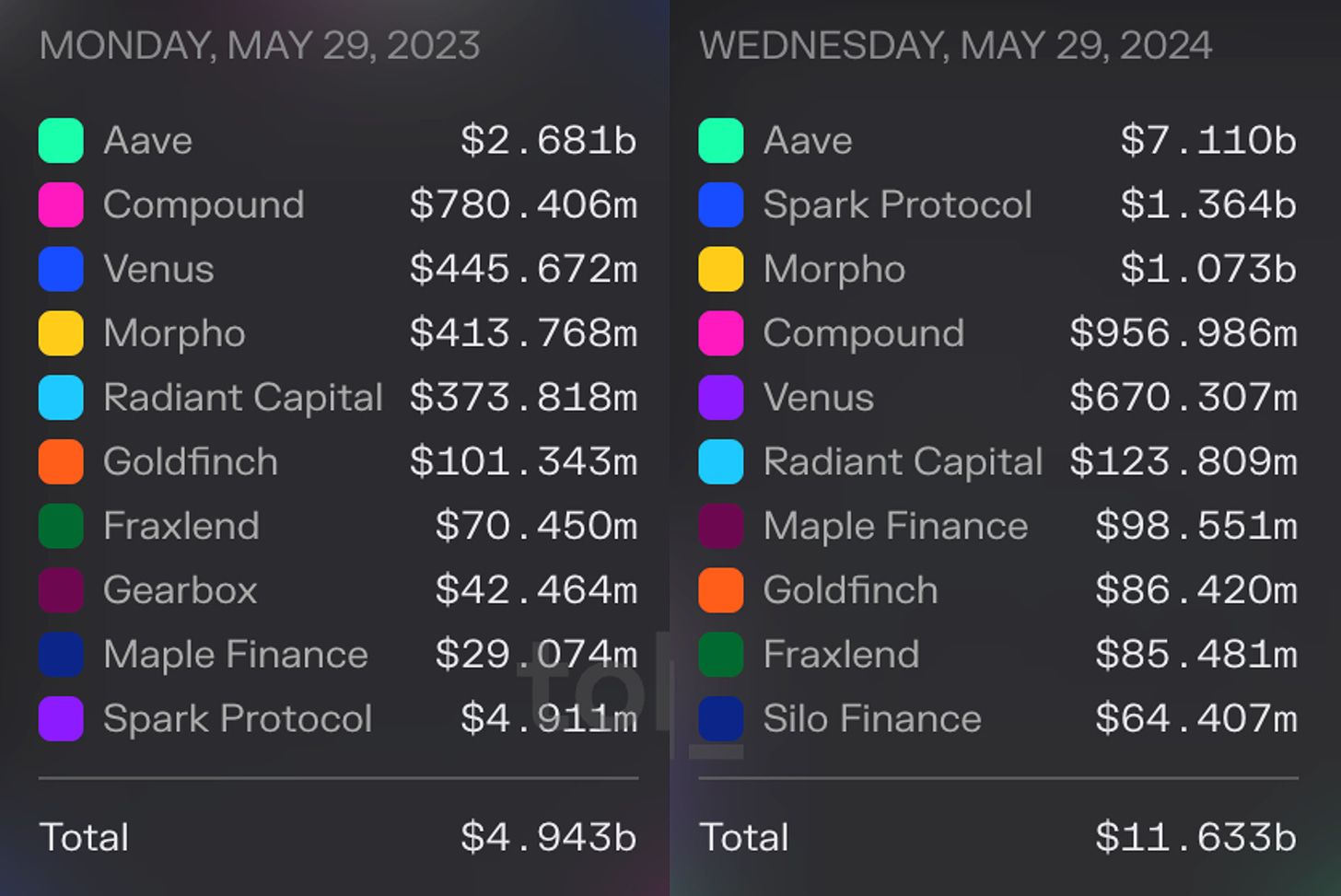

This similar sample is enjoying out within the DeFi lending house. The primary profitable merchandise had been these with all the things self-contained. Whereas the unique three DeFi lenders – MakerDAO, Aave, and Compound – had many transferring elements, all of them operated in a pre-defined construction set by their respective core groups. As of late, nevertheless, development in DeFi lending has come from a brand new crop of initiatives that cut up up the core features of a lending protocol.

These initiatives are creating remoted markets, minimizing governance, separating danger administration, liberalizing oracle obligations, and eradicating different single dependencies. Others are creating easy-to-use bundled merchandise that put a number of DeFi legos collectively to supply a extra all-encompassing lending product.

This new push to unbundle DeFi borrowing has been memed into Modular Lending. We are big fans of memes here at Dose of DeFi, however have additionally seen new initiatives (and their buyers) attempt to hype new narratives in the marketplace extra for his or her baggage than as a result of there’s some underlying innovation (taking a look at you, DeFi 2.0).

Our take: the hype is actual. DeFi lending will undergo the same metamorphosis because the core base layer – the place new modular protocols emerged like Celestia whereas current incumbents shifted their roadmaps to grow to be extra modular – as Ethereum has completed because it continues to unbundle itself.

Within the rapid time period, the important thing opponents are forging totally different paths. Morpho, Euler, Ajna, Credit score Guild and others are seeing success as new modular lending initiatives, whereas MakerDAO strikes towards a much less concentrated SubDAO mannequin. Then you could have the not too long ago introduced Aave v4, which is transferring within the modular course, mirroring Ethereum’s structure shift. These paths being carved-out now may nicely decide the place the worth accrues within the DeFi lending stack over the long run.

There are usually two approaches to constructing complicated techniques. One technique is to concentrate on the end-user expertise and make sure the complexity doesn’t hinder usability. This implies controlling the whole stack (as Apple does with its {hardware} and software program integration).

The opposite technique focuses on enabling a number of events to construct particular person elements of a system. Right here, the centralized designers of the complicated system concentrate on core requirements that create interoperability, whereas counting on the market to do the innovation. That is seen with the core web protocols, which haven’t modified, whereas the purposes and companies which have constructed on prime of TCP/IP have pushed innovation on the web.

This analogy is also utilized to economies, the place a authorities is seen as the bottom layer, a la TCP/IP, guaranteeing interoperability by means of the rule of regulation and social cohesion, the place financial improvement then happens within the personal sector constructed on prime of the governance layer. Neither of those approaches work on a regular basis; many corporations, protocols, and economies function someplace on the spectrum.

People who help the modular lending thesis consider that innovation in DeFi will likely be pushed by specialization in every a part of the lending stack, reasonably than specializing in simply the end-user expertise.

A key cause for that is the need to remove single dependencies. Lending protocols require shut danger monitoring and a small difficulty can result in catastrophic loss, so constructing redundancy is vital. Monolithic lending protocols have launched a number of oracles in case one fails, however modular lending takes this hedging strategy and applies it to each layer of the lending stack.

For each DeFi mortgage, we will establish 5 key elements which are wanted – however may be modified:

-

A mortgage asset

-

A collateral asset

-

Oracle

-

Max loan-to-value (LTV)

-

Rate of interest mannequin.

These elements should be intently monitored to make sure a platform’s solvency and stop unhealthy debt accruing due to speedy worth adjustments (we may additionally add the liquidation system to the 5 elements above).

For Aave, Maker, and Compound, token governance makes selections for all property and customers. Initially, all property had been pooled collectively and shared the danger of the entire system. However even the monolithic lending protocols have moved shortly into creating remoted markets for every asset, to compartmentalize the danger.

Isolating markets shouldn’t be the one factor you are able to do to make your lending protocol extra modular. The true innovation is occurring in new protocols which are reimagining what’s crucial in a lending stack.

The most important gamers within the modular world are Morpho, Euler and Gearbox:

-

Morpho is the clear chief of modular lending in the intervening time, though it appears not too long ago uncomfortable with the meme, attempting to morph into “not modular, not monolithic, but aggregated”. With $1.8 billion in TVL, it’s arguably already within the prime tier of the DeFi lending business as an entire, however its ambitions are to be the biggest. Morpho Blue is its major lending stack, on which it’s permissionless to create a vault tuned to no matter parameters it needs. Governance solely permits what may be modified – at present 5 totally different elements – not what these elements ought to be. That’s configured by the vault proprietor, usually a DeFi danger supervisor. The opposite main layer of Morpho is MetaMorpho, an try to be the aggregated liquidity layer for passive lenders. This can be a explicit piece targeted on end-user expertise. It’s akin to Uniswap having the DEX on Ethereum and likewise Uniswap X for environment friendly commerce routing.

-

Euler launched its v1 in 2022 and generated over $200 million in open curiosity earlier than a hack drained almost all protocol funds (though they had been later returned). Now, it’s getting ready to launch its v2 and reenter a maturing modular lending ecosystem as a significant participant. Euler v2 has two key elements. One, the Euler Vault Kit (EVK), which is a framework for creation of ERC4626 compatible vaults with further borrowing performance, enabling them to function passive lending swimming pools, and two, the Ethereum Vault Connector (EVC), which is an EVM primitive that primarily permits multi-vault collateralisation, i.e., a number of vaults can use collateral made out there by one vault. V2 has a deliberate Q2/Q3 launch.

-

Gearbox supplies an opinionated framework that’s extra person centric, i.e. customers can simply arrange their positions with out an excessive amount of oversight, no matter their ability/information degree. Its major innovation is a “credit account” which serves as a list of allowable actions and whitelisted property, denominated in a borrowed asset. It’s mainly an remoted lending pool, analogous to Euler’s vaults, besides that Gearbox’s credit score accounts maintain each person collateral and borrowed funds in a single place. Like MetaMorpho, Gearbox demonstrates {that a} modular world can have a layer that makes a speciality of packaging for the tip person.

Specialization in elements of the lending stack presents a chance to construct various techniques which will goal a particular area of interest or wager on a future development driver. Some main movers with this strategy are listed right here:

-

Credit Guild intends to strategy the already-established pooled lending market with a trust-minimized governance mannequin. Current incumbents, resembling Aave, have very restrictive governance parameters, and most of the time this leads to apathy amongst smaller token holders since their votes seemingly do not change a lot. Thus, an sincere minority in charge of most tokens is chargeable for most adjustments. Credit score Guild turns this dynamic on its head by introducing an optimistic, vetocracy-based governance framework, which stipulates varied quorum thresholds and latencies for various parameter adjustments, whereas integrating a risk-on strategy to take care of unexpected fallouts.

-

Starport’s ambitions are a wager on the cross-chain thesis. It has applied a really fundamental framework for composing various kinds of EVM-compatible lending protocols. It’s designed to deal with information availability and time period enforcement for the protocols constructed atop it by way of two core elements:

1. The Starport contract, which is chargeable for mortgage originating (time period definition) and refinancing (time period renewal). It shops this information for the protocols constructed atop the Starport kernel and makes it out there when wanted.

2. The custodian contract, which primarily holds the collateral of debtors on originating protocols atop Starport, and ensures that debt settlements and closure proceed in keeping with the phrases outlined by the originating protocols and saved within the Starport contract.

-

Ajna boasts a very permissionless mannequin of oracleless pooled lending with no governance at any degree. Swimming pools are arrange in distinctive pairs of quote/collateral property supplied by lenders/debtors, permitting customers to evaluate demand for both of the property and allocate their capital accordingly. Ajna’s oracle-less design is borne off lenders’ potential to specify the worth at which they’re prepared to lend, by specifying the quantity of collateral a borrower ought to pledge per quote token they maintain (or vice versa). It is going to be particularly interesting to the lengthy tail of property (very similar to Uniswap v2 does for small-ish tokens).

The lending house has attracted a slew of recent entrants, which has additionally reinvigorated the biggest DeFi protocols to launch new lending merchandise:

-

Aave v4, which was introduced final month, is awfully similar to Euler v2. It comes after Aave zealot Marc “Chainsaw” Zeller mentioned that Aave v3 would be the end state of Aave because of its modularity. Its mushy liquidation mechanism was pioneered by Llammalend (explainer under); its unified liquidity layer can also be much like Euler v2’s EVC. Whereas many of the impending upgrades aren’t novel, they’re additionally but to be extensively examined in a extremely liquid protocol (which Aave already is). It’s loopy how profitable Aave has been at successful market share on EVERY chain. Its moat could also be shallow, however it’s huge, and offers Aave a extraordinarily sturdy tailwind.

-

Curve, or more informally Llammalend, is a sequence of remoted and one-way (non-borrowable collateral) lending markets during which crvUSD (already minted), Curve’s native stablecoin, is used as both the collateral or debt asset. This permits it to mix Curve’s experience in AMM design and provide distinctive alternatives as a lending market. Curve has all the time pushed on the left aspect of the street in DeFi, however it’s labored out for them. It has as such carved out a significant niche in the DEX market, except for the Uniswap goliath, and is making everybody query their tokenomics skepticism with the success of the veCRV model. Llamalend seems to be one other chapter within the Curve story:

-

Its most attention-grabbing characteristic is its danger administration and liquidation logic, which relies on Curve’s LLAMMA system that allows ‘soft liquidations’.

-

LLAMMA is applied as a market making contract that encourages arbitrage between an remoted lending market’s property and exterior markets.

-

Similar to a concentrated liquidity Automated Market Maker (clAMM eg. Uniswap v3), LLAMMA evenly deposits a borrower’s collateral throughout a variety of user-specified costs, known as bands, the place the supplied costs are tremendously skewed in relation to the oracle worth with a purpose to guarantee arbitrage is all the time incentivised.

-

On this means, the system can robotically promote (soft-liquidate) parts of the collateral asset into crvUSD as the previous’s worth decreases previous bands. This decreases the general mortgage well being, however is decidedly higher than outright liquidations, particularly contemplating the express help of long-tail property.

-

Whew. Curve founder Michael Egorov making over-engineered criticisms out of date since 2019.

Each Curve and Aave are hyper targeted on the expansion of their respective stablecoins. This can be a good long-term technique for fee-extraction (ahem, income) functionality. Each are following within the footsteps of MakerDAO, which has not given up on DeFi lending, spinning off Spark as an remoted model that has had a really profitable previous yr even with none native token incentives (but). However a stablecoin and the loopy potential to print cash (credit score is a hell of a drug) are simply gigantic alternatives long run. Not like lending, nevertheless, stablecoins do require some onchain governance or offchain centralized entities. For Curve and Aave, which have a number of the oldest and most energetic token governance (behind MakerDAO in fact), this route is smart.

The query we will’t reply is what’s Compound doing? It was as soon as DeFi royalty, kickstarting DeFi summer time and literally establishing the yield farming meme. Clearly, regulatory issues have constricted its core staff and buyers from being extra energetic, which is why its market share has dwindled. Nonetheless, very similar to Aave’s huge, shallow moat, Compound nonetheless has $1 billion in open loans and a large governance distribution. Only in the near past, some have picked up the baton to develop Compound outdoors the Compound Labs Workforce. It’s unclear to us what markets it ought to concentrate on – maybe giant, blue-chip markets, particularly if it could acquire some regulatory benefit.

The DeFi lending unique three (Maker, Aave, Compound) are all rejiggering their methods in response to the shift to a modular lending structure. Lending towards crypto collateral was as soon as a great enterprise, however when your collateral is onchain, your margins will compress as markets grow to be extra environment friendly.

This doesn’t imply there aren’t any alternatives in an environment friendly market construction, simply that nobody can monopolize their place and extract lease.

The brand new modular market construction permits extra permissionless worth seize for proprietary our bodies resembling danger managers and enterprise capitalists. This permits a extra skin-in-the-game strategy to danger administration, and straight interprets to raised alternatives for finish customers, since financial losses will trigger a lot hurt to a vault supervisor’s fame.

An excellent instance of that is the latest Gauntlet-Morpho drama in the course of the ezETH depeg.

Gauntlet, a longtime danger supervisor, ran an ezETH vault which suffered losses in the course of the depeg. Nevertheless, because the danger was extra outlined and remoted, customers throughout different metamorpho vaults had been largely insulated from the fallout, whereas Gauntlet had to offer autopsy evaluations and take duty.

The rationale Gauntlet launched the vault within the first place was as a result of it felt its future prospects had been extra promising on Morpho, the place it may cost a direct payment, versus offering danger administration advisory providers to Aave governance (which tends to focus extra on politiking than danger evaluation – you attempt wining and eating a chainsaw).

Simply this week, Morpho founder, Paul Frambot, revealed {that a} smaller danger supervisor, Re7Capital, which also has a great research newsletter, was incomes $500,000 in annualized onchain income as a supervisor of Morpho vaults. Whereas not enormous, this demonstrates how one can construct monetary corporations (and never simply degen yield farming) on prime of DeFi. It does increase some long-term regulatory questions, however that’s par for the course in crypto these days. And furthermore, this may not cease danger managers from topping the ‘who’s set to achieve essentially the most’ listing for the way forward for modular lending.

-

U.S. Home Approves Crypto FIT21 Invoice With Wave of Democratic Assist Link

-

Block Analitica proposes new rate of interest framework for MakerDAO Link

-

DOJ costs two brothers with fraud for baiting MEV bots Link

-

Maker founder Rune proposes ‘PureDai’ made up of solely crypto collateral Link

-

EIP-7706 would add a brand new gasoline sort particular for calldata Link

-

ENS goals to launch personal L2, possible with zkSync Link

-

Token circulation regulatory chart in mild of latest US progress Link

That’s it! Suggestions appreciated. Simply hit reply. Because of Zhev for main assistance on breaking down the most important modular gamers. A lot inexperienced in Tennessee within the spring.

Dose of DeFi is written by Chris Powers, with assist from Denis Suslov and Financial Content Lab. I spend most of my time contributing to Powerhouse, an ecosystem actor for MakerDAO. A few of my compensation comes from MKR, so I’m financially incentivized for its success. All content material is for informational functions and isn’t meant as funding recommendation.

| CoinFN