Growing scalability has at all times been the primary precedence for blockchains making an attempt to seize extra customers. A fast gander at L2fees.info and L2beat exhibits transaction prices of lower than $0.01 at quite a few L2s, not far off Solana’s miniscule charges. So whereas it’s too early to say we’ve achieved scalability, we’re awfully shut.

Now, the mindshare of researchers, builders and buyers turns to fixing the thorny issues that stop mainstream adoption. Unresolved MEV points and the shortage of regularity readability are hurdles to beat, however the major impediment to mainstream adoption is the poor UX from an absence of chain interoperability, particularly amongst Ethereum L2s. To attain frictionless interoperability, researchers and builders have coalesced behind the abstraction meme, be it account or chain abstraction. Under, Zhev seems at how these purpose to enhance UX, and which meme will in the end win out.

– Chris

Blockchain builders are cussed, with strong opinions. This has led to the dominance of ideologically-driven growth that’s inflexible, and as such, esoteric debates loom bigger than the person preferences of the market.

Divergence amongst these ideologies has ostensibly led to the fragmentation of capital and innovation throughout siloed ecosystems. This definitely makes issues spicy and sometimes grants us front-row seats to spats of drama between these ecosystems. But there is no such thing as a doubt that the way forward for the “new internet” can be far much less tribalistic than it at the moment is. Ultimately.

The following billion customers will not be involved with underlying ideologies. Fairly, they’ll care in regards to the outcomes of their transactions and in the end UX. But the present fragmented panorama hinders builders making an attempt to construct seamless experiences.

Interoperability is essential to enhancing UX, however bridges are too clunky of their present state. A broad remodeling of mechanisms on the very base layer – the place a lot of the issues emanate – can be wanted for an interoperable future to stay possible.

On this piece, we consider the essential properties of blockchains that trigger fragmentation, and supply an summary of outstanding mechanisms being explored to unravel this (inside and past single ecosystems). On this means, we take a bottom-up method to understanding the newest meme craze of abstraction at each the account and chain ranges. And the way these affect the interoperability dialogue.

Blockchains are notoriously known as a shared ledger, however these within the know name this ledger the blockchain state. On blockchains, a state will not be static. It’s at all times being up to date with further transactions.

How these transactions are added to the state (or ledger) is known as a state mannequin, which decides what’s a sound transaction, how consensus is reached, and how you can keep a shared ledger state throughout an sincere majority of a blockchain’s nodes. Most significantly, the state mannequin specifies how a sequence ought to deal with conflicting state updates. For instance, when two transactions wish to spend the identical asset, or when two conflicting transactions wish to entry the identical state.

Blockchain interoperability means a single person initiates a transaction that impacts the state mannequin on two separate chains in some trustless and decentralized means. Not all state fashions are the identical. In actual fact, the 2 largest blockchains have vastly totally different buildings.

The 2 main state fashions are:

-

Unspent transaction output (UTXO) mannequin: State is managed by monitoring particular person transaction outputs (represented as property) – that may both be spent or not – and the restrictions on spending them (represented because the asset’s holder). Spent outputs and their corresponding inputs are trackable to a public key, which can be utilized to approve mentioned enter for future spends by verifying key possession. Thus, every asset is tracked utilizing the final transaction during which they had been spent, and the present restrictions on spending them once more (its present holder).

-

Account mannequin: Maps an handle to its stability and present state. Versus monitoring every asset within the community, this mannequin tracks every account within the community and balances for every asset on a unified ledger. All interactions in an account-based chain are implicitly interlinked, so there’s just one international tree of interdependent transactions that are each state and time-variant.

Bitcoin makes use of the UTXO mannequin, with restricted programmability. Nonetheless, this downside comes with numerous execution benefits. Essentially the most notable is transaction localisation, which signifies that as an alternative of making a brand new department as a part of a world state tree for every interplay (as within the account mannequin), remoted state transitions will be represented and executed as an remoted native state tree.

The account mannequin, in the meantime, is generally utilized by Ethereum and different smart-contract chains. It’s much less rigorous as a result of it leaves willpower of a transaction’s state to sensible contracts. This makes issues a bit difficult as sensible contracts principally specify state adjustments primarily based on the chain’s present state. Within the presence of a number of contracts, this could simply result in surprising outcomes if the present state is modified by one other transaction earlier than the sensible contract’s desired state change will be attained.

The important thing takeaway: so long as settlement happens on a world state tree with a single-threaded and sequential execution scheme, there’ll at all times be implicit interdependence between sensible contracts. Which means that transactions are neither time- nor state-invariant, and will be invalidated attributable to one other legitimate transaction that comes earlier than them. It additionally means a “double spend” is not obvious till a contract is executed – versus a UTXO mannequin, the place an invalid state change could possibly be decided with out utilizing any of the execution layer.

The widespread adoption of the account mannequin makes it an excellent part to construct interoperability infrastructure. But to do that, a brand new perspective round accounts, moderately than blockchains themselves, is required. This definitely appears per the broader pattern: Stephane Gosselin of Frontier Research lately compared the shift from a chain-centric view of crypto to an account-centric view to the shift from a geocentric worldview to a heliocentric worldview.

Ethereum accounts are decomposed into 4 fields: a nonce, a stability, a codeHash, and a strorageHash. These assist outline the 2 varieties of accounts in Ethereum: externally-owned accounts (EOAs) and contract accounts (CAs). EOAs will be managed by anybody holding the non-public keys and have empty codeHash and storageHash fields (and by extension, haven’t got entry to persistent storage).

CAs are managed by code deployed on to the community (aka, a wise contract). Their interactions are fully pull-based, i.e., they will solely ship particular transactions in response to a transaction from one other account. Thus, the actions of a CA are considerably static and predetermined by its code’s logic. They should be constructed/derived from an account creator’s handle and its nonce worth, and the account creator should be an EOA account with a stability to pay for the account’s storage utilization.

Briefly, EOAs present customers with full autonomy (i.e., they will start transactions) at the price of programmability (i.e. their logic is strictly constricted), whereas contract accounts take the opposite route (programmability at the price of autonomy).

Reaching interoperability is necessary as a result of to function on a brand new chain, a 3rd social gathering should ship a transaction on the person’s behalf. After all, blockchains are constructed to forestall this, so new protocol guidelines should be launched.

At present, for transactions from any account to be thought of legitimate after which executed, there are 4 checks (or what we name “constraints”) it should fulfill: 1) Authentication 2) Authorization 3) Replay safety, and 4) Gasoline cost.

For EOAs, every of those checks are constrained to make sure a single legitimate outcome. Authentication and authorisation are offered by the EOA’s non-public key; replay safety is offered by the transaction’s nonce, and fuel cost should be offered by the account from which the transaction originates. These enshrined constraints restrict EOAs.

Contract accounts enable extra programmability round these validity checks. Authentication and authorisation of transactions are depending on its code’s logic, granting numerous leeway round key administration and entry insurance policies (fuel cost could also be settled by one other account, e.g., its caller). The dearth of granular constrictions permits transactions originating from contract accounts to be extra programmable, granting them coveted options equivalent to atomicity.

Okay, now that we perceive the final construction of accounts on Ethereum and what’s wanted to ship a sound transaction, we are able to have a look at the account-based technical options aiming to reinforce interoperability.

Like Bitcoin, Ethereum launched solely with EOAs however first imagined “smart accounts” in 2017 with the introduction of EIP-86. Sensible accounts are supposed to mix the perfect properties of EOAs and CAs with a purpose to delivery a brand new, composable primitive, however the course of has been gradual and tedious.

The problem for the Ethereum neighborhood is needing to improve two various kinds of accounts (EOAs & CAs). Though researchers mentioned they had been transferring ahead with each, it at all times appeared like upgrading EOAs was much less of a precedence, given the view of many – together with Vitalik – that sensible contract wallets are the endgame for normal customers.

A imaginative and prescient for this sensible contract wallet-led future started to coalesce across the thought of Account Abstraction, which might make all accounts on Ethereum contract-based. AA would take away all deterministic constraints on accounts from the consensus layer, and outline probabilistic constraints throughout the execution layer, which might create a single commonplace for accounts throughout the EVM world.

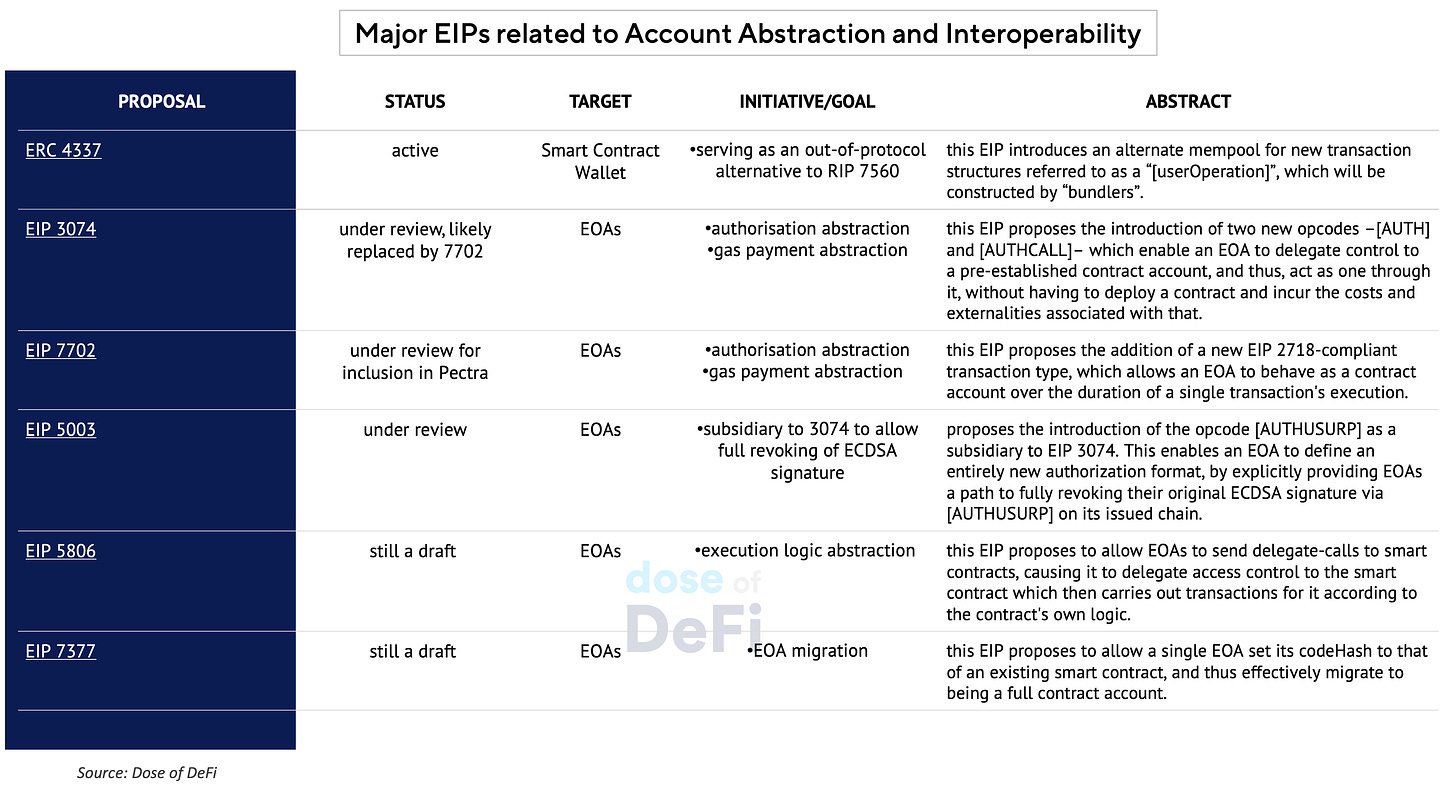

The cornerstone of this imaginative and prescient is ERC-4337, which was carried out final 12 months and allows accounts to package up the actions they wish to take right into a UserOperation, which is shipped to a devoted mempool the place bundlers can put all of them right into a transaction that makes a single name.

A devoted mempool is a large step however attaining the complete imaginative and prescient of AA would require numerous adjustments to the Ethereum protocol, together with the consensus layer, which is at all times a delicate space. As such, Ethereum has been gradual in implementing upgrades to its account mannequin that might improve interoperability.

So even when sensible contracts and AA are the long run, EOAs are nonetheless in huge observe at this time so many utility builders have been pushing for upgrades alongside the push for protocol adjustments to reinforce sensible contract wallets.

ETH researchers listened and deliberate EIP-3074 for inclusion within the subsequent Pectra replace, however acquired vital pushback from supporters of EIP-4337. They argued the brand new transaction sort proposed could be incompatible with EIP-4337 and solidify the 2 parallel observe fashions for EOAs and CAs. There have been additionally issues about rising censorship however the necessary level was that EIP-3074 would harm the long run imaginative and prescient of Account Abstraction and EIP-4337. There additionally might have been aggressive worries about getting new customers on sensible contract wallets if EOAs had the identical performance.

Responding to the pushback, EIP-3074 was withdrawn and Vitalik wrote EIP 7702 in 22 minutes to realize the identical ends as EIP-3074 however is forward-compatible with EIP-4337, and importantly, doesn’t introduce any new opcodes to the EVM.

We consider there’s a center floor that maintains Ethereum’s gradual method to attaining AA but additionally enhances the expertise of EOAs, in order that interoperability infrastructure will be constructed now. Provided that upgrading EOAs with extra programmability signifies that solely some of the deterministic constraints are faraway from present account requirements, we seek advice from this as “constraint abstraction”.

Constraint abstraction is taken into account a viable different attributable to many components: together with, the complexity related to absolute abstraction, EOA enshrinement in dAPPs’ UI/UX, and customers’ fears.

Having elements of an account as modules moderately than irreversibly built-in verticals opens up numerous channels for interoperability. These channels that may transcend chain boundaries symbolize a brand new method to fixing the fragmentation downside, and have been collectively known as chain abstraction.

Much like account abstraction – an meant finish state with quite a few pathways to its realization – chain abstraction seeks to unify and simplify customers’ actions throughout all (most, in case you search to be pragmatic) present ecosystems. Whereas it’s straightforward for anybody chain to level fingers and proclaim that their stack is best, it ought to be all too apparent at this level that one of the simplest ways ahead is a collaborative effort for UX simplification.

OneBalance, which emerged out of Frontier Analysis, was created with this objective: a collaborative that transcends execution environments to supply a single account commonplace for customers throughout all ecosystems.

It describes its proposed answer – credible accounts – as “ultra HTLCs”, and we are likely to agree. HTLCs are an important primitive that by no means obtained their medals because of the complexity related to implementations when first ideated. Perhaps now we now have a dependable mechanism to summary this complexity from customers.

With out clear technical definitions, the distinction between account, chain and constraint abstraction is totally on the meme aspect of issues. What is obvious is that no matter route the business strikes, the brand new system can be powered by intents and the idea {that a} set of extra specialised brokers – pushed by some definable quantity of (non-detrimental) extractable worth – could be prepared to compete to assist customers settle their requests.

Whereas there are various fanciful definitions for intents, they’re merely a person expressing their desired consequence/aim for a broadcasted request. A simplification of their request, eradicating pointless restrictions within the “how” of the request and putting them within the “what”.

Specialised actors known as “solvers” then take it upon themselves to establish essentially the most cost-effective pathway (the “how”) that respects the person’s aim (the “what”).

HTLCs didn’t take off after they had been first launched in 2017-2018 because of the perceived complexity. Now greater than ever, with the presence of MEV-hardened solvers within the combine, it might be nice to see them get the love they deserve. HTLCs are one of many easiest iterations of a know-how powering interoperability; alternatively the rise and funding of intent-centric designs has proven that person welfare is paramount.

We consider that if crypto needs to take the onboarding downside critically, then it should prioritize person welfare at each attainable degree. With interoperability, we consider intent-powered HTLCs are a step in the best route. We additionally consider numerous the present work being branded chain abstraction is pointless; a lot of the options have existed within the shadows for a very long time attributable to complexity of use. It’s now merely time for synergy.

There has at all times been a necessity for a easy UX and a need to implement interoperability. What’s been lacking is the motivation (pushed by market demand for cross-chain buying and selling) and the elevated functionality of solvers to execute the complicated cross-chain transactions. Solvers could be a very good match, however there’s a danger, abstraction additional entrenches block builders.

New improvements should now be inspired to synchronize with outdated ones with out introducing further vaporware. And intents + HTLCs appears an important place to begin in redefining cross-chain UX.

-

SEC sues Consensys over MetaMask swaps and staking providers Link

-

Gnosis to launch threshold-encrypted mempools by Shutterized in July Link

-

Balancer begins planning v3 Link

-

James Prestwich on the Infinite Jungle podcast from Galaxy Link

-

Arbitrum proposes TimeBoost, a brand new transaction ordering coverage Link

-

Studying record for Trusted Execution Environments (TEEs) Link

-

Curve founder suffers liquidation cascade on CRV-baced loans Link

-

Restaked ETH reaches $13bn (3.7m ETH) in market measurement Link

That’s it! Suggestions appreciated. Simply hit reply. Nice to have Zhev go deeper on the protocol degree. A number of of nice dialogue within the Ethereum analysis neighborhood this week as properly.

Dose of DeFi is written by Chris Powers, with assist from Denis Suslov, Zhev and Financial Content Lab. I spend most of my time contributing to Powerhouse, an ecosystem actor for MakerDAO. All content material is for informational functions and isn’t meant as funding recommendation.

| CoinFN